Double Top And Double Bottom Chart Patterns

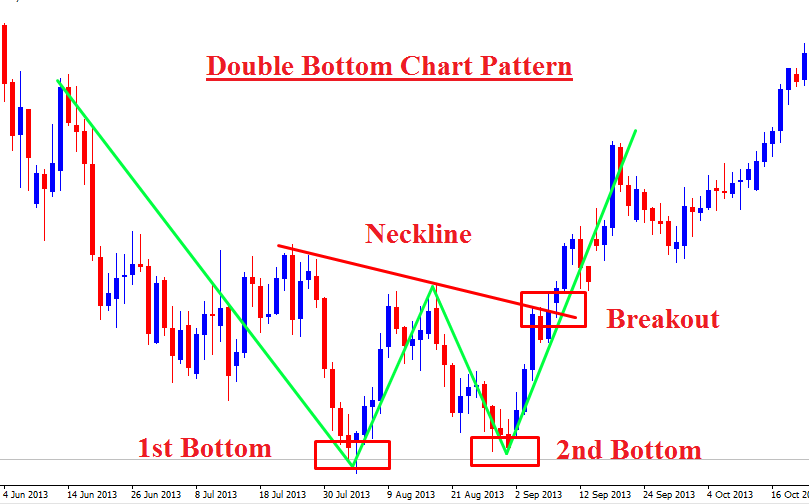

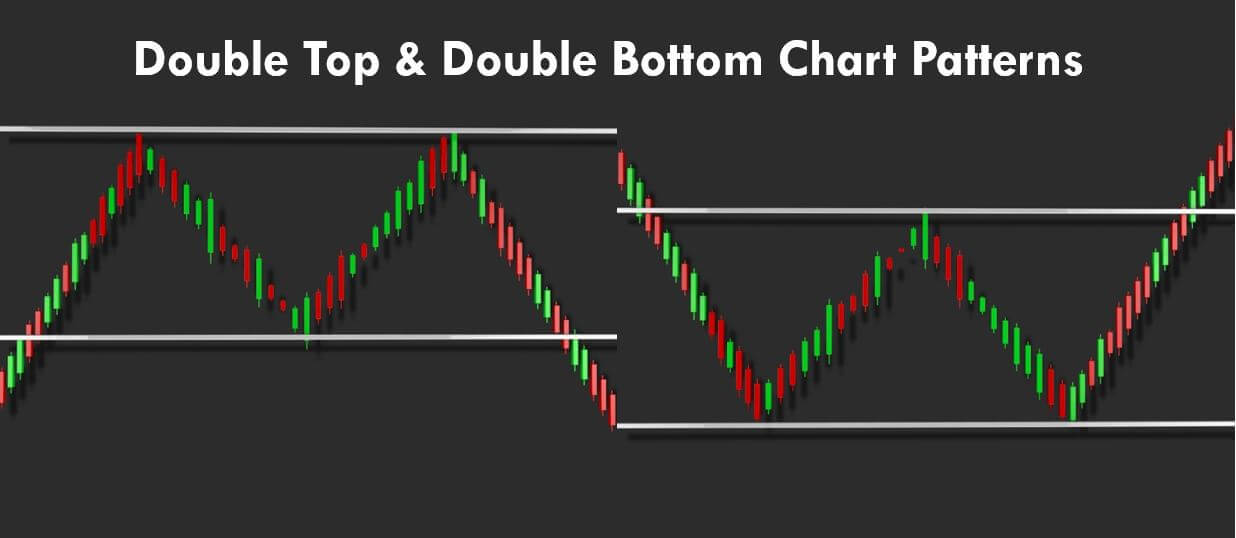

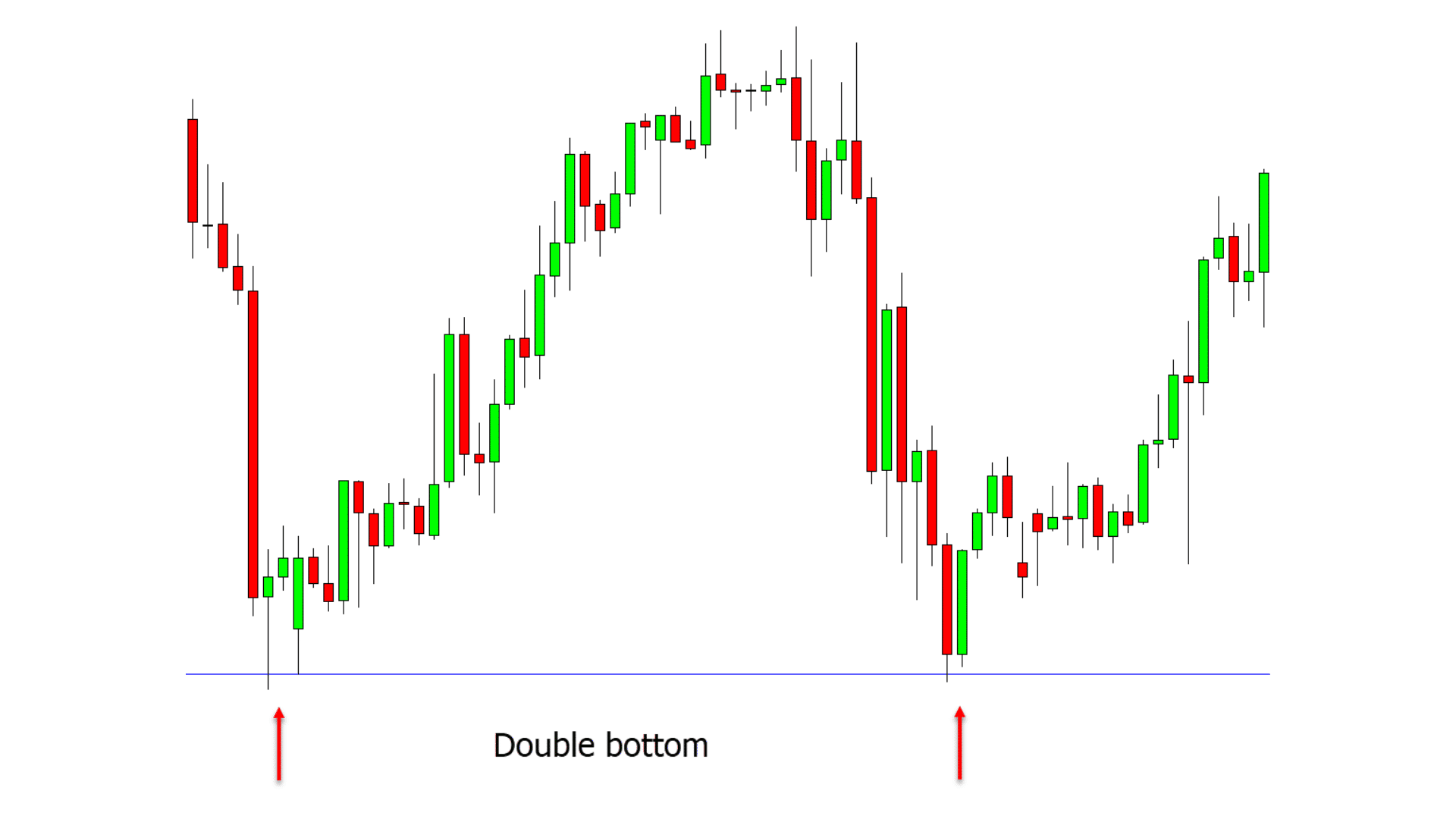

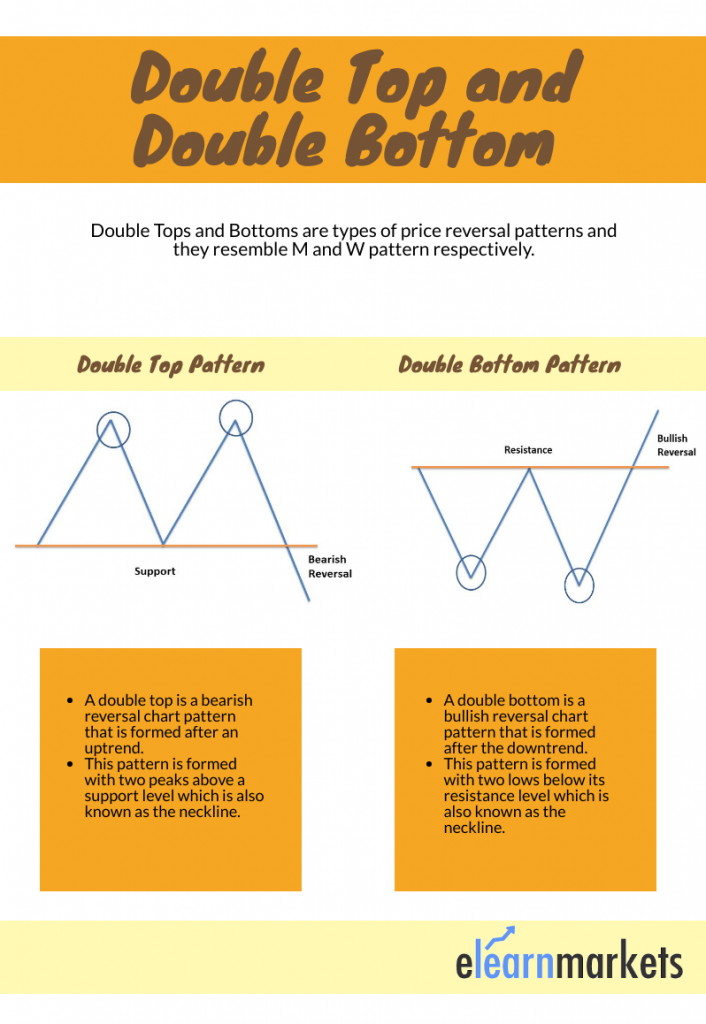

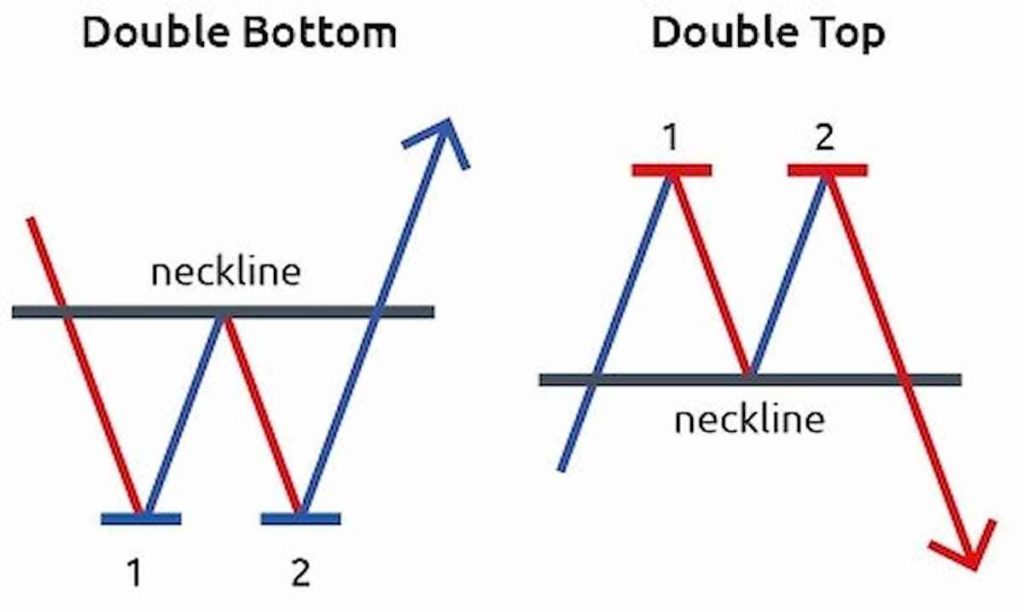

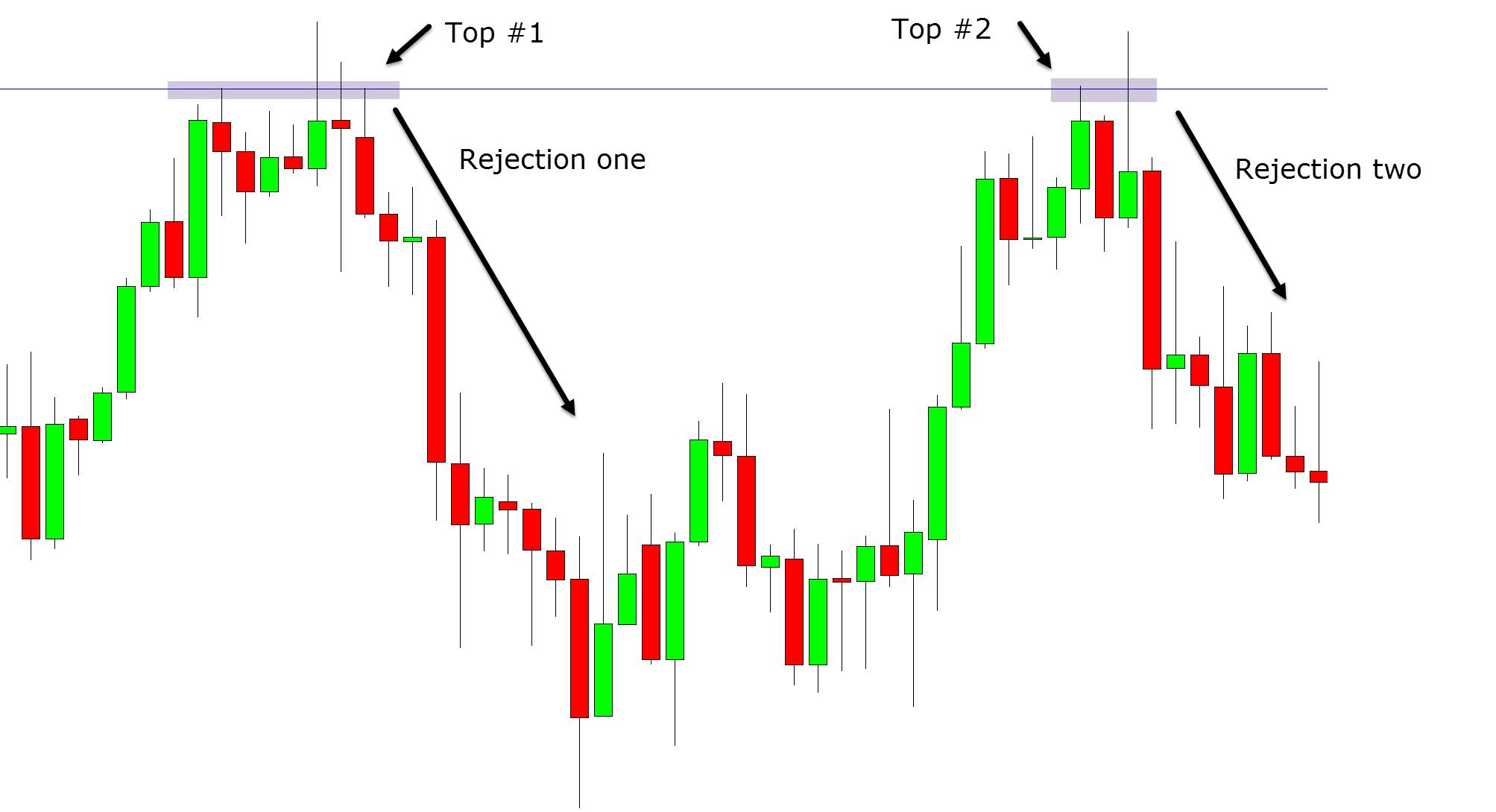

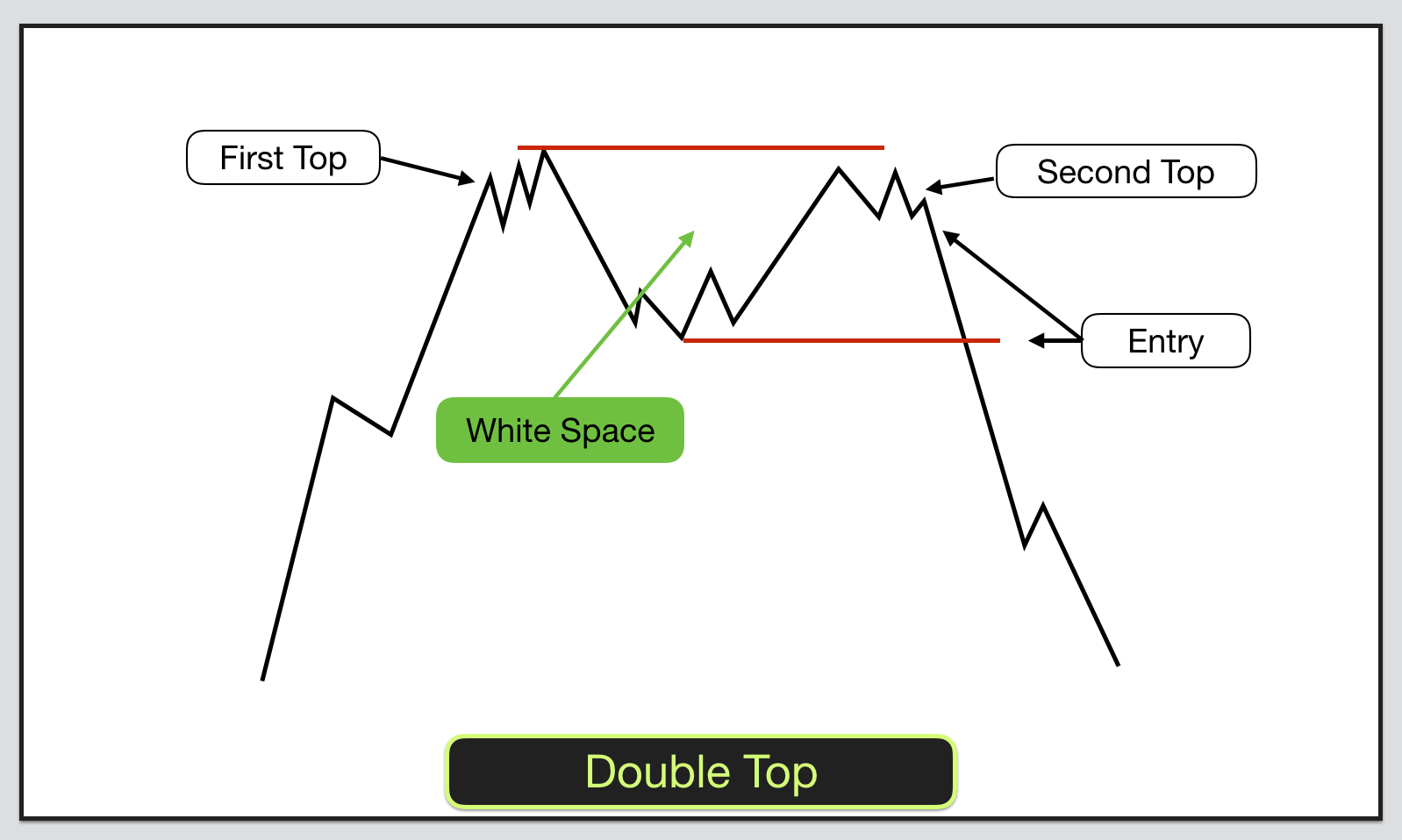

Double Top And Double Bottom Chart Patterns - What is a double bottom? Web double bottoms and tops are chart patterns that take the shape of a “w” for double bottoms and an “m” for double tops. A double bottom pattern consists of three parts: [1] [2] double top confirmation. These patterns usually move over a longer period of time. Web the double top and double bottom patterns are powerful technical tools used by traders in major financial markets including forex. It is a reversal chart pattern, which appears at the end of trends. Skillfully leveraging these patterns could reap significant rewards. Traders typically look for the price to close below the confirmation line, accompanied by an increase in volume, before initiating a sell signal. These reversal chart patterns take a longer period to be formed. Web double top and double bottom are reversal chart patterns observed in the technical analysis of financial trading markets of stocks, commodities, currencies, and other assets. What is a double bottom? Web one of the most common methods of technical analysis is the use of chart patterns. Similar to the double top pattern, it consists of two bottom levels near. My double top and double bottom analysis based on six popular etfs. Web a double bottom chart pattern generally looks like the letter w, marking two price lows (bottoms) and three reversal points, and consists of three key elements. How to become a professional trader : They signify a shift in market sentiment and are typically seen after an extended. A double bottom pattern consists of three parts: Web how to identify double tops and double bottom patterns. Traders typically look for the price to close below the confirmation line, accompanied by an increase in volume, before initiating a sell signal. Web which chart pattern is best for trading? In fact, this pattern appears so often that it alone leads. The double top is a. Web double top and double bottom are reversal chart patterns observed in the technical analysis of financial trading markets of stocks, commodities, currencies, and other assets. Web a double top is a chart pattern characterized by two price highs that are rejected by a resistance level, signaling a potential bearish reversal trend. Web the double. Double top resembles the m pattern and indicates a bearish reversal whereas double bottom resembles the w pattern and indicates a bullish reversal. A double top is another bearish reversal pattern that is very commonly used by the traders. It is a reversal chart pattern, which appears at the end of trends. Traders typically look for the price to close. These patterns usually move over a longer period of time. Web double tops and double bottoms are chart patterns used to signify a reversal from the prevailing trend. We can find these patterns around support and resistance levels. Traders use these patterns to identify potential areas of support and resistance, as well as trend. After a strong downtrend, the market. Learn to identify some useful chart patterns, merry christmas. Similar to the double top pattern, it consists of two bottom levels near a support line called the neckline. We can find these patterns around support and resistance levels. Web updated june 28, 2021. A double bottom pattern is a classic technical analysis charting formation that represents a major change in. Web double bottoms and tops are chart patterns that take the shape of a “w” for double bottoms and an “m” for double tops. These formations suggest that asset prices have hit a bottom or a top twice before continuing on the trend reversal path. What is double top and bottom? Traders use these patterns to identify potential areas of. Treating the double top as a long entry. The double top chart pattern; Traders typically look for the price to close below the confirmation line, accompanied by an increase in volume, before initiating a sell signal. 11 chart patterns for trading symmetrical triangle. Web double top and double bottom are reversal chart patterns observed in the technical analysis of financial. Traders typically look for the price to close below the confirmation line, accompanied by an increase in volume, before initiating a sell signal. How to identify a double top pattern on forex. It is a reversal chart pattern, which appears at the end of trends. What is a double bottom? Web double top and double bottom are reversal chart patterns. Web how to identify double tops and double bottom patterns. Here, we explain double tops and double bottoms including what they tell traders and how to trade using them. Web a double top is a chart pattern characterized by two price highs that are rejected by a resistance level, signaling a potential bearish reversal trend. We can find these patterns around support and resistance levels. How to become a professional trader : Web a double bottom chart pattern generally looks like the letter w, marking two price lows (bottoms) and three reversal points, and consists of three key elements. Short momentum neckline double bottom relative strength index parabolic sar. Traders typically look for the price to close below the confirmation line, accompanied by an increase in volume, before initiating a sell signal. Web updated june 28, 2021. These patterns usually move over a longer period of time. In fact, this pattern appears so often that it alone leads some to think. Today we are going to talk about a very common chart formation. How to identify a double top pattern on forex. Learn to identify some useful chart patterns, merry christmas. Web the double top and double bottom patterns are classic reversal patterns in forex trading. The double top chart pattern;

Forex chart pattern trading on double top and double bottom

115. Trading The Double Tops and Double Bottom Chart Patterns Forex

Double Top and Double Bottom Pattern Quick Guide With PDF

How to Use Double Top and Double Bottom Patterns

The Ultimate Guide to Double Top and Double Bottom Pattern

![[90 win] How to Trade Double Tops double bottom pattern trading](https://i.ytimg.com/vi/e6ct8SJCpiM/maxresdefault.jpg)

[90 win] How to Trade Double Tops double bottom pattern trading

Double Top Pattern Explained for Forex Traders

Double Top Pattern Definition How to Trade Double Tops & Bottoms?

Double Top and Double Bottom Indicator for MT4 and MT5 Free

Double Top And Double Bottom Chart Patterns Day Trading Swing Trading

Web Which Chart Pattern Is Best For Trading?

A Double Bottom Pattern Is A Classic Technical Analysis Charting Formation That Represents A Major Change In Trend.

Let’s Learn How To Identify These Chart Patterns And Trade Them.

Technical Analysis Patterns, Including The Double Top And Double Bottom, Provide Savvy Traders With A Window Into The Psychology Behind Price Movements.

Related Post: