Double Top Candlestick Pattern

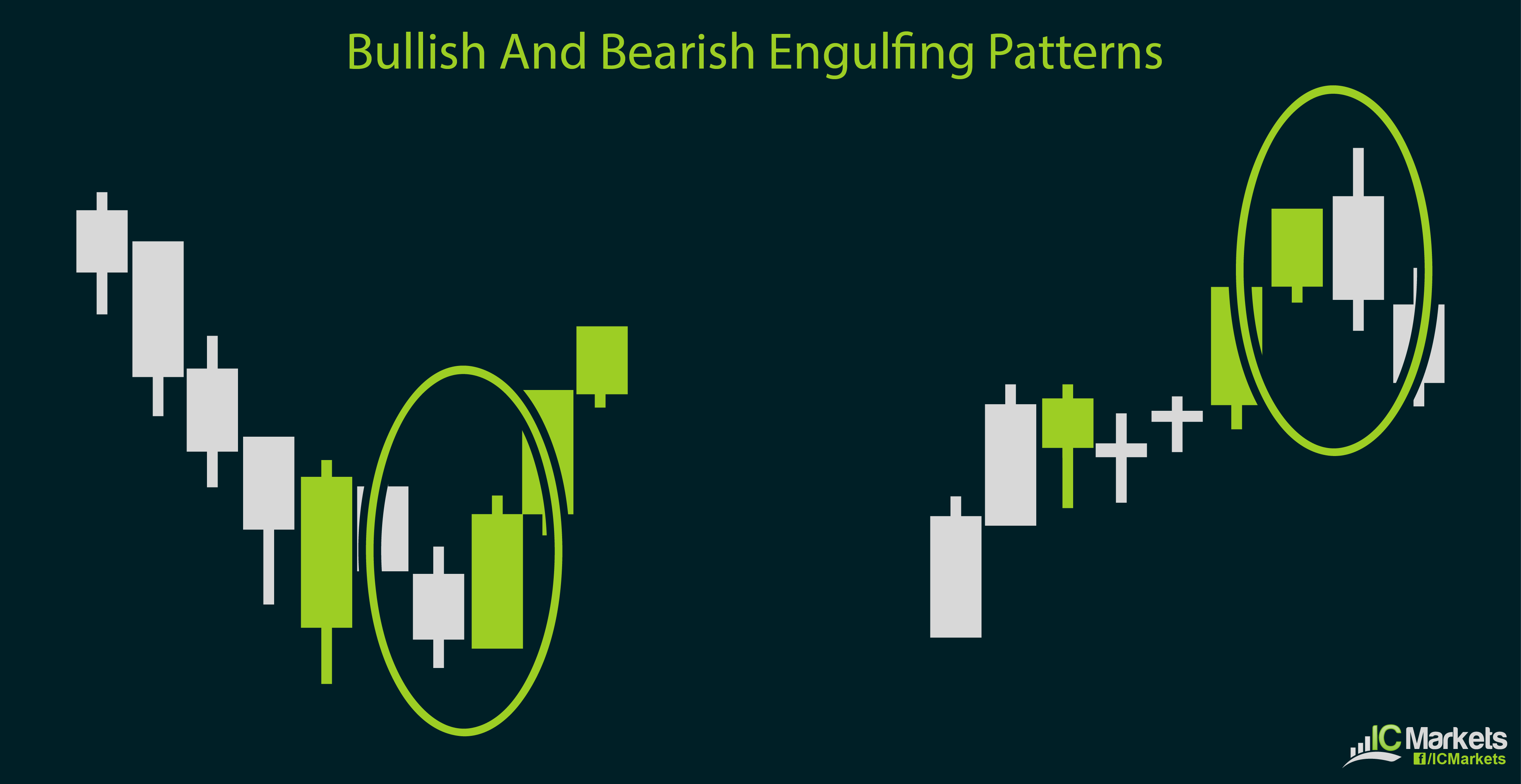

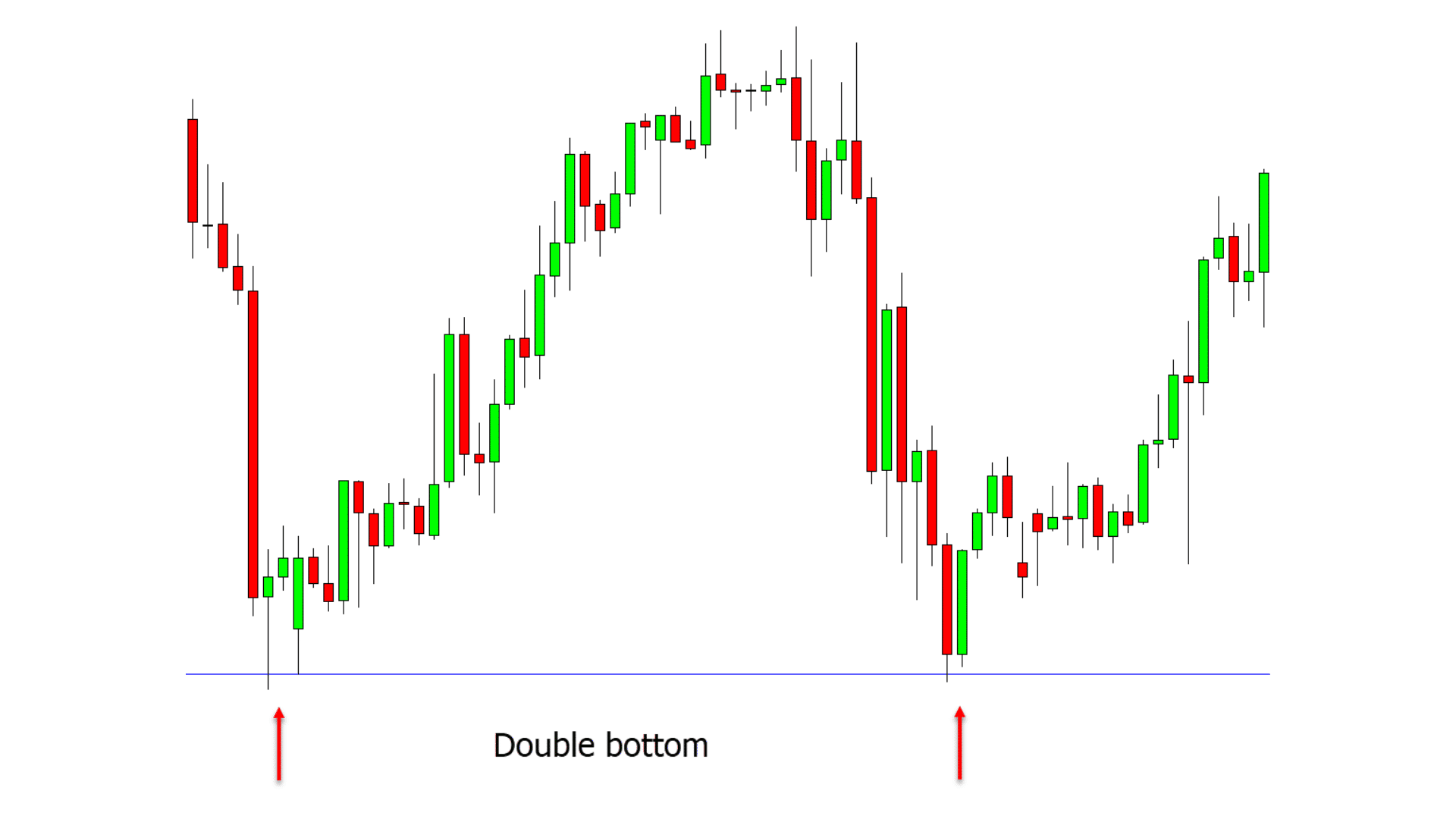

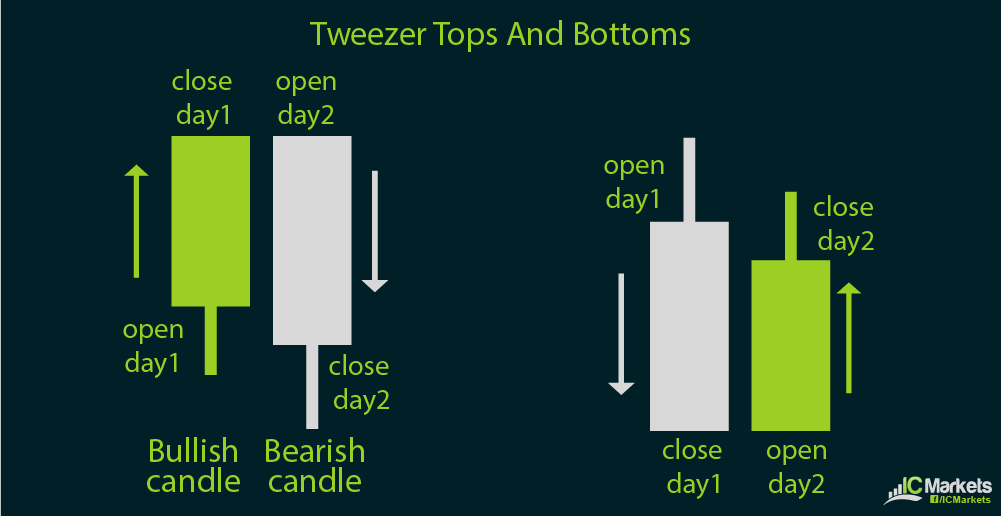

Double Top Candlestick Pattern - The pullback to the neckline. Web the main double candlestick patterns are of two types: Web the double top is a bearish reversal pattern that appears after the price reaches a high two times, and there is a decline between them. Web the double top pattern looks like an “m” while the double bottom pattern looks like a “w.” the double top is a bearish reversal chart pattern. Web also, note the prior two days’ candles, which showed a double top, or a tweezers top, itself a reversal pattern. To identify dual japanese candlestick patterns, you need to look for specific formations that consist of two candlesticks in total. The “tops” are peaks that are formed when the price hits a certain level that can’t be broken. 65 views 6 minutes ago #candlestickpatterns #doubletop #doublebottom. Double tops and bottoms are important technical analysis patterns used by traders. Look at the chart below: The breakout of the neckline. What does a double top pattern mean in technical analysis? Web like single candlestick patterns, double candlestick patterns provide an extensive picture of market sentiment. Equal distance in terms of time between highs. A double top is formed after there is an extended move up. Web a double top pattern is a bearish pattern indicating downward market prices, increasing bearish momentum, and declining bullish momentum. The “tops” are peaks that are formed when the price hits a certain level that can’t be broken. Like the double bottom and tr. A double top has an 'm' shape and indicates a bearish reversal in trend. Identifying and. Web the formation of the double top. A bullish engulfing line is the corollary pattern to a bearish engulfing line. Volume decreases on the second top. A double top pattern means that the market may reverse from bullish price action to bearish price action. Web the double top is a chart pattern with two swing highs very close in price. Web the double top pattern entails two high points within a market which signifies an impending bearish reversal signal. Web the formation of the double top. Web the double top is a bearish reversal pattern that appears after the price reaches a high two times, and there is a decline between them. They are formed by twin highs that can’t. Two peaks that are near equal in price. Web a double top is a frequently occurring chart pattern that indicates a bearish trend reversal, usually at the end of an uptrend. A bullish engulfing line is the corollary pattern to a bearish engulfing line. Web also, note the prior two days’ candles, which showed a double top, or a tweezers. Similar to the double top pattern, it consists of two bottom levels near a support line called the neckline. Like the double bottom and tr. Each pattern has its own characteristics and provides better insights into the market trends and about price alterations. They can be classified as trend reversal patterns or as trend continuation patterns, though there are far. The “tops” are peaks that are formed when the price hits a certain level that can’t be broken. Like the double bottom and tr. A measured decline in price will occur between the two high points,. Similar to the double top pattern, it consists of two bottom levels near a support line called the neckline. Web a double top is. Web the formation of the double top. Web the main double candlestick patterns are of two types: The “tops” are peaks that are formed when the price hits a certain level that can’t be broken. Look at the chart below: Web the double top is a bearish reversal pattern that appears after the price reaches a high two times, and. Volume decreases on the second top. The breakout of the neckline. Similar to the double top pattern, it consists of two bottom levels near a support line called the neckline. Web the double top reversal is a bearish reversal pattern typically found on bar charts, line charts, and candlestick charts. Like other bearish reversal candlestick patterns such as bearish engulfing,. Like other bearish reversal candlestick patterns such as bearish engulfing, shooting star, evening star, etc., this is a bearish reversal pattern but a chart pattern. Web the double top pattern entails two high points within a market which signifies an impending bearish reversal signal. Double candlestick patterns, composed of two specific candlesticks, are used in technical analysis to signal potential. Web the double top pattern is a bearish reversal pattern that occurs after an uptrend and signals a potential trend reversal, suggesting that the market may be running out of steam. What does a double top pattern mean in technical analysis? A double top has an 'm' shape and indicates a bearish reversal in trend. They are a combination of two candlesticks, which form together and are employed in technical analysis. Web the double top pattern looks like an “m” while the double bottom pattern looks like a “w.” the double top is a bearish reversal chart pattern. Volume decreases on the second top. Web a double top pattern consists of several candlesticks that form two peaks or resistance levels that are either equal or near equal height. They are formed by twin highs that can’t break above to form new highs. They can be classified as trend reversal patterns or as trend continuation patterns, though there are far more double candlestick reversal patterns than double candlestick continuation patterns, and they can be bullish or bearish. A double top pattern means that the market may reverse from bullish price action to bearish price action. Web the formation of the double top. Identifying and effectively trading this pattern can provide traders with an edge in understanding market dynamics and making informed trading decisions. Web double candlestick patterns are candlestick patterns that consists of two candlesticks. Double candlestick patterns, composed of two specific candlesticks, are used in technical analysis to signal potential trend reversals or confirmations, with popular examples being bullish engulfing and. Equal distance in terms of time between highs. Look at the chart below:

Best Double Candlestick Patterns Episode 02 Basic Technical

Double Candlestick Patterns IC Markets Official Blog

Double Top and Double Bottom Pattern Quick Guide With PDF

![Candlestick Patterns The Definitive Guide [UPDATED 2022]](https://www.alphaexcapital.com/wp-content/uploads/2020/04/Bullish-Harami-Candlestick-Patterns-Example-by-Alphaex-Capital-1030x1030.png)

Candlestick Patterns The Definitive Guide [UPDATED 2022]

The Common Forex Candlestick Patterns

Candlestick Patterns The Trader's Guide

Double Candlestick Patterns IC Markets Official Blog

What Is The Double Top Candlestick Pattern & How To Trade With It The

Double Top Pattern A Forex Trader’s Guide

Candlestick Patterns The Definitive Guide (2021)

Web The Double Top Is A Chart Pattern With Two Swing Highs Very Close In Price.

The Pullback To The Neckline.

Similar To The Double Top Pattern, It Consists Of Two Bottom Levels Near A Support Line Called The Neckline.

Like Other Bearish Reversal Candlestick Patterns Such As Bearish Engulfing, Shooting Star, Evening Star, Etc., This Is A Bearish Reversal Pattern But A Chart Pattern.

Related Post: