Doji Star Pattern

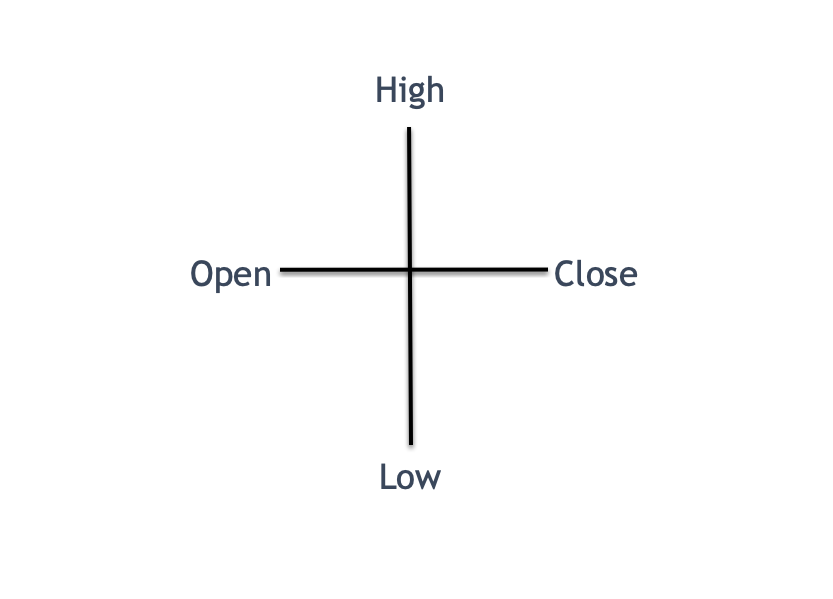

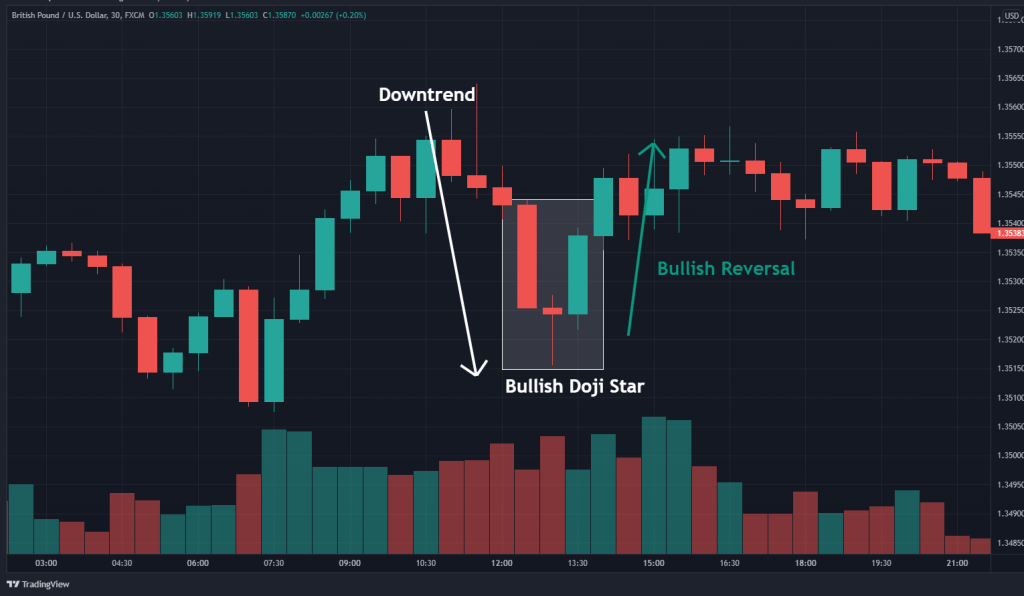

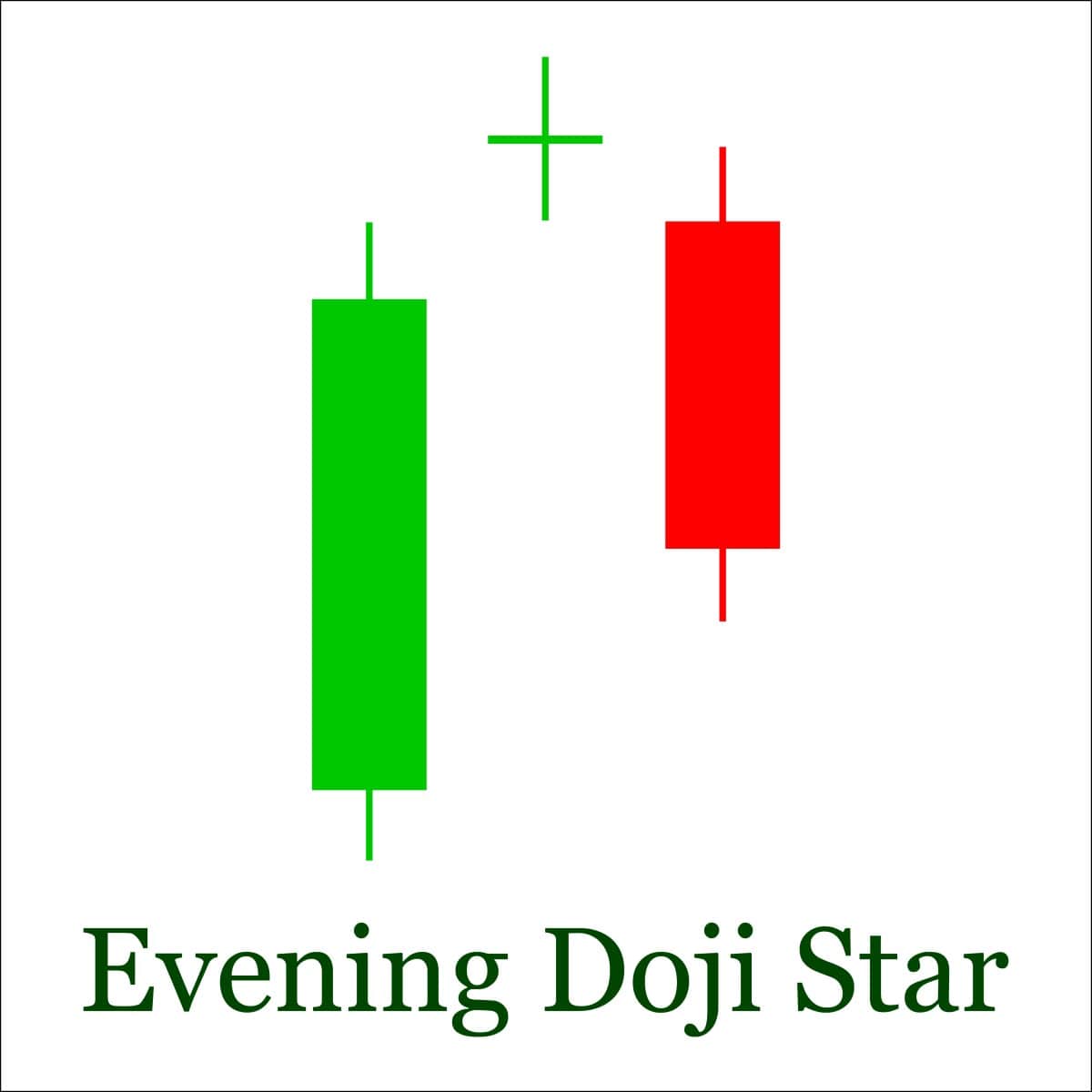

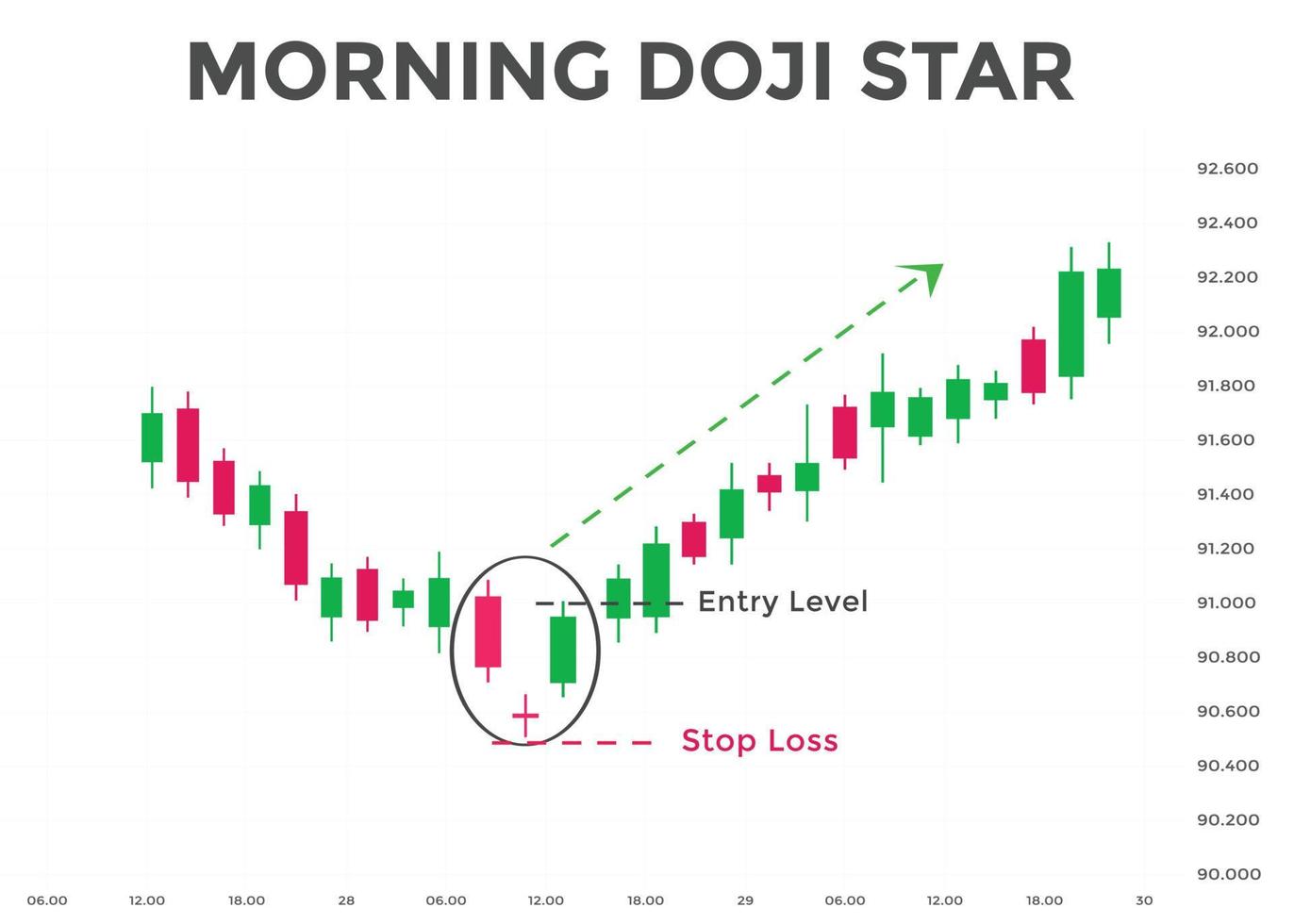

Doji Star Pattern - Web bearish doji star: It is considered a reversal signal with confirmation during the next trading day. 1) trading with the doji star pattern. The pattern looks like a plus sign or cross. Web the morning doji star must occur in a downtrend. Web a bearish doji star pattern is formed just below the resistance zones created by the occurrences of black candles (numbered from 1 to 3). This is a bullish reversal candlestick pattern that is found in a downtrend and consists of two candles. A morning doji star appeared on alphabet’s (goog) daily chart on march 24th, 2020. Web evening doji star pattern. The bearish doji star pattern appears. So, look for a buildup to form (as an entry trigger) and trade the breakout. This pattern is composed of three candlesticks, with the first one being a tall bearish candle. It is considered a reversal signal with confirmation during the next trading day. A doji candlestick has a small real body and looks like a plus sign on stock. This pattern typically indicates a potential reversal from an uptrend to a downtrend. Web a doji star is seen as a strong signal for a reversal. The first candle is a long, green, or tall white candle. The open and close prices are almost identical. It starts with a long candle, gaps to draw a doji and then it reverses. This pattern is composed of three candlesticks, with the first one being a tall bearish candle. The open and close prices are almost identical. They are typically black or a neutral color on a stock chart. 1) trading with the doji star pattern. It consists of three candles; The gbp/usd chart below shows the doji star appearing at the bottom of. The pattern looks like a plus sign or cross. The bullish doji star (also called a morning star) and the bearish doji star (called an evening star). A doji candlestick is an indecision candle. Menu icon a vertical stack of three evenly spaced. They are typically black or a neutral color on a stock chart. A doji candlestick forms when a. Web an evening doji star pattern is identified by three specific candlesticks: Web as a side note, a double doji represents and even stronger moment of indecision and a greater chance of a trend reversal. Its occurrence should be confirmed on the. The doji candle (second line) should not be preceded by or followed by a price gap. The bullish doji star (also called a morning star) and the bearish doji star (called an evening star). In a bullish doji star, a long red candle appears at the end of a bear run, followed by a doji. Web below we explore various. How to spot a bearish doji star pattern. The bullish doji star (also called a morning star) and the bearish doji star (called an evening star). The open and close prices are almost identical. Web doji candlestick pattern is formed when opening and closing prices are at the same or almost at the same level. Web evening doji star pattern. Web bearish doji star: This pattern is composed of three candlesticks, with the first one being a tall bearish candle. A bullish first candle, followed by a doji evening star, and finally, a bearish third candle. The doji is said to be a star doji as there’s a gap on both sides, and it’s an evening because it portends darkness. This star doji has a long white candle, followed by a gap up doji, followed by a gap down bearish candle. The doji is said to be a star doji as there’s a gap on both sides, and it’s an evening because it portends darkness or bearish price action. First confirmation is when the gap is covered. This pattern comes. Dojis are found near both support and resistance levels. Web the morning doji star must occur in a downtrend. In a bullish doji star, a long red candle appears at the end of a bear run, followed by a doji. 1) trading with the doji star pattern. The bullish doji star (also called a morning star) and the bearish doji. 2 doji in a row are also considered good signals of trend reversals, although not as strong as 3 doji. The three candles of the bearish doji star are as follows: Prior the bearish doji star occurrence, a resistance zone is created by the white candle (1), rising window and white candle (2) being the first line. Web doji candlestick pattern is formed when opening and closing prices are at the same or almost at the same level. Web the morning doji star must occur in a downtrend. It’s best to combine additional indicators like the rsi or macd for further signal confirmation. The doji represents indecision and a potential loss of. This pattern typically indicates a potential reversal from an uptrend to a downtrend. A single doji star candle alone means that buyers and sellers reached equilibrium during the candle period, ending at almost the same price that it started. Its occurrence should be confirmed on the following candles. Menu icon a vertical stack of three evenly spaced. Web below we explore various doji candlestick strategies that can be applied to trading. A bullish first candle, followed by a doji evening star, and finally, a bearish third candle. 1) trading with the doji star pattern. This is a bullish reversal candlestick pattern that is found in a downtrend and consists of two candles. The second line of the pattern is a northern doji pattern.

How To Trade The Doji Star Pattern (in 3 Easy Steps)

![Bullish Morning Doji Star Candlestick Pattern [With PDF]](https://tradingpdf.net/wp-content/uploads/2023/05/morning-doji-star-1024x836.png)

Bullish Morning Doji Star Candlestick Pattern [With PDF]

Doji Star Bullish Pattern Formation, Example, Tri Star Candlestick

Candlestick Patterns The Definitive Guide (2021)

dojistarcandlestickpattern Forex Training Group

![Doji Star Candlestick Pattern [FREE PDF] Trading PDF](https://tradingpdf.net/wp-content/uploads/2023/07/doji-star-example-1024x853.png)

Doji Star Candlestick Pattern [FREE PDF] Trading PDF

How To Trade The Doji Star Pattern (in 3 Easy Steps)

How To Trade Blog Doji Candlestick And How To Use It In Forex Most

Doji Chart Pattern How to Use the Candlestick in Trading

Morning Doji Star candlestick chart pattern. Candlestick chart Pattern

Web A Doji Star Is Seen As A Strong Signal For A Reversal.

It Consists Of Three Candles;

This Pattern Comes In Two Varieties:

When A Doji Star Appears Inside An Existing Trading.

Related Post: