Descending Flag Pattern

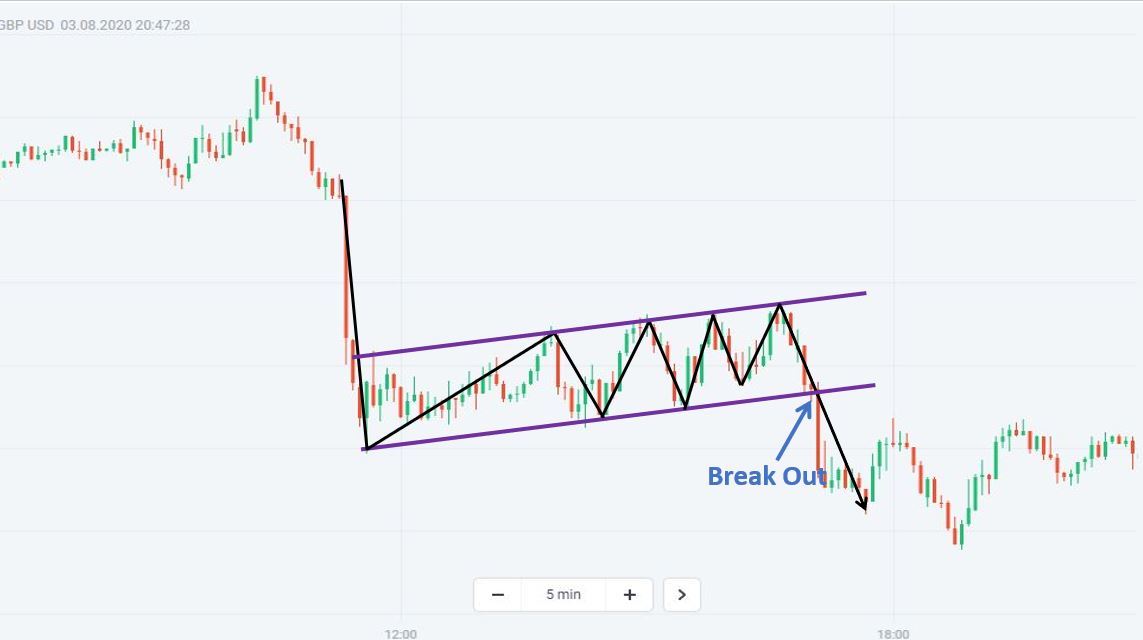

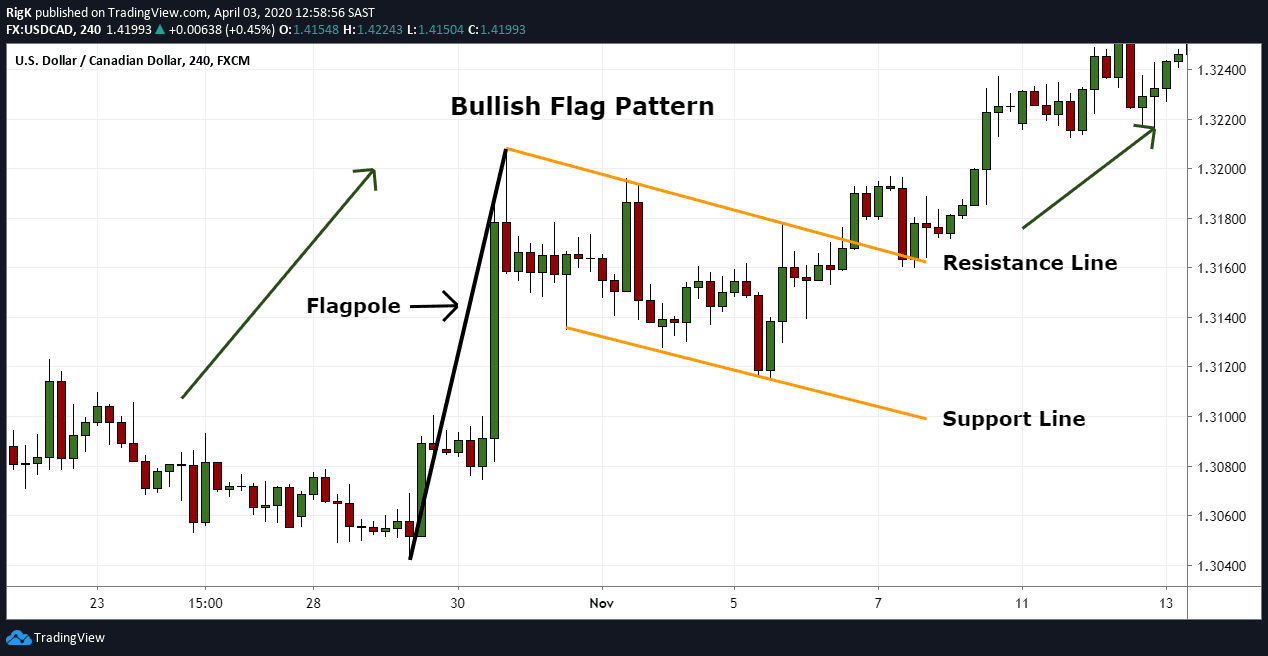

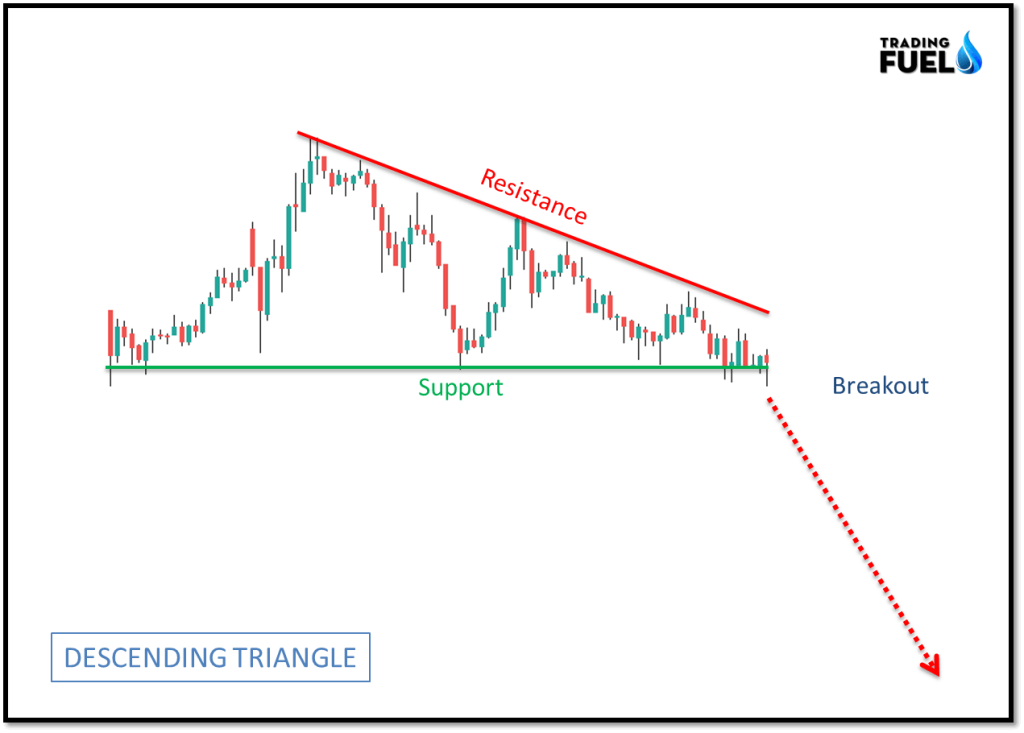

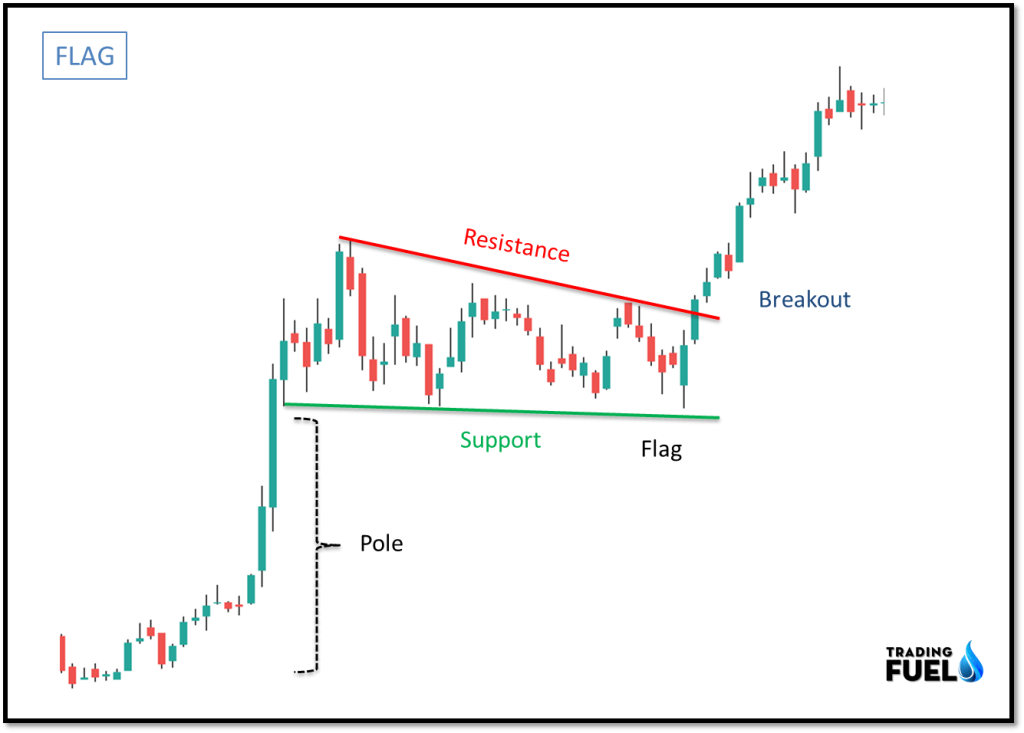

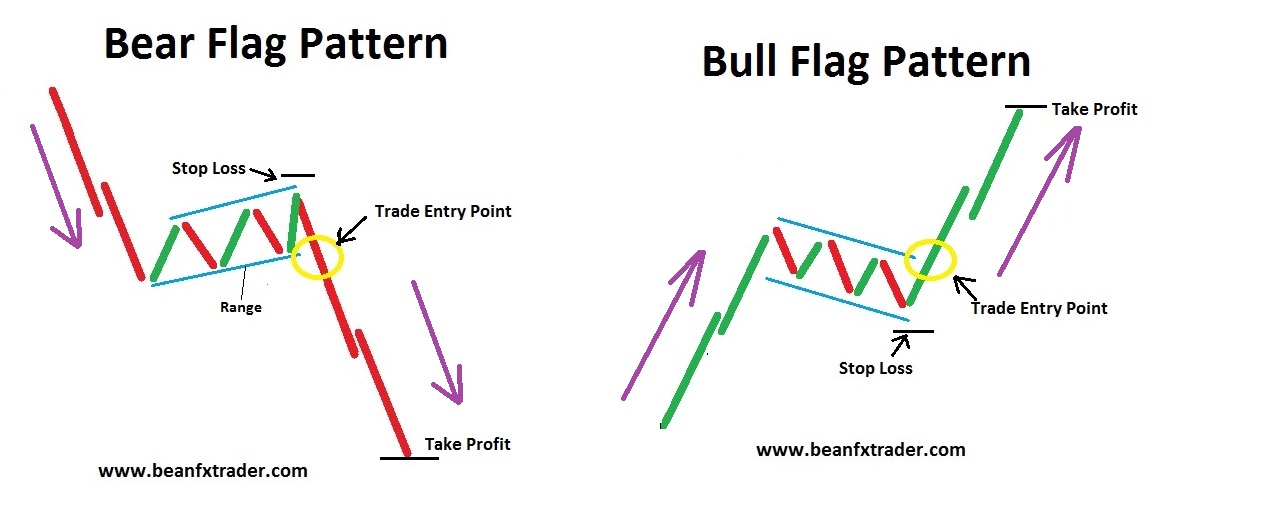

Descending Flag Pattern - Price action breakouts can occur in either direction,. Web faibik dec 21, 2021. The descending flag shows as a continuation pattern. Yuval atsmon is a senior partner who leads the new mckinsey center for strategy innovation, which studies ways new technologies can augment the timeless principles of strategy. Web the short answer is no. Lower pivot highs and lower pivot lows are a bearish signal. There is some debate on the timeframe, and some consider eight weeks to be pushing the limits for a reliable pattern. The main difference between descending and wedge bull flags lies in their consolidation shapes. A descending triangle can be defined as a downward sloping upper bound and horizontal lower bound. There are many technical charting patterns that traders can monitor to help them identify price action breakouts. The descending triangle is the same formation as the ascending triangle, but inverse. In the last 30 years, the city has undergone a transformation to. Web this setup suggests potential for an extension pattern: A bullish pennant is indicated by a positive thrust preceding a converging triangle or ascending triangle. Descending flags have parallel trend lines that slope down, while. Contrary to a bearish channel, this pattern is quite short term and shows the fact that buyers will need a break. Hi all, this is just a initial stage of the pattern, the pattern usually change to ascending/descending triangle and sometime to raising/ falling wedge or a channel. The main difference between descending and wedge bull flags lies in their. It is oriented in the direction of that trend which it consolidates. Web the bearish flag pattern is a powerful technical analysis tool used by traders to identify potential bearish trends in the foreign exchange (forex) and gold markets. Price action breakouts can occur in either direction,. A bearish flag appears after a negative impulse leading to an ascending channel. A bearish flag appears after a negative impulse leading to an ascending channel or a rising wedge. From january 1, 2020, to february 28, 2020, the btc rose sharply from $10,000 to around $41,000. Contrary to a bearish channel, this pattern is quite short term and shows the fact that buyers will need a break. Web the flag pattern is. Price action breakouts can occur in either direction,. There are many technical charting patterns that traders can monitor to help them identify price action breakouts. During this period, the price trades in a narrow range, heading up and down, each time with slightly lower supports and resistances. Web this setup suggests potential for an extension pattern: A bearish flag appears. Descending flags have parallel trend lines that slope down, while wedge flags converge, creating a narrowing pattern. Both indicate potential bullish continuations but may offer slightly different entry. Web this setup suggests potential for an extension pattern: In the last 30 years, the city has undergone a transformation to. However, there are numerous aspects of strategists’ work where ai and. The descending triangle is the same formation as the ascending triangle, but inverse. The flag is built by two straight downward parallel lines which is shaped like a rectangle. From january 1, 2020, to february 28, 2020, the btc rose sharply from $10,000 to around $41,000. It is oriented in the direction of that trend which it consolidates. Rising range. Web a bullish flag emerges from a positive impulse followed by a descending channel or a falling wedge. The descending triangle chart pattern can be a bearish continuation pattern that will normally form in a downtrend. The flag is built by two straight downward parallel lines which is shaped like a rectangle. A flag pattern is a technical analysis chart. It is considered a continuation pattern, indicating that the prevailing trend is likely to continue after a brief consolidation or pause. Web a bullish flag emerges from a positive impulse followed by a descending channel or a falling wedge. A bearish chart pattern used in technical analysis that is created by drawing one trendline that connects a series of lower. A pennant is a continuation pattern in technical analysis formed when there is a large movement in a stock, the flagpole, followed by a consolidation period with converging trendlines. Bearish flag pattern = bear flag. Web descending triangle chart pattern. A bear flag pattern price target is set by measuring the flagpole height and subtracting this measurement from the short. A bear flag pattern price target is set by measuring the flagpole height and subtracting this measurement from the short breakout price. Hi all, this is just a initial stage of the pattern, the pattern usually change to ascending/descending triangle and sometime to raising/ falling wedge or a channel. There are many technical charting patterns that traders can monitor to help them identify price action breakouts. The descending flag shows as a continuation pattern. Web as soon as the descending or an ascending channel violates, it signals the start of the next leg of the trend continuation, and the price moves forward. It is oriented in the direction of that trend which it consolidates. Ideally, these patterns will form between one and four weeks. Contrary to a bearish channel, this pattern is quite short term and shows the fact that buyers will need a break. In the last 30 years, the city has undergone a transformation to. A bearish flag appears after a negative impulse leading to an ascending channel or a rising wedge. Bearish flag pattern = bear flag. From january 1, 2020, to february 28, 2020, the btc rose sharply from $10,000 to around $41,000. Web faibik dec 21, 2021. The chart example above shows a bullish flag pattern that formed in the usd/cad currency pair. Web powerful solar storm sparks stunning display of northern lights across the globe 02:04. A bear flag is a bearish continuation pattern that appears during a downtrend.

Flag Pattern Forex Trading

What Is Flag Pattern? How To Verify And Trade It Efficiently

Flag Pattern Forex Trading

Flag Pattern Full Trading Guide with Examples

What Is Flag Pattern? How To Verify And Trade It Efficiently

Triangle Pattern, Flag Pattern & More.. (Continuation Chart Pattern

Triangle Pattern, Flag Pattern & More.. (Continuation Chart Pattern

FLAG PATTERNS FX & VIX Traders Blog

Descending Flag pattern in EURUSD for FXEURUSD by jgarge84 — TradingView

How To Trade Blog What Is Flag Pattern? How To Verify And Trade It

A Descending Channel Or Downtrend Is The Price Action Contained Between Two Downward Sloping Parallel Lines.

There Is Some Debate On The Timeframe, And Some Consider Eight Weeks To Be Pushing The Limits For A Reliable Pattern.

A Bearish Pennant Follows A Negative.

A Flag Pattern Is A Technical Analysis Chart Pattern That Can Be Observed In The Price Charts Of Financial Assets, Such As Stocks, Currencies, Or Commodities.

Related Post: