Descending Triangle Chart Pattern

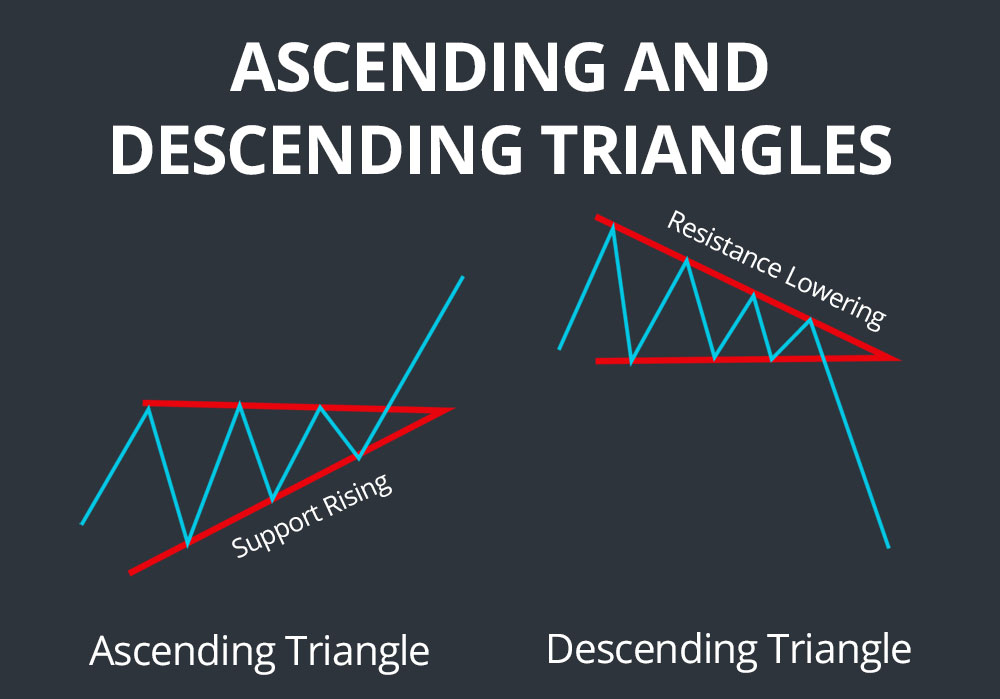

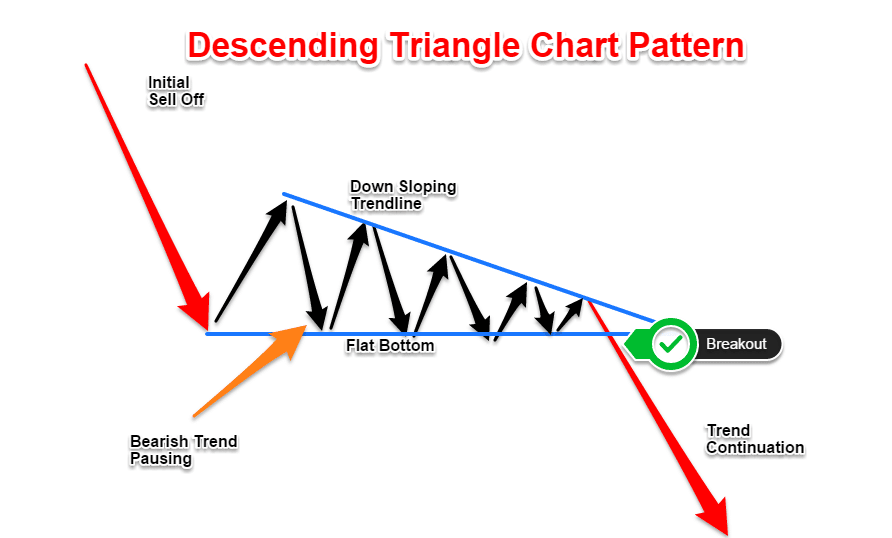

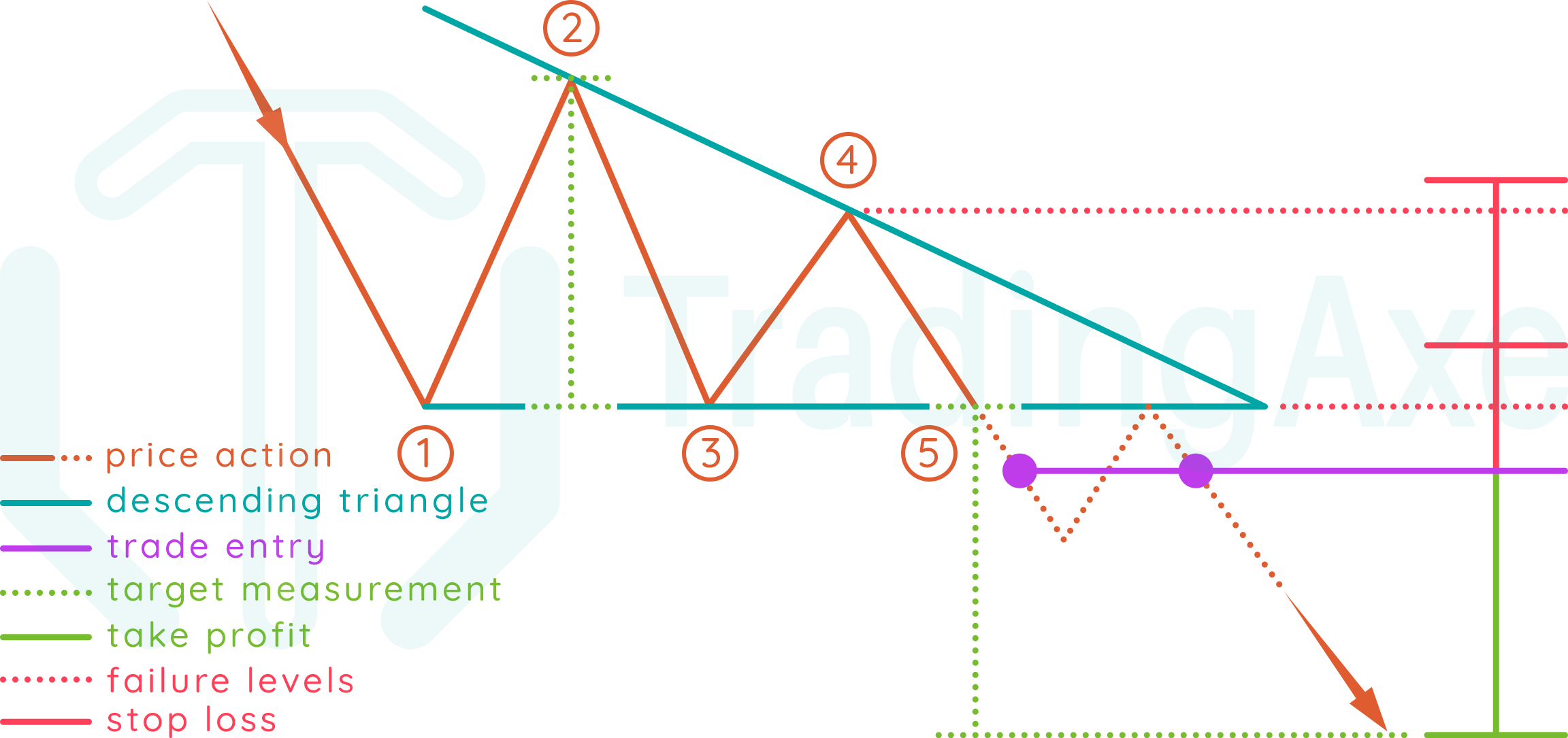

Descending Triangle Chart Pattern - If one happens, the next resistance will be at $0.000032, 35% above the current price. The pattern is visible when the price of an asset makes lower highs while the support level remains constant. It is created by price moves that allow for a horizontal line to be drawn along the swing highs and a rising trendline to be. Web a descending triangle refers to a bearish chart pattern used in technical analysis that is characterized by a descending upper trendline and a second, flatter horizontal trendline, which is lower than the first. The following are the features that help to identify the descending triangles chart pattern. The pattern is formed by two converging lines. Traders anticipate the market to continue in the direction of the larger trend and develop trading setups accordingly. This pattern indicates that sellers are. The ascending, descending, and symmetrical triangles. Scanner guide scan examples feedback. ️ there should be an existing. The descending triangle is recognized primarily in downtrends and is often thought of as a bearish signal. If one happens, the next resistance will be at $0.000032, 35% above the current price. The ascending, descending, and symmetrical triangles. Web a descending triangle is a bearish continuation chart pattern that occurs during a downward trend. The price action trades in a clear downtrend, as there is a series of the lower lows and lower highs. Mark the the pattern's first swing high point and connect this point directly to the lower swing high points with a trendline. Inflation updates, as the ppi and cpi figures might have a strong impact on fed policy expectations. As. However, it can also occur as a consolidation in an uptrend as well. Web a descending triangle is a powerful technical analysis pattern with a predictive accuracy of 87%. Web symmetrical triangle descending triangle ascending triangle. This pattern indicates that sellers are. The pattern is visible when the price of an asset makes lower highs while the support level remains. But what does the pattern look like? Web the descending triangle pattern suggests a potential bearish continuation or reversal in price trends. Less than 3 days ago. Web shib/usdt daily chart | credit: Web a regular descending triangle pattern is commonly considered a bearish chart pattern or a continuation pattern with a downtrend. Web a regular descending triangle pattern is commonly considered a bearish chart pattern or a continuation pattern with a downtrend. The price tends to consolidate for a while and allows the trader to draw a horizontal trend line on the upside. Web a triangle chart pattern involves price moving into a tighter and tighter range as time goes by and. After all, fomc officials still seem to be making up their minds when it comes to picking between easing. But sometimes descending triangle can be bullish without a breakout in the opposite direction known as reversal pattern. The second line is a horizontal support, also known as the descending triangle support line. Scanner guide scan examples feedback. The pattern is. Web the following diagram shows the three basic types of triangle chart patterns: This pattern indicates that sellers are. Gold traders seem to be playing it safe ahead of this week’s u.s. Web symmetrical triangle descending triangle ascending triangle. Web a descending triangle is a chart pattern used in technical analysis created by drawing one trend line connecting a series. The descending triangle pattern is a type of chart pattern often used by technicians in price action trading. Web a triangle chart pattern involves price moving into a tighter and tighter range as time goes by and provides a visual display of a battle between bulls and bears. The pattern is visible when the price of an asset makes lower. The price action trades in a clear downtrend, as there is a series of the lower lows and lower highs. Inflation updates, as the ppi and cpi figures might have a strong impact on fed policy expectations. Web the descending triangle is a bearish formation that usually forms during a downtrend as a continuation pattern. The following are the features. The price tends to consolidate for a while and allows the trader to draw a horizontal trend line on the upside. Stock passes all of the below filters in cash segment: What is descending triangle ?? But what does the pattern look like? The first line is a bearish oblique resistance line, also known as the descending triangle resistance line. The pattern is flexible, can break out up or down, and is a continuation or reversal pattern. The following are the features that help to identify the descending triangles chart pattern. We go into more detail about what they are and how. The ascending, descending, and symmetrical triangles. Inflation updates, as the ppi and cpi figures might have a strong impact on fed policy expectations. Traders look for a confirmation of a breakdown in price by watching for high trading volume as a signal to enter a short position. The second line is a horizontal support, also known as the descending triangle support line. The upper line must connect two price highs. This pattern indicates that sellers are. After all, fomc officials still seem to be making up their minds when it comes to picking between easing. Web an ascending triangle chart pattern is formed during the upward price movement in an uptrend. The price tends to consolidate for a while and allows the trader to draw a horizontal trend line on the upside. The basics behind descending triangles. A descending triangle signals traders to take short position. It forms during a downtrend as a continuation pattern, characterized by a horizontal line at the bottom formed by comparable lows and a descending trend line at the top formed by declining peaks. The price action trades in a clear downtrend, as there is a series of the lower lows and lower highs.

How To Trade Descending Triangle Chart Pattern TradingAxe

Triangle Pattern Characteristics And How To Trade Effectively How To

Descending Triangle Trading Strategy Guide

Descending Triangle Chart Pattern Profit and Stocks

Triangle Chart Patterns Complete Guide for Day Traders

What are Triangle chart Patterns Ascending Triangle , Descending

Descending Triangle Pattern Best Reversal Triangle (2023)

The Descending Triangle What is it & How to Trade it?

How To Trade Descending Triangle Chart Pattern TradingAxe

![Chart Patterns The Advanced Guide [Bonus Cheat Sheet] ForexSpringBoard](https://forexspringboard.com/wp-content/uploads/2018/11/descending_triangle.png)

Chart Patterns The Advanced Guide [Bonus Cheat Sheet] ForexSpringBoard

But What Does The Pattern Look Like?

Mark The The Pattern's First Swing High Point And Connect This Point Directly To The Lower Swing High Points With A Trendline.

The Descending Triangle Is Recognized Primarily In Downtrends And Is Often Thought Of As A Bearish Signal.

Web The Descending Triangle Pattern Suggests A Potential Bearish Continuation Or Reversal In Price Trends.

Related Post: