Double Bottom Chart Pattern

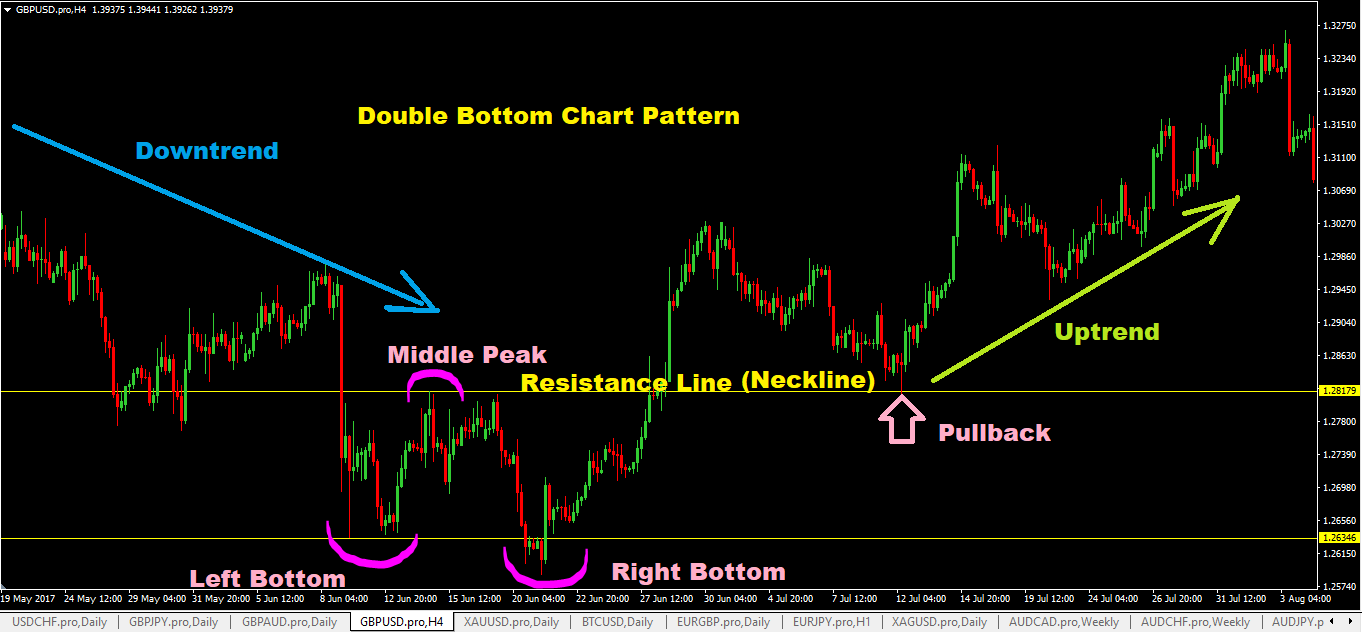

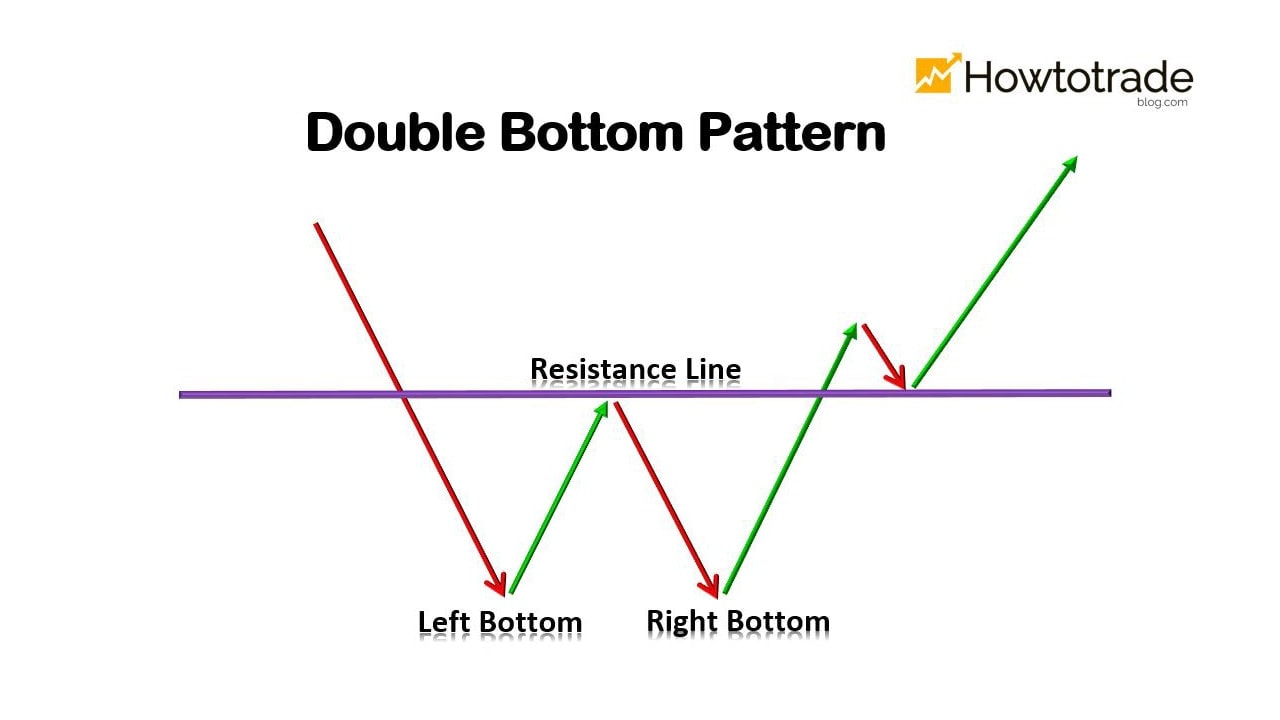

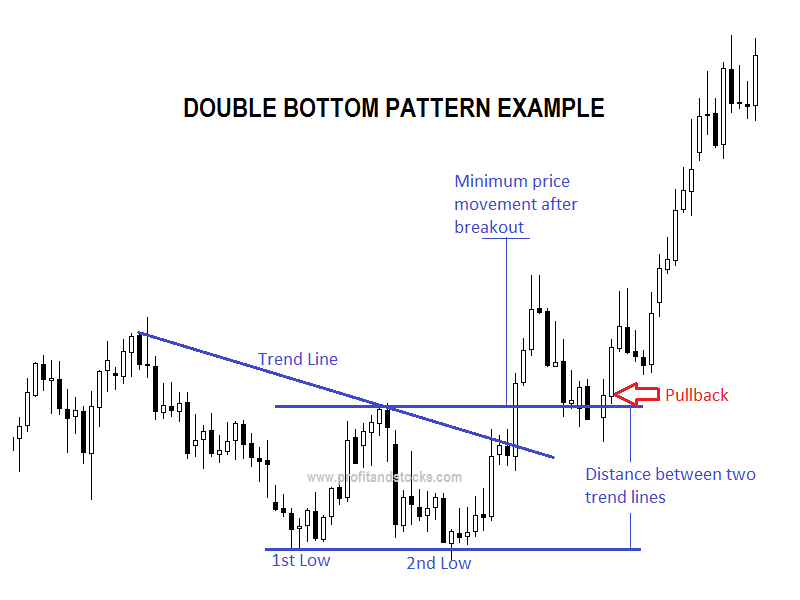

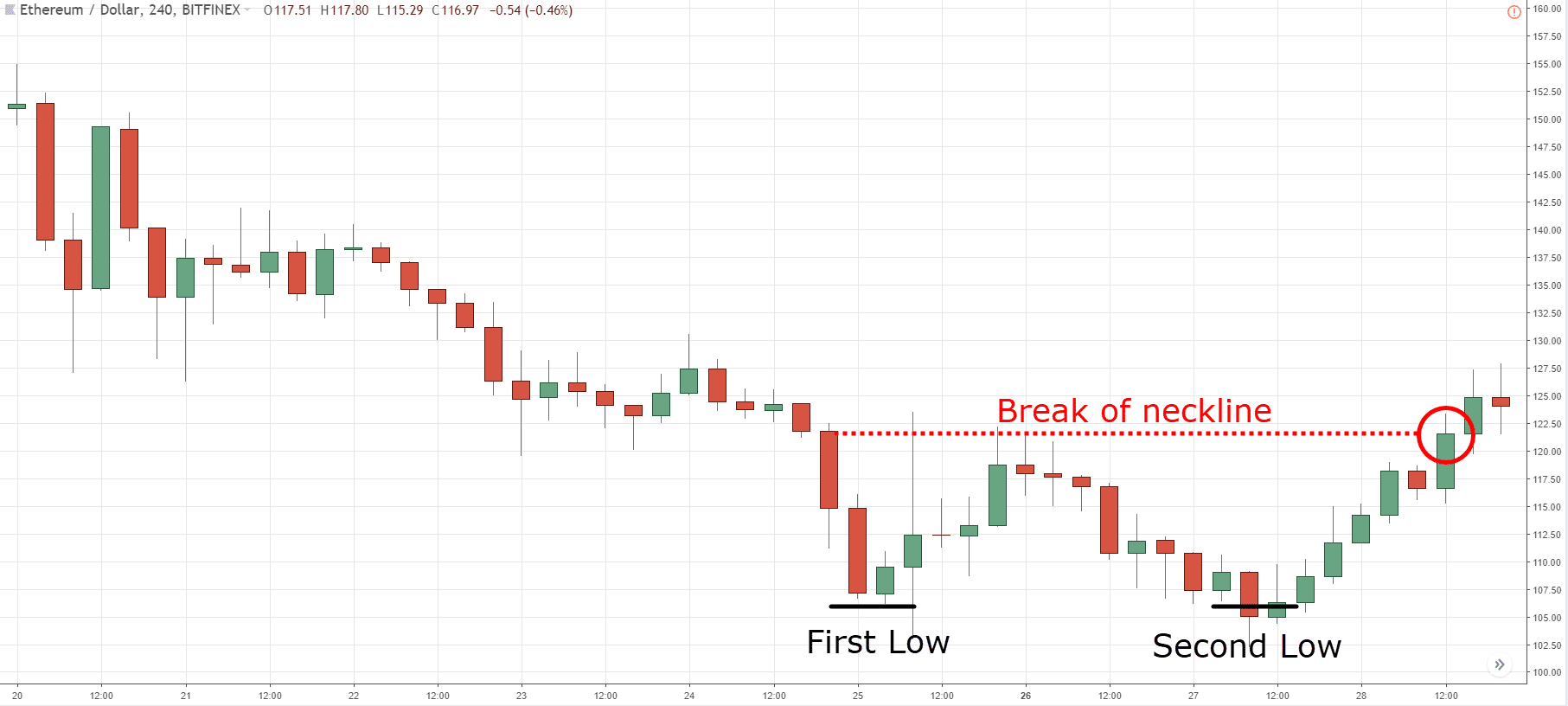

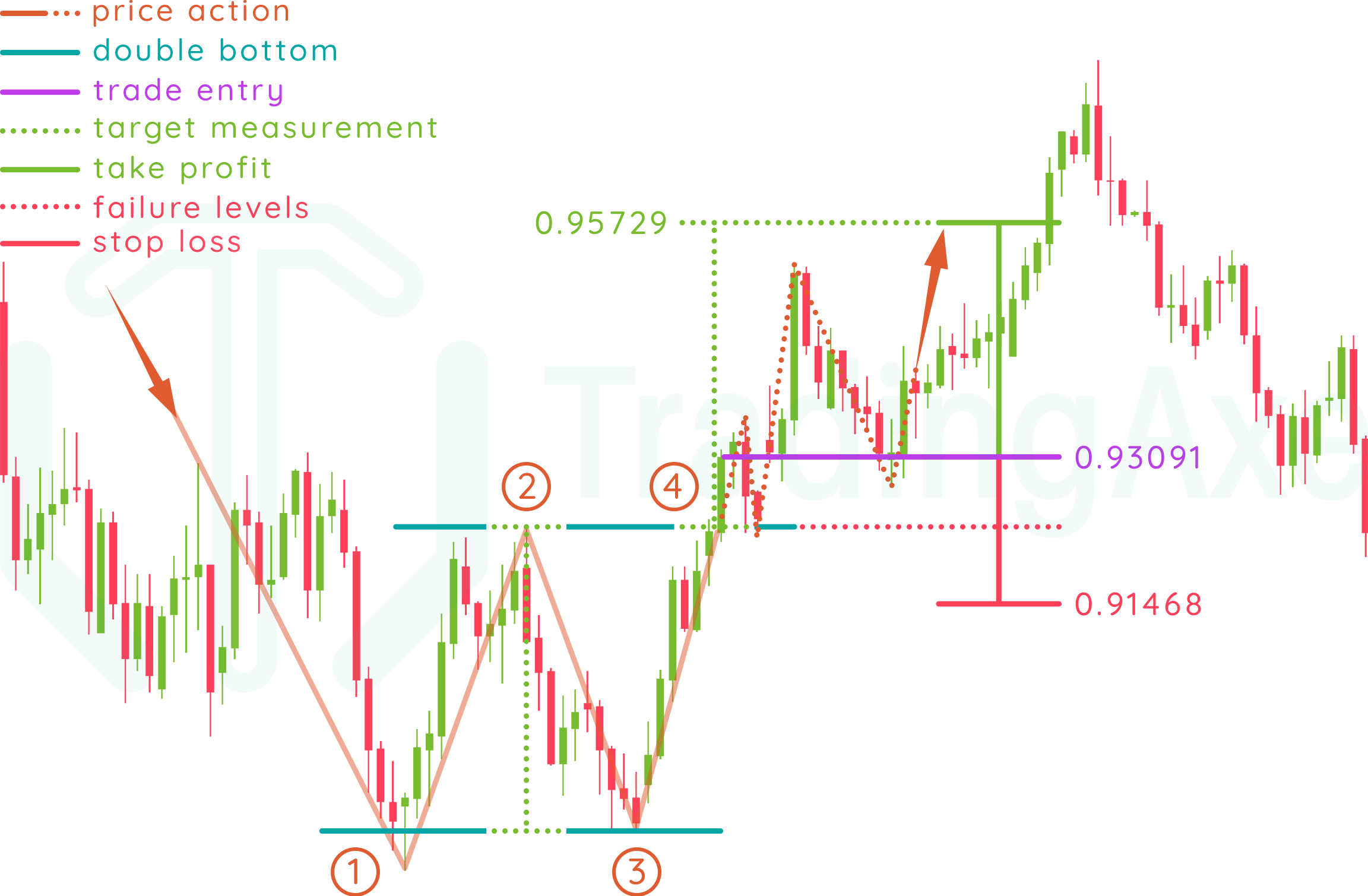

Double Bottom Chart Pattern - Web a double bottom pattern is a chart or price pattern, or chart formation, that can be identified using various trend lines and curves, which makes chart patterns more apparent and recognizable. The double bottom chart pattern is certainly most effective when it appears at the end of a downtrend. Web see why leading organizations rely on masterclass for learning & development. To trade the pattern, you follow three simple steps: This will create a retest of the previous low that must hold. Chart patterns in which the quote for the underlying investment moves in a similar pattern to the letter w (double bottom) or m (double top). A double bottom is a charting pattern used in technical analysis. Chart formations can help investors identify potential trade entry prices and establish price targets and exit times. Web double top and bottom: Web the **double bottom** is a price action pattern that is indicative of a trend change once activated. The pattern is seen in a downtrend and may indicate the end of the downtrend, so it is considered a bullish reversal pattern. The double bottom shows chart patterns of a downtrend, a reversal pattern upward, another dip to a second bottom, and a final trend reversal that moves upward. A double bottom is a charting pattern used in technical. Web the double bottom reversal is a bullish reversal pattern typically found on bar charts, line charts, and candlestick charts. To trade the pattern, you follow three simple steps: The double bottom chart pattern is certainly most effective when it appears at the end of a downtrend. The double bottom shows chart patterns of a downtrend, a reversal pattern upward,. The pattern is seen in a downtrend and may indicate the end of the downtrend, so it is considered a bullish reversal pattern. It describes the drop of a stock or index, a rebound, another drop to the same or similar level as the original. Web the **double bottom** is a price action pattern that is indicative of a trend. Wait for the pattern to form. Web the double bottom reversal is a bullish reversal pattern typically found on bar charts, line charts, and candlestick charts. Web double top and bottom: It describes the drop of a stock or index, a rebound, another drop to the same or similar level as the original. A double bottom is a charting pattern. Web the **double bottom** is a price action pattern that is indicative of a trend change once activated. It describes the drop of a stock or index, a rebound, another drop to the same or similar level as the original. Web the double bottom chart pattern is found at the end of a downtrend and resembles the letter w(see chart. In the example below, we can see a clear w formation at the end of a bearish trend. Price needs to establish a bearish expansion towards the lows before reversing with an impulse. At the end of the article, we provide you with a. Web a double bottom pattern is a chart or price pattern, or chart formation, that can. The impulse then needs to get sold into; It describes the drop of a stock or index, a rebound, another drop to the same or similar level as the original. Web a double bottom pattern is a chart or price pattern, or chart formation, that can be identified using various trend lines and curves, which makes chart patterns more apparent. Web double top and bottom: This will create a retest of the previous low that must hold. The impulse then needs to get sold into; Wait for the pattern to form. Learn how to identify this upward trend. Web the double bottom chart pattern is found at the end of a downtrend and resembles the letter w(see chart below). Price needs to establish a bearish expansion towards the lows before reversing with an impulse. The impulse then needs to get sold into; Web see why leading organizations rely on masterclass for learning & development. The double bottom chart. The pattern is seen in a downtrend and may indicate the end of the downtrend, so it is considered a bullish reversal pattern. When this happens, the price can potentially reverse and move up higher. Double bottom chart pattern at the end of a downtrend. Note that a double bottom reversal on a bar or line chart is completely different. The double bottom shows chart patterns of a downtrend, a reversal pattern upward, another dip to a second bottom, and a final trend reversal that moves upward. Web the double bottom is one of the easiest chart patterns to trade, which makes it perfect for beginners or anyone who wants to quickly add another profitable set up to their overall trading strategy. The pattern is seen in a downtrend and may indicate the end of the downtrend, so it is considered a bullish reversal pattern. Wait for the pattern to form. Price falls to a new low and then rallies slightly higher before returning to the. Web double top and bottom: Double bottom chart pattern at the end of a downtrend. At the end of the article, we provide you with a. Web the **double bottom** is a price action pattern that is indicative of a trend change once activated. Web the double bottom chart pattern is a price action formation on the chart that consists of two swing lows that end around the same level, and a swing high between them. To trade the pattern, you follow three simple steps: Learn how to identify this upward trend. Web a double bottom pattern is a chart or price pattern, or chart formation, that can be identified using various trend lines and curves, which makes chart patterns more apparent and recognizable. In the example below, we can see a clear w formation at the end of a bearish trend. This will create a retest of the previous low that must hold. Price needs to establish a bearish expansion towards the lows before reversing with an impulse.

Double Bottom Chart Pattern Forex Trading Strategy

What Is A Double Bottom Pattern? How To Use It Effectively How To

Double Bottom Chart Pattern Profit and Stocks

Double Bottom Pattern Rules and Example StockManiacs

What Is A Double Bottom Pattern? How To Use It Effectively How To

The Double Bottom Pattern Trading Strategy Guide

Double Bottom Pattern Your 2023 Guide Daily Price Action

How To Trade Double Bottom Chart Pattern TradingAxe

How To Trade Double Bottom Chart Pattern TradingAxe

Double Bottom Pattern A Trader’s Guide

Web See Why Leading Organizations Rely On Masterclass For Learning & Development.

The Double Bottom Chart Pattern Is Certainly Most Effective When It Appears At The End Of A Downtrend.

The Impulse Then Needs To Get Sold Into;

Note That A Double Bottom Reversal On A Bar Or Line Chart Is Completely Different From Double.

Related Post: