Doji Candlestick Patterns

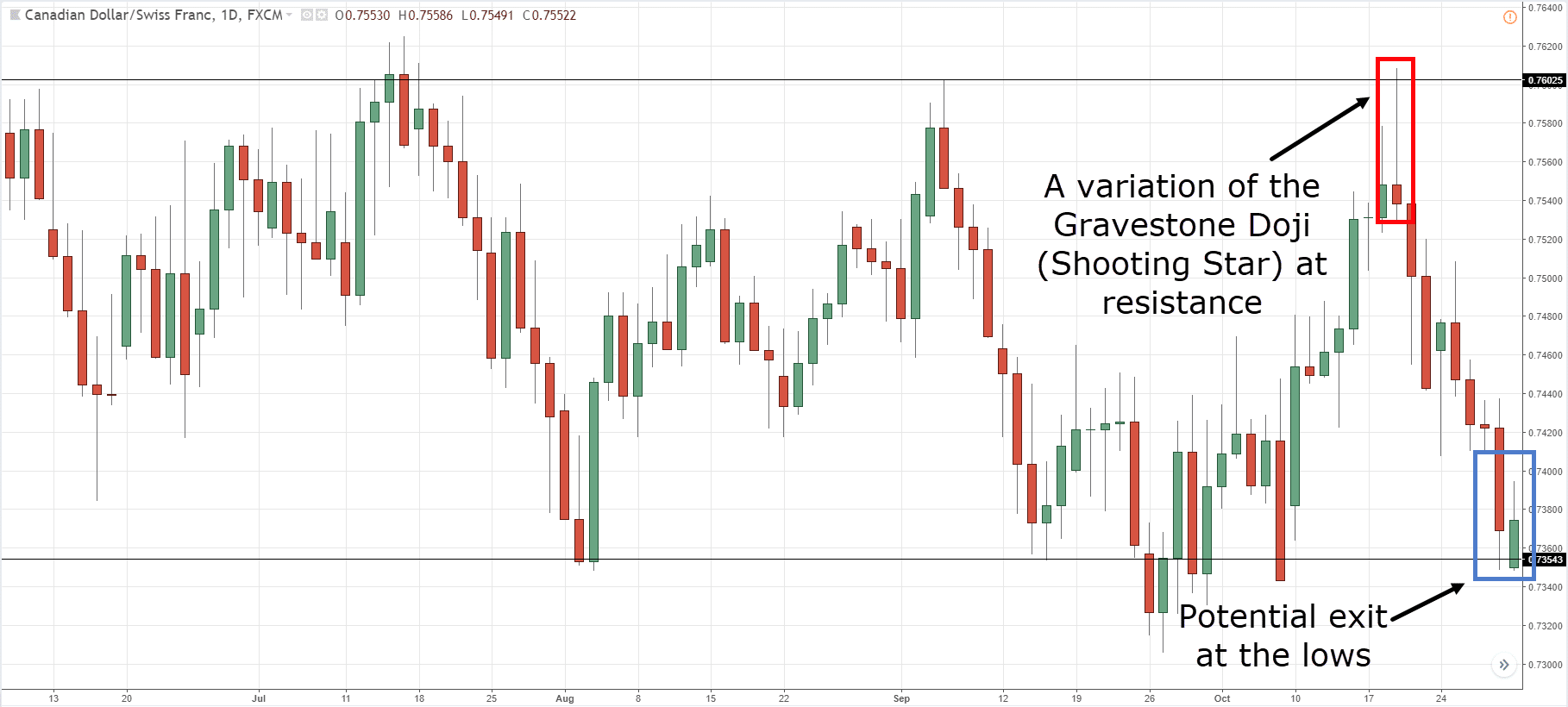

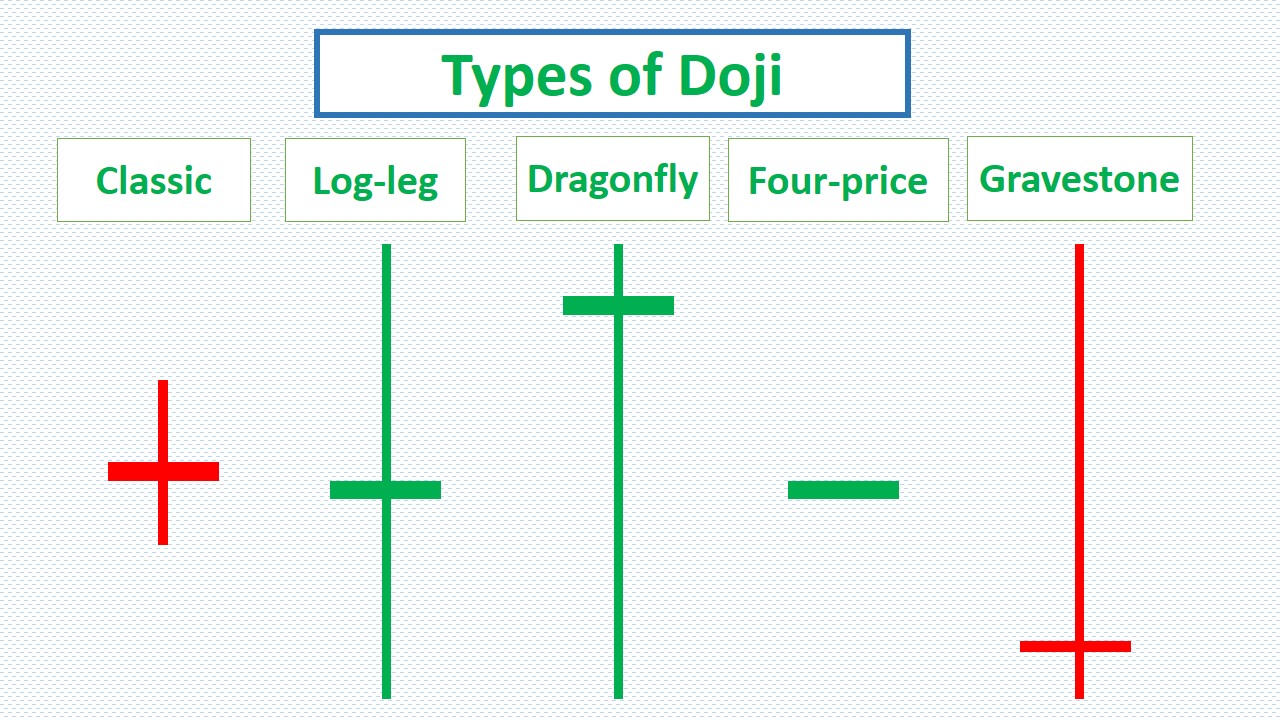

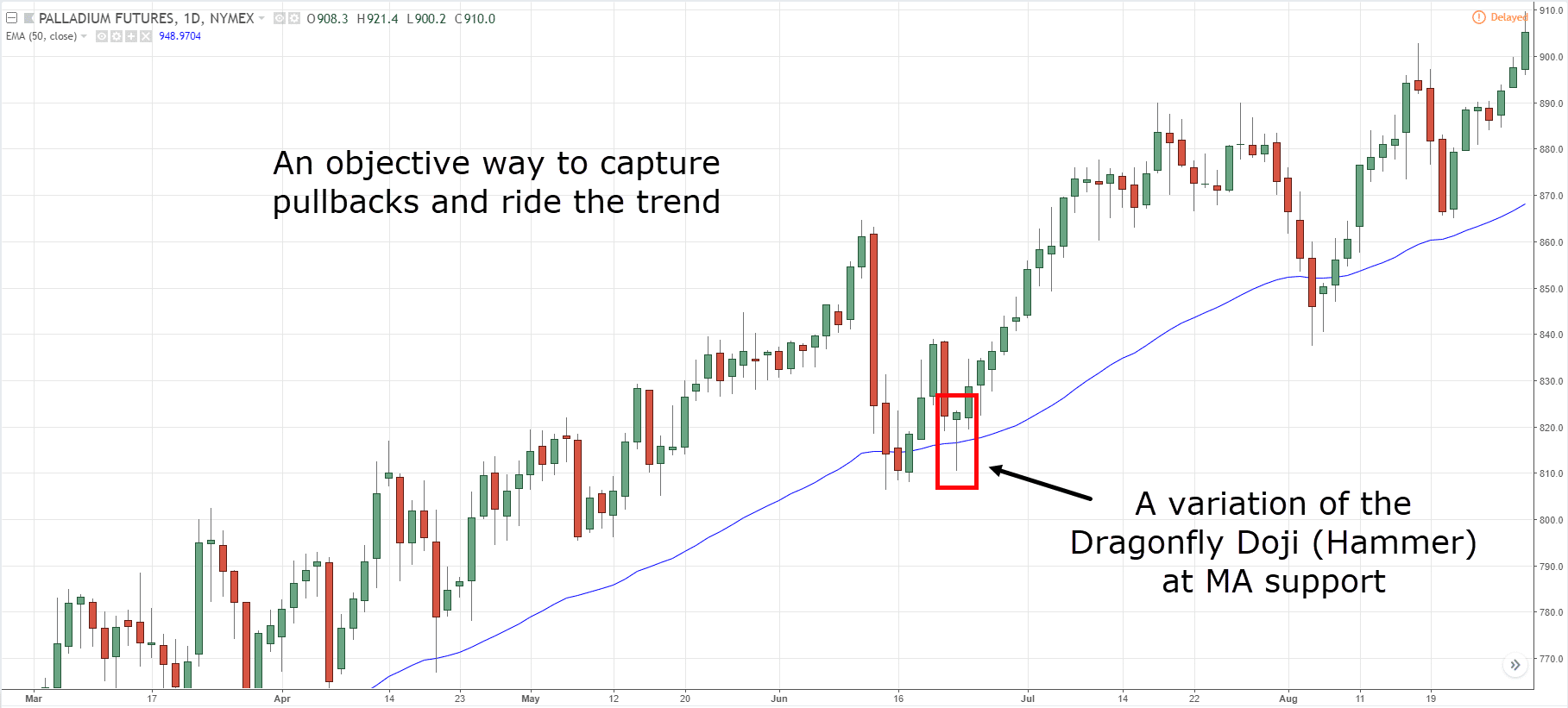

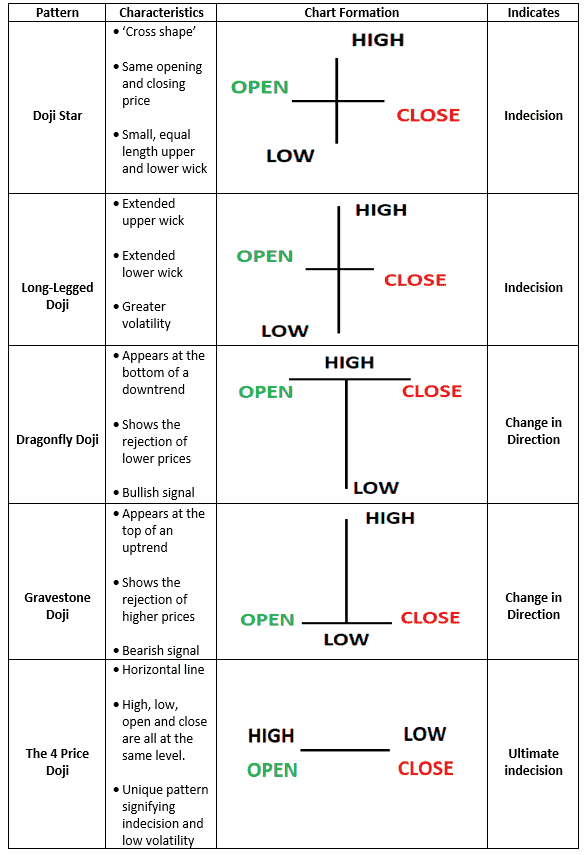

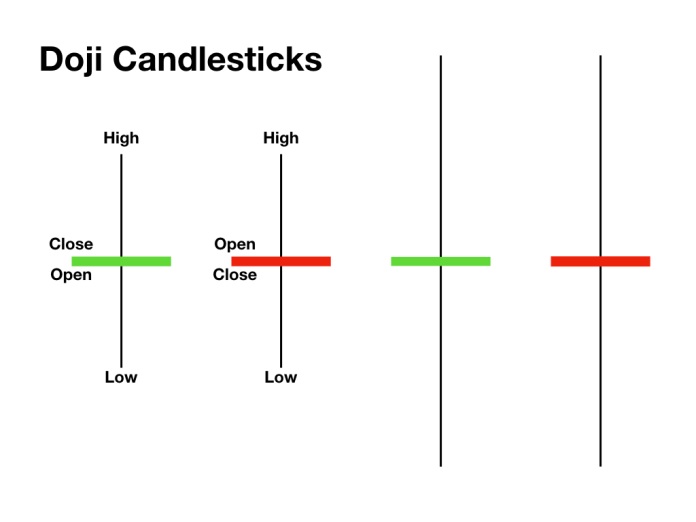

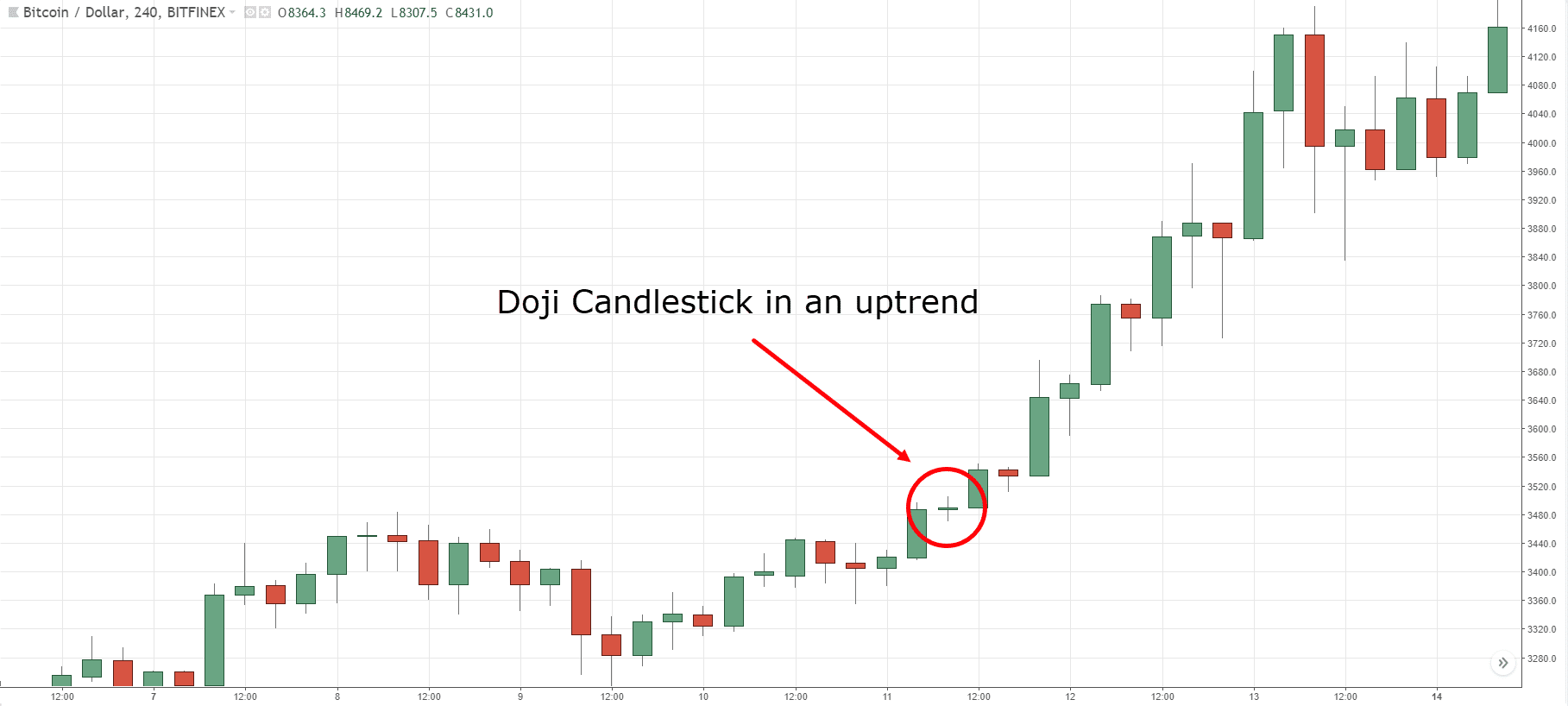

Doji Candlestick Patterns - Web the doji candlestick pattern is a formation that occurs when a market’s open price and close price are almost exactly the same. This doji candlestick is formed when the market opens, and bullish traders push prices up, whereas bearish traders reject the higher price and push it back down. It signals market neutrality and a reversal trend but cannot be used to trade for profits alone without using other market analysis tools. How to identify and use the doji pattern? Web a doji (dо̄ji) is a name for a trading session in which a security has open and close levels that are virtually equal, as represented by a candle shape on a chart. Web updated april 10, 2024. It will also cover top strategies to trade using the doji. How is a doji candlestick pattern formed? Doji form when the open and close of a candlestick are equal, or very close to equal. Learn to identify over 50 candlestick chart patterns. Web updated april 10, 2024. Read on to learn how to identify, classify, and trade doji patterns in the live market. Doji form when the open and close of a candlestick are equal, or very close to equal. Web a doji candlestick pattern is considered to be a transitional formation since it doesn’t signal either one of a continuation or. A doji candle is dominated by wicks with very small bodies or no bodies at all. Web a doji candlestick pattern is considered to be a transitional formation since it doesn’t signal either one of a continuation or a reversal of the trend. What is the doji candlestick pattern? Web like most patterns, the doji is a single candle; Read. A doji candle is dominated by wicks with very small bodies or no bodies at all. The morning doji star candlestick pattern. Web candlestick patterns are like building blocks in understanding how the stock market behaves and how prices might change. Why are doji candles important? And 2#, it comes in 4 variations: This doji candlestick is formed when the market opens, and bullish traders push prices up, whereas bearish traders reject the higher price and push it back down. The doji is one of the most misunderstood candlestick patterns. The color of the real body is not very important. How is a doji candlestick pattern formed? Candlestick patterns play a crucial role. Web in financial technical analysis, a candlestick pattern is a movement in prices shown graphically on a candlestick chart that some believe can help to identify repeating patterns of a particular market movement. Web a gravestone doji is a bearish reversal candlestick pattern that is formed when the open, low, and closing prices are all near each other with a. Read on to learn how to identify, classify, and trade doji patterns in the live market. Web by rayner teo. Dragonfly doji can be translated into turkish as dragonfly doji. A standard doji is a single candlestick that does not signify much on its own. The process involves prices moving above and below the opening level during the trading session,. The pattern shows indecision and is most. The most textbook teaches you that a doji represents indecision in the markets. Stay updated with the latest trends and insights in the finance world. Based on this shape, technical. Web the doji candlestick pattern is a formation that occurs when a market’s open price and close price are almost exactly the same. How to trade the doji candlestick. Web like most patterns, the doji is a single candle; Web a dragonfly doji is a type of candlestick pattern that can signal a potential reversal in price to the downside or upside, depending on past price action. Morning doji star candlestick pattern and evening doji star candlestick pattern. Dojis look like a plus. Bullish version of doji is the dragonfly doji; Read on to learn how to identify, classify, and trade doji patterns in the live market. Web in financial technical analysis, a candlestick pattern is a movement in prices shown graphically on a candlestick chart that some believe can help to identify repeating patterns of a particular market movement. They can therefore. (most traders never figure this out) 2. Do you know there are 4 types of doji and each has a different meaning to it? Web a gravestone doji is a bearish reversal candlestick pattern that is formed when the open, low, and closing prices are all near each other with a long upper shadow. Web find out why doji candlestick. Investing, market updates, trading news, trends. Doji candlesticks come in several different shapes and sizes. Doji candlesticks are classified depending on the position of. Introduction to 35 candlestick patterns candlestick patterns are visual representations of price movements within a specific. Web updated april 10, 2024. Web japanese candlesticks with a long upper shadow, long lower shadow, and small real bodies are called spinning tops. Dojis look like a plus sign or cross. They are often considered to suggest indecision in a given market. Web find out why doji candlestick patterns are important in trading, and how forex markets can react. Web a doji candlestick pattern is considered to be a transitional formation since it doesn’t signal either one of a continuation or a reversal of the trend. It signals market neutrality and a reversal trend but cannot be used to trade for profits alone without using other market analysis tools. Doji candlesticks appear when the opening and closing prices of an asset are virtually the same. What is the doji candlestick pattern? Web candlestick patterns are like building blocks in understanding how the stock market behaves and how prices might change. Web by rayner teo. The most textbook teaches you that a doji represents indecision in the markets.

What Is Doji Candlestick? How To Use Doji Candlestick Patterns

Doji Candlestick Pattern ForexBoat Trading Academy

The Complete Guide to Doji Candlestick Pattern

All Doji Candlestick Patterns & How to Trade Them

The Complete Guide to Doji Candlestick Pattern

Doji Candlestick Pattern Meaning, Formation, Types, Limitation

What Is Doji Candlestick? How To Use Doji Candlestick Patterns

Doji candlestick patterns How to identify and trade them in IQ Option

What Is Doji Candlestick? How To Use Doji Candlestick Patterns

The Complete Guide to Doji Candlestick Pattern

It Resembles A Dragonfly In Shape And Thanks To This Feature, It Can Be Easily Recognized When It Forms.

However, It’s Special For Two Reasons:

A Doji Candle Is Dominated By Wicks With Very Small Bodies Or No Bodies At All.

Web What Is A Doji Candlestick Pattern?

Related Post: