Donation Slip Template

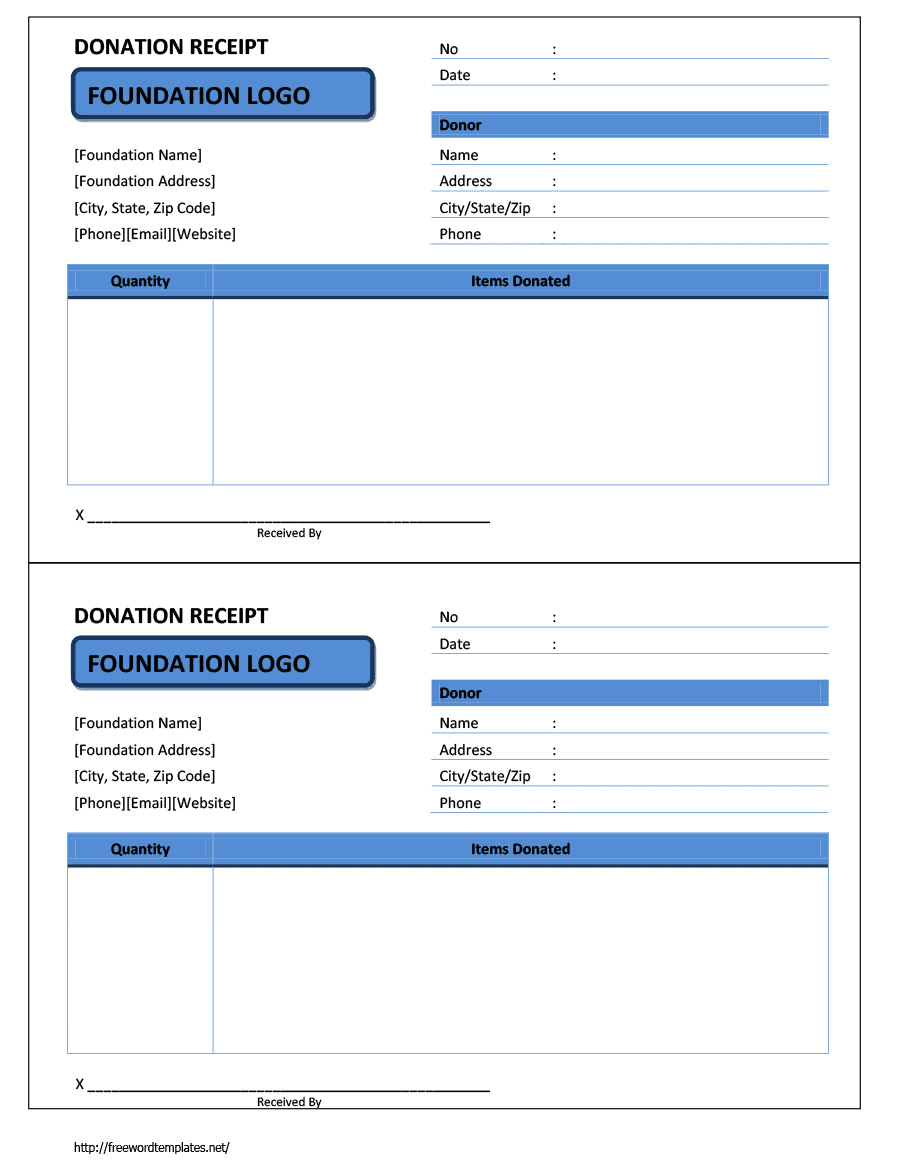

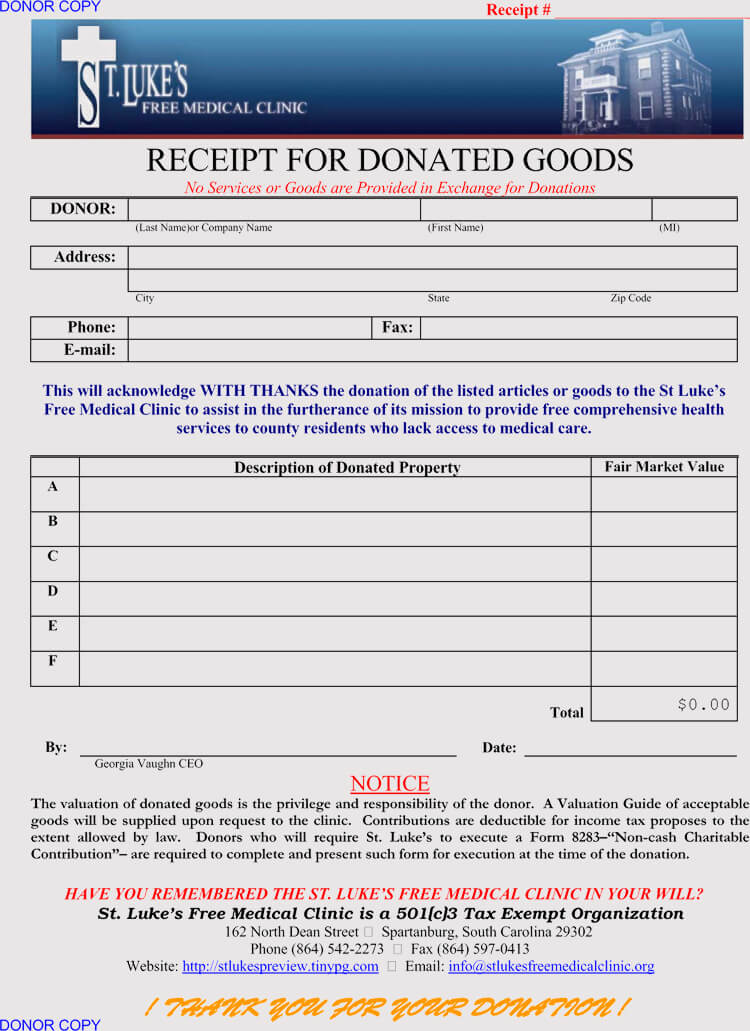

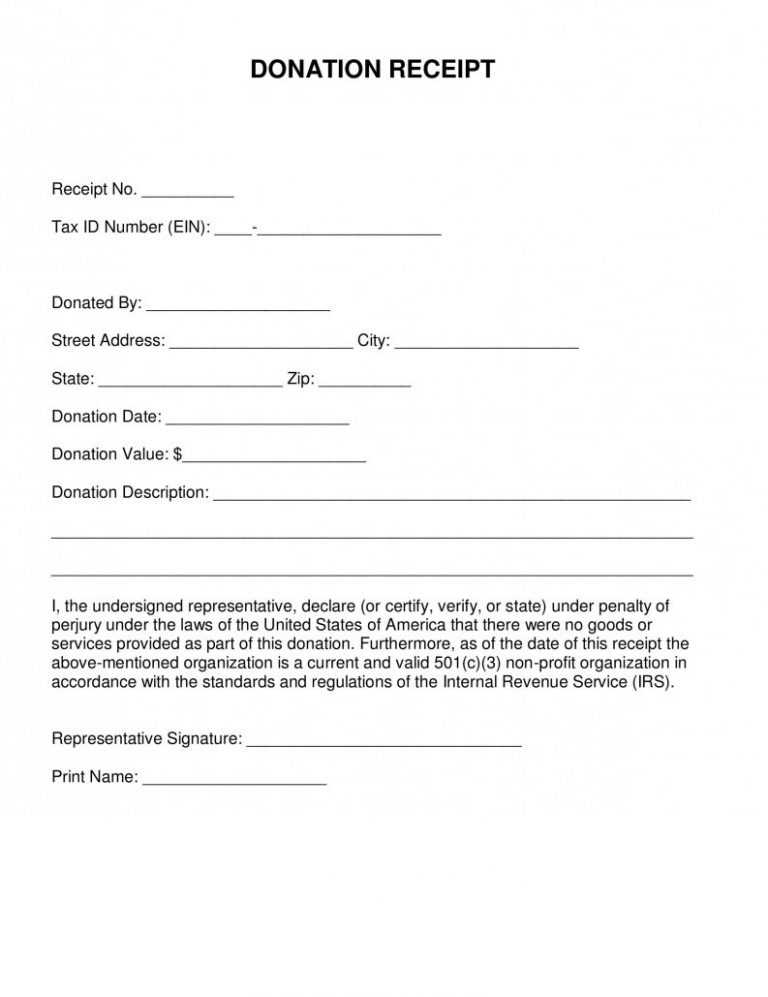

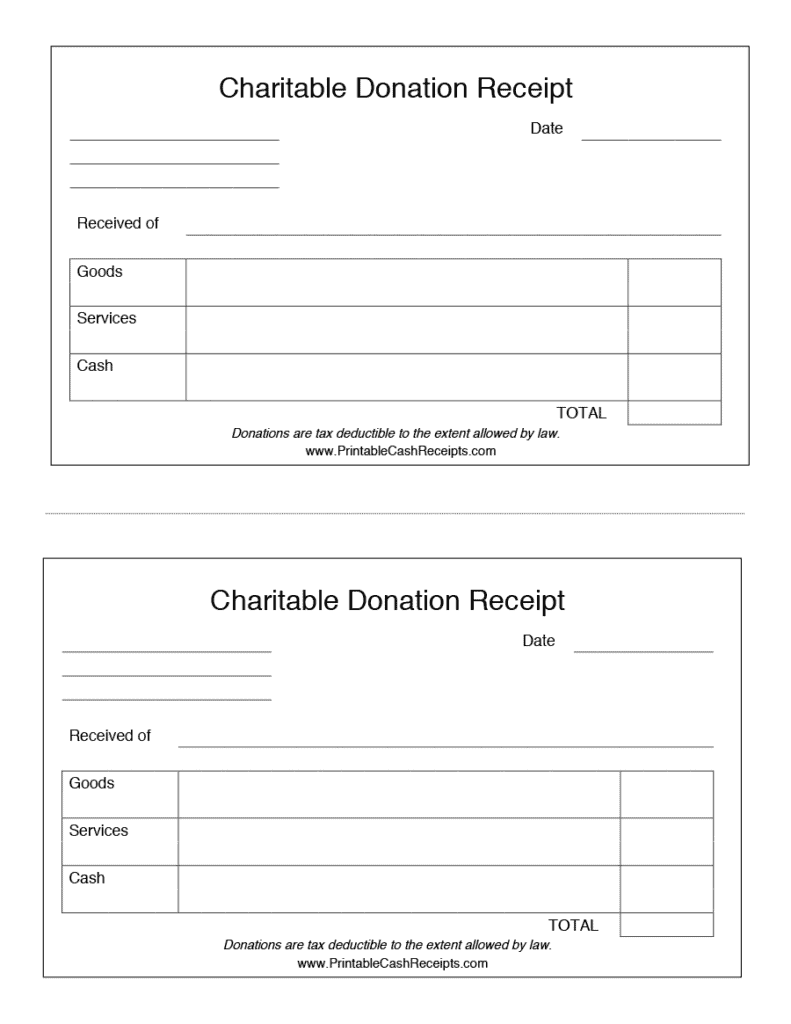

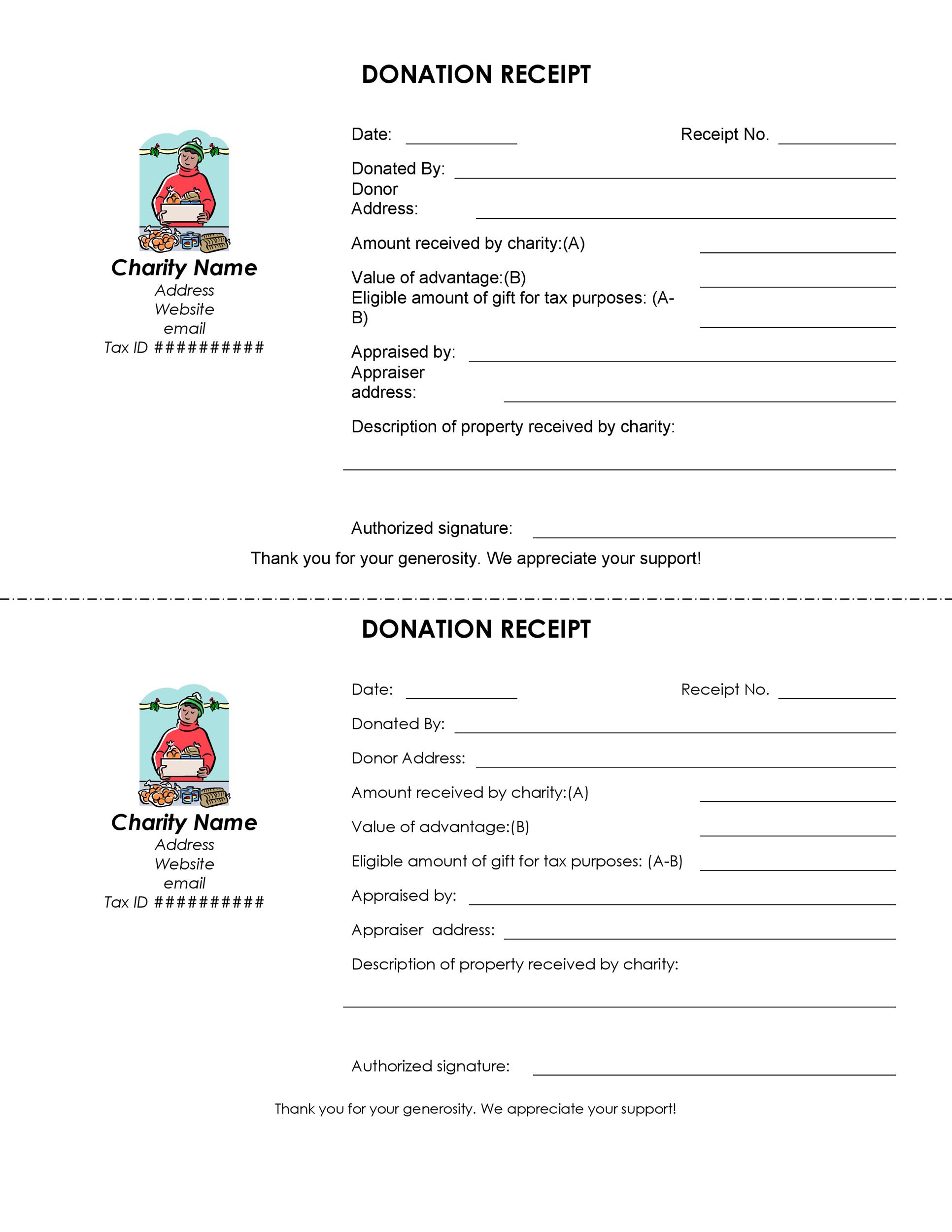

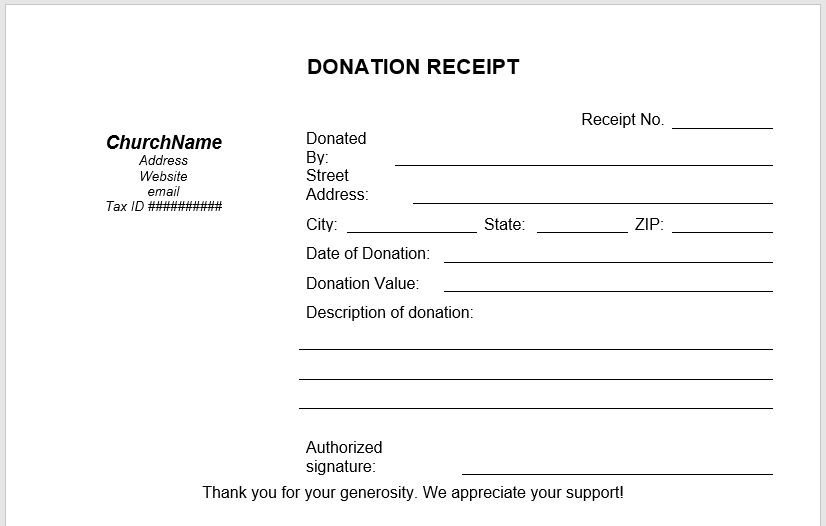

Donation Slip Template - Web donation receipt templates and letters. Charitable donation receipt templates provide a practical and efficient way to generate accurate receipts that acknowledge and record donations. After the receipt has been issued, the donor will be. You can also add your own branding to this template by adding your organization’s logo. A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. These free printable templates in pdf and word format simplify the. The templates are meticulously designed to meet legal and relational needs. We will populate it automatically with all the necessary donation details and organization info. Formstack documents works for your organization as a donation receipt generator. Web donation receipt template. This template is easily customizable and includes fields for donor information, donation date, and a description of the goods or services provided. Our free ai website builder even allows you to create your own. Just be sure to review your donation receipt templates annually to make any necessary updates. These receipts are also used for tax purposes by the organization.. Formstack documents works for your organization as a donation receipt generator. Deliver the written acknowledgment of the contribution. Then, you can customize this basic template based on donation type, such as noncash contributions or monetary support. Charitable donation receipt templates provide a practical and efficient way to generate accurate receipts that acknowledge and record donations. Web donation receipt templates and. Web how to give a cash donation (3 steps) accept the donation from a recipient. Web this is where a tool like formstack documents can come in handy. A donor is responsible for valuing the donated items, and it’s important not to abuse or overvalue such items in the event of a tax audit. Set it up once and let. We will populate it automatically with all the necessary donation details and organization info. Your donation of $250 on july 4, 2019, to our save the turtles! The templates are meticulously designed to meet legal and relational needs. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual’s taxes. According to. Web how to give a cash donation (3 steps) accept the donation from a recipient. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual’s taxes. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax. Web a donation receipt provides documentation to those who give to your organization and serves as a record for tax purposes. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. These free printable templates in pdf and word format simplify the. Web how. Donation receipts are administrative documents that also function as unique tokens of appreciation, affirming the profound impact of every contribution. After the receipt has been issued, the donor will be. Web a donation receipt acts as a written record that a donor is given, proving that a gift has been made to a legal organization. You can also add your. First, craft the outline of your donation receipt with all the legal requirements included. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual’s taxes. This donation receipt pdf template contains the necessary information which may be needed for cash donation such as the name of the donor, the amount donated,. First, craft the outline of your donation receipt with all the legal requirements included. It is the duty of the organization receiving the donation to issue a receipt for the donor’s tax purposes. Web donors can choose the 501(c)(3) donation receipt template that fits best their needs. This donation receipt pdf template contains the necessary information which may be needed. Consider which way you’ll want to create the receipt based on your. They are a big part of the charitable sector. Set it up once and let it work in the background to create receipts every time you accept payments automatically. There are various types of receipts including the following: Formstack documents works for your organization as a donation receipt. Web donors can choose the 501(c)(3) donation receipt template that fits best their needs. Web this is where a tool like formstack documents can come in handy. If you are responsible for creating a document like this for your organization, these charitable donation receipt templates make it easy to acknowledge gifts from your donors in a variety of situations. After the receipt has been issued, the donor will be. Charities are only required to submit 501c3 donation receipts for amounts greater than $250, but it is good practice to issue a 501c3 donation receipt for all donations. There are various types of receipts including the following: Consider which way you’ll want to create the receipt based on your. First, craft the outline of your donation receipt with all the legal requirements included. Our free ai website builder even allows you to create your own. Web donation receipt template. Web basic nonprofit donation receipt template in excel. Deliver the written acknowledgment of the contribution. Set it up once and let it work in the background to create receipts every time you accept payments automatically. We will populate it automatically with all the necessary donation details and organization info. Just be sure to review your donation receipt templates annually to make any necessary updates. You can also add your own branding to this template by adding your organization’s logo.

6+ Free Donation Receipt Templates

Donation Receipt Templates 15 Free Printable Templates My Word

46 Free Donation Receipt Templates (501c3, NonProfit)

Free Printable Donation Receipt Template

Non Profit Donation Receipt Templates at

6+ Free Donation Receipt Templates Word Excel Formats

50+ Free Receipt Templates (Cash, Sales, Donation, Taxi...)

Donation Receipt Template in Microsoft Word

5 Free Donation Receipt Templates in MS Word Templates

20 Best Free Microsoft Word Receipt Templates to Download

Formstack Documents Works For Your Organization As A Donation Receipt Generator.

Then, You Can Customize This Basic Template Based On Donation Type, Such As Noncash Contributions Or Monetary Support.

The Written Acknowledgment Required To Substantiate A Charitable Contribution Of $250 Or More Must Contain The Following Information:

It’s People Like You Who Make What We Do Possible.

Related Post: