Double Top Chart Pattern Breakout

Double Top Chart Pattern Breakout - Web double top is a bearish reversal chart pattern that occurs after a stock reaches similar high prices in two sessions with a drop in price in between. Web double top breakout: What is a double top? How to find insanely profitable risk to reward trading setups. The chart on the right shows an example of an adam & adam double top chart pattern. Double top pattern, which looks. A basic p&f buy signal, such as a double top. Every chart pattern has a confirmation signal. How to use the double top chart pattern and pinpoint market reversals with. It occurs when the price of an asset forms two. Es futures double top rejection. The pullback to the neckline. If it is a false. An a++ double top reversal is composed of two. Web a double top breakout signals a bullish resolution to the triangle pattern. The “tops” are peaks that are formed when the price hits a certain level that can’t be broken. The breakout of the neckline. What is double top and bottom? If it is a false. Web a double top is an extremely bearish technical reversal pattern that forms after an asset reaches a high price two consecutive times with a moderate. Web a double top is a reversal pattern that is formed after there is an extended move up. Note that a trend line break is not enough. The breakout of the neckline. Every chart pattern has a confirmation signal. Web the breakout double top pattern is a technical analysis chart formation indicating a potential bearish reversal. Every chart pattern has a confirmation signal. Web forex for beginners. Web double top is a bearish reversal chart pattern that occurs after a stock reaches similar high prices in two sessions with a drop in price in between. A basic p&f buy signal, such as a double top. What is double top and bottom? How to use the double top chart pattern and pinpoint market reversals with. Web a double top pattern is a bearish pattern in technical analysis that signals a bearish reversal of an uptrend. Web the formation of the double top. The double top pattern entails two high points within a market which signifies an impending bearish. The double top reversal. The breakout of the neckline. This bearish reversal pattern occurs when the price reaches a high point twice with a moderate decline in between. An a++ double top reversal is composed of two. This chart pattern occurs after an extended price. Web there are five bullish breakout p&f patterns. Web a double top pattern is a bearish pattern in technical analysis that signals a bearish reversal of an uptrend. It occurs when the price of an asset forms two. An a++ double top reversal is composed of two. Web in the case of the double top and double bottom patterns, a trader could place a stop order just below. Web confirmation after the breakout; Note that a trend line break is not enough. If it is a false. Identify the phase of the market. Web the formation of the double top. Double top pattern, which looks. Note that a trend line break is not enough. It resembles an ‘m’ shape and. The signal line is located at the bottom, between the two tops of the. Es futures double top rejection. Web a double top pattern is a bearish pattern in technical analysis that signals a bearish reversal of an uptrend. Double top helps to know the. Web a double top is an extremely bearish technical reversal pattern that forms after an asset reaches a high price two consecutive times with a moderate decline. Web there are five bullish breakout p&f. Web the formation of the double top. Double top helps to know the. The double top pattern entails two high points within a market which signifies an impending bearish. How to find insanely profitable risk to reward trading setups. What is a double top? It resembles an ‘m’ shape and. Double top pattern, which looks. Web forex for beginners. Web a double top is an extremely bearish technical reversal pattern that forms after an asset reaches a high price two consecutive times with a moderate decline. Web a double top is a reversal pattern that is formed after there is an extended move up. This chart pattern occurs after an extended price. Web double top is a bearish reversal chart pattern that occurs after a stock reaches similar high prices in two sessions with a drop in price in between. Web there are five bullish breakout p&f patterns. The formation of a bearish candlestick pattern signal (bearish engulfing bar). The signal line is located at the bottom, between the two tops of the. An a++ double top reversal is composed of two.

Double top patterns are some of the most common price patterns that

Double Top Trading Patterns Strategy Guide (PDF)

Double Top Chart Pattern Profit and Stocks

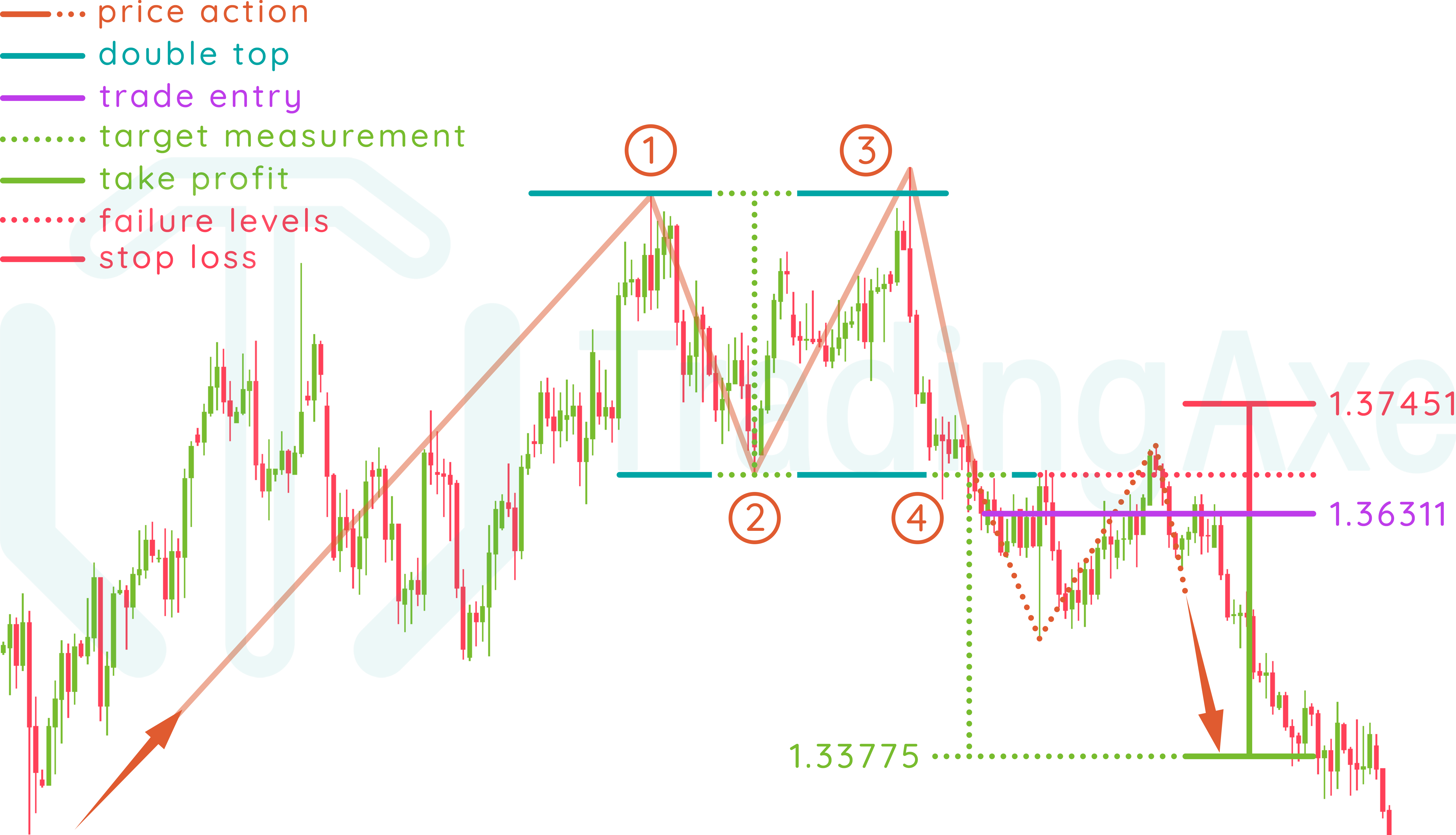

How To Trade Double Top Chart Pattern TradingAxe

Double Top Pattern Your Complete Guide to Consistent Profits

Double Top Pattern Your Complete Guide To Consistent Profits

The Double Top Trading Strategy Guide

AUDCAD Bearish Price Action Signal Double Top Pattern Chart Analysis

The Double Top Chart Pattern Pro Trading School

![[90 win] How to Trade Double Tops double bottom pattern trading](https://i.ytimg.com/vi/e6ct8SJCpiM/maxresdefault.jpg)

[90 win] How to Trade Double Tops double bottom pattern trading

The Pullback To The Neckline.

Identify The Phase Of The Market.

The Chart On The Right Shows An Example Of An Adam & Adam Double Top Chart Pattern.

Web A Double Top Breakout Signals A Bullish Resolution To The Triangle Pattern.

Related Post: