Descending Wedge Pattern

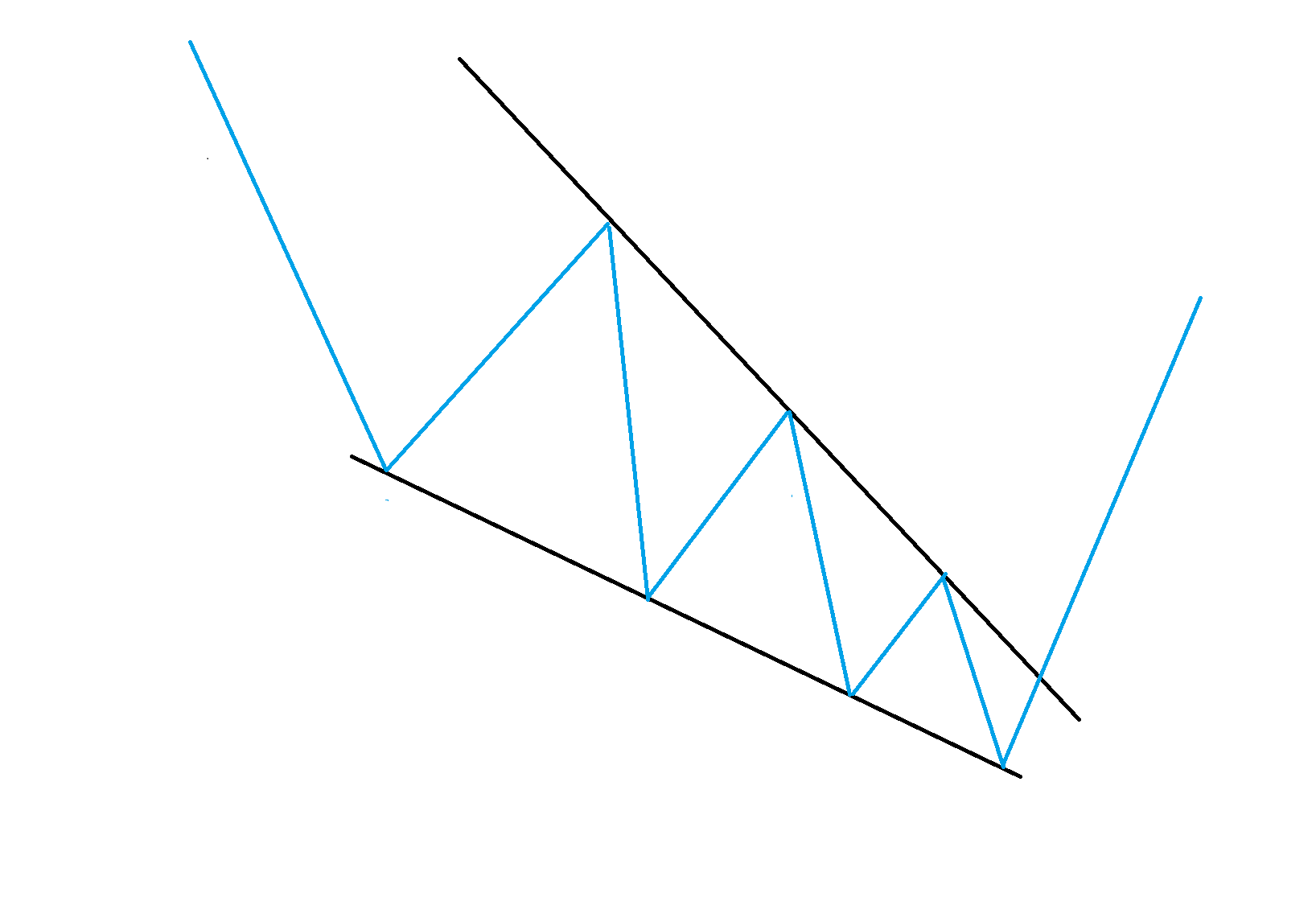

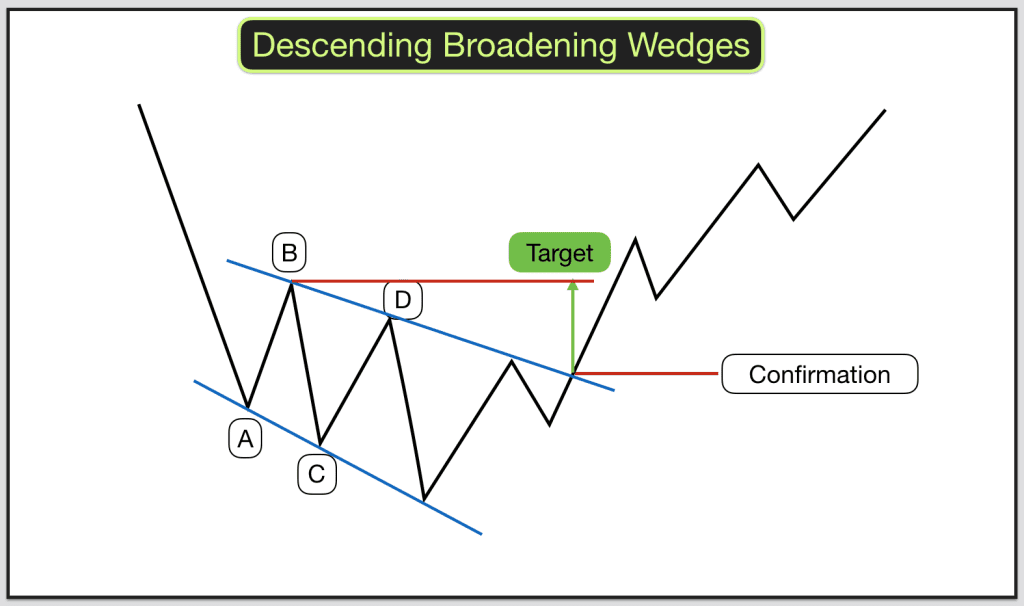

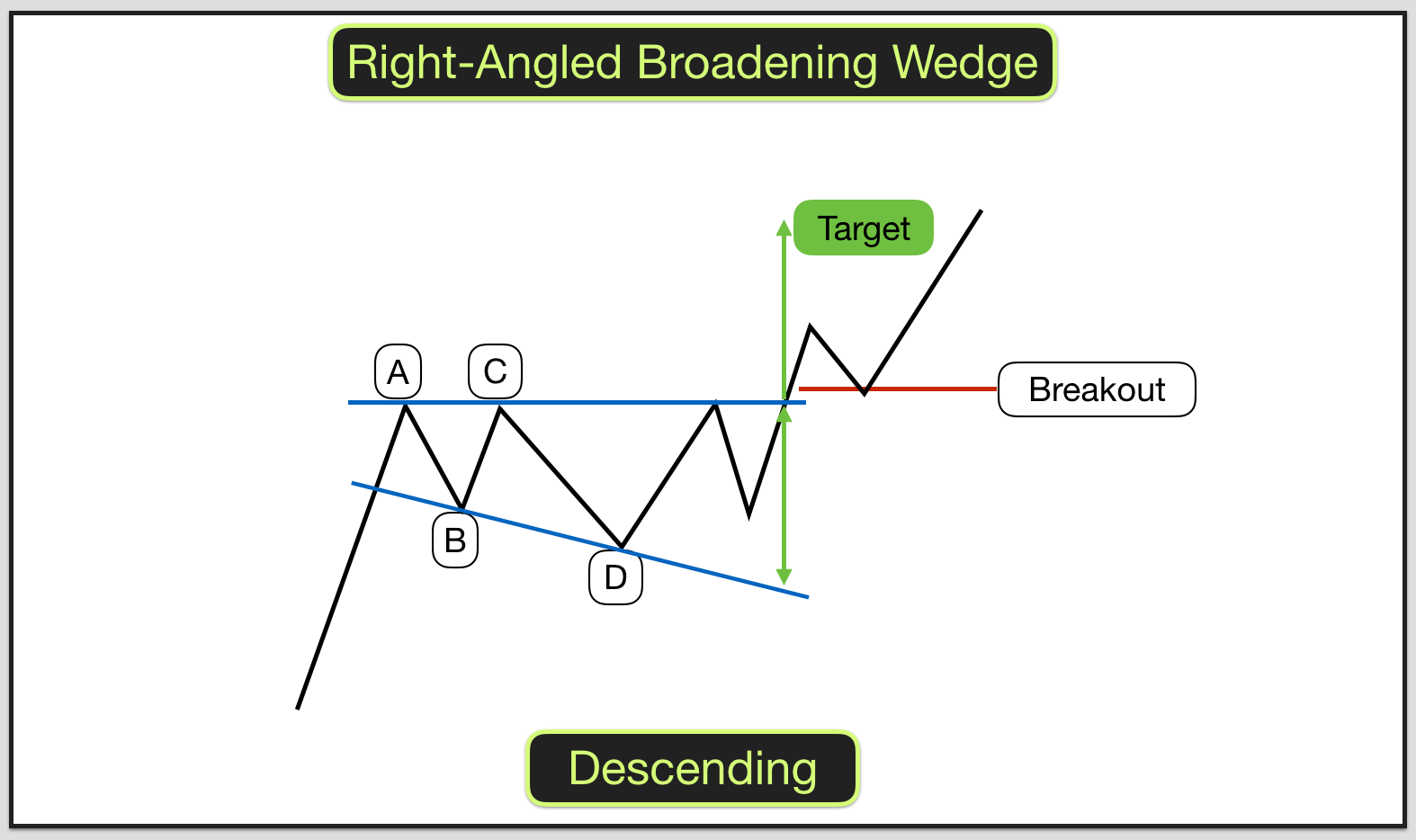

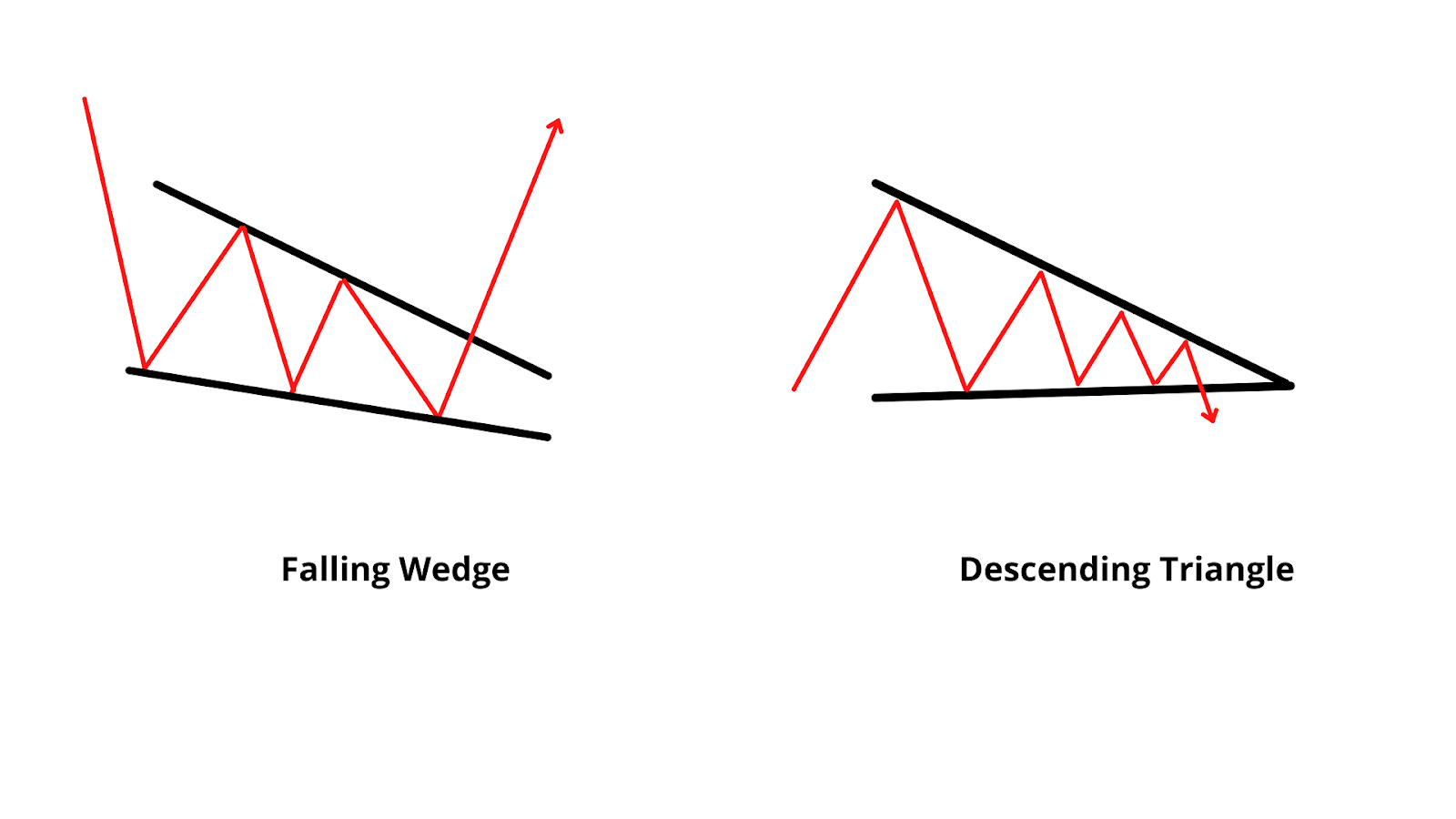

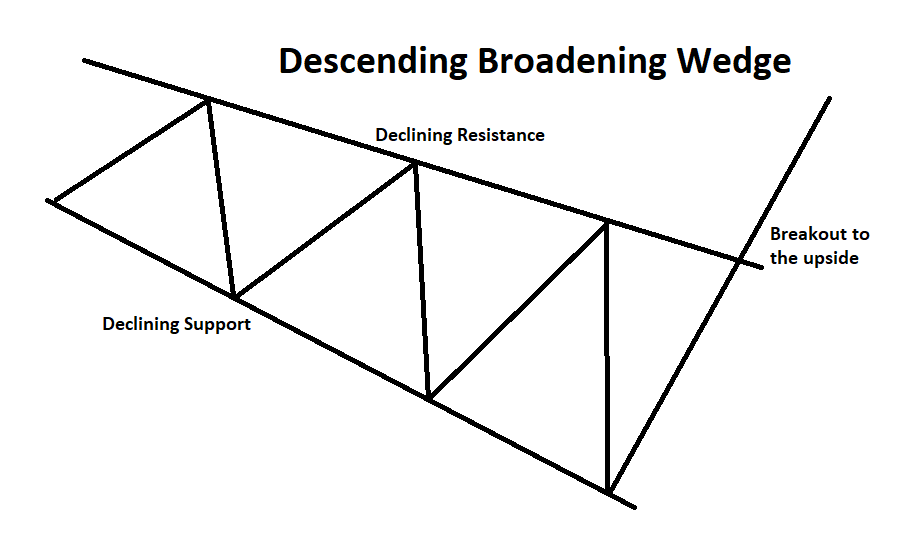

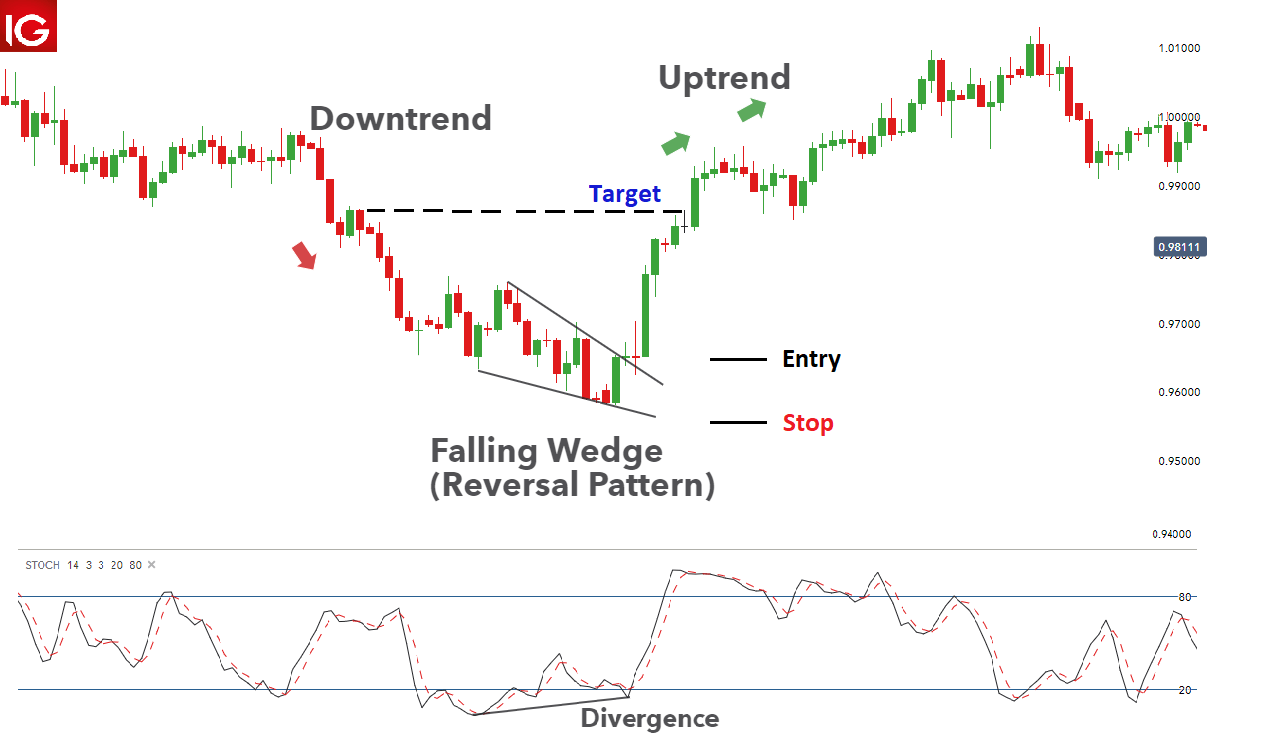

Descending Wedge Pattern - As you can see, the bottoms are decreasing, but the tops are decreasing at a faster pace. This price action forms a descending cone shape that trends lower as the vertical highs and vertical lows move together to converge. The wedge pattern can either be a continuation pattern or a reversal pattern, depending on the type of wedge and the preceding trend. How do you trade a rising or falling wedge pattern? Web gold’s trend remains bullish, says the analyst, noting that the precious metal’s breakout above the resistance line on a descending wedge pattern on the daily chart means bulls now have a. It is formed by two diverging bullish lines. Web decending broadening wedges are megaphone shaped chart patterns with lower peaks and lower valleys. The first is rising wedges where price is contained by 2 ascending trend lines that converge because the lower trend line is steeper than. Web the descending wedge is a bullish chart pattern that begins with a wide trading range at the top and contracts to a smaller trading range as prices trend down. Web the rising wedge is a bearish chart pattern found at the end of an upward trend in financial markets. It suggests a potential reversal in the trend. The most common reversal pattern is the rising and falling wedge, which typically occurs at the end of a trend. It is the opposite of the bullish falling wedge pattern that occurs at the end of a downtrend. The patterns may be considered rising or falling wedges depending on their direction. Web. A descending broadening wedge is confirmed/valid if it has good oscillation between the two upward lines. A descending broadening wedge forms as price moves between the upper resistance and lower support trend lines multiple times as the trading range expands during the. Web the falling wedge is the exact opposite of the upward wedge. Traders recognize the rising wedge as. This pattern is created by two declining and diverging trend lines. This article explains the structure of a falling wedge formation, its importance as well as technical approach to trading this pattern. Web the falling or descending wedge pattern is a bullish signal that suggests a potential reversal in price trend especially when the wedge pattern appears in a downtrend.. This lesson shows you how to identify the pattern and how you can use it to look for possible buying opportunities. It is the opposite of the bullish falling wedge pattern that occurs at the end of a downtrend. Wedges signal a pause in the current trend. Web the falling wedge is the exact opposite of the upward wedge. Web. Web the falling wedge is a bullish pattern that suggests potential upward price movement. Web the falling or descending wedge pattern is a bullish signal that suggests a potential reversal in price trend especially when the wedge pattern appears in a downtrend. Web gold’s trend remains bullish, says the analyst, noting that the precious metal’s breakout above the resistance line. What are wedge chart patterns? Web what is an ascending/descending correction? Web in a wedge chart pattern, two trend lines converge. Web the falling or descending wedge pattern is a bullish signal that suggests a potential reversal in price trend especially when the wedge pattern appears in a downtrend. Web the rising wedge is a bearish chart pattern found at. Traders recognize the rising wedge as a consolidation phase after a medium to. This pattern, while sloping downward, signals a likely trend reversal or continuation, marking a potential inflection point in trading strategies. As you can see, the bottoms are decreasing, but the tops are decreasing at a faster pace. Web what is an ascending/descending correction? How can i automatically. Identifying the falling wedge pattern in a downtrend. Web a descending triangle is a chart pattern used in technical analysis created by drawing one trend line connecting a series of lower highs and a second horizontal trend line connecting a series. Web wedge patterns are usually characterized by converging trend lines over 10 to 50 trading periods. Web the falling. Web gold’s trend remains bullish, says the analyst, noting that the precious metal’s breakout above the resistance line on a descending wedge pattern on the daily chart means bulls now have a. This pattern, while sloping downward, signals a likely trend reversal or continuation, marking a potential inflection point in trading strategies. What is a falling or descending wedge? It. It means that the magnitude of price movement within the wedge pattern is decreasing. Web wedge patterns are usually characterized by converging trend lines over 10 to 50 trading periods. When you encounter this formation, it signals that forex traders are still deciding where to take the pair next. Web a descending broadening wedge is bullish chart pattern (said to. Web a descending triangle is a chart pattern used in technical analysis created by drawing one trend line connecting a series of lower highs and a second horizontal trend line connecting a series. Web wedge patterns are usually characterized by converging trend lines over 10 to 50 trading periods. How do you trade a rising or falling wedge pattern? What are wedge chart patterns? So, the resistance and support levels both decline in the downward wedge, but the decrease in the resistance level is steeper and faster. This formation occurs when the price of an asset demonstrates a series of lower lows and lower highs within a range that expands over time. Web the falling (or descending) wedge can also be used as either a continuation or reversal pattern, depending on where it is found on a price chart. Read this article for performance statistics and trading tactics, written by internationally known author and trader thomas bulkowski. Web the descending wedge is a bullish chart pattern that begins with a wide trading range at the top and contracts to a smaller trading range as prices trend down. Web the rising wedge is a bearish chart pattern found at the end of an upward trend in financial markets. Many people mistaken it for just an equilibrium triangle, but in fact it really is a. Web as a descending wedge pattern, it develops on the chart when there are lower bottoms and even lower tops: Web what is an ascending/descending correction? There are 2 types of wedges indicating price is in consolidation. Web the descending broadening wedge pattern is a notable chart pattern in the world of technical analysis, often seen as a bullish reversal pattern. Also called the downward or descending wedge, this pattern results in an overall downward price movement.

Trade Charting

Falling Wedge Pattern What is it? How it Works? and How to Trade?

Trade Charting

SANDUSDT Descending Broadening wedge pattern! for BINANCESANDUSDT by

How to trade Wedges Broadening Wedges and Broadening Patterns

How to trade Wedges Broadening Wedges and Broadening Patterns

Falling Wedge Patterns How to Profit from Slowing Bearish Momentum

Descending Broadening Wedge Pattern Explained New Trader U

Descending Wedge Chart Pattern

Trading the Falling Wedge Pattern

Web In A Wedge Chart Pattern, Two Trend Lines Converge.

Web The Rising Wedge Is A Technical Chart Pattern Used To Identify Possible Trend Reversals.

This Pattern, While Sloping Downward, Signals A Likely Trend Reversal Or Continuation, Marking A Potential Inflection Point In Trading Strategies.

This Pattern Is Created By Two Declining And Diverging Trend Lines.

Related Post: