Discounted Cash Flow Excel Template

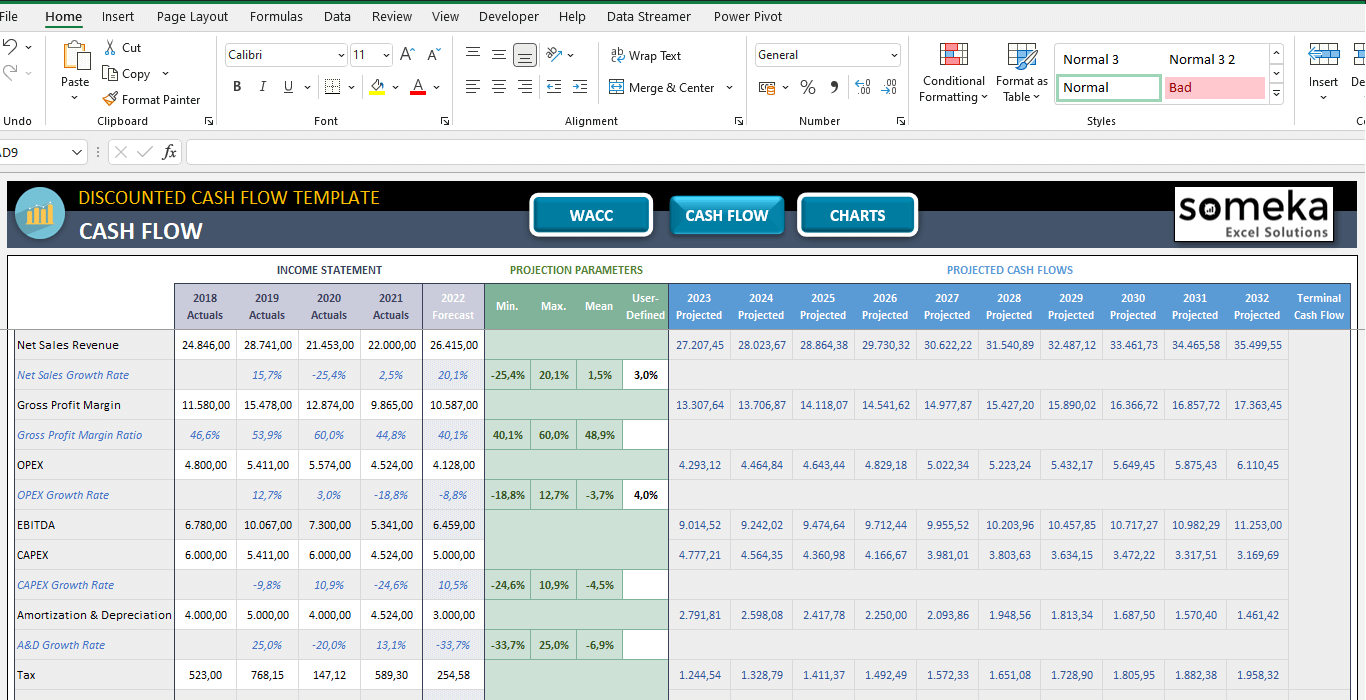

Discounted Cash Flow Excel Template - Web using the discounted cash flow formula in excel to calculate free cashflow to firm (fcff) enter this formula in c11 to calculate the total amount of equity and debt. Sum the discounted cash flows to find the investment’s npv. =sum(d6:d25) here, the sum function adds the present value over the 20 years of cash flow. Add the initial investment cost, usually as a negative value, to calculate the total dcf. You now have your own cash flow. The dcf model enables users to. Our simple dcf template is your key to unlocking the intrinsic value of businesses without the complexity. This template allows you to build your own discounted cash flow model with different assumptions. Valuing companies using a dcf model is considered a core skill for investment bankers, private. Web formula for discounted cash flow in excel: The dcf model enables users to. It comes complete with an example of a dcf model so even beginners can get started quickly and accurately. It achieves this by assessing the company’s expected future earnings and then knowing its present value. Web 1.1 future value • 9 minutes. (wso users get 15% off!) from axial. Hit enter to get the npv value in e2. Web 1.1 future value • 9 minutes. Web discounted cash flow template. * dashboard, * income statement, * cash flow, * balance sheet, * wacc calculation, * dcf calculation, * liquidity. Read this excel tutorial to find out how you can easily estimate the net present value of your holdings with. Dcfs are widely used in both academia and in practice. Read this excel tutorial to find out how you can easily estimate the net present value of your holdings with our free template, step by step. Web the discounted cash flow (dcf) model in excel is like a calculator. Input your own numbers in place of the example numbers in. The template also includes other tabs for. Welcome to our simple dcf (discounted cash flow) template, tailored for both. Web the macabacus discounted cash flow template implements key concepts and best practices related to dcf modeling. Add or cut line items as needed (select the row with your mouse, right click and choose insert, or delete) ensure that the formulas. (yum) dcf excel template main parts of the financial model: 1.3 present value of multiple cash flows • 5 minutes. Web the macabacus discounted cash flow template implements key concepts and best practices related to dcf modeling. The template uses the discounted cash flow (dcf) method,. List all projected cash flows in a column. =npv(d2,b2:b12) calculate npv in excel using the npv function. The template uses the discounted cash flow (dcf) method,. Estimate the total value of the present values. It computes the perpetuity growth rate implied by the terminal multiple method and vice versa and sensitizes the analysis over a range of assumed terminal multiples and perpetuity growth rates without the use of. The only thing left here is to calculate the total of all these. Web 1.1 future value • 9 minutes. (wso users get 15% off!) from axial. Web an editable excel template on discounted cash flow (dcf) is a tool that can help individuals and businesses evaluate the present value of an investment based on its expected future cash flows.. Enter your name and email in the form below and download the free template now! =sum(d6:d25) here, the sum function adds the present value over the 20 years of cash flow. =npv(d2,b2:b12) calculate npv in excel using the npv function. Input your own numbers in place of the example numbers in the blue font color cells. Dive into the world. Web discounted cash flow is calculated in this section using the present value calculated in the above section. Web to perform a dcf in excel: =npv(d2,b2:b12) calculate npv in excel using the npv function. Read this excel tutorial to find out how you can easily estimate the net present value of your holdings with our free template, step by step.. It achieves this by assessing the company’s expected future earnings and then knowing its present value. You then add up all of those discounted cash flows, and the sum is really the intrinsic value of the company. (wso users get 15% off!) from axial. Discover the intrinsic value of any company using our free discounted cash flow (dcf) template. Web. Enter this formula in c12 and press enter to find the cost of debt. (wso users get 15% off!) from axial. 1.5 present value of annuity • 3 minutes. =npv(d2,b2:b12) calculate npv in excel using the npv function. Web discounted cash flow valuation model: 1.3 present value of multiple cash flows • 5 minutes. Web the discounted cash flow (dcf) model in excel is like a calculator. Web an editable excel template on discounted cash flow (dcf) is a tool that can help individuals and businesses evaluate the present value of an investment based on its expected future cash flows. 10 readings • total 100 minutes. Determine your discount rate based on investment risk. The dcf model enables users to. Web 1.1 future value • 9 minutes. This is a nifty dcf for newbies. Web to do that, i’ll use a formula that takes the cash flow value, multiples it by the discount rate (i’ll use 5%) raised to a negative power (the year). Input your own numbers in place of the example numbers in the blue font color cells. Discover the intrinsic value of any company using our free discounted cash flow (dcf) template.

Free Discounted Cash Flow Templates Smartsheet

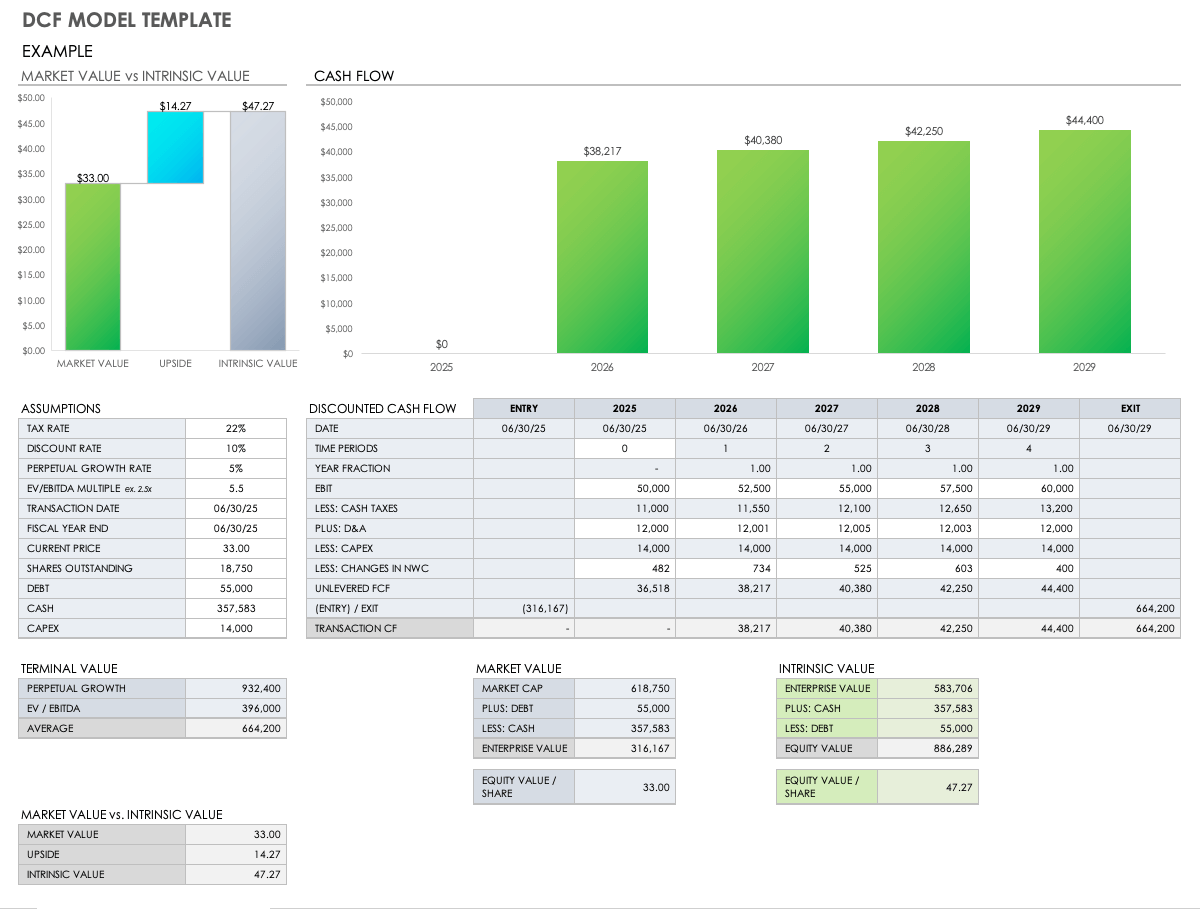

discounted cash flow excel template —

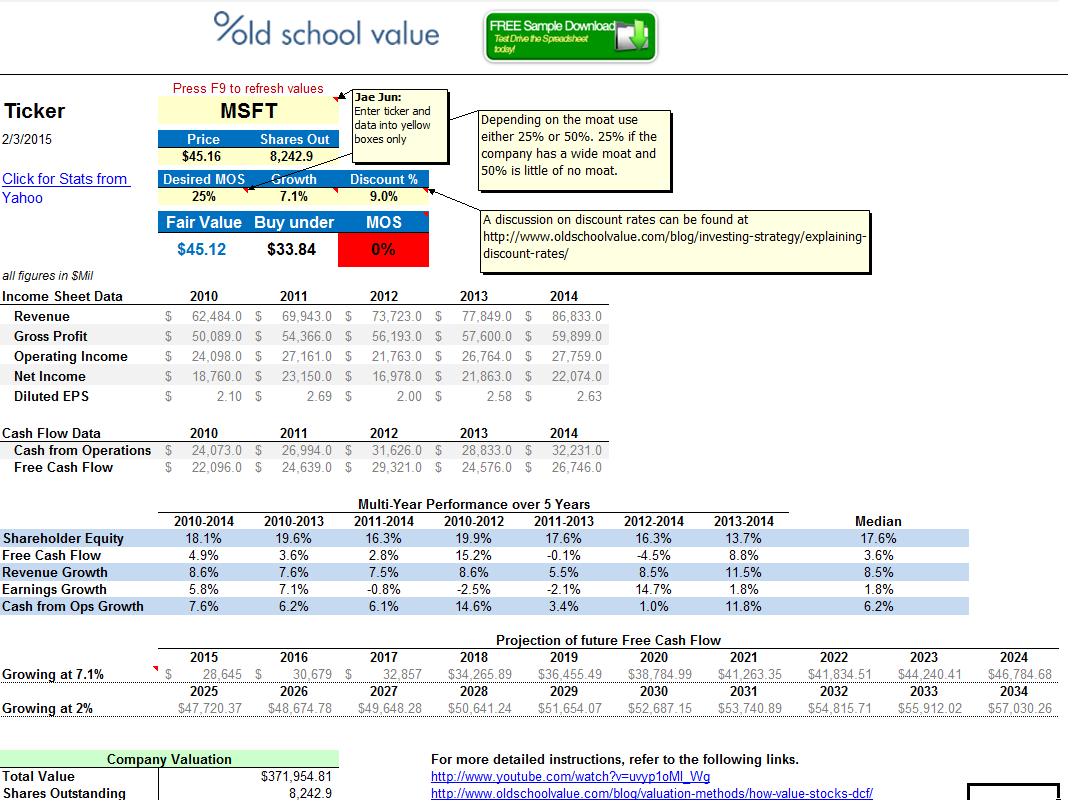

Discounted Cash Flow Spreadsheet

Discounted Cash Flow Template Free DCF Valuation Model in Excel!

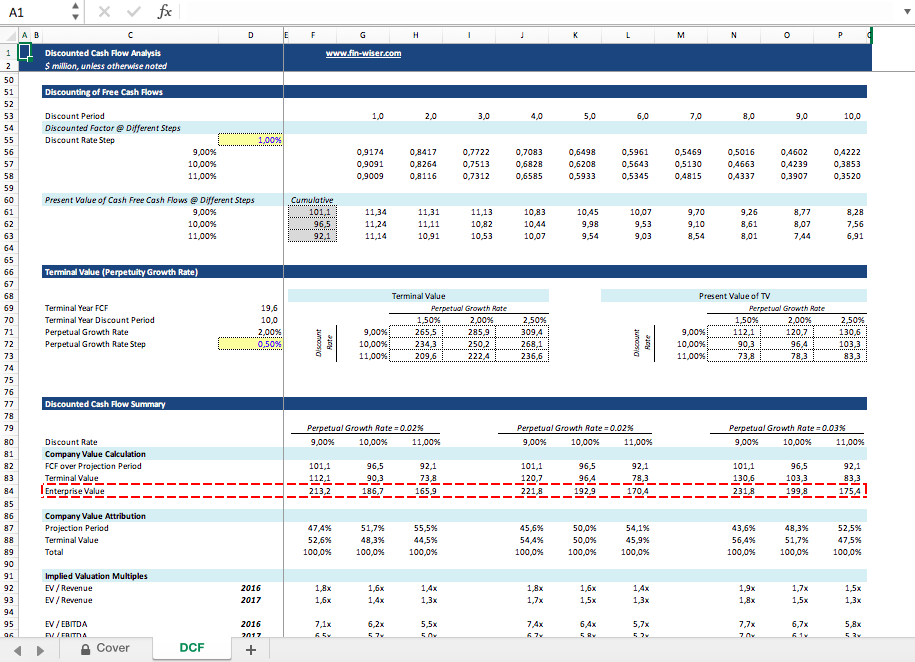

Discounted Cash Flow (DCF) Model Free Excel Template Macabacus

Discounted Cash Flow (DCF) Model Free Excel Template Macabacus

DCF Discounted Cash Flow Model Excel Template Eloquens

Single Sheet DCF (Discounted Cash Flow) Excel Template Eloquens

Discounted Cash Flow Excel Template DCF Valuation Template

Free Discounted Cash Flow Templates Smartsheet

Below This Column Header You’ll Be Calculating The Net Present Value.

Web Discounted Cash Flow Template.

It Comes Complete With An Example Of A Dcf Model So Even Beginners Can Get Started Quickly And Accurately.

The Big Idea Behind A Dcf Model.

Related Post: