Discounted Cash Flow Model Template

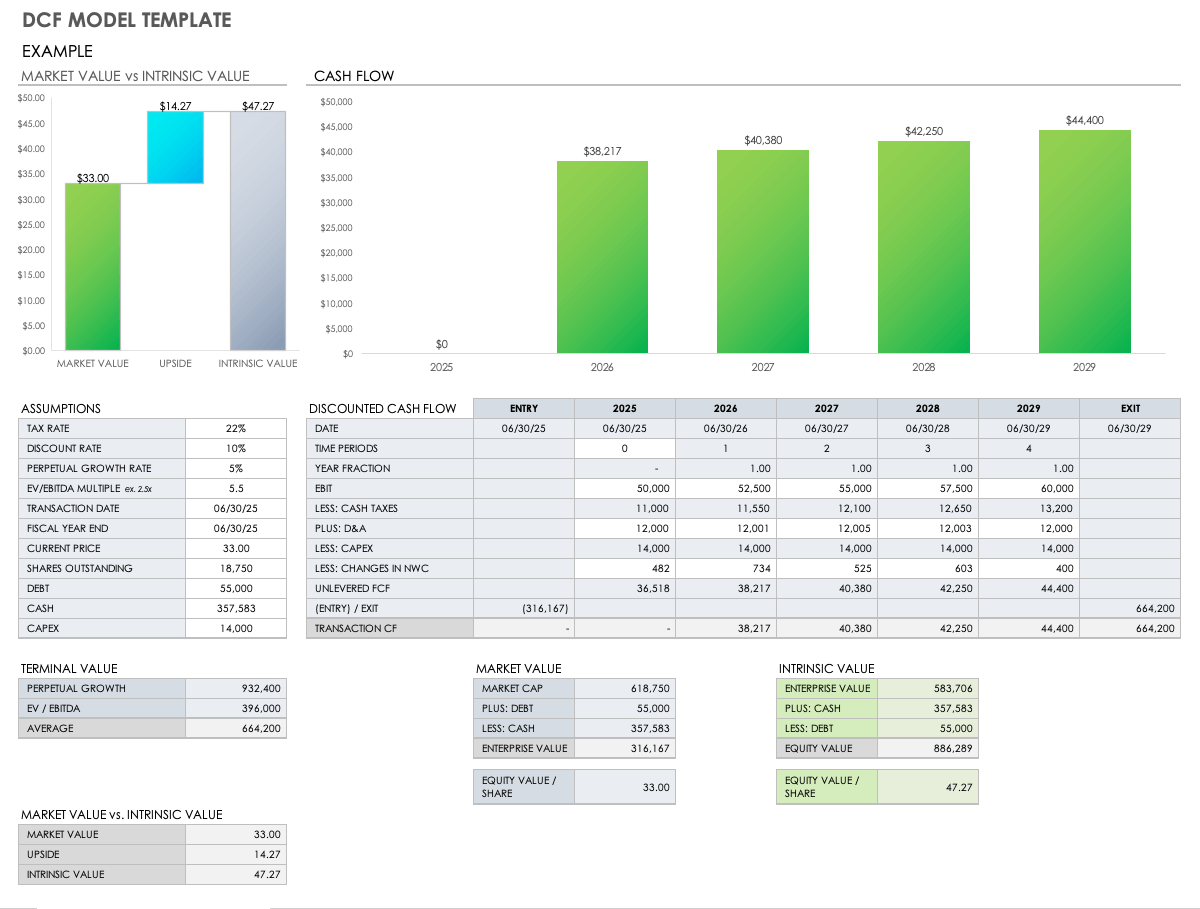

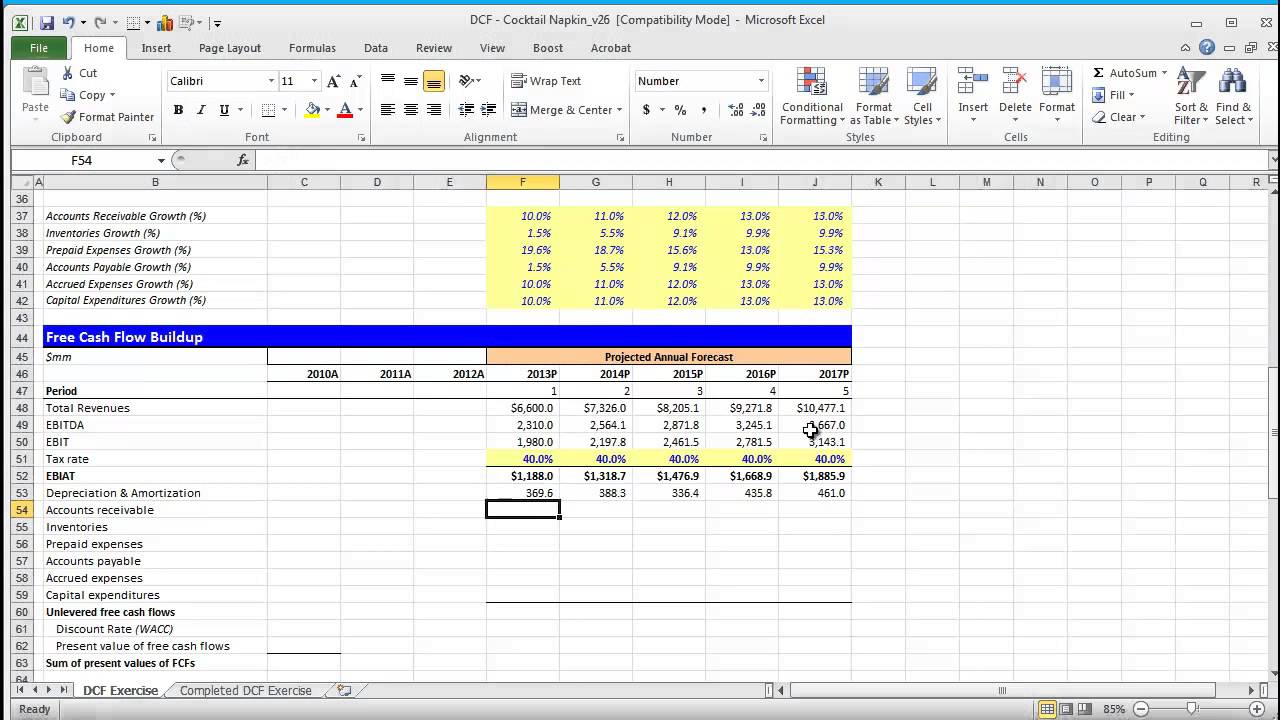

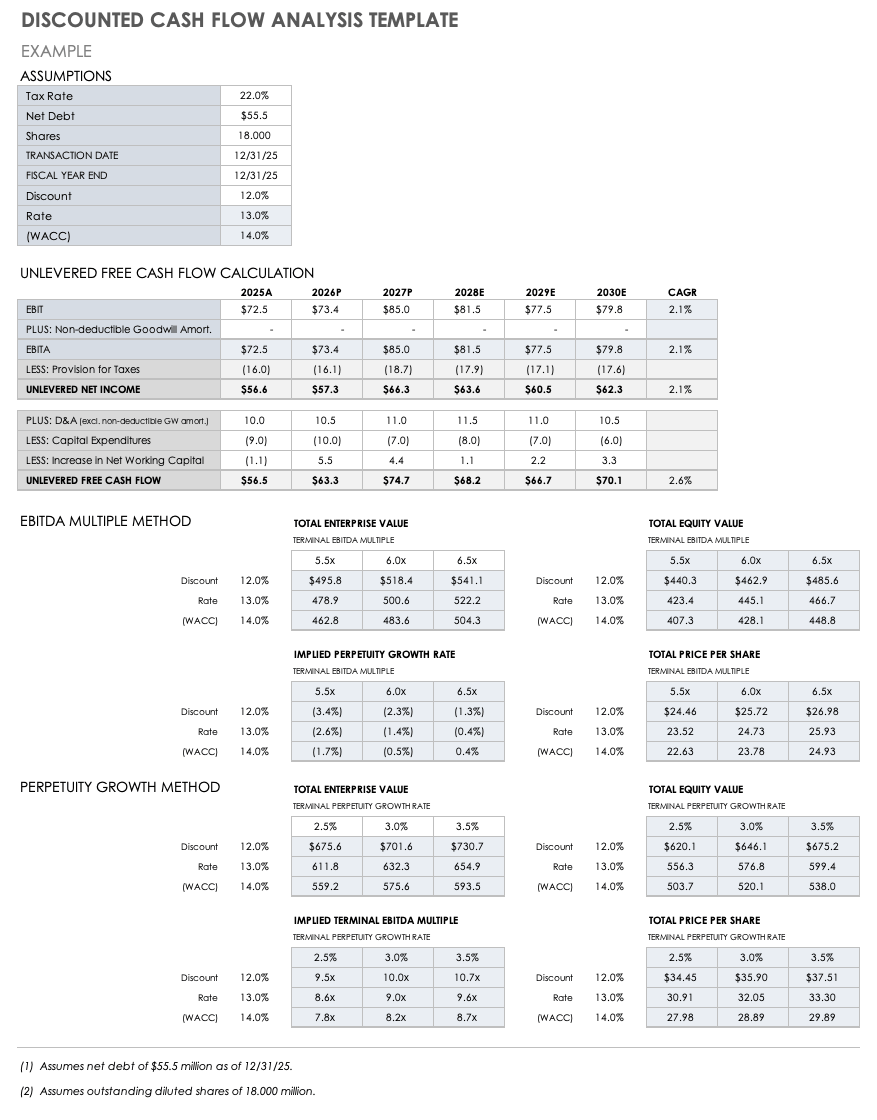

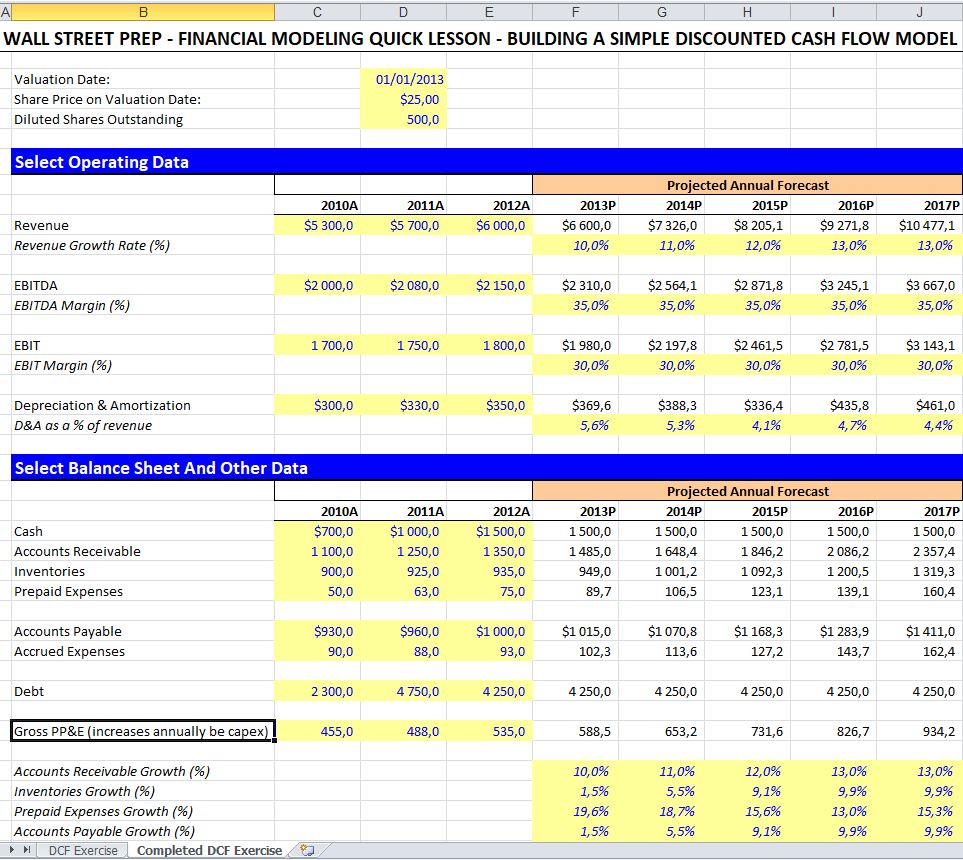

Discounted Cash Flow Model Template - Web fcff is a measure of the company’s ability to generate cash flow from its core business operations after accounting for necessary capital investments and taxes. Valuing companies using a dcf model is considered a core skill for investment bankers, private. The formula for discounted cash flow (dcf) in excel is: The dcf valuation method is widely used. Then, if you chose using capm for calculating the cost. Web the executive summary also provides a quick overview of the whole dcf excel template. Web in dcf analysis, essentially what you are doing is projecting the cash flows of a company, project or asset, and determining the value of those future cash flows today. Web discounted cash flow (dcf) is a valuation method used to estimate the attractiveness of an investment opportunity. To calculate dcf, you discount future cash flows back to their present value. If it is less than 5%, gurufocus uses 5% instead. Hence, we must first project them using the cash flow statement (cfs). Our simple dcf template is your key to unlocking the intrinsic value of businesses without the complexity. If the dcf model is built after a financial model, the projected cfs should already have been created which can be used directly in our model. (yum) dcf excel template main. Fcff = ebit × (1−t) + depreciation − capital expenditures −. You now have your own cash flow. You can also copy the formulas down for more years. Web the macabacus discounted cash flow template implements key concepts and best practices related to dcf modeling. Having a discounted cash flow model ready is very useful for explaining a business’s economics. Web a basic dcf model involves projecting future cash flows and discounting them back to the present using a discount rate that reflects the riskiness of the capital. You now have your own cash flow. Having a discounted cash flow model ready is very useful for explaining a business’s economics and discussing its impact on the valuation. Therefore, the most. Web the discounted cash flow model, or “dcf model”, is a type of financial model that values a company by forecasting its cash flows and discounting them to arrive at a current, present value. Dcfs are widely used in both academia and in practice. This file allows you to calculate discounted cash flow in excel. Web download wso's free discounted. Web this template offers you two different equity cost calculation methods: If it is higher than 20%, gurufocus uses 20%. A certain amount of money today has greater buying power today than the same amount of money in the future. This template allows you to build your own discounted cash flow model with different assumptions. Web the executive summary also. Our simple dcf template is your key to unlocking the intrinsic value of businesses without the complexity. Web as the name suggests, a discounted cash flow model requires projections of future cash flows to discount them to a present value. Web download wso's free discounted cash flow (dcf) model template below! It is often used in discounted cash flow (dcf). Input your own numbers in place of the example numbers in the blue font color cells. Having a discounted cash flow model ready is very useful for explaining a business’s economics and discussing its impact on the valuation. Web discounted cash flow (dcf) is a valuation method used to estimate the attractiveness of an investment opportunity. Web formula for discounted. Download the free dcf model template. Unravelling the true worth of a company has never been this straightforward. Therefore, the most used and theoretical sound valuation method for determining the expected value of a based on its projected free cash flows. Web dcf model, financial analysis, financial planning. And so, many people in industry compare that value to market values. Enter your name and email in the form below and download the free template now! Below is a preview of the dcf model template: To calculate dcf, you discount future cash flows back to their present value. Web the discounted cash flow (dcf) analysis represents the net present value (npv) of projected cash flows available to all providers of capital,. It looks at the present value of annual cash flows, allowing you to adjust the template for the discount rate. Then, if you chose using capm for calculating the cost. The dcf valuation method is widely used. Dcfs are widely used in both academia and in practice. You can also copy the formulas down for more years. Web the discounted cash flow (dcf) analysis represents the net present value (npv) of projected cash flows available to all providers of capital, net of the cash needed to be invested for generating the projected growth. This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. Web discounted cash flow (dcf) analysis template. It computes the perpetuity growth rate implied by the terminal multiple method and vice versa and sensitizes the analysis over a range of assumed terminal multiples and perpetuity growth rates without the use of slow excel. Web fcff is a measure of the company’s ability to generate cash flow from its core business operations after accounting for necessary capital investments and taxes. Dcf stands for d iscounted c ash f low, so a dcf model is simply a forecast of a company’s unlevered free cash flow discounted back to today’s value, which is called the net present value (npv). It is often used in discounted cash flow (dcf) analysis to determine the intrinsic value of a company’s equity. Web discounted cash flow valuation is a form of intrinsic valuation and part of the income approach. Input your own numbers in place of the example numbers in the blue font color cells. The template uses the method, which discounts future cash flows back to present value. Dcf = cf1 / (1+r)^1 + cf2 / (1+r)^2 +. This dcf model training guide will teach you the basics, step. * dashboard, * income statement, * cash flow, * balance sheet, * wacc calculation, * dcf calculation, * liquidity. There is also a second calculation where it proves these. Web a basic dcf model involves projecting future cash flows and discounting them back to the present using a discount rate that reflects the riskiness of the capital. Web formula for discounted cash flow in excel:

Free Discounted Cash Flow Templates Smartsheet

Financial Modeling Quick Lesson Building a Discounted Cash Flow (DCF

Free Discounted Cash Flow Templates Smartsheet

Discounted Cash Flow Model Formula, Example & Interpretation eFM

Discounted Cash Flow (DCF) Model Template + Instructions Eloquens

Discounted Cash Flow (DCF) Excel Model Template Eloquens

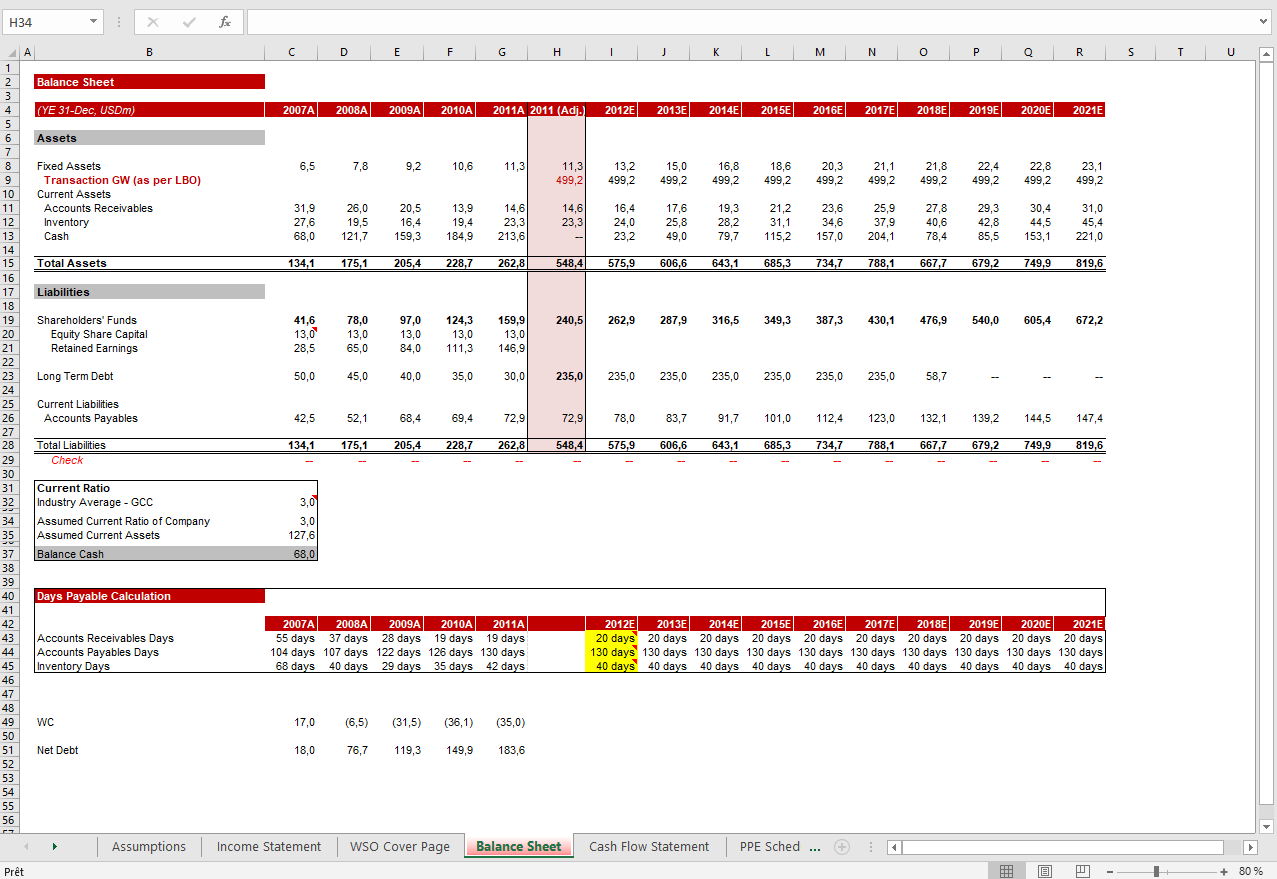

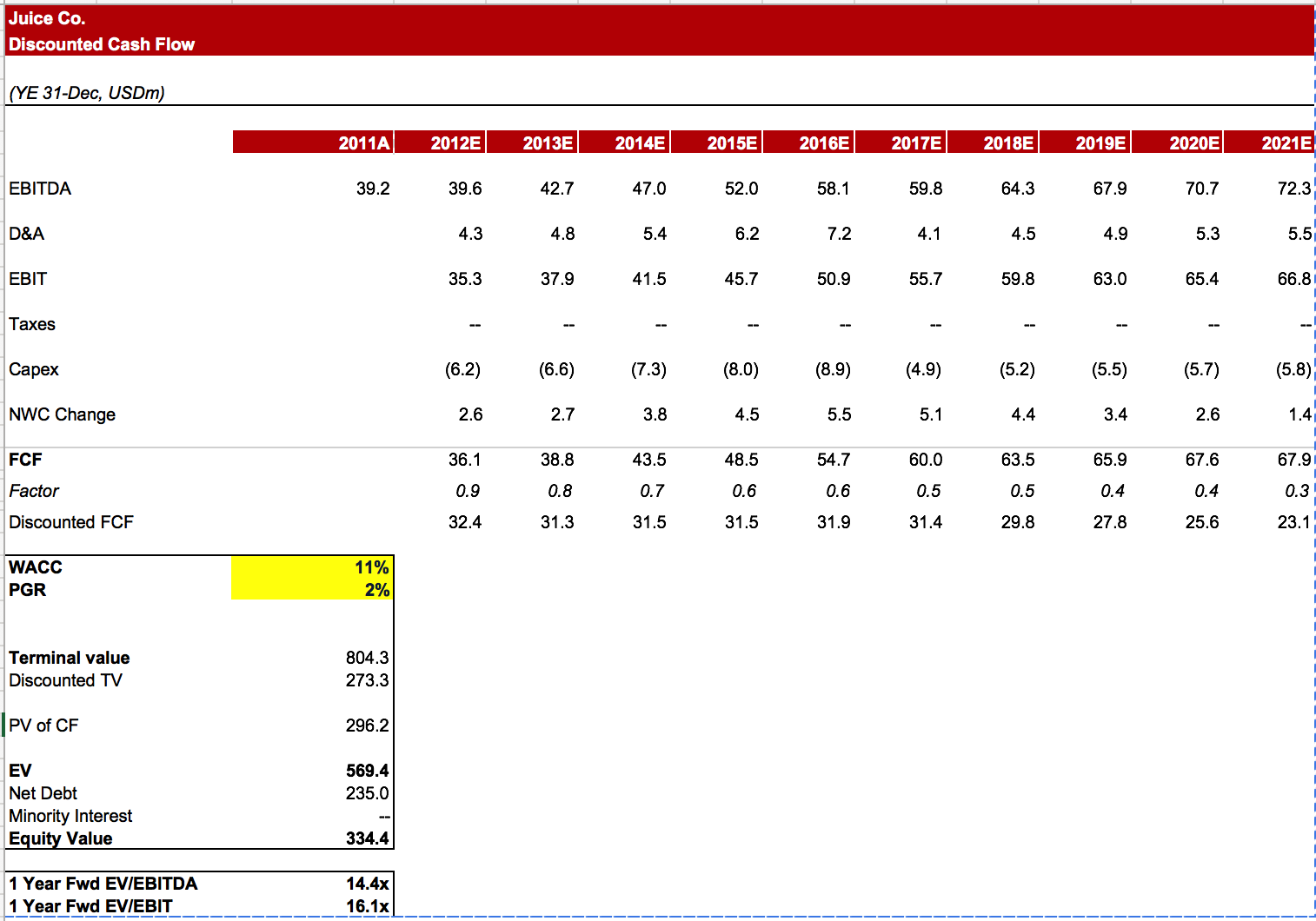

Discounted Cash Flow (DCF) Model Template Wall Street Oasis

DCF Discounted Cash Flow Model Excel Template Eloquens

Discounted Cash Flow (DCF) Model Free Excel Template Macabacus

Free Discounted Cash Flow Templates Smartsheet

Web Discounted Cash Flow (Dcf) Is A Valuation Method Used To Estimate The Attractiveness Of An Investment Opportunity.

Web This Template Offers You Two Different Equity Cost Calculation Methods:

First, Please Select The Equity Cost Calculation Method In The Assumptions Table And Define The Income Tax Rate.

Web The Macabacus Discounted Cash Flow Template Implements Key Concepts And Best Practices Related To Dcf Modeling.

Related Post: