Divergence Chart Patterns

Divergence Chart Patterns - Web so what else makes it different from other patterns? Web in technical analysis, divergence refers to the phenomenon when the price and a technical indicator (like the rsi) display conflicting signals. In the last chart we saw divergence in expectations for fed and ecb interest rates with convergence in uk us. Some foreign exchange traders regard oscillator divergences as the holy grail of technical analysis. This is something that occurs when. How to trade with divergences? Web to effectively trade based on bullish divergence, it is crucial to combine it with other factors such as support and resistance levels, trendlines, and chart patterns. Where cp is the closing price and. How to use rsi divergence. The primary function of hidden. The primary function of hidden. Web trading divergences in forex. This is something that occurs when. Web rsi has fixed boundaries with values ranging from 0 to 100. Where cp is the closing price and. Web so what else makes it different from other patterns? How to use rsi divergence. The name of this pattern speaks of its character. Trading example with rsi stochastics. Web to effectively trade based on bullish divergence, it is crucial to combine it with other factors such as support and resistance levels, trendlines, and chart patterns. Trading example with rsi stochastics. What hidden divergence tells us: Where cp is the closing price and. How to use rsi divergence. How to trade with divergences? Web within the intricate tapestry of financial markets, divergence chart patterns emerge as key threads for traders aiming to unravel potential shifts in momentum. Some foreign exchange traders regard oscillator divergences as the holy grail of technical analysis. What hidden divergence tells us: Web rsi has fixed boundaries with values ranging from 0 to 100. Web to effectively trade based. The primary function of hidden. Web rsi has fixed boundaries with values ranging from 0 to 100. Web so what else makes it different from other patterns? How to use rsi divergence. A bullish divergence pattern refers to a. What hidden divergence tells us: In finance — including crypto trading — there is a technical pattern known as a divergence. Where cp is the closing price and. Some foreign exchange traders regard oscillator divergences as the holy grail of technical analysis. Web within the intricate tapestry of financial markets, divergence chart patterns emerge as key threads for traders aiming. What hidden divergence tells us: The name of this pattern speaks of its character. Web identify the appropriate indicators: The primary function of hidden. This is something that occurs when. A bullish divergence pattern refers to a. Web so what else makes it different from other patterns? Web rsi has fixed boundaries with values ranging from 0 to 100. Trading example with rsi stochastics. Web what is the divergence pattern? We have a divergence when the price movement is contrary to the indicator movement. Web so what else makes it different from other patterns? Web identify the appropriate indicators: Momentum can be calculated by using the formula: Web in technical analysis, divergence refers to the phenomenon when the price and a technical indicator (like the rsi) display conflicting signals. Web within the intricate tapestry of financial markets, divergence chart patterns emerge as key threads for traders aiming to unravel potential shifts in momentum. Momentum can be calculated by using the formula: Web identify the appropriate indicators: Web to effectively trade based on bullish divergence, it is crucial to combine it with other factors such as support and resistance levels,. Web within the intricate tapestry of financial markets, divergence chart patterns emerge as key threads for traders aiming to unravel potential shifts in momentum. Some foreign exchange traders regard oscillator divergences as the holy grail of technical analysis. Web to effectively trade based on bullish divergence, it is crucial to combine it with other factors such as support and resistance levels, trendlines, and chart patterns. The name of this pattern speaks of its character. Web what is the divergence pattern? Web trading divergences in forex. This is something that occurs when. How to use rsi divergence. If you’ve been following other traders’ technical analysis for a while… you’ve most likely heard alien terms like bullish. Where cp is the closing price and. Momentum can be calculated by using the formula: How to trade with divergences? Web identify the appropriate indicators: Web in technical analysis, divergence refers to the phenomenon when the price and a technical indicator (like the rsi) display conflicting signals. In finance — including crypto trading — there is a technical pattern known as a divergence. We have a divergence when the price movement is contrary to the indicator movement.

MACD Divergence Forex Trading Strategy The Ultimate Guide To Business

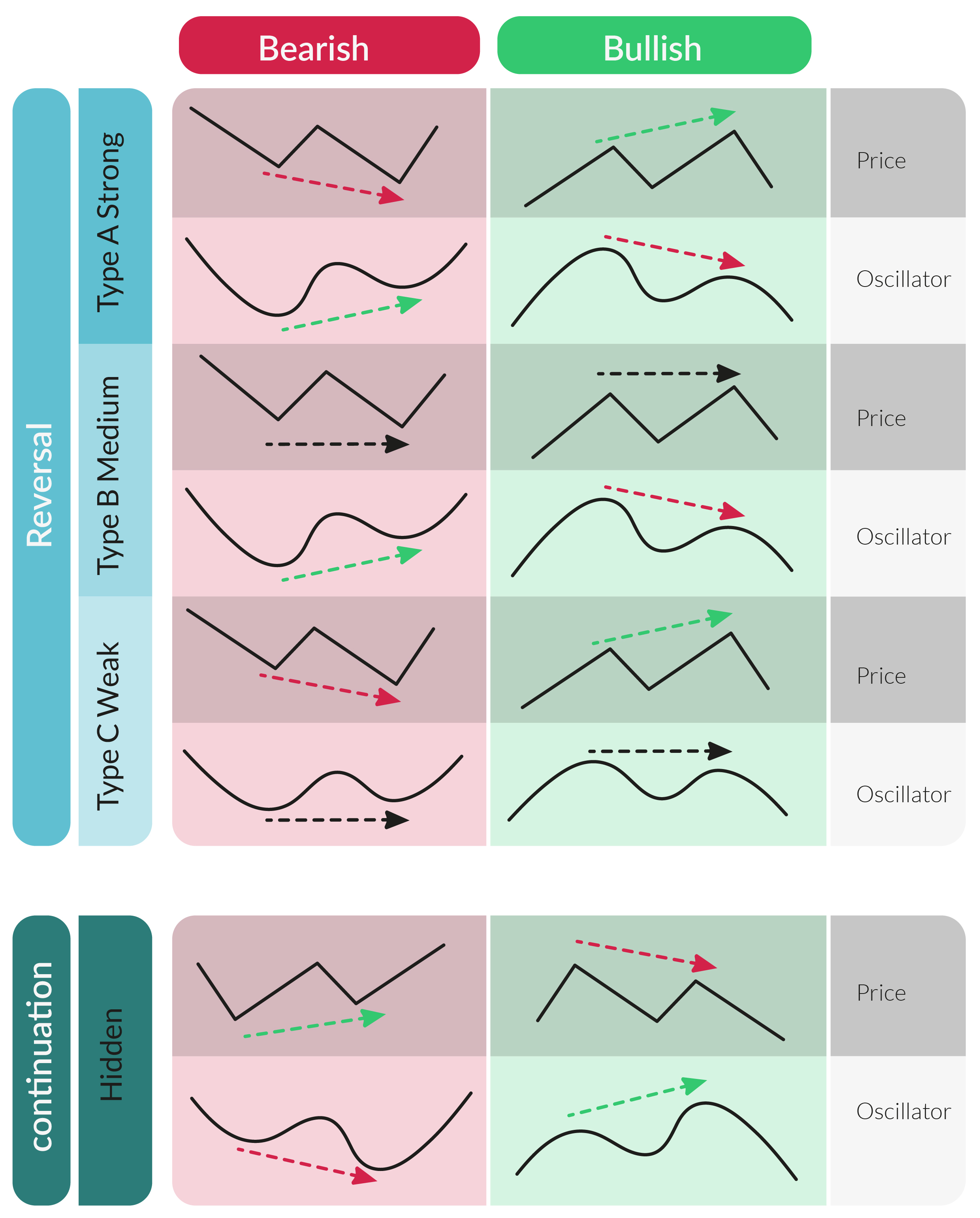

The New Divergence Indicator and Strategy 3rd Dimension

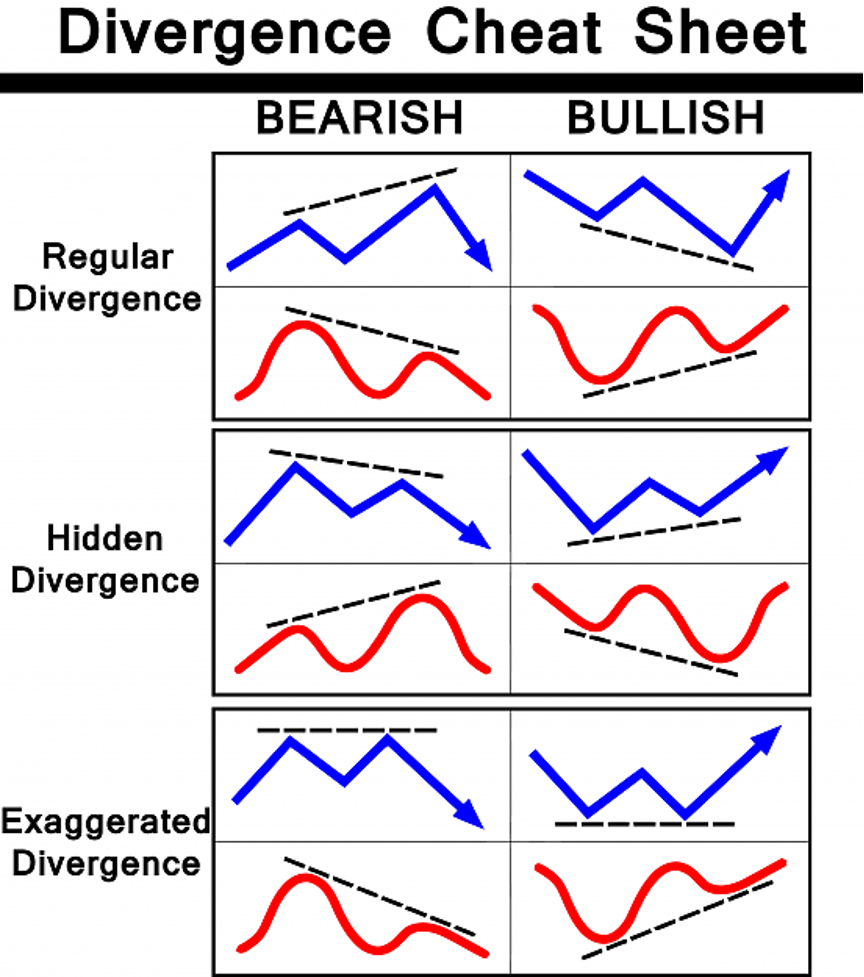

Divergence explains cheat sheet in 2023 Trading charts, Candlestick

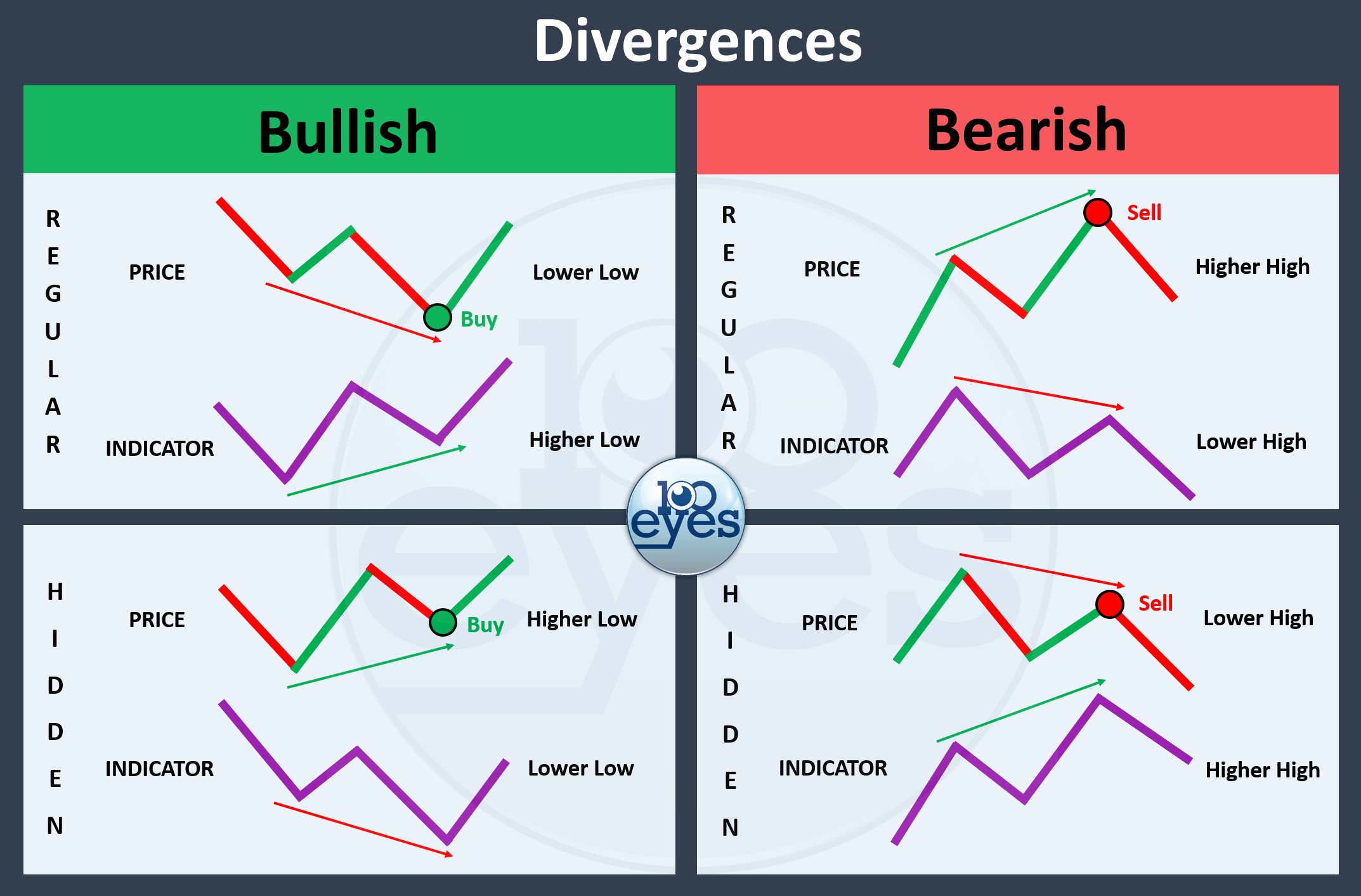

Divergence Trading 100eyes Scanner

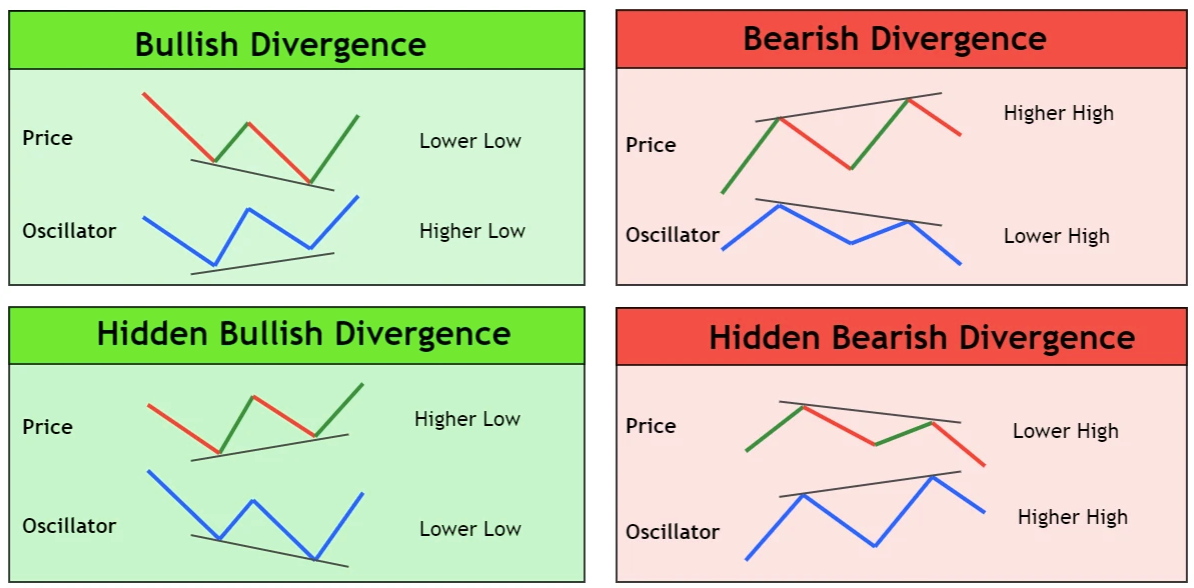

Divergence Trading Guide 101 The Basics Technical Analysis

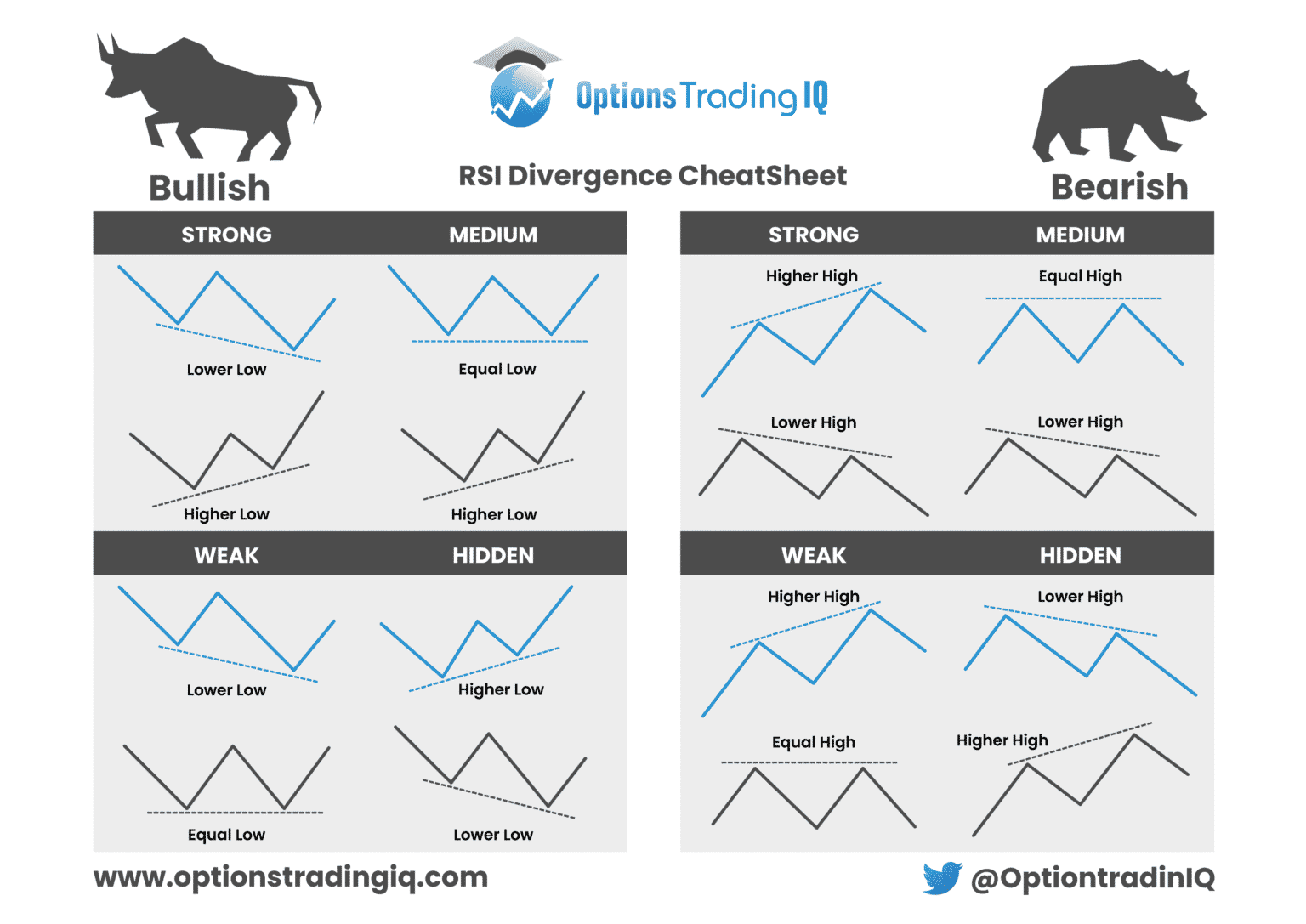

RSI Divergence Cheat Sheet Options Trading IQ

Trading strategy with Divergence chart patterns Trading charts, Forex

The Ultimate Divergence Cheat Sheet A Comprehensive Guide for Traders

![RSI Divergence Cheat Sheet [FREE Download] HowToTrade](https://howtotrade.com/wp-content/uploads/2023/02/rsi-divergence-cheat-sheet-2048x1448.png)

RSI Divergence Cheat Sheet [FREE Download] HowToTrade

Types of Divergence for POLONIEXETHBTC by Yrat — TradingView

Trading Example With Rsi Stochastics.

A Bullish Divergence Pattern Refers To A.

Choose Reliable Indicators Such As Rsi, Macd, Or Stochastic Oscillator That Can Detect Divergence Patterns Effectively.

What Hidden Divergence Tells Us:

Related Post: