Depreciation Schedule Template Excel

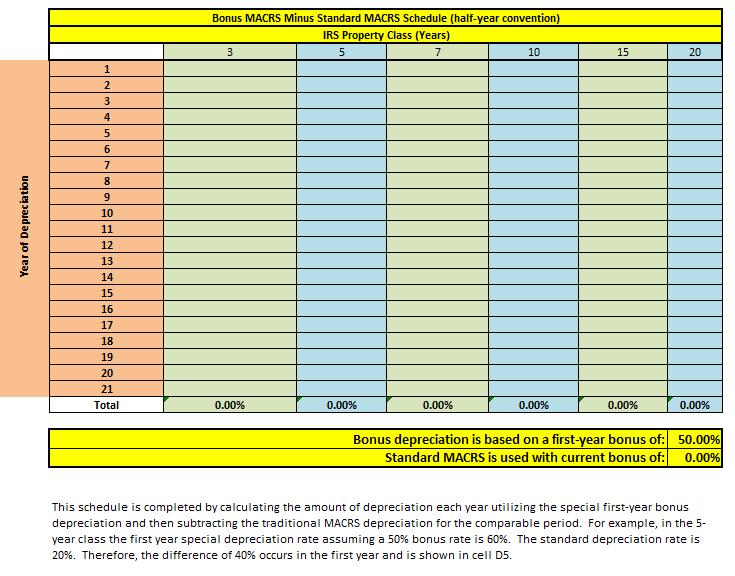

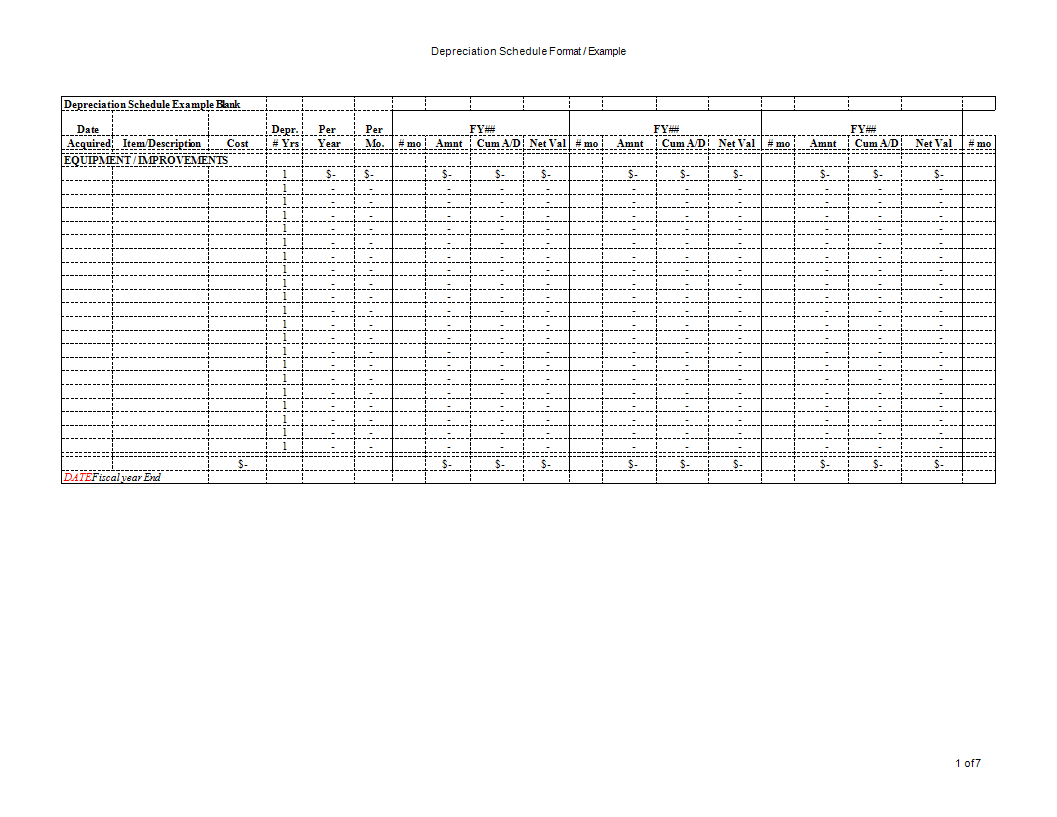

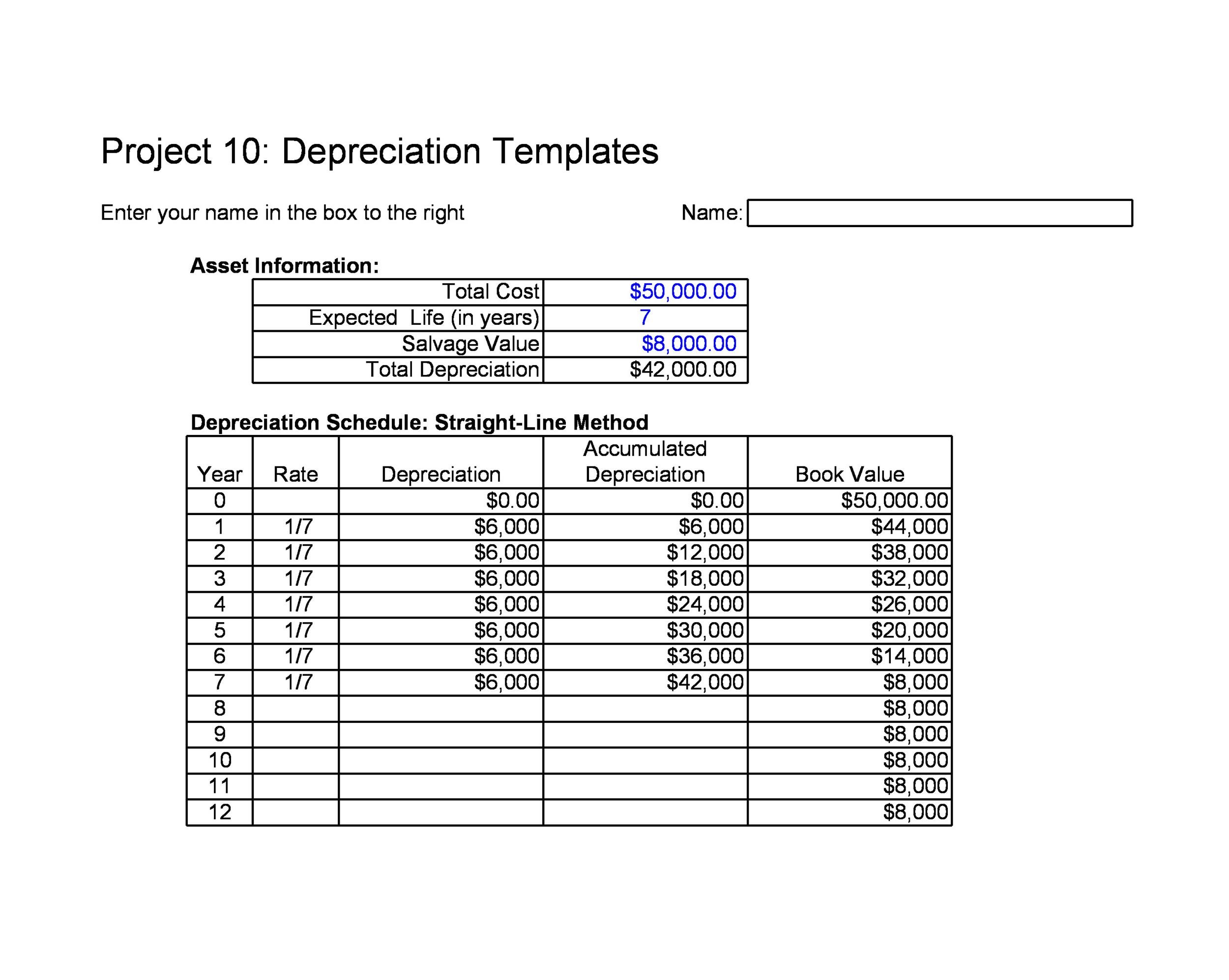

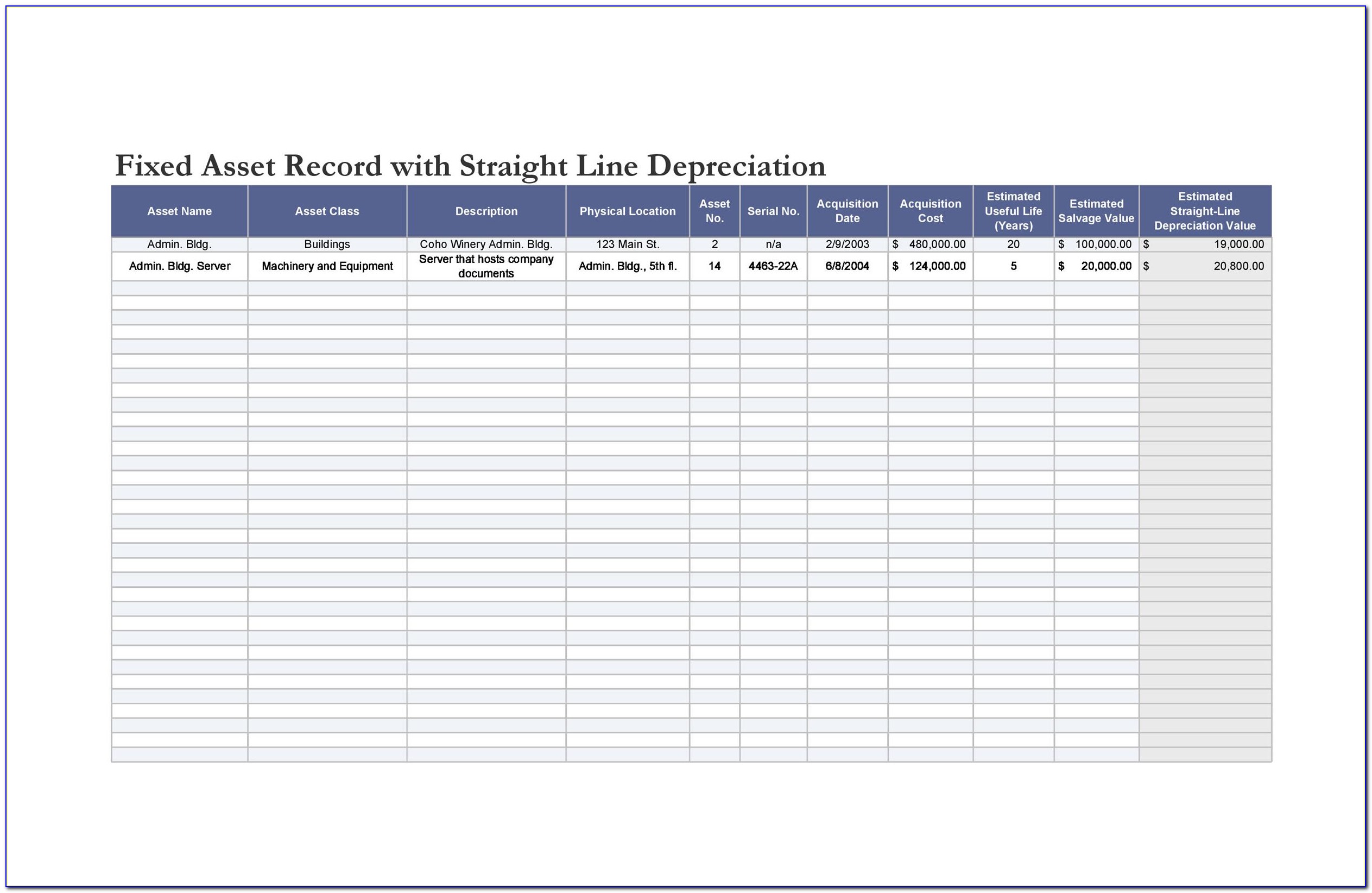

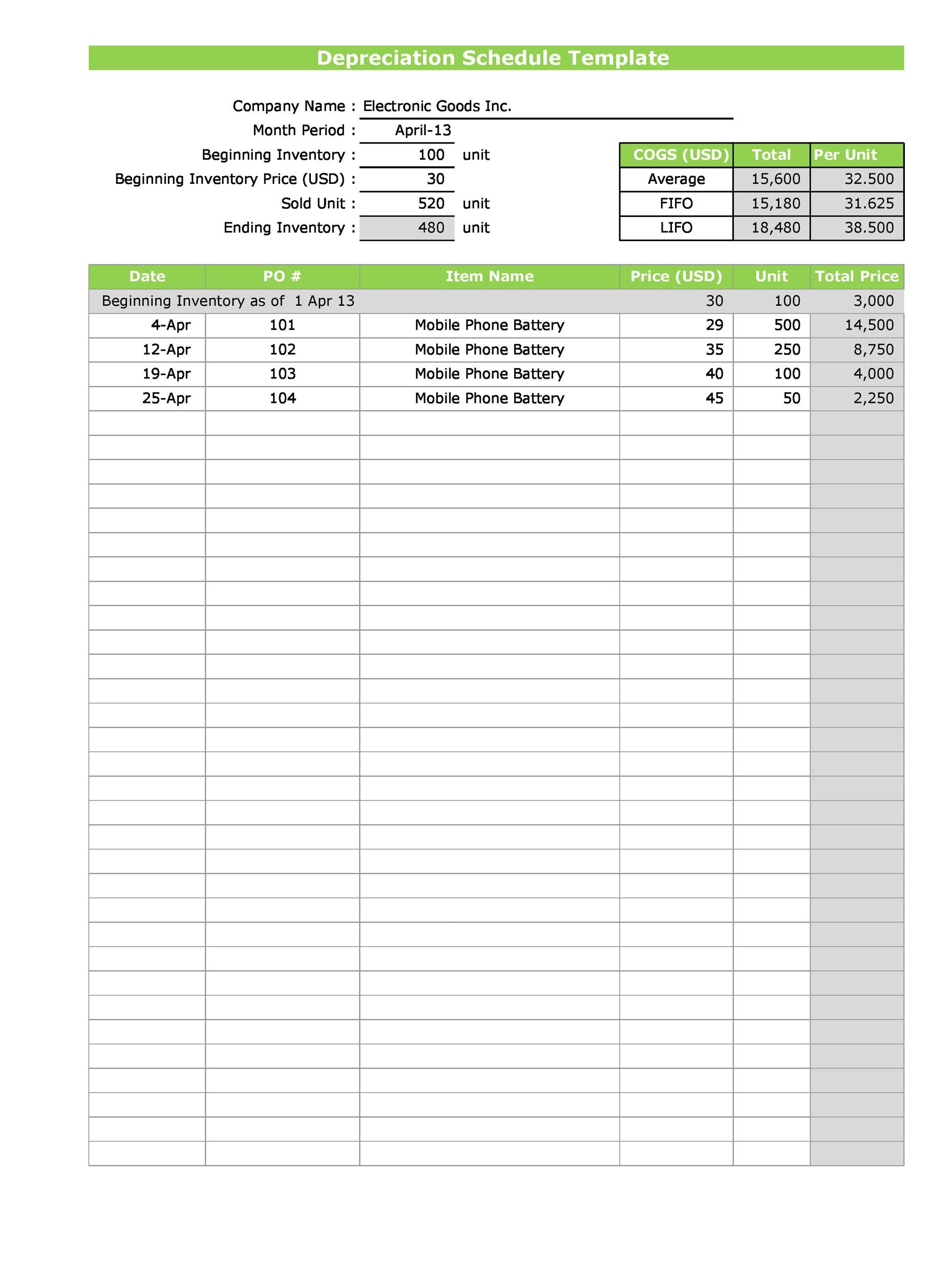

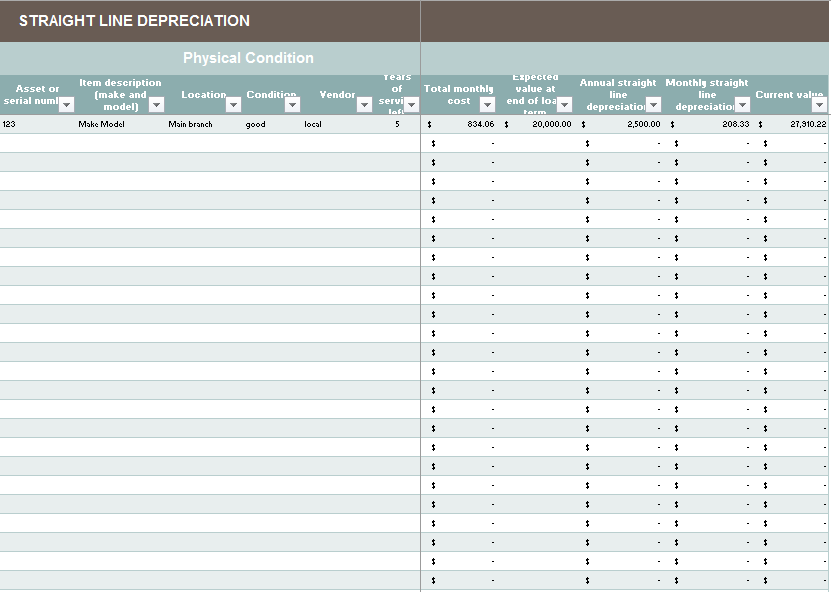

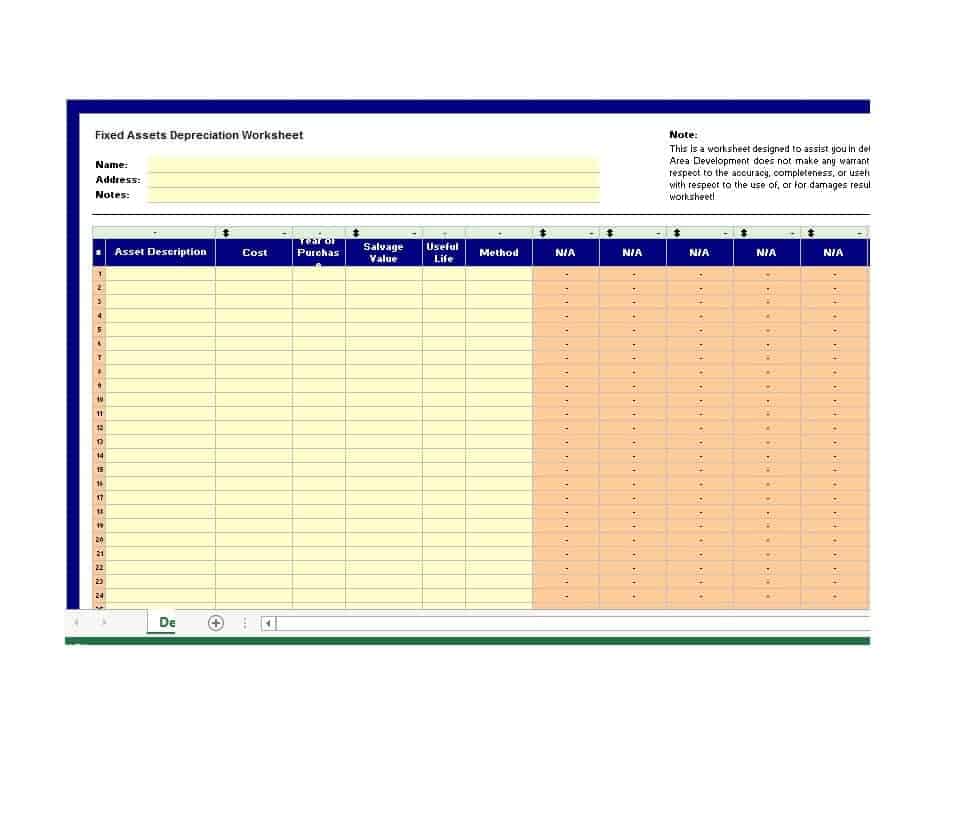

Depreciation Schedule Template Excel - As a result, you can see the result in cell d9. With the help of tax depreciation schedule, companies can easily keep track of transactions and events pertaining to the writing off of the asset. Open microsoft excel and click the new button. Web the straight line depreciation schedule template is available for download in excel format by following the link below. First of all, to calculate the wdv at starting of month, we will type the following formula in cell d9. First calculate the amount using your preferred method. Web at the bottom of the depreciation schedule, prepare a breakdown of the net change in pp&e. As for amortization, the purpose is also to match the cost. Web depreciation schedules edit this template edit this template depreciation schedules are important tools for businesses and individuals to track the value of assets over time. Deduce the annual depreciation expense from the beginning period value to calculate the ending period value. Web the straight line depreciation schedule template is available for download in excel format by following the link below. Web download the free template. Open microsoft excel and click the new button. Web using our above example, your depreciation for the first year will be $848.80 (1.061% x $80,000). Web depreciation schedules edit this template edit this template depreciation schedules. D j = d j c. Multiply the beginning period book value by the twice the regular annual rate (i.e. Straight line method depreciation schedule v 1.01 download link the straight line depreciation schedule calculator is one of many financial calculators used in bookkeeping and accounting, discover another at the links. The depreciation formula is pretty basic, but finding the. The depreciation formula is pretty basic, but finding the correct depreciation rate (d j) is the difficult part because it. First of all, to calculate the wdv at starting of month, we will type the following formula in cell d9. Web download the free template. The above example only considers the value of the property only as the basis of. Web however, there is an easier method for creating a depreciation schedule in microsoft excel using templates. Web in the value of asset column, type the full value of the asset. You can depreciate the property from the second year at 3.636% (100%/27.5 years): $1,200,000 x 40% = $480,000). Web contents of depreciation calculator excel template. The final total should be the ending balance. 100% / 5 years = 20%). It uses the rate of depreciation on the closing asset value of the. Web excel | google sheets. As a rental property owner, you already know the process. You can depreciate the property from the second year at 3.636% (100%/27.5 years): Web 28+ free simple depreciation schedule templates (ms excel, pdf) businesses and organizations use a depreciation schedule template, a spreadsheet or document, to monitor and control the asset’s depreciation over time. Web under the macrs, the depreciation for a specific year j (d j) can be calculated. You can depreciate the property from the second year at 3.636% (100%/27.5 years): It uses the rate of depreciation on the closing asset value of the. The workbook contains 3 worksheets: Web the depreciation schedule template is an effective and easy way to help business owners keep a working long term depreciation schedule for their assets. 100% / 5 years. Web depreciation is used to match the cost of obtaining an asset to the income a company will earn due to acquiring it. The practice of spreading out the cost of a tangible item over the course of its useful life is called depreciation. In the remaining two rows type “0”. Web the straight line depreciation schedule template is available. Web the straight line depreciation schedule template is available for download in excel format by following the link below. Multiply the beginning period book value by the twice the regular annual rate (i.e. In the next year row for the first year, in the column of “depreciation expanse”, write the total amount that you want to depreciate. The practice of. As for amortization, the purpose is also to match the cost. Web at the bottom of the depreciation schedule, prepare a breakdown of the net change in pp&e. The first four arguments are mandatory, while the. The final total should be the ending balance. You can prepare a depreciation schedule using the declining balance depreciation method with the db function. This begins with the beginning balance of pp&e, net of accumulated depreciation. This template consists of 2 sections: Web however, there is an easier method for creating a depreciation schedule in microsoft excel using templates. The spreadsheet should be updated after an asset is acquired, sold or retired to ensure accurate record keeping within the spreadsheet. It uses the rate of depreciation on the closing asset value of the. Create a new excel spreadsheet file and assemble the following information in row 1 of the spreadsheet. In the green box, enter the current year in format yyyy, 2024 is entered, but if it is a later or earlier year, change it. The first four arguments are mandatory, while the. In the end, the template displays the depreciation schedule for the diminishing balance method. The workbook contains 3 worksheets: Assemble the column headers in row 1 of the spreadsheet. D j = d j c. In the search bar, located at the top of the dialog box, click on schedules and search for “depreciation.” notice that there are several templates to choose from. Enter your name and email in the form below and download the free template now! The final total should be the ending balance. First calculate the amount using your preferred method.

20+ Free Depreciation Schedule Templates MS Excel & MS Word

Depreciation schedule Excel format Templates at

Straight Line Depreciation Schedule Excel Template For Your Needs

Create Depreciation Schedule in Excel (8 Suitable Methods) ExcelDemy

9 Free Depreciation Schedule Templates in MS Word and MS Excel

Depreciation Schedule Template Excel Free Printable Templates

Depreciation Schedule Template Excel Free Printable Templates

Monthly Depreciation Schedule Excel Template Printable Templates

20+ Free Depreciation Schedule Templates MS Excel & MS Word

Depreciation Schedule Template Excel Free For Your Needs

100% / 5 Years = 20%).

Web Depreciation Is Used To Match The Cost Of Obtaining An Asset To The Income A Company Will Earn Due To Acquiring It.

$1,200,000 X 40% = $480,000).

Enter The Description Of The Fixed Asset;

Related Post: