Diamond Trading Pattern

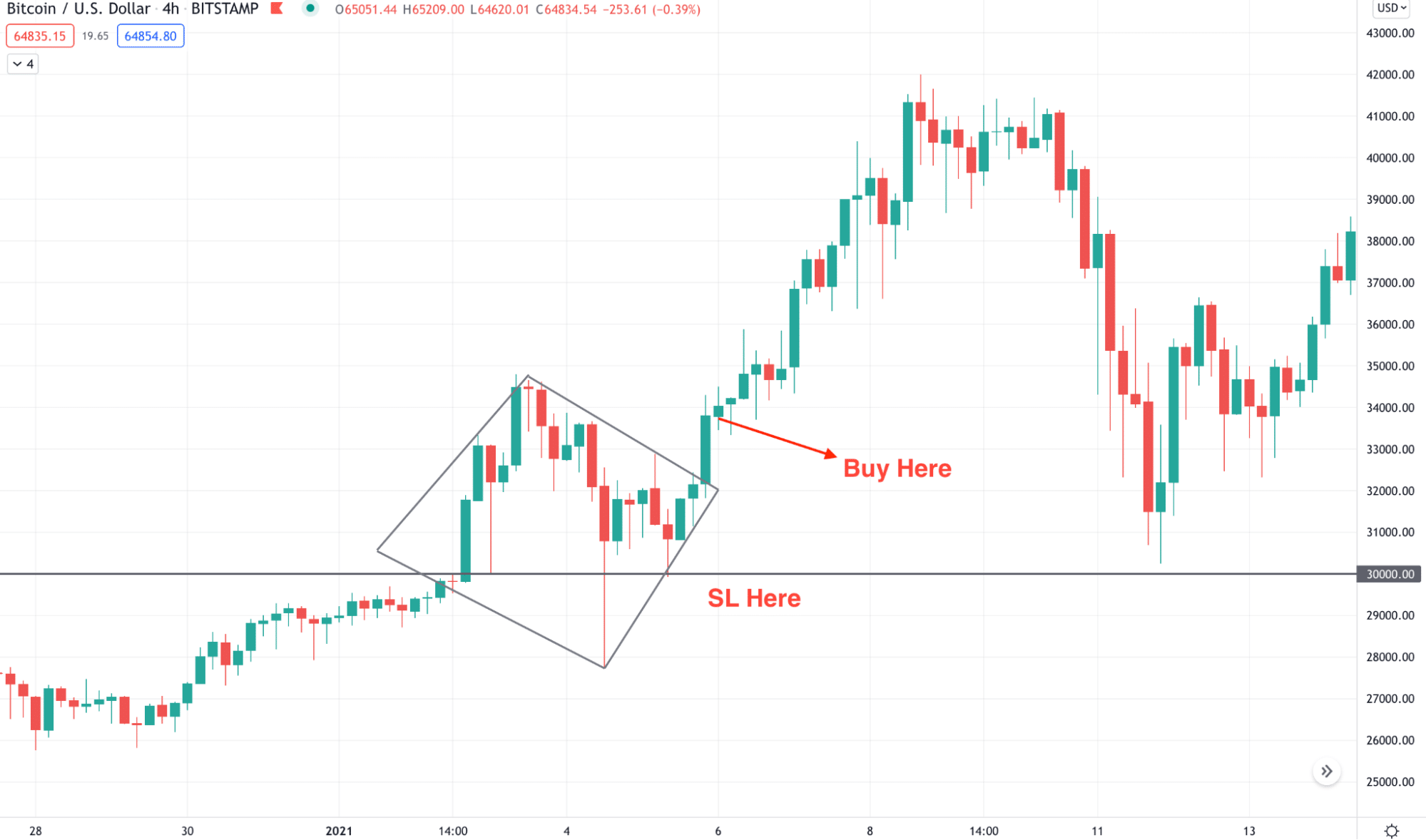

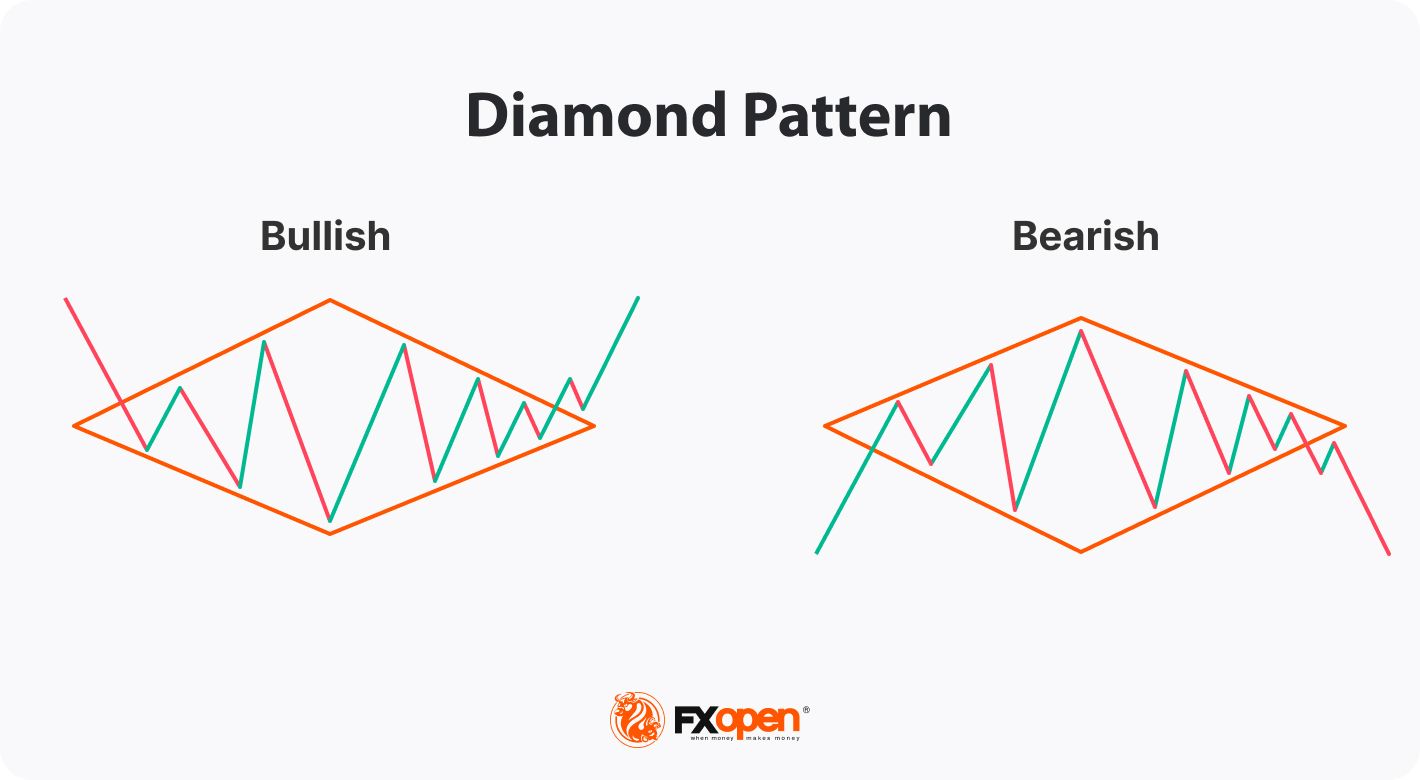

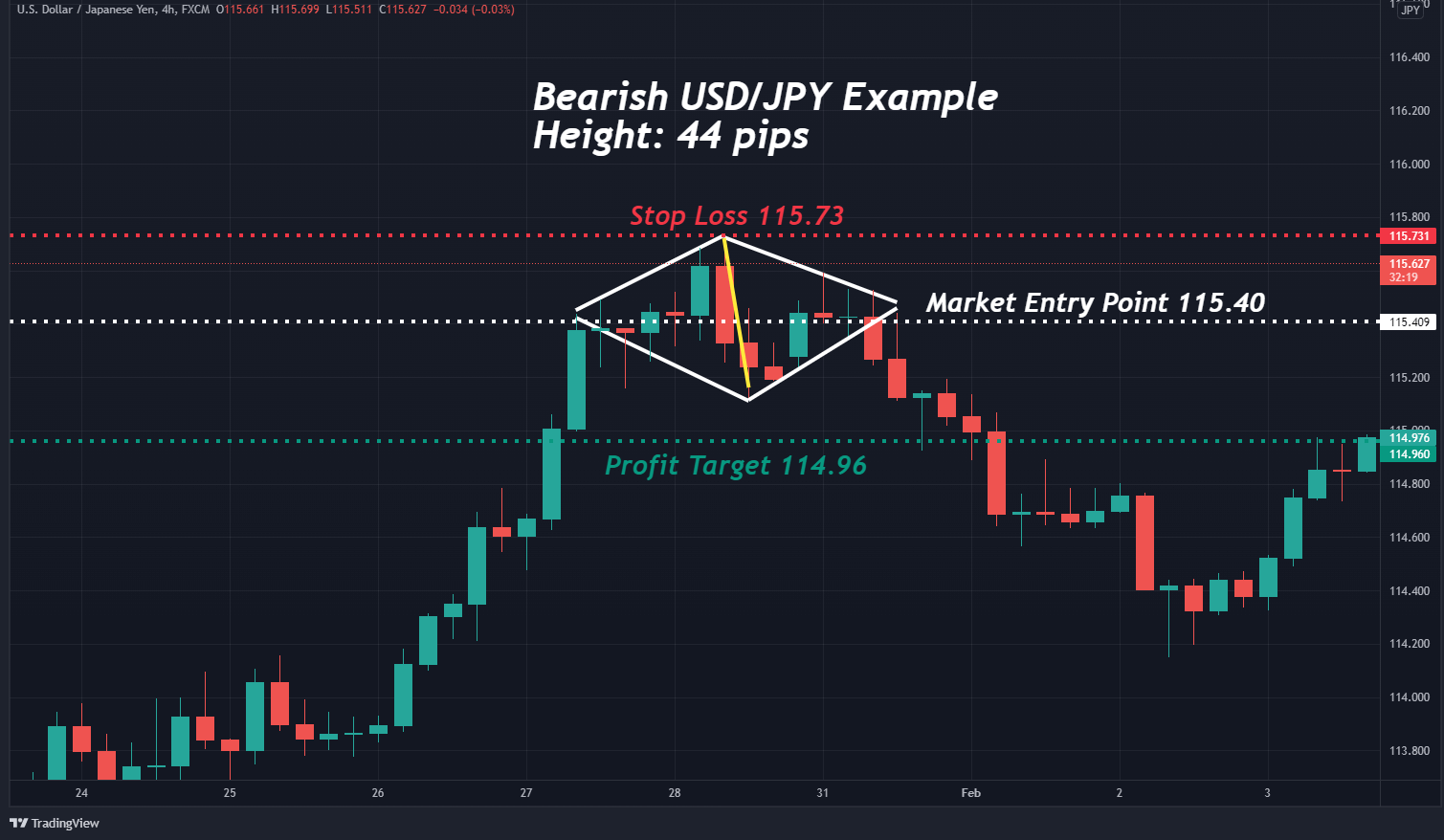

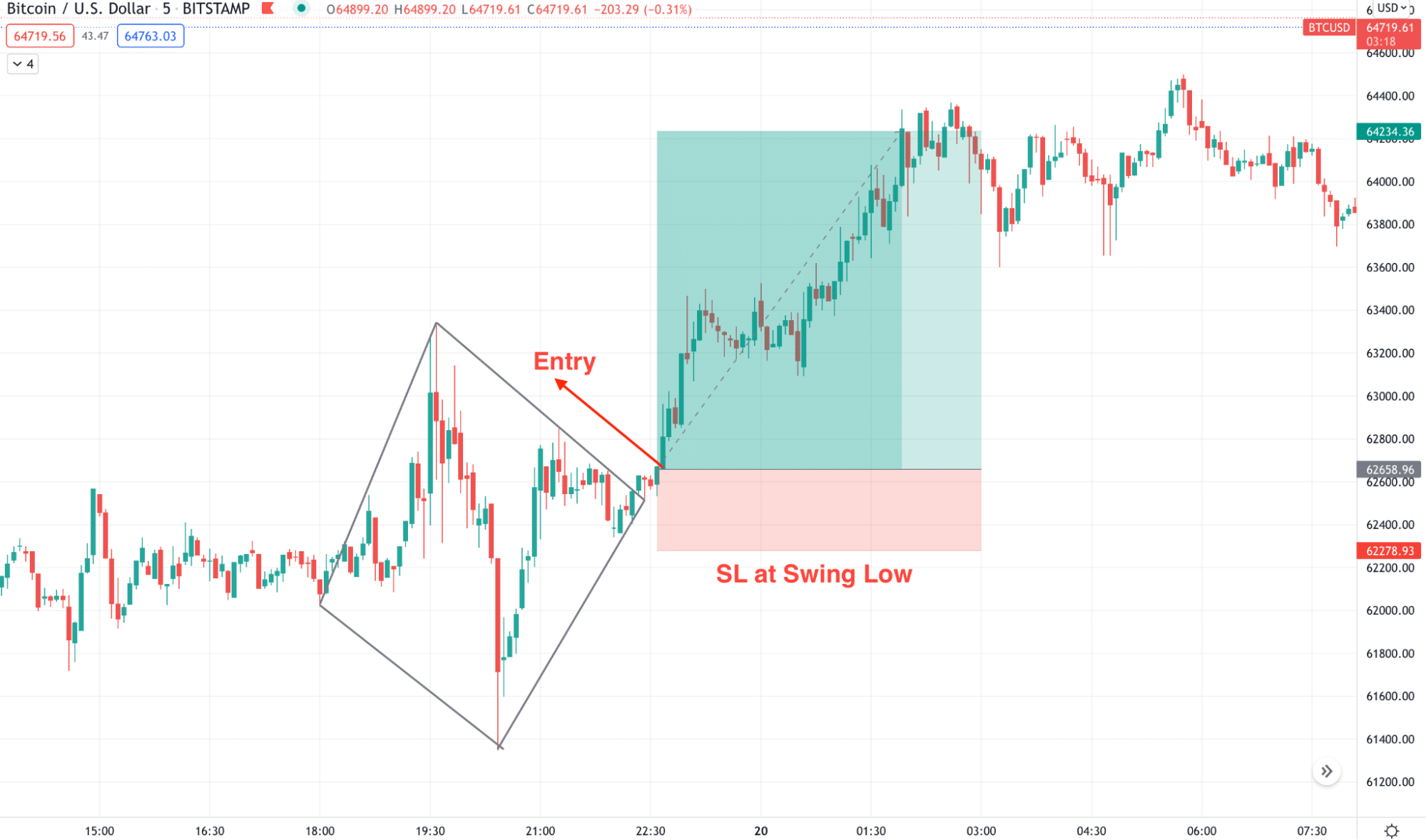

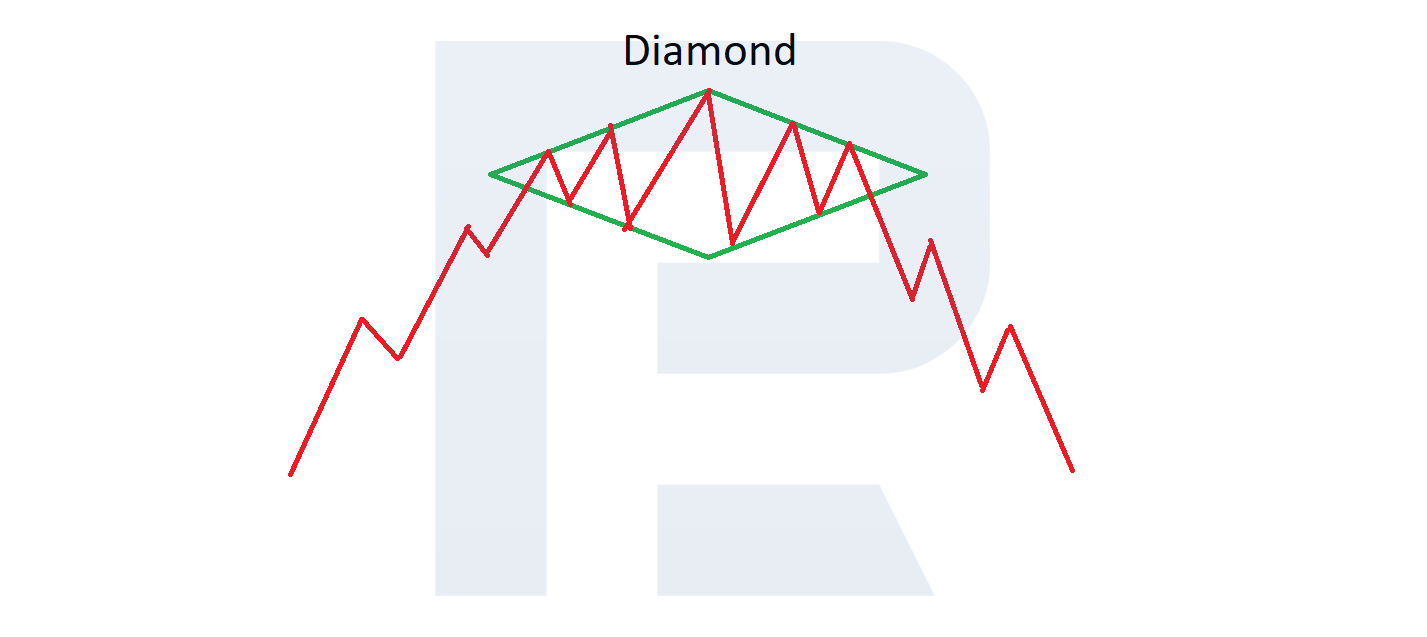

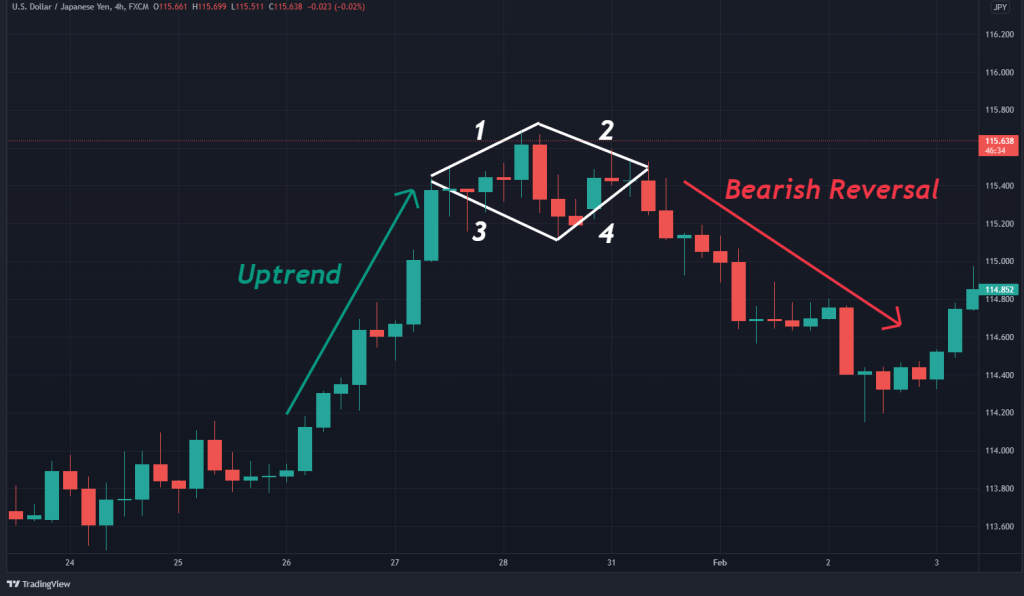

Diamond Trading Pattern - A diamond top can be. Investors are always looking for stocks that are poised to beat at earnings season and black diamond therapeutics, inc. Sell when the price breaks the lower right side of the diamond. Check for candlestick patterns like dojis or pin bars that signal indecision and reversal. This causes the first round of consolidation. Diamond patterns are chart patterns that are used for detecting reversals in an asset’s trending value, which when traded with properly can lead to great returns. Web diamond top formation: This decrease in volume signifies a decrease in market participation and is a characteristic feature of the pattern. In this lesson, we will dive into the specifics of recognizing and trading the diamond pattern. Web the diamond pattern is a popular technical analysis tool used in trading to identify potential trend reversals. All you need to do is determine market entry, locate your stop loss, and select a viable profit target. However, technical traders should become familiar with this pattern as it provides a good trading. Web the diamond pattern in trading is a significant reversal chart formation, signaling potential trend reversals. This bearish reversal pattern expands into a high and contracts. Web how to trade the diamond bottom. Web diamond chart patterns in trading. The firm has earnings coming up pretty soon, and events are shaping up quite nicely for their report. Web diamond recognition trading revolves around investor psychology, as most patterns do. Investors are always looking for stocks that are poised to beat at earnings season and black diamond. Market securities trailing stop diamond top strategy. Web the diamond pattern is a popular technical analysis tool used in trading to identify potential trend reversals. Web diamond or crisscross patterns are essentially the runway models of the lawn patterns — chic, mesmerizing, and always in vogue. Web diamond pattern trading holds great significance in the stock market as it can. Sell when the price breaks the lower right side of the diamond. Web diamond recognition trading revolves around investor psychology, as most patterns do. The red arrow indicates a breakout of the diamond pattern. Similar to the checkerboard pattern, the crisscross pattern also. This decrease in volume signifies a decrease in market participation and is a characteristic feature of the. Diamond pattern trading is the strategy traders use to trade these rare trend reversal patterns. A diamond bottom is formed by two juxtaposed symmetrical triangles, so forming a diamond. Web the key to trading diamond pattern stocks starts with quickly detecting when those angled trendlines are forming, signaling consolidation before a powerful move. Market securities trailing stop diamond top strategy.. Check for candlestick patterns like dojis or pin bars that signal indecision and reversal. Web diamond top formation: The diamond top pattern is not a common formation but is considered a strong bearish reversal pattern amongst technical analysts. Web the diamond pattern is a popular technical analysis tool used in trading to identify potential trend reversals. A breakout below the. Investors are always looking for stocks that are poised to beat at earnings season and black diamond therapeutics, inc. With the order level set, add the stop loss level at either of the following levels: Web diamond pattern trading holds great significance in the stock market as it can provide traders with valuable insights into future price movements. Enter the. By this time, the trader should already have a plan for entering the trade ready. As such, many traders are not very familiar with its structure or trading application. Web the diamond pattern in trading is a significant reversal chart formation, signaling potential trend reversals. Web diamond recognition trading revolves around investor psychology, as most patterns do. A broadening wedge. Similar to the checkerboard pattern, the crisscross pattern also. However, technical traders should become familiar with this pattern as it provides a good trading. Web first, a diamond top pattern happens when the asset price is in a bullish trend. Second, the price will form what seems like a broadening wedge pattern. There aren’t many opportunities to trade the diamond. In the realm of technical trading analysis, one of the most precise tactics for setting price targets is leveraging the diamond pattern chart.this pattern provides insightful projections on price movements post a breakout point.the process involves delineating the height of the. A breakout below the lower trendline is a clarion call to sell. Sell when the price breaks the lower. It has four trendlines, consisting of two support lines and two resistance. This pattern, resembling a diamond shape, is recognized for its rarity and the powerful signal it provides, often occurring at major market tops and bottoms. The firm has earnings coming up pretty soon, and events are shaping up quite nicely for their report. In the realm of technical trading analysis, one of the most precise tactics for setting price targets is leveraging the diamond pattern chart.this pattern provides insightful projections on price movements post a breakout point.the process involves delineating the height of the. Web the diamond pattern is a popular technical analysis tool used in trading to identify potential trend reversals. Diamond pattern trading is the strategy traders use to trade these rare trend reversal patterns. This pattern marks the exhaustion of the selling current and investor indecision. Web diamond pattern trading is a technical analysis strategy used by traders and investors to identify potential trend reversals in financial markets. Use indicators like moving averages, macd, or rsi to confirm the prior trend is weakening. However, like any other trading tool, this formation has pitfalls, and traders should be aware of them before entering the live market. The diamond top pattern is not a common formation but is considered a strong bearish reversal pattern amongst technical analysts. This causes the first round of consolidation. Web the diamond pattern is an advanced chart formation that occurs in the financial markets. This pattern looks at a very specific way of thinking that factors into how the stock behaves. You can spot the diamond pattern in crypto*, stock, currency, and commodity charts. Similar to the checkerboard pattern, the crisscross pattern also.

Diamond Pattern Trading How to Identify and Use The FX Post

How to Trade the Diamond Chart Pattern Market Pulse

How to Trade the Diamond Chart Pattern (In 3 Easy Steps)

Diamond Pattern Trading How to Identify and Use The FX Post

Diamond Chart Pattern Explained Forex Training Group

![Diamond Chart Pattern Explained [Example Included]](https://srading.com/wp-content/uploads/2022/12/diamond-chart-pattern-top.jpg)

Diamond Chart Pattern Explained [Example Included]

Diamond Chart Pattern Trading Reversal Graphic Formations R Blog

How to Trade the Diamond Chart Pattern (In 3 Easy Steps)

Diamond Pattern Trading Explained

Diamond Chart Pattern Explained Forex Training Group

Sell When The Price Breaks The Lower Right Side Of The Diamond.

However, Technical Traders Should Become Familiar With This Pattern As It Provides A Good Trading.

The Low Of The Diamond Chart Pattern.

Web How To Trade The Diamond Bottom.

Related Post: