Discounted Cash Flow Template Excel

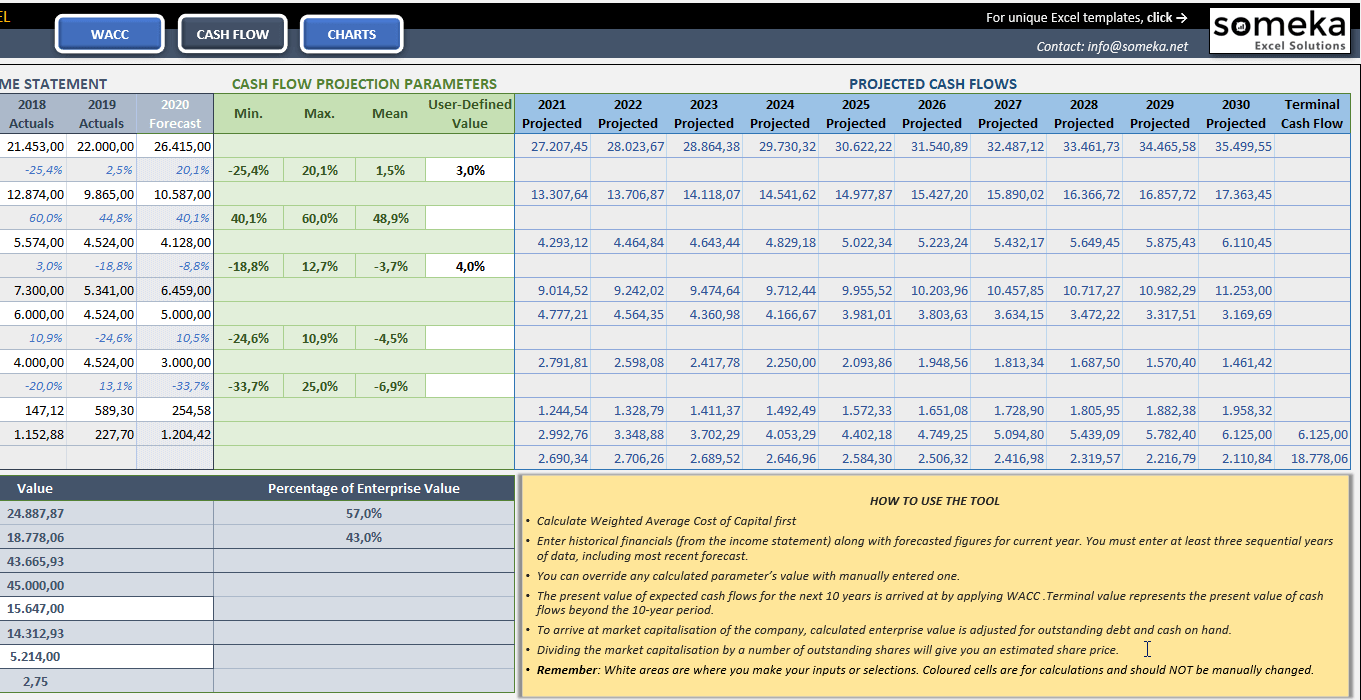

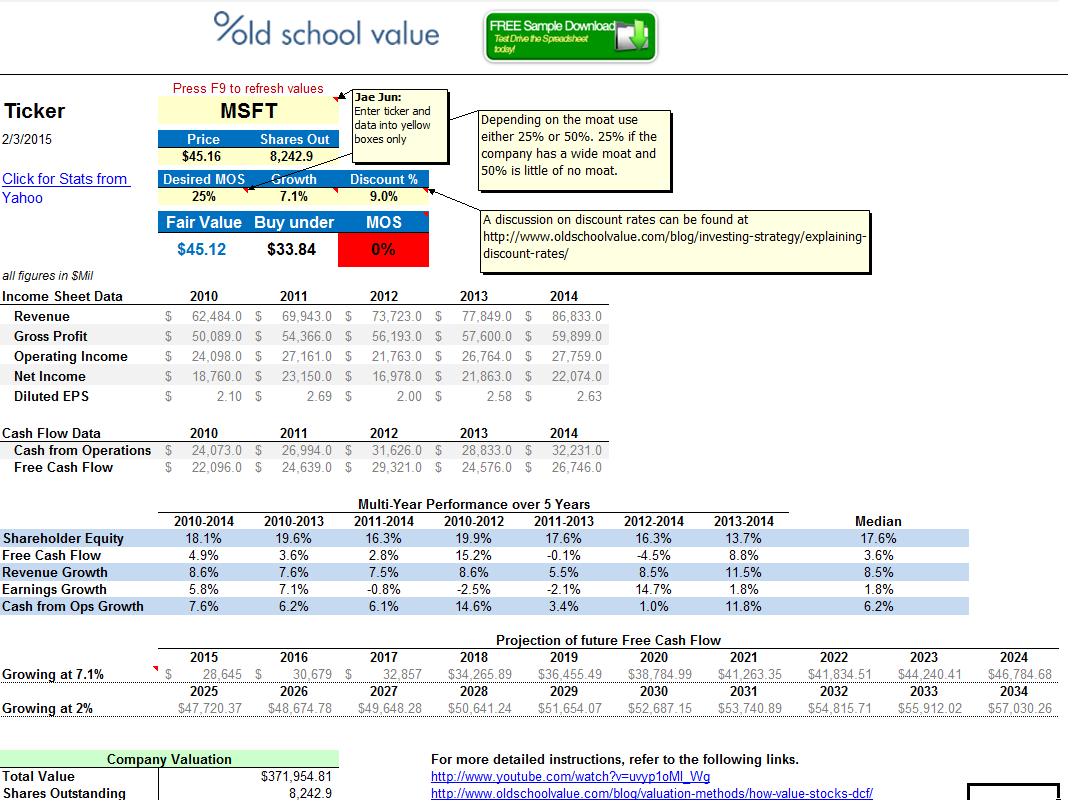

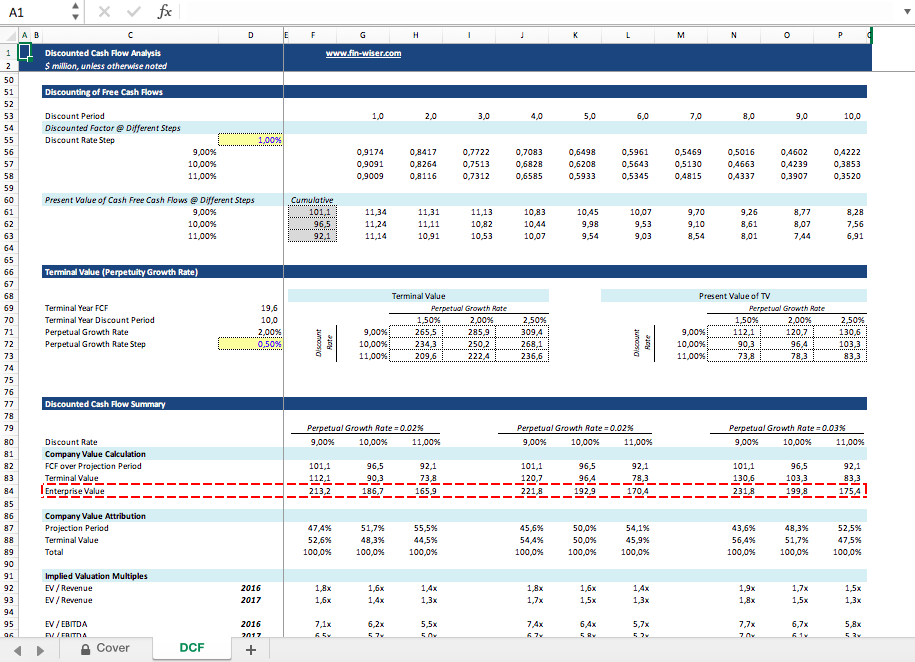

Discounted Cash Flow Template Excel - Web discounted cash flow (dcf) model template. A discounted cash flow (dcf) analysis is one of the most important tools an investor can use to determine the intrinsic value of a stock. Download wso's free discounted cash flow (dcf) model template below! Web the discounted cash flow (dcf) formula is equal to the sum of the cash flow in each period divided by one plus the discount rate ( wacc) raised to the power of the period number. Discounted cash flow is actually a valuation method that is used to forecast future gainings based on the present investment. Just plug the numbers into this formula. This guide will teach you how to get and use a free dcf template in excel. R = the interest rate or discount rate. Here is the dcf formula: Web this involves dividing each cash flow by the appropriate discount factor, which is calculated as (1+discount~rate)^n (1+discount rate)n, where ‘n’ represents the number of periods into the future. Cfn is the last year in the forecast.) r = the discount rate. The cheat sheet below includes important discounted cash flow formulas. Web discounted cash flow (dcf) model template. Dcf = cf1 / (1+r)^1 + cf2 / (1+r)^2 +. Web here, cft = cash flow in period t (time) r = discount rate. Download the free dcf model template Web discounted cash flow valuation model: Here is the dcf formula: How to build dcf model excel structures? All included here with examples and real life case studies. Enter your name and email in the form and download the free template now! Web the discounted cash flow (dcf) formula is equal to the sum of the cash flow in each period divided by one plus the discount rate ( wacc) raised to the power of the period number. Enter this formula in c12 and press enter to find. All included here with examples and real life case studies. Companies grow and change over time, and often they are riskier with higher growth potential in earlier years, and then they mature and become less risky later on. To calculate dcf, you discount future cash flows back to their present value. A discounted cash flow (dcf) analysis is one of. Discounted cash flow (dcf) model template. Companies grow and change over time, and often they are riskier with higher growth potential in earlier years, and then they mature and become less risky later on. An editable excel template on discounted cash flow (dcf) is a tool that can help individuals and businesses evaluate the present value of an investment based. Discounted cash flow is actually a valuation method that is used to forecast future gainings based on the present investment. Web our discounted cash flow valuation template is designed to assist you through the journey of valuation. T = period of time (1,2,3,……,n) we can easily calculate the discounted cash flow and validate it, just follow the steps: N =. Discounted cash flow (dcf) model template. Discover the intrinsic value of any company using our free discounted cash flow (dcf) template. It comes complete with an example of a dcf model so even beginners can get started quickly and accurately. Discounted cash flow valuation template ; Basic discounted cash flow valuation template ;. A discounted cash flow (dcf) analysis is one of the most important tools an investor can use to determine the intrinsic value of a stock. We'll also review how to use the template to make informed investment decisions. Cf = cash flow in the period. All that’s really necessary here is to map out the payment schedule, including how much. Read this excel tutorial to find out how you can easily estimate the net present value of your holdings with our free template, step by step. Sample discounted cash flow excel template; Discounted cash flow analysis template; Gather the cash flow data. Forecast future cash flows and determine the present value of these cash flows by discounting. Dcf = cf1 / (1+r)^1 + cf2 / (1+r)^2 +. N = the period number. We'll also review how to use the template to make informed investment decisions. This includes identifying the time periods for which cash flows will occur and determining the amount of cash flow for each period. Companies grow and change over time, and often they are. Read this excel tutorial to find out how you can easily estimate the net present value of your holdings with our free template, step by step. Discounted cash flow cheat sheet. Use our dcf model template for your financial valuations. Just plug the numbers into this formula. Discounted cash flow valuation template ; Hit enter to get the npv value in e2. Cf = the cash flow in a given year (cf1 is year one. Web our discounted cash flow valuation template is designed to assist you through the journey of valuation. This includes identifying the time periods for which cash flows will occur and determining the amount of cash flow for each period. Web this involves dividing each cash flow by the appropriate discount factor, which is calculated as (1+discount~rate)^n (1+discount rate)n, where ‘n’ represents the number of periods into the future. Download wso's free discounted cash flow (dcf) model template below! The template comes with various scenarios along with sensitivity analysis. Gather the cash flow data. Below is a preview of the dcf model template: Sample discounted cash flow excel template; Analyzing the components of the formula.

Free Discounted Cash Flow Templates Smartsheet

DCF Discounted Cash Flow Model Excel Template Eloquens

discounted cash flow excel template —

Discounted Cash Flow Template Free DCF Valuation Model in Excel!

Discounted Cash Flow Excel Template Free

Discounted Cash Flow (DCF) Model Free Excel Template Macabacus

Discounted Cash Flow Spreadsheet

Discounted Cash Flow (DCF) Model Free Excel Template Macabacus

Single Sheet DCF (Discounted Cash Flow) Excel Template Eloquens

Free Discounted Cash Flow Templates Smartsheet

Web The Formula For Discounted Cash Flow (Dcf) In Excel Is:

All That’s Really Necessary Here Is To Map Out The Payment Schedule, Including How Much Cash You’ll Receive Every Year.

Cfn Is The Last Year In The Forecast.) R = The Discount Rate.

Using The Discounted Cash Flow Formula In Excel To Calculate Free Cashflow To Firm (Fcff) Enter This Formula In C11 To Calculate The Total Amount Of Equity And Debt.

Related Post: