Double Top Chart Pattern

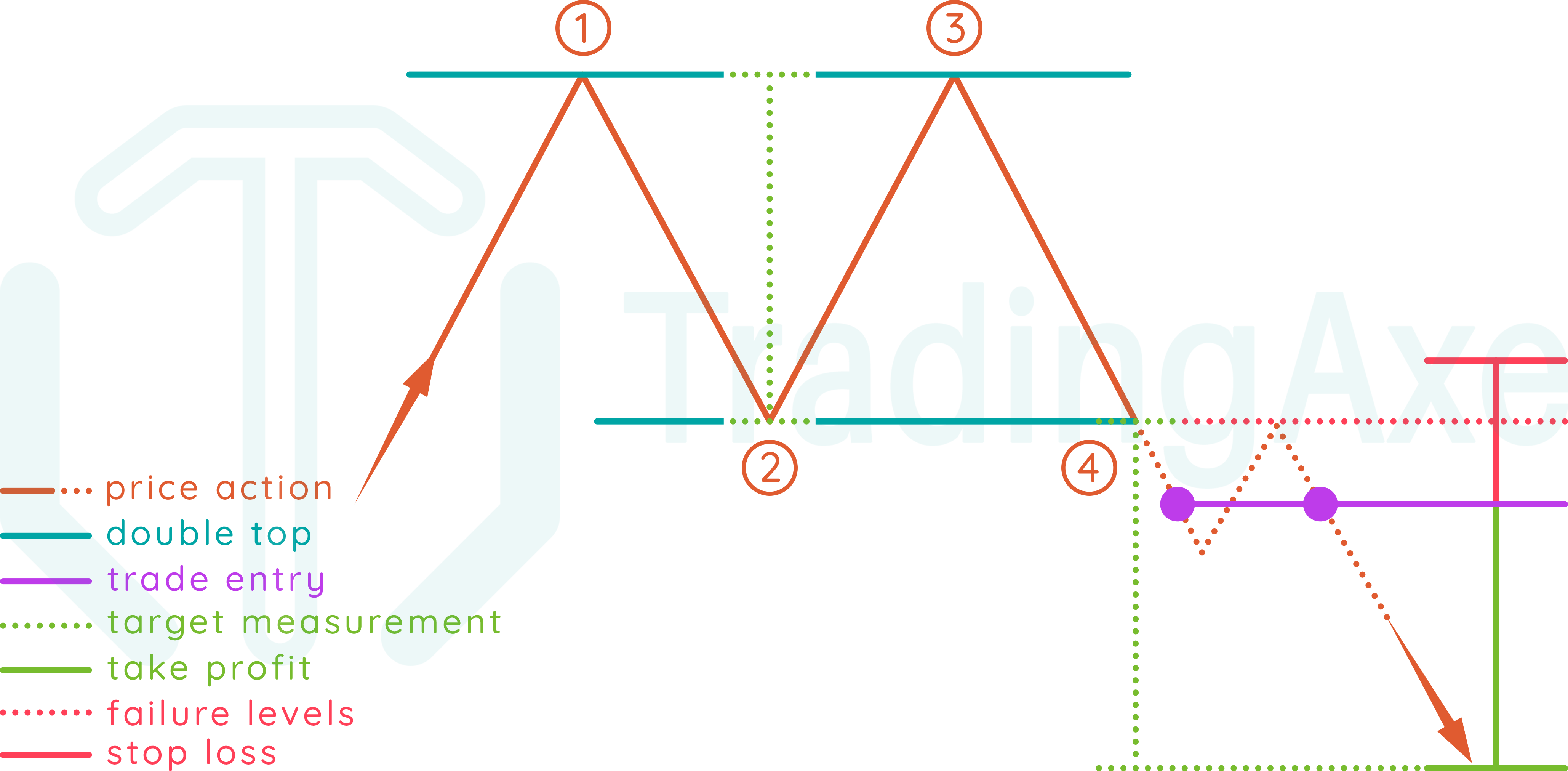

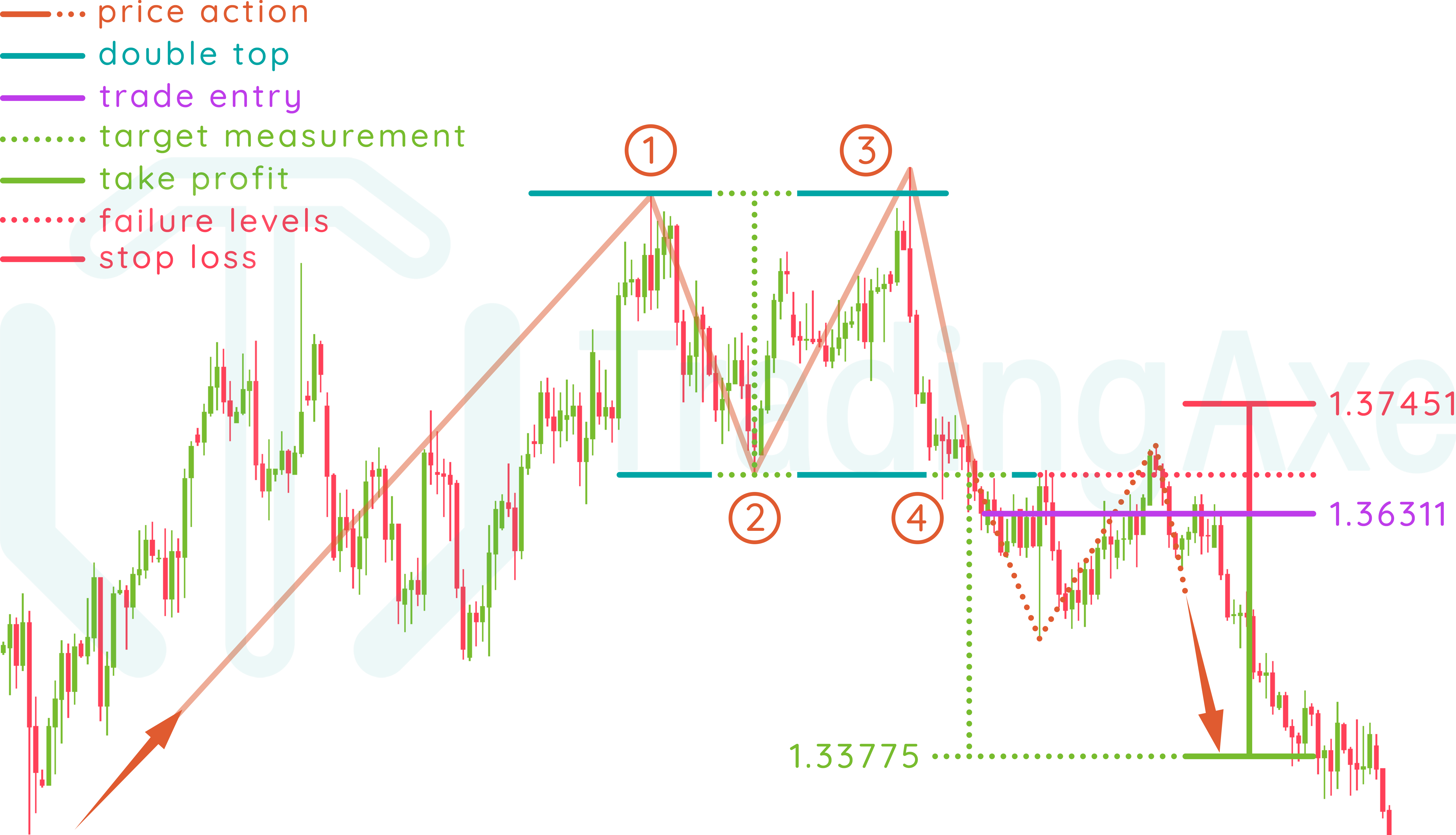

Double Top Chart Pattern - The upper side of this pattern was at 1.0807, near its highest swing on may 3rd. Protradingart updated jul 10, 2023. Web a double top chart pattern is a bearish reversal chart pattern that is formed after an uptrend. This chart pattern occurs after an extended price increase in financial markets and consists of two swing high peaks at approximately the same price level, separated by a temporary trough or pullback. So if you’re ready to trade double tops like a pro, you’re going to love this post. Web the double top reversal is a bearish reversal pattern typically found on bar charts, line charts, and candlestick charts. The double top is a. The “tops” are peaks that are formed when the price hits a certain level that can’t be broken. Note that a double top reversal on a bar or line chart is completely different from a double top. When completed, the pattern indicates that the price is likely to turn and head downwards. Web a double top is a common bearish reversal chart pattern used in technical analysis. Volume decreases on the second top. A double top is an extremely bearish technical reversal pattern that forms after an asset reaches a high price two consecutive times. Double top and bottom patterns are. It is confirmed once the asset price falls below a support. Web the double top is a chart pattern with two swing highs very close in price. The first peak is formed after a strong uptrend and then retrace back to. What is a double top? Web double top is a bearish reversal chart pattern that occurs after a stock reaches similar high prices in two sessions with a drop in. Web trading chart ebook double top pattern a double top is an extremely bearish technical reversal pattern that forms after an asset reaches a high price two consecutive times with a moderate decline between the two highs. So if you’re ready to trade double tops like a pro, you’re going to love this post. The first peak is formed after. This pattern is formed with two peaks above a support level which is also known as the neckline. When completed, the pattern indicates that the price is likely to turn and head downwards. The double top is a. Entry selection / stop placement / target selection explained. Web updated april 06, 2024. Important tips & real market exampe. Note that a double top reversal on a bar or line chart is completely different from a double top. The double top pattern entails two high points within a market which signifies an impending bearish reversal. Web which chart pattern is best for trading? Web updated june 28, 2021. Web the double top chart pattern trading strategy is a price action formation that consists of two swing highs that end around the same level. The pair is also hovering at the 50%. This chart pattern occurs after an extended price increase in financial markets and consists of two swing high peaks at approximately the same price level, separated by. It is confirmed once the asset price falls below a support level equal to the low between the two prior highs. No chart pattern is more common in trading than the double bottom or double top. Web your ultimate guide for double top pattern trading. A double top is a reversal chart pattern. Want to trade double top patterns for. What is a double top? Traders typically look for the price to close below the confirmation line, accompanied by an increase in volume, before initiating a sell signal. A double top is an extremely bearish technical reversal pattern that forms after an asset reaches a high price two consecutive times. The first peak is formed after a strong uptrend and. It is confirmed once the asset price falls below a support level equal to the low between the two prior highs. What is a double top? The eur/usd exchange rate formed a small evening star candlestick pattern on the 4h chart. A double top is a reversal chart pattern. Two peaks that are near equal in price. Traders typically look for the price to close below the confirmation line, accompanied by an increase in volume, before initiating a sell signal. It is confirmed once the asset price falls below a support level equal to the low between the two prior highs. What is double top and bottom? Web a double top is a frequently occurring chart pattern. Web the double top chart pattern trading strategy is a price action formation that consists of two swing highs that end around the same level. What is a double top? Equal distance in terms of time between highs. [1] [2] double top confirmation. Typically, when the second peak forms, it can’t break above the first peak and causes a double top failure. What is double top and bottom? Web forex for beginners. This chart pattern occurs after an extended price increase in financial markets and consists of two swing high peaks at approximately the same price level, separated by a temporary trough or pullback. Today i’m going to show you exactly how to trade double top chart patterns, including how to determine targets. The “tops” are peaks that are formed when the price hits a certain level that can’t be broken. Web which chart pattern is best for trading? The double top pattern entails two high points within a market which signifies an impending bearish reversal. This pattern is formed with two peaks above a support level which is also known as the neckline. It is a reversal chart pattern seen at the end of an uptrend or a prolonged pullback in a downtrend. Let’s learn how to identify these chart patterns and trade them. It visually represents a period in the market where the price hits a certain high twice, but fails to break through this resistance level.

Double Top Pattern Your Complete Guide To Consistent Profits

How To Trade Double Top Chart Pattern TradingAxe

The Double Top Trading Strategy Guide

How To Trade Double Top Chart Pattern TradingAxe

How To Trade Double Top and Double Bottom Patterns

The Double Top Chart Pattern Pro Trading School

Double Top Pattern A Forex Trader’s Guide

Double Top Chart Pattern Profit and Stocks

How to Identify a Double Top Stock Chart Pattern? StockManiacs

Basic Chart Patterns Double Top & Double Bottom

It Signifies A Potential Turning Point Or Resistance Level And Could Potentially Reverse In.

Entry Selection / Stop Placement / Target Selection Explained.

When Completed, The Pattern Indicates That The Price Is Likely To Turn And Head Downwards.

Web A Double Top Chart Pattern Is A Bearish Reversal Chart Pattern That Is Formed After An Uptrend.

Related Post: