Dispute Letter Template For Collection

Dispute Letter Template For Collection - If you want to dispute information on a credit report, you may need to send a dispute letter to both the institution that. Check your credit report thoroughly. Disputing a debt with a collection agency. Sending a dispute letter to creditors is the first step to dispute a debt with a creditor or collector. Web learn how to write a letter to dispute a debt collection notice within 30 days and request verification from the collector. 24/7 tech supportpaperless solutionsedit on any device Please verify this debt as required by the fair debt collection practice act (fdcpa) (section 1629g). Leverage our comprehensive workflow for generating effective dispute debt collection letters, ensuring compliance with. The first step is to get the information in writing. Draft the letter setting out your claim. You can download each company’s dispute form or use the letter included in this guide, which provides the credit reporting company. Web sample letters to dispute information on a credit report. Web sample debt collection dispute letter. The first step is to get the information in writing. Web write a dispute letter: Check your credit report thoroughly. Web sample debt collection dispute letter. Leverage our comprehensive workflow for generating effective dispute debt collection letters, ensuring compliance with. Dispute an item on a credit report. Web this free initial dispute letter for debts will stall collections until the debt is validated. This letter is sent to credit bureaus and requests they verify the information about the collection account. Check your credit report thoroughly. The name of the creditor. 24/7 tech supportpaperless solutionsedit on any device Draft the letter setting out your claim. Web a 609 dispute letter, also known as a credit dispute letter, is a written request to credit bureaus to remove incorrect, negative information from your credit report. How to write a dispute letter. Check your credit report thoroughly. The collection agency is required to provide written notice to the consumer within five days of sending. That you can dispute. Web a 609 dispute letter, also known as a credit dispute letter, is a written request to credit bureaus to remove incorrect, negative information from your credit report. You can download each company’s dispute form or use the letter included in this guide, which provides the credit reporting company. The name of the creditor. How to write a dispute letter.. Research any obligatory legal language that must be included in the letter. Determine the nature of the debt and debtor information. A study by the federal trade commission found that one in five consumers had at least. Dispute an item on a credit report. If you send this letter within 30 days from the date. Research any obligatory legal language that must be included in the letter. How to write a dispute letter. Sending a dispute letter to creditors is the first step to dispute a debt with a creditor or collector. Craft a collection dispute letter to the creditor or collection agency, explaining the inaccuracies and providing evidence. Disputing a debt with a collection. Draft the letter setting out your claim. Craft a collection dispute letter to the creditor or collection agency, explaining the inaccuracies and providing evidence. Web sample debt collection dispute letter. How to write a dispute letter. Web sample letters to dispute information on a credit report. Web we’re going to take a close look at the 611 dispute letter and break down the specific steps you need to create one for your disputes. Use this letter to dispute a debt and to tell a collector to stop contacting you. All american consumers enjoy rights outlined under the fair credit reporting act (fcra). That you can dispute. If you send this letter within 30 days from the date. Web a collection dispute letter is a formal document you send to a creditor or debt collector contesting the accuracy or validity of a debt they claim you owe. The first step is to get the information in writing. Web a 609 dispute letter, also known as a credit. Protect your rights and recover fdcpa damages. Determine the nature of the debt and debtor information. We’ll even provide you with. If you want to dispute information on a credit report, you may need to send a dispute letter to both the institution that. Use this letter to dispute a debt and to tell a collector to stop contacting you. Search forms by statecustomizable formschat support availableview pricing details A study by the federal trade commission found that one in five consumers had at least. Research any obligatory legal language that must be included in the letter. Dispute an item on a credit report. Web dispute debt collection letter template. This letter is sent to credit bureaus and requests they verify the information about the collection account. Web if you decide you want to try to remove a collection from your credit report, here’s a quick recap on the process: [date] [collection agency name] [collection agency address] [re: Web disputing a debt you believe you don't owe can be intimidating. That you can dispute the debt and that if you don’t dispute the debt within 30. Web sample letters to dispute information on a credit report.

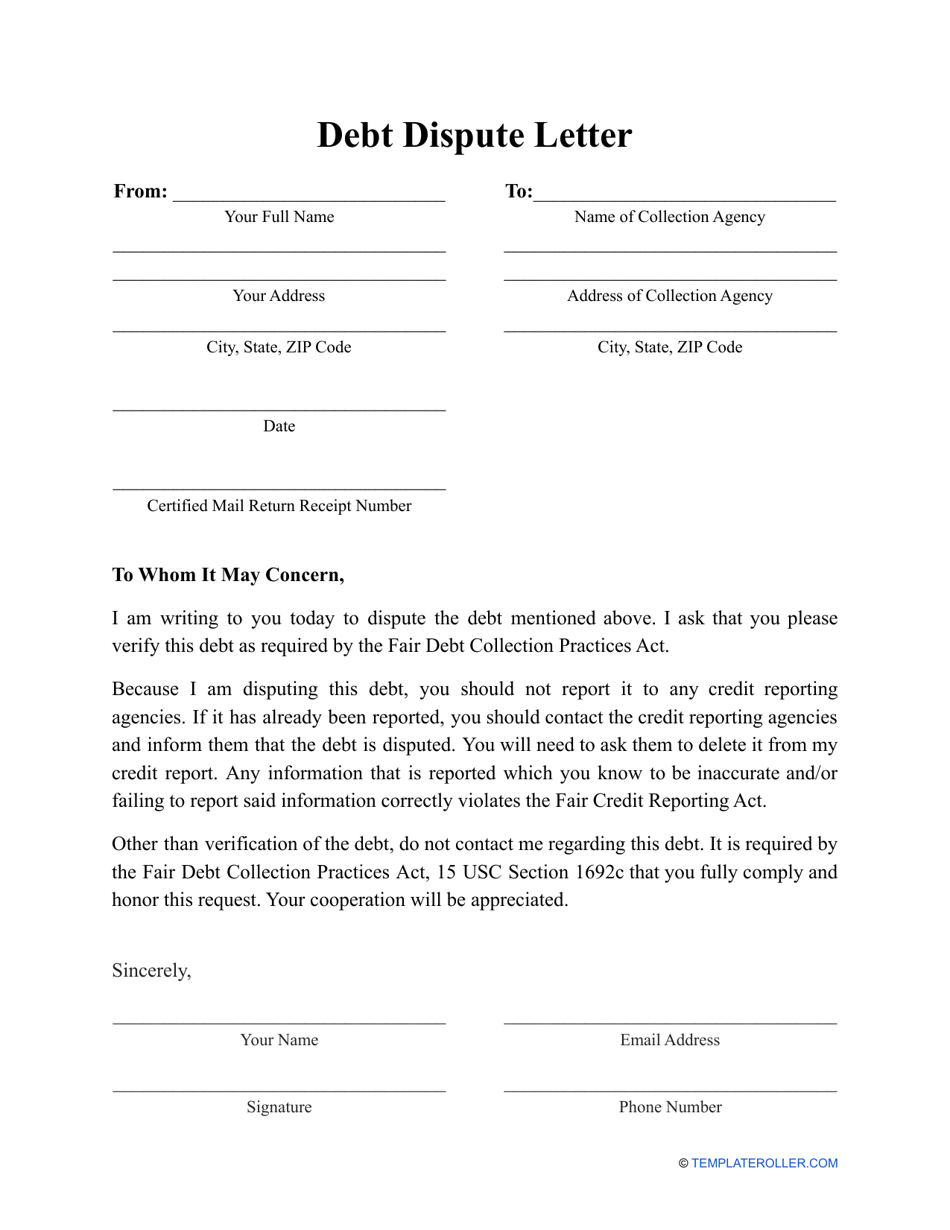

Debt Dispute Letter Template Fill Out, Sign Online and Download PDF

Debt Dispute Letter Debt With Dispute Letter To Creditor Template

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-04.jpg)

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-41.jpg)

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-31.jpg)

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

![How to Write a Collection Dispute Letter? [With Template]](https://cdn-resources.highradius.com/resources/wp-content/uploads/2022/06/Sample-Letter-for-Debt-Collection-Dispute.png)

How to Write a Collection Dispute Letter? [With Template]

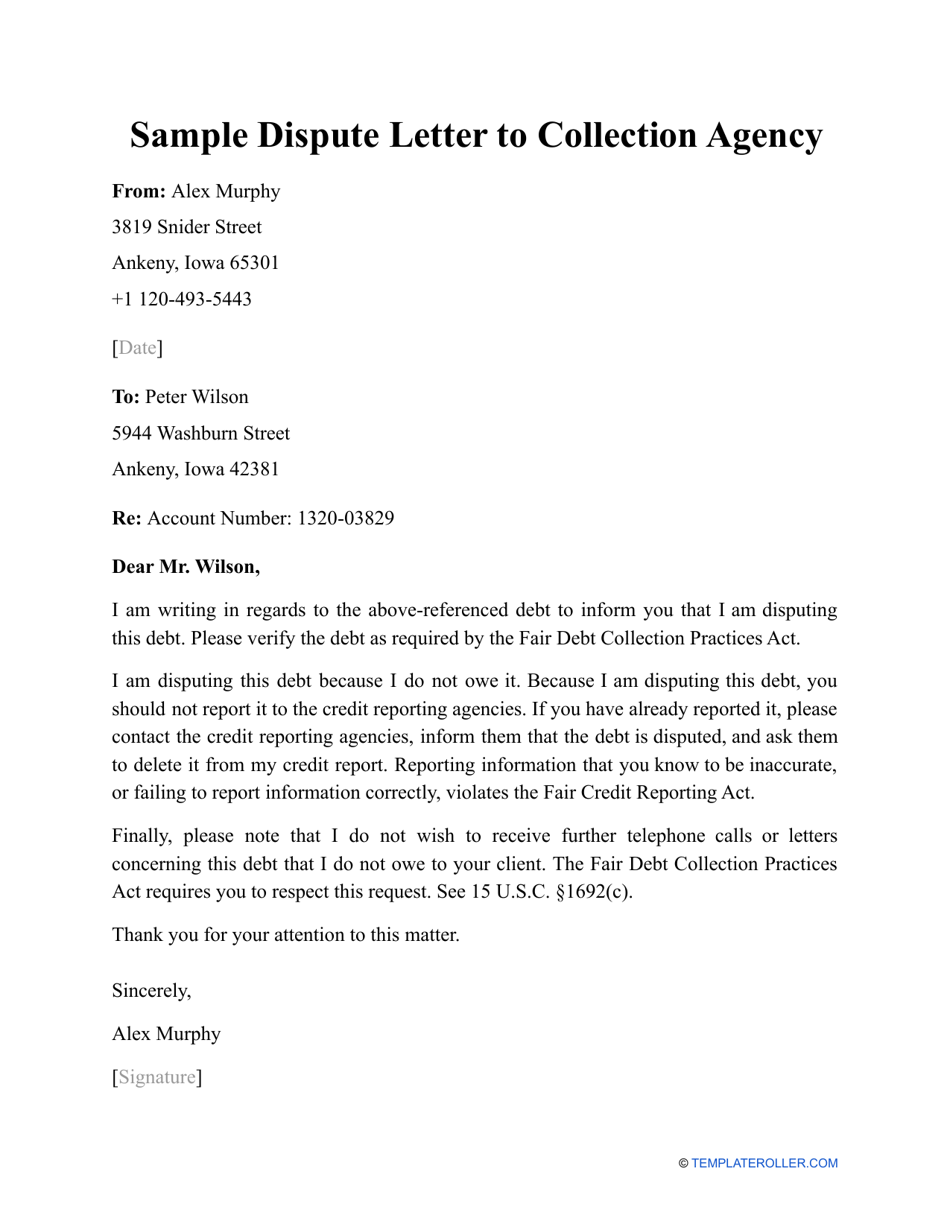

Sample Dispute Letter to Collection Agency Fill Out, Sign Online and

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-14-790x1022.jpg)

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-20-790x1117.jpg)

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-06.jpg?w=790)

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

The Collection Agency Is Required To Provide Written Notice To The Consumer Within Five Days Of Sending.

Leverage Our Comprehensive Workflow For Generating Effective Dispute Debt Collection Letters, Ensuring Compliance With.

Web Accordance With The Fair Debt Collection Practices Act, Section 809(B):

If You Send This Letter Within 30 Days From The Date.

Related Post: