Double Bottom Pattern Stocks

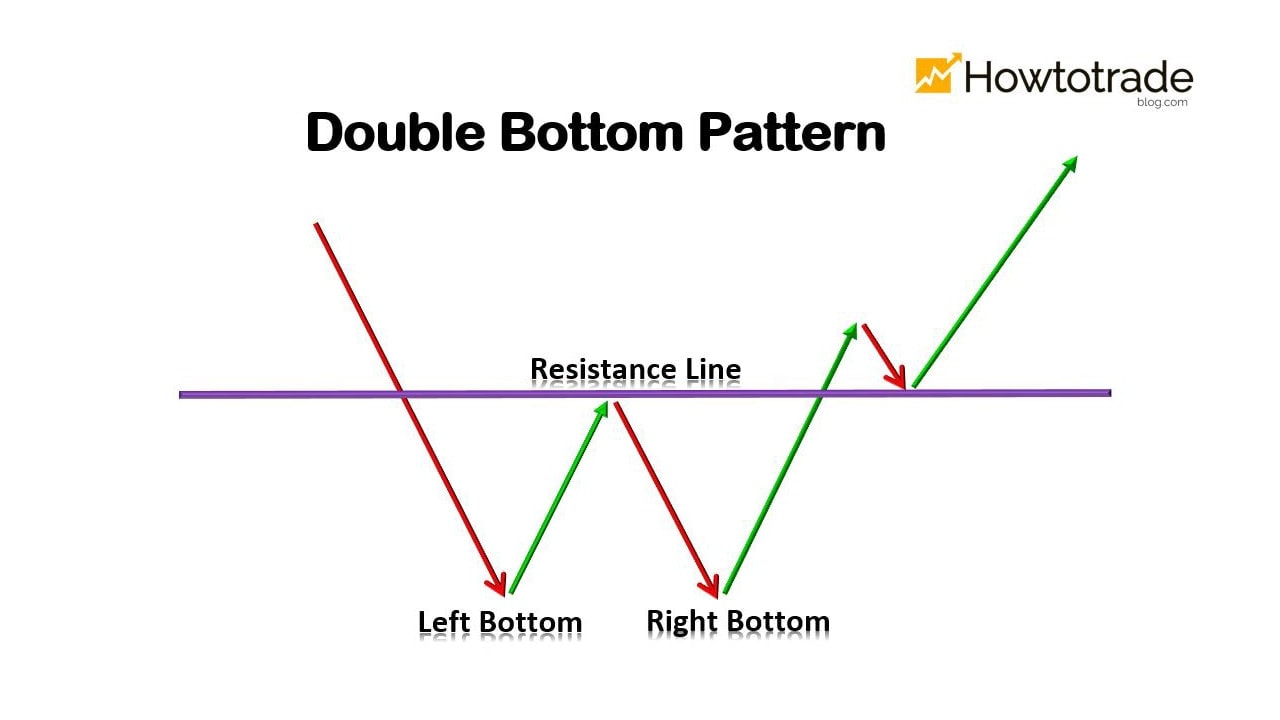

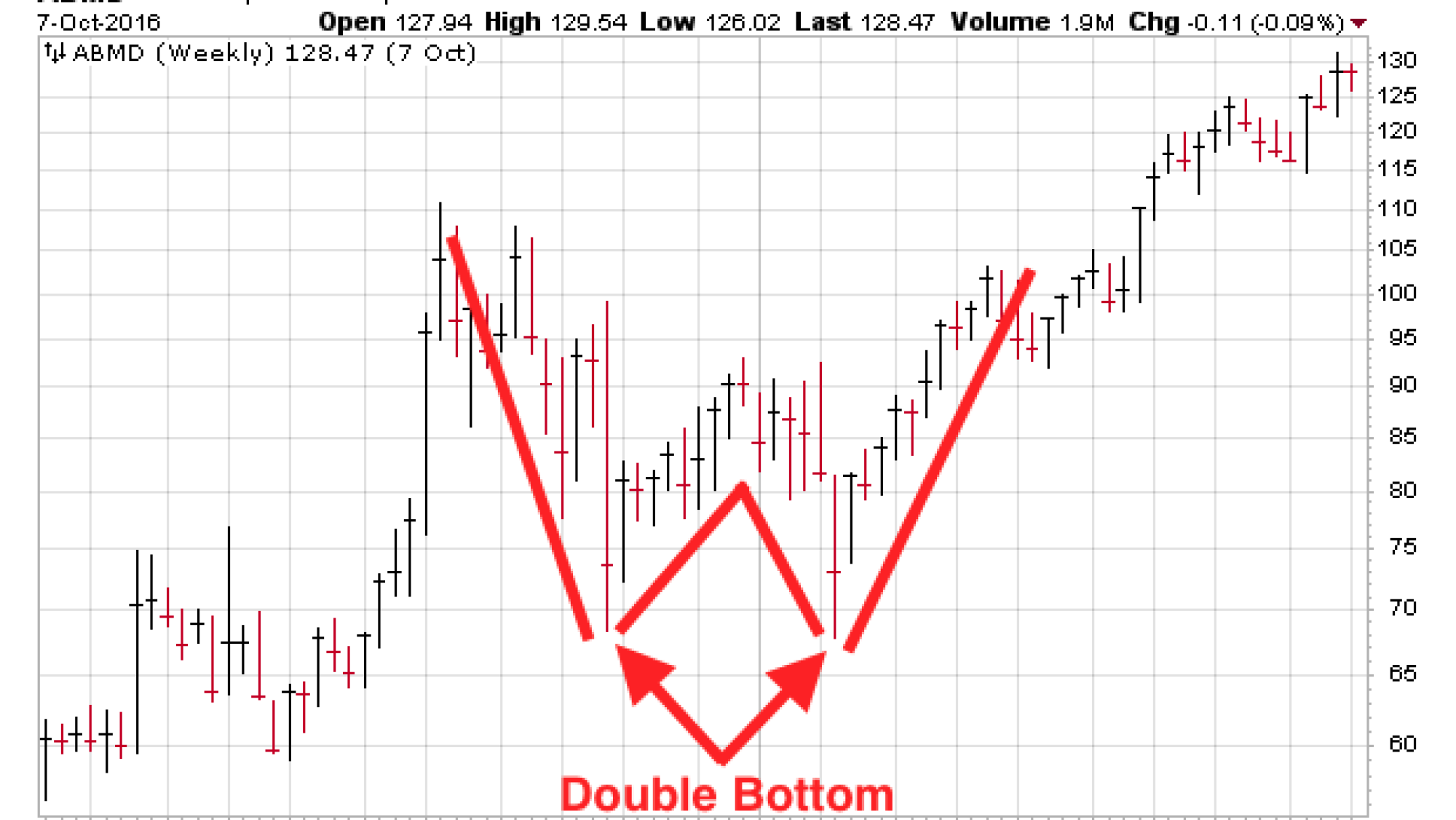

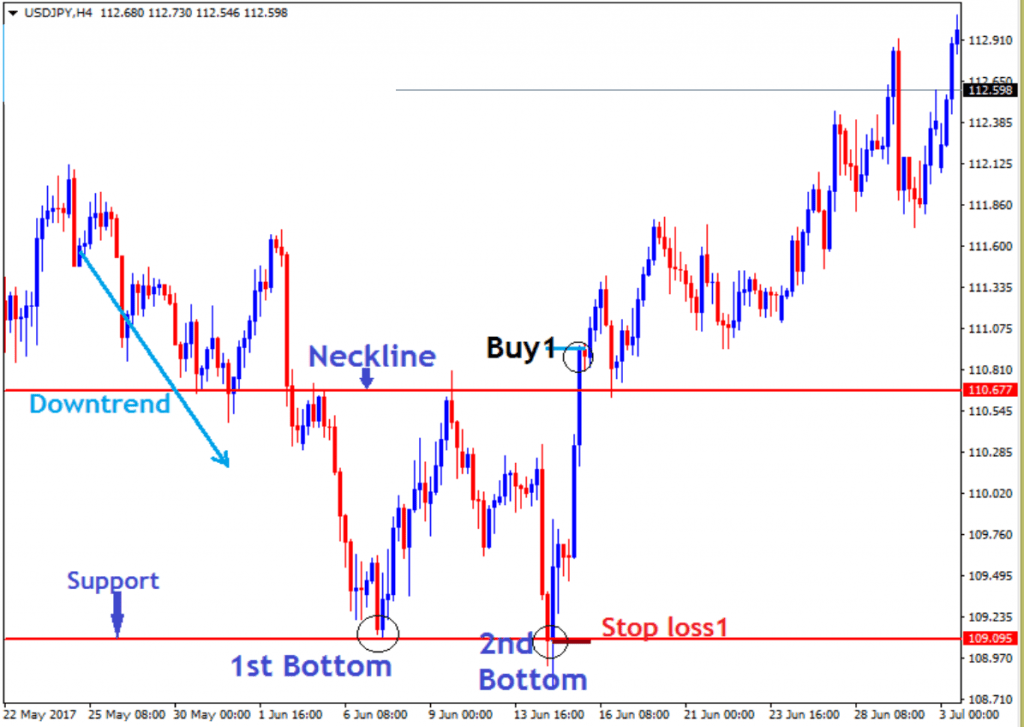

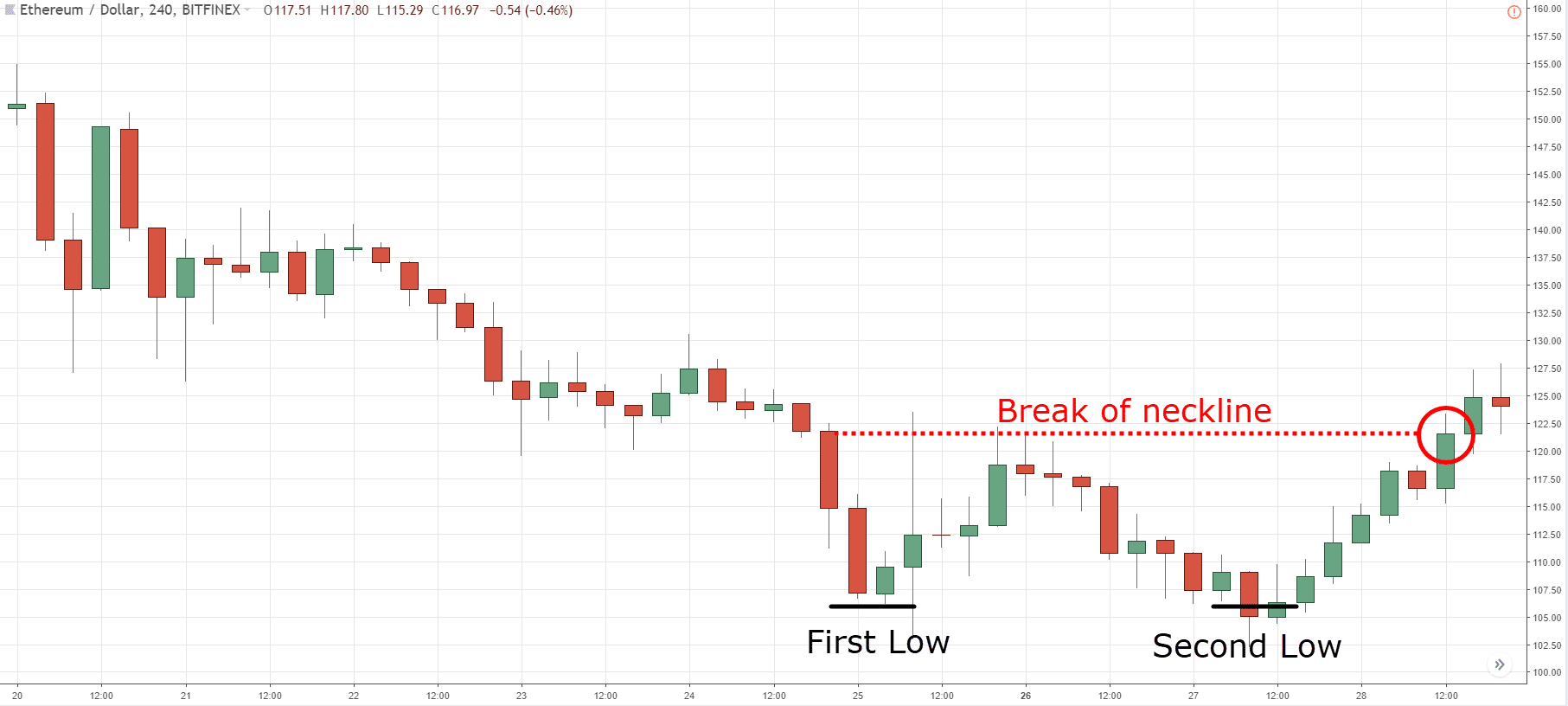

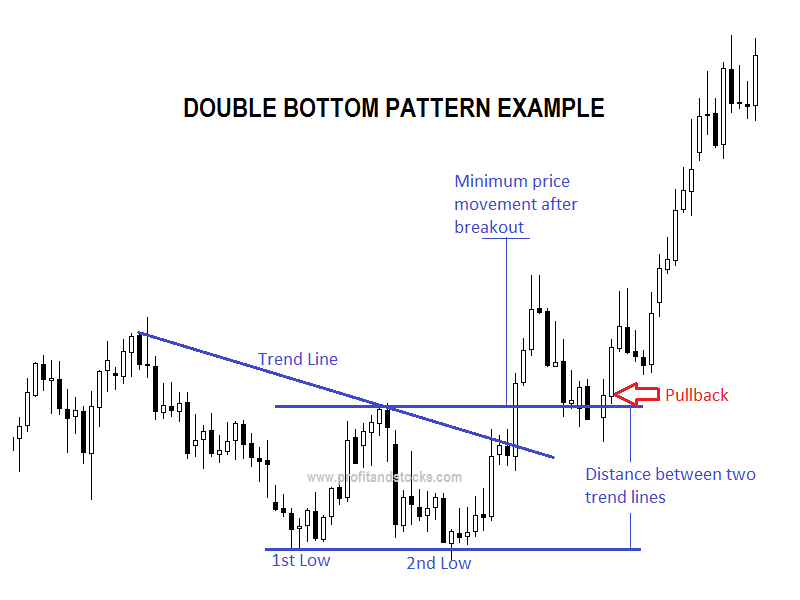

Double Bottom Pattern Stocks - The price has bounced from the buy liquidity support area at $11.5, suggesting a strong level of buying interest at that price point. This is an example of a double bottom pattern. Browse, filter and set alerts for announcements. Web double bottom patterns are essentially the opposite of double top patterns. If you want to find winning stocks, better know it. Traders would enter a long position on the bullish candlestick that breaks above the top of the double bottom. Double bottom get email updates double bottom. #link/usdt has recently shown a bullish shark and double bottom pattern, indicating a potential uptrend. The charts below show how this. In the world of stock trading and technical analysis, chart patterns are a trader's best friend. Run queries on 10 years of financial data. #link/usdt has recently shown a bullish shark and double bottom pattern, indicating a potential uptrend. Web double bottom technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. [1] [2] double top confirmation. A double bottom looks like “w” shape,. Web double bottom patterns describe a stock drop, followed by a rebound, and then another drop to the same support level. Web in the third installment of this how to read stock charts series, you'll learn to spot the most profitable chart patterns (aka bases): It comes after a prolonged bearish trend, highly considered as a bullish reversal chart pattern.. Meaning that the price of an asset that has been continuously decreasing over time is about to reverse and start increasing again. Browse, filter and set alerts for announcements. What is a double bottom? They provide valuable insights into potential price movements and can serve as reliable signals for making buy or. Learn more.find out today.learn at no cost.free animation. If you want to find winning stocks, better know it. Web stock screener for investors and traders, financial visualizations. Learn more.find out today.learn at no cost.free animation videos. Web double top and double bottom are reversal chart patterns observed in the technical analysis of financial trading markets of stocks, commodities, currencies, and other assets. Web technical & fundamental stock screener,. Web 11:00 am et 04/29/2019. The impulse then needs to get sold into; Web trading with a double bottom pattern: Access to all records is available to premium users. #link/usdt has recently shown a bullish shark and double bottom pattern, indicating a potential uptrend. Web the double bottom pattern is an indicator that’s used to describe changes in price trends and momentum. A double bottom is formed following a single rounding. The double bottom is frequently used in the forex and equity markets as buy/bullish signals. Learn and analyze growth stocks with the pros. Web stock screener for investors and traders, financial visualizations. [1] [2] double top confirmation. Run queries on 10 years of financial data. Traders would enter a long position on the bullish candlestick that breaks above the top of the double bottom. What is a double bottom? Price needs to establish a bearish expansion towards the lows before reversing with an impulse. Web the double bottom pattern is an indicator that’s used to describe changes in price trends and momentum. A double bottom looks like “w” shape, in that it begins with a stock’s or security’s price at a specific high point, then dips, rebounds slightly, dips again, then rises again. In the world of stock trading and technical analysis, chart patterns. The impulse then needs to get sold into; Web the **double bottom** is a price action pattern that is indicative of a trend change once activated. Web stock screener for investors and traders, financial visualizations. Browse, filter and set alerts for announcements. Web as the name implies, the double bottom pattern consists of two bottoms, which look like the letter. Meaning that the price of an asset that has been continuously decreasing over time is about to reverse and start increasing again. Price needs to establish a bearish expansion towards the lows before reversing with an impulse. If you want to find winning stocks, better know it. They provide valuable insights into potential price movements and can serve as reliable. This is an example of a double bottom pattern. Cup with handle (and cup without handle), double. Access to all records is available to premium users. Web the double bottom reversal is a bullish reversal pattern typically found on bar charts, line charts, and candlestick charts. Web double bottom patterns are essentially the opposite of double top patterns. Extra savings & incomebuy stocksstockseasy to apply Browse, filter and set alerts for announcements. The price has bounced from the buy liquidity support area at $11.5, suggesting a strong level of buying interest at that price point. Web double bottom patterns describe a stock drop, followed by a rebound, and then another drop to the same support level. Double bottom get email updates double bottom. The double bottom is frequently used in the forex and equity markets as buy/bullish signals. If you want to find winning stocks, better know it. See prices and trends of over 10,000 commodities. Web the **double bottom** is a price action pattern that is indicative of a trend change once activated. Traders would enter a long position on the bullish candlestick that breaks above the top of the double bottom. Web double bottom technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc.

What Is A Double Bottom Pattern? How To Use It Effectively How To

Double Bottom Chart Pattern 101 Should You Invest? Cabot Wealth Network

Double Bottom Pattern A Trader’s Guide

Double Bottom Pattern New Trader U

Double Bottom Pattern Rules and Example StockManiacs

Double Bottom Pattern How to Trade Stocks and Crypto Llitefinance

How to Trade Forex DOUBLE BOTTOM PATTERN ForexCracked

The Double Bottom Pattern Trading Strategy Guide

Double Bottom Chart Pattern Profit and Stocks

What Is A Double Bottom Pattern? How To Use It Effectively How To

It Comes After A Prolonged Bearish Trend, Highly Considered As A Bullish Reversal Chart Pattern.

Price Needs To Establish A Bearish Expansion Towards The Lows Before Reversing With An Impulse.

Showing Page 1 Of 1.

Web The Double Bottom Chart Pattern Is A Technical Analysis Trading Strategy In Which The Trader Attempts To Identify A Reversal Point In The Market.

Related Post: