Divergence Patterns

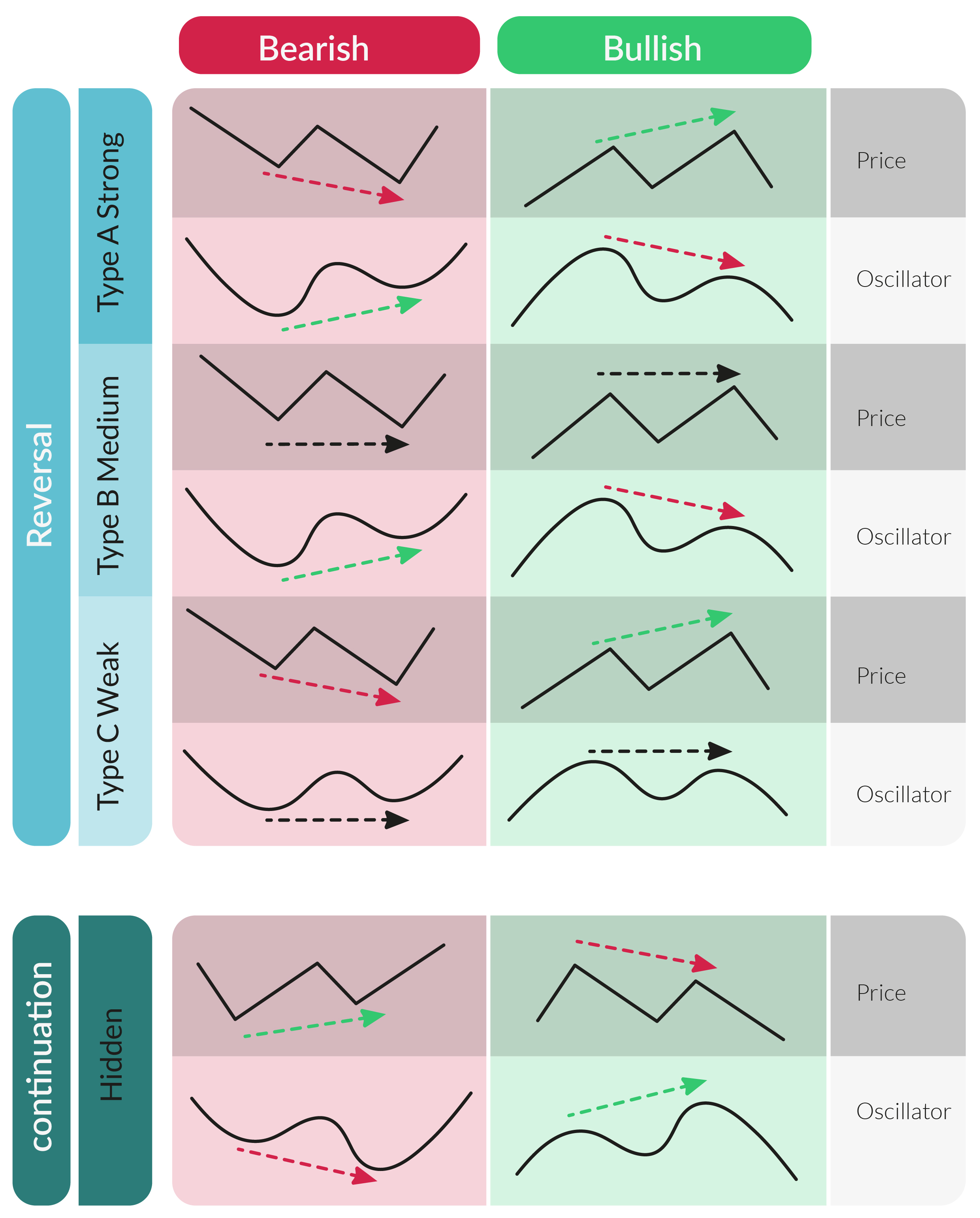

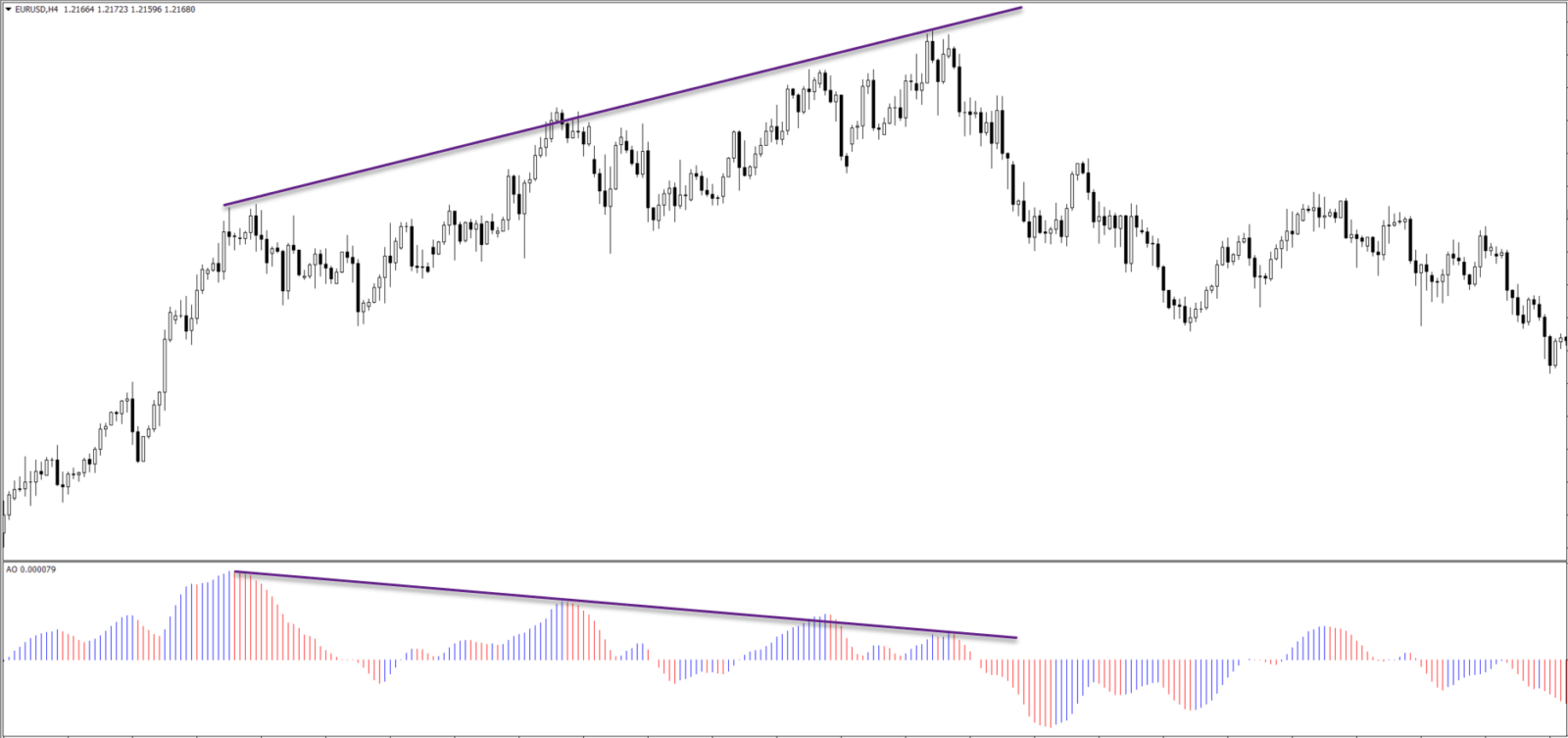

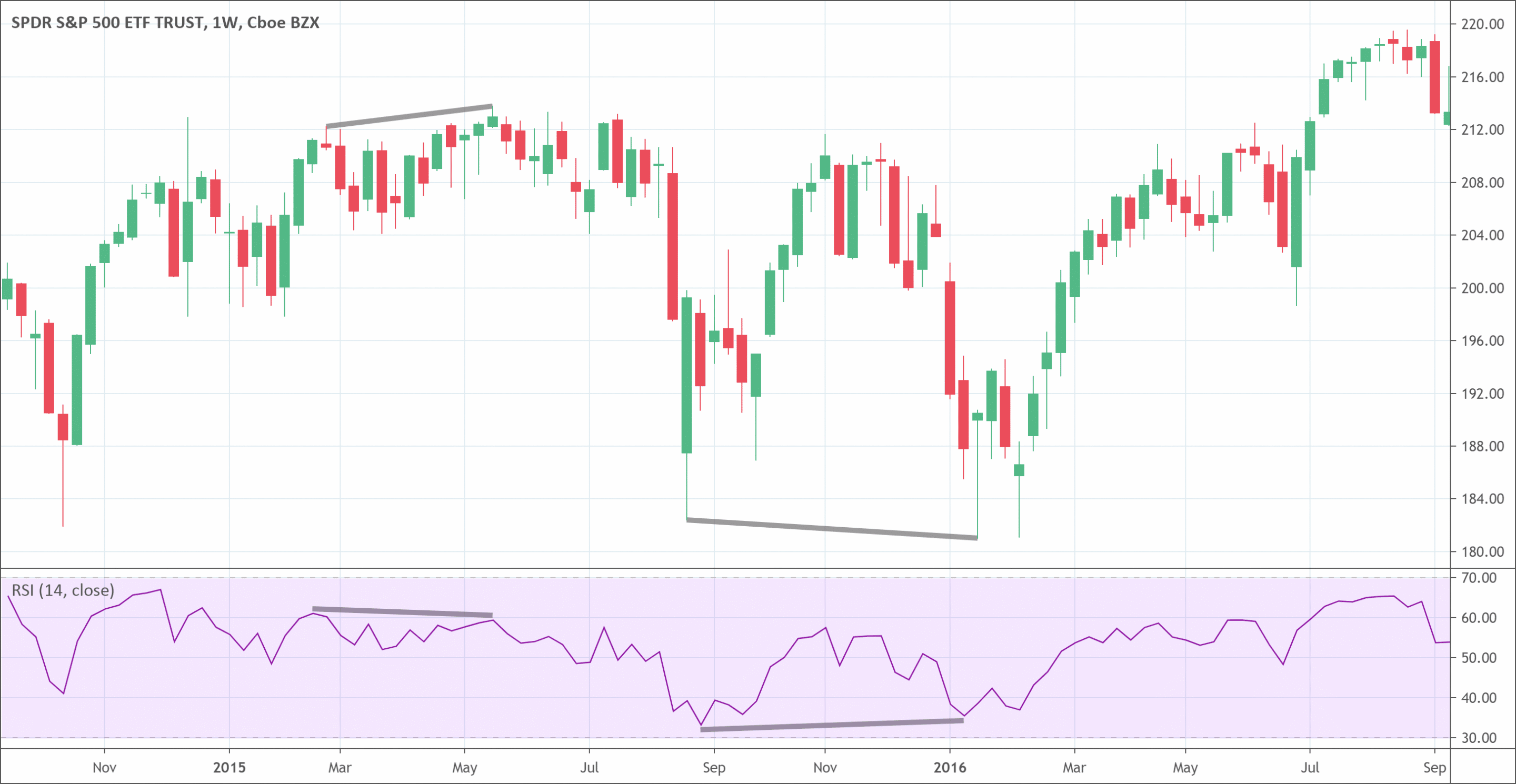

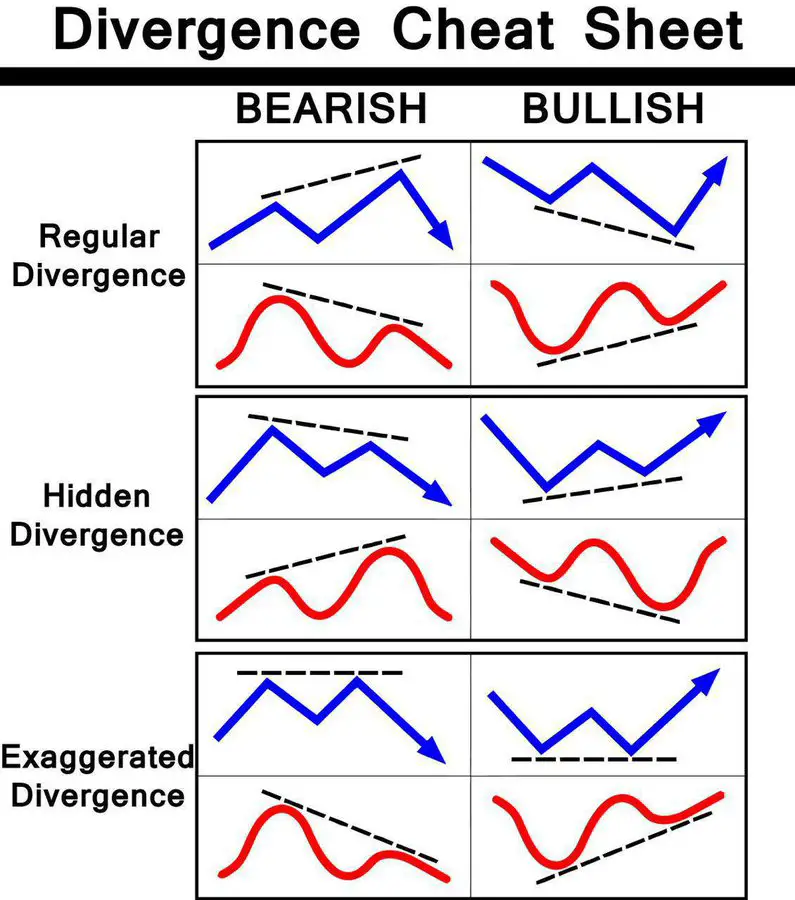

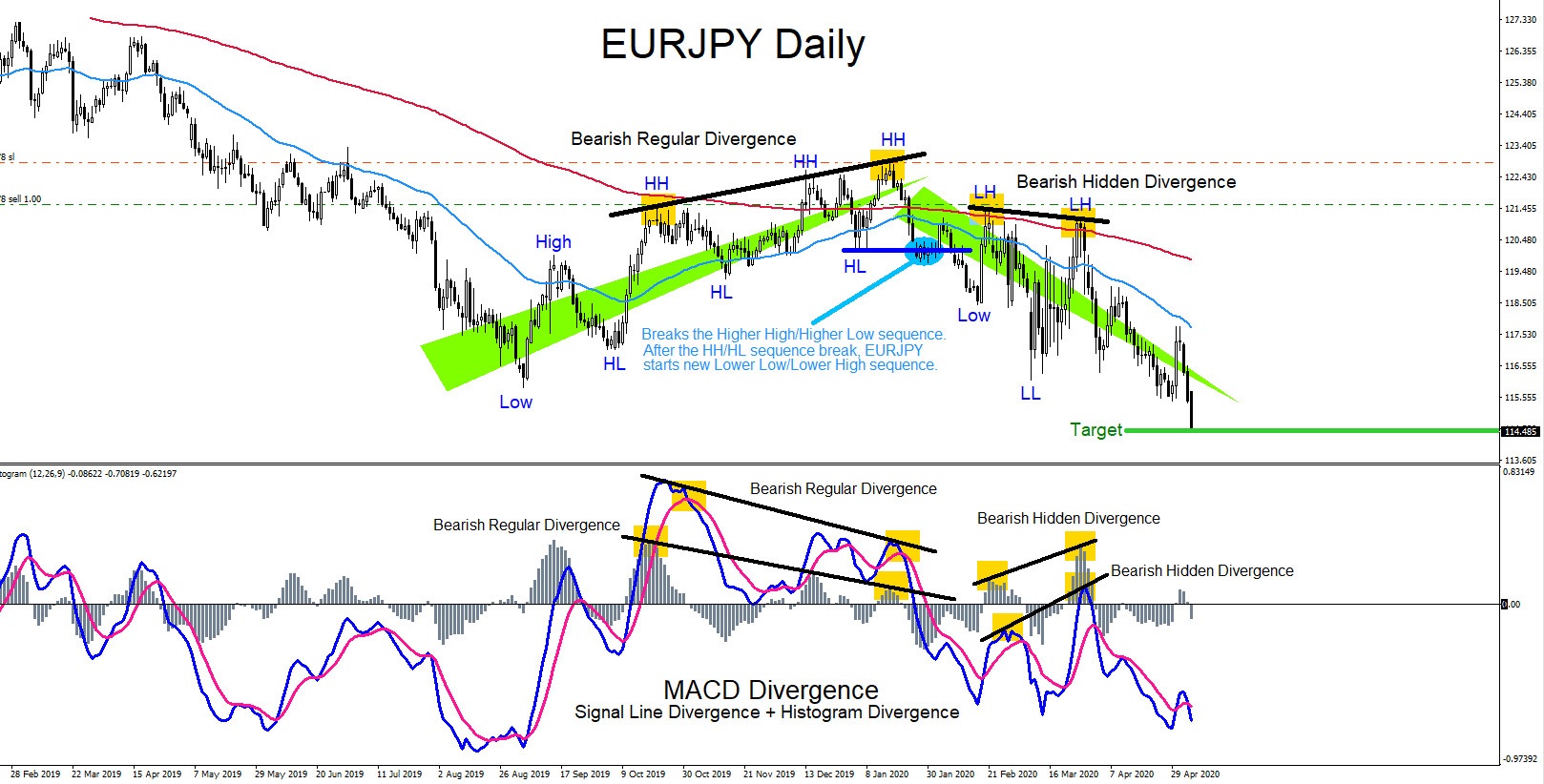

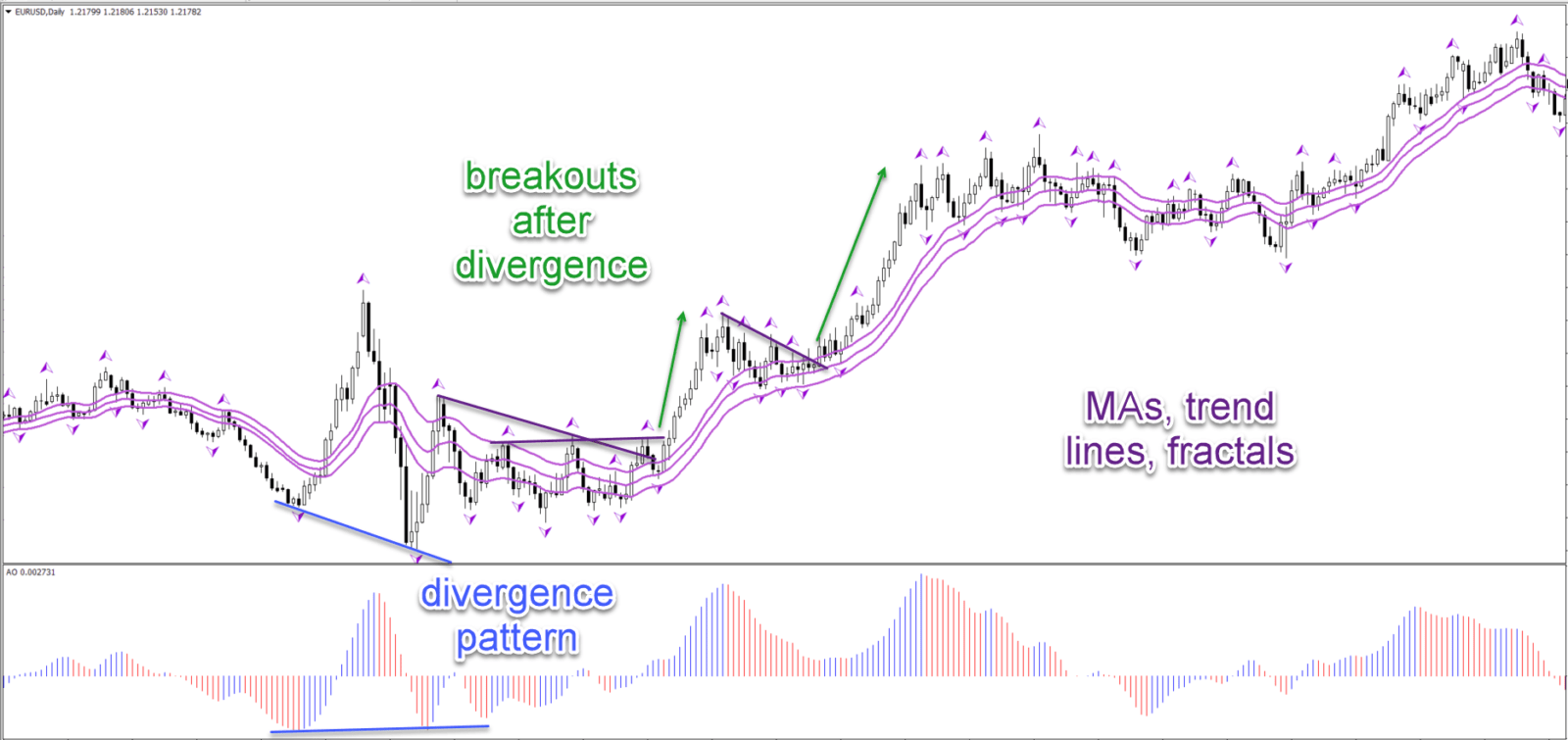

Divergence Patterns - While hidden divergence is observed at the end of a trend consolidation, classic or regular divergence is. Welles wilder, the relative strength index (rsi) is a momentum oscillator indicator that measures the speed and price changes. Before you head out there and start. Web this type of regular divergence pattern comes in two forms: Web divergence occurs when the price of an asset and an indicator, such as the relative strength index (rsi), move in opposite directions. Web the three common types of divergences seen in trading are hidden divergence, reverse divergence and bearish divergence. Web april 10, 2024 by finnegan s. Divergence is a pattern type that can be seen on cryptocurrency price charts that denotes a potential trend change. Web in trading, divergence means that the price swings and the indicator (oscillator) movement are not in phase. Web how to spot bullish and bearish divergence patterns. A divergence signal is formed if the price is. Thinkmarkets > learn to trade > indicators & patterns > general patterns > divergence patterns. Welles wilder, the relative strength index (rsi) is a momentum oscillator indicator that measures the speed and price changes. This is when price creates higher tops on the chart, while your indicator is giving you lower.. Web how to spot bullish and bearish divergence patterns. This pattern provides valuable insights into potential price reversals or changes in trends. Divergence is a pattern type that can be seen on cryptocurrency price charts that denotes a potential trend change. A divergence signal is formed if the price is. Web divergences are used by traders in an attempt to. Bullish and bearish trends can be spotted before they start affecting the price. Web relative strength index (rsi) divergence is a technical analysis tool used by traders to identify potential trend reversals in the market. Web this type of regular divergence pattern comes in two forms: Web how to spot bullish and bearish divergence patterns. Divergence is a pattern type. “woah, what the *beep* is a divergence!” Web in trading, divergence means that the price swings and the indicator (oscillator) movement are not in phase. Web the best indicator for divergence patterns is the awesome oscillator (chris’s favorite), but there are also others like macd.pro (nenad’s favorite), the rsi,. Thinkmarkets > learn to trade > indicators & patterns > general. If you’ve been following other traders’ technical analysis for a while… you’ve most likely heard alien terms like bullish divergence, hidden divergence, reversal divergence, and bearish divergence. Web relative strength index (rsi) divergence is a technical analysis tool used by traders to identify potential trend reversals in the market. This is when price creates higher tops on the chart, while. Before you head out there and start. Web the best indicator for divergence patterns is the awesome oscillator (chris’s favorite), but there are also others like macd.pro (nenad’s favorite), the rsi,. Web divergences are used by traders in an attempt to determine if a trend is getting weaker, which may lead to a trend reversal or continuation. Thinkmarkets > learn. This pattern provides valuable insights into potential price reversals or changes in trends. Web divergences are used by traders in an attempt to determine if a trend is getting weaker, which may lead to a trend reversal or continuation. If you’ve been following other traders’ technical analysis for a while… you’ve most likely heard alien terms like bullish divergence, hidden. If you’ve been following other traders’ technical analysis for a while… you’ve most likely heard alien terms like bullish divergence, hidden divergence, reversal divergence, and bearish divergence. Divergence is a pattern type that can be seen on cryptocurrency price charts that denotes a potential trend change. Web relative strength index (rsi) divergence is a technical analysis tool used by traders. If you’ve been following other traders’ technical analysis for a while… you’ve most likely heard alien terms like bullish divergence, hidden divergence, reversal divergence, and bearish divergence. Divergence is a pattern type that can be seen on cryptocurrency price charts that denotes a potential trend change. “woah, what the *beep* is a divergence!” In the pursuit of making informed market. This pattern provides valuable insights into potential price reversals or changes in trends. Web a bullish divergence pattern refers to a situation when the price drops to new lows but the indicator does not follow and signals something different. In the pursuit of making informed market decisions, astute traders harness the analytical power of divergence chart patterns. Web the contrasting. While hidden divergence is observed at the end of a trend consolidation, classic or regular divergence is. Web april 10, 2024 by finnegan s. Web divergences are used by traders in an attempt to determine if a trend is getting weaker, which may lead to a trend reversal or continuation. This is when price creates higher tops on the chart, while your indicator is giving you lower. Web this type of regular divergence pattern comes in two forms: If you’ve been following other traders’ technical analysis for a while… you’ve most likely heard alien terms like bullish divergence, hidden divergence, reversal divergence, and bearish divergence. Web how to spot bullish and bearish divergence patterns. Web relative strength index (rsi) divergence is a technical analysis tool used by traders to identify potential trend reversals in the market. Web trading divergences is a common strategy focusing on finding a miscorrelation between the asset’s price and a technical indicator. Web a bullish divergence pattern refers to a situation when the price drops to new lows but the indicator does not follow and signals something different. Bullish and bearish trends can be spotted before they start affecting the price. Web a divergence pattern is a technical indicator that suggests a trend reversal. In the pursuit of making informed market decisions, astute traders harness the analytical power of divergence chart patterns. This pattern provides valuable insights into potential price reversals or changes in trends. Before you head out there and start. Web developed in 1978 by j.

The New Divergence Indicator and Strategy 3rd Dimension

What Is RSI Divergence? Learn How To Spot It

Learn How Divergence Patterns Help Indicate Reversals

Divergence Everything Traders Should Know PatternsWizard

Divergence Cheat Sheet New Trader U

Trading strategy with Divergence chart patterns Trading charts, Forex

The Ultimate Divergence Cheat Sheet A Comprehensive Guide for Traders

Divergence Trading Patterns

Learn How Divergence Patterns Help Indicate Reversals

How To Trade an RSI Divergence Complete Guide Living From Trading

Divergence Is A Pattern Type That Can Be Seen On Cryptocurrency Price Charts That Denotes A Potential Trend Change.

Web The Three Common Types Of Divergences Seen In Trading Are Hidden Divergence, Reverse Divergence And Bearish Divergence.

Web In Trading, Divergence Means That The Price Swings And The Indicator (Oscillator) Movement Are Not In Phase.

Web Divergence Occurs When The Price Of An Asset And An Indicator, Such As The Relative Strength Index (Rsi), Move In Opposite Directions.

Related Post: