Debt Snowball Spreadsheet Template

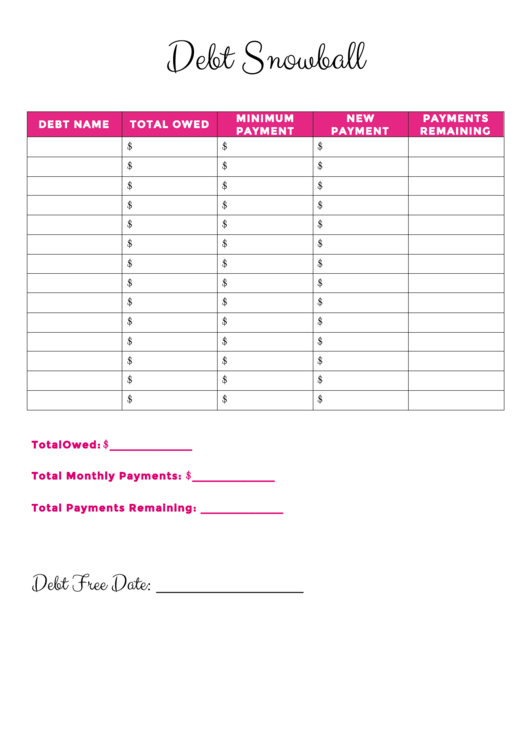

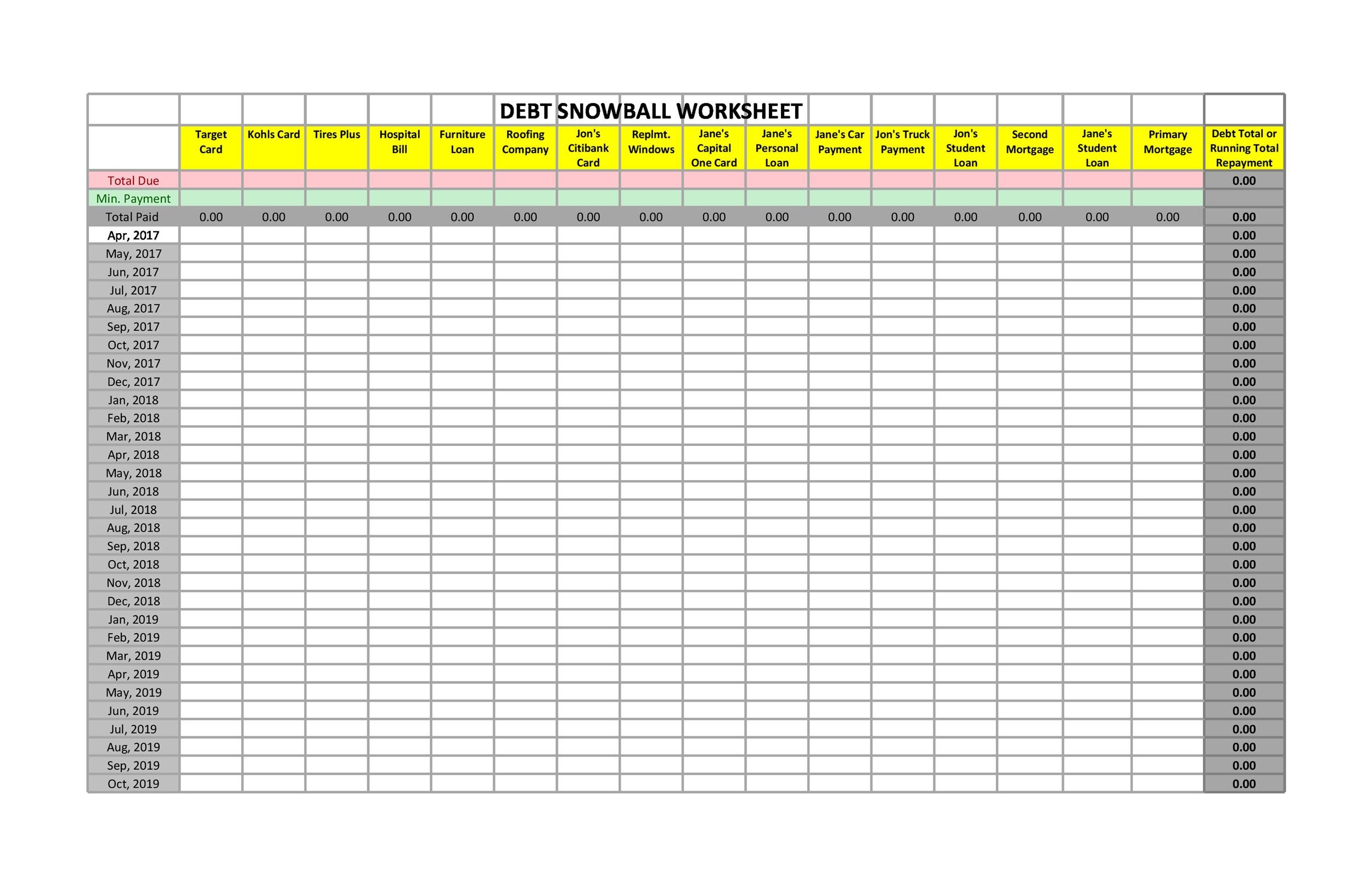

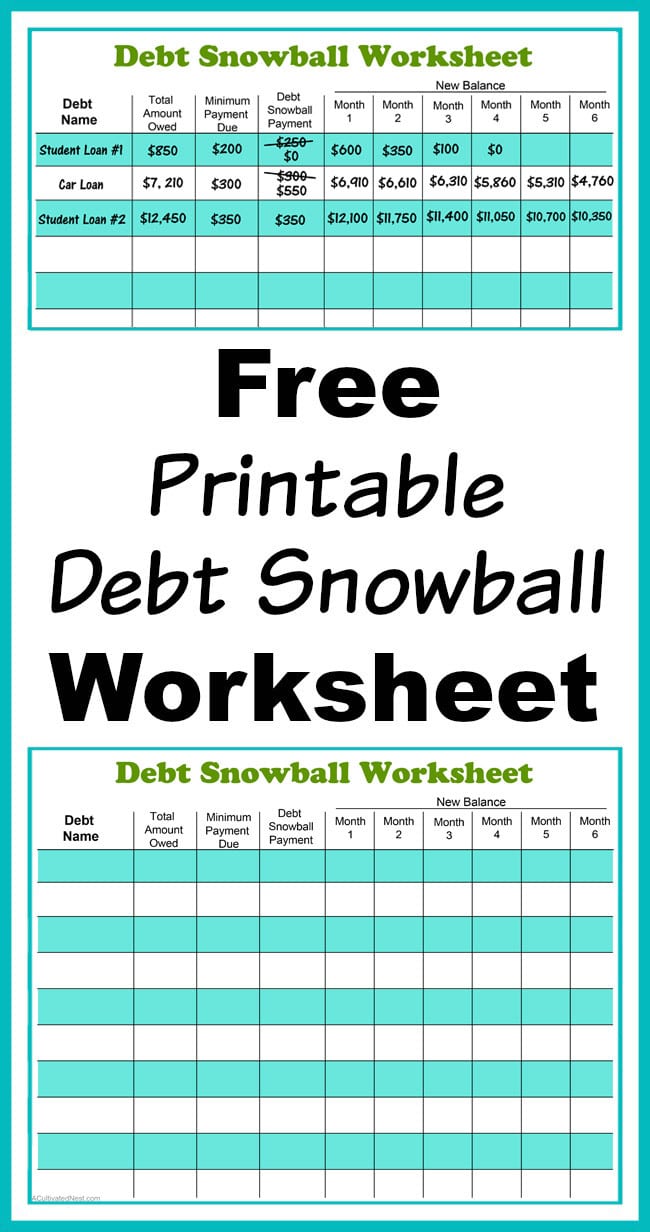

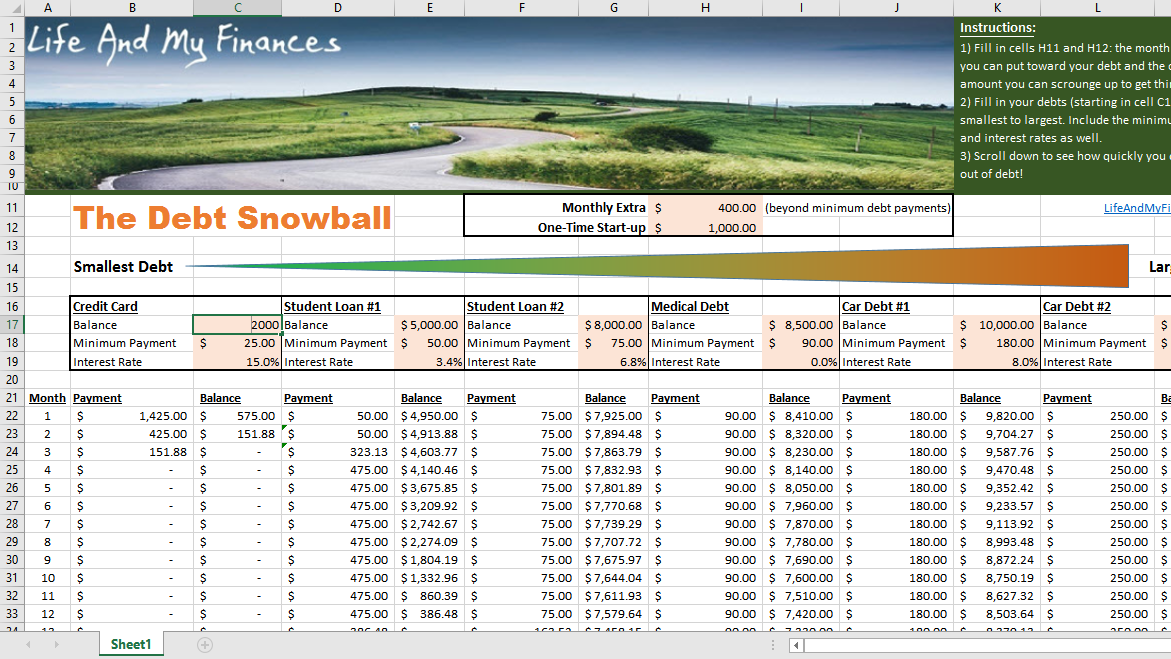

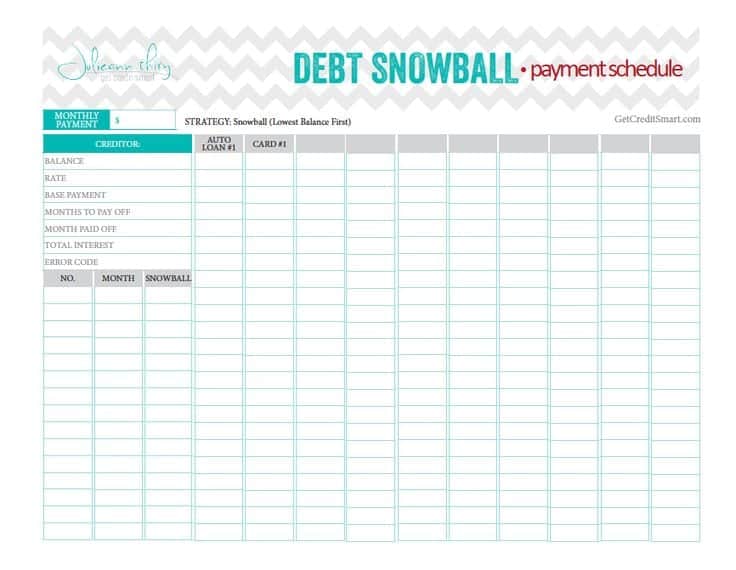

Debt Snowball Spreadsheet Template - 2 the benefits of using the debt snowball method. Web automatically track all your debt in a flexible spreadsheet template with a custom plan to pay it off. Use our debt snowball calculator to help you eliminate your credit card, auto, student loan, and other debts. $4,000 ($75 minimum payment) for example, let's say you have $1,000 to pay towards. List your debts from smallest to largest balance (ignore interest rate) list your minimum payment amounts for each debt. 4 how does the snowball method for paying off. $3,000 ($70 minimum payment) 4th debt: Use a variety of payoff prioritization methods to build your debt payoff plan including: The debt snowball worksheet from template lab for excel is a simplified template that can be used to work out successive payments due, starting from the. $1,000 ($50 minimum payment) 2nd debt: Ensure you lift down your entire debts on this form sum them up to come up with your total debt. Debt tracker template by spreadsheetpoint. Web the debt snowball spreadsheet from spreadsheet point for google sheets is a handy google sheets spreadsheet for keeping track of common loan obligations. 2.2 you can negotiate the interest rates; We can’t help but. Managing debt is a normal part of the modern financial journey. Web the debt snowball google sheets template is the perfect tool for guiding you through the debt snowball process of paying off your debt. List your debts from smallest to largest balance (ignore interest rate) list your minimum payment amounts for each debt. The strategy worked so well for. Web the debt snowball spreadsheet from spreadsheet point for google sheets is a handy google sheets spreadsheet for keeping track of common loan obligations. 2 the benefits of using the debt snowball method. Web about the debt payoff template for google sheets. “tiller has been a great tool for managing our family’s finances. We can’t help but recommend our own. Web the debt snowball follows these exact steps to help you pay off your debt: Managing debt is a normal part of the modern financial journey. $2,000 ($65 minimum payment) 3rd debt: And then—once it opens—at the top of the file select “open with google sheets”. Web about the debt payoff template for google sheets. By the time you’re ready to attack your largest debt, it will feel achievable. You start by listing your debts from smallest to largest by payoff balance. Web the debt snowball google sheets template is the perfect tool for guiding you through the debt snowball process of paying off your debt. Web a debt snowball spreadsheet will assist you in. Web the debt snowball google sheets template is the perfect tool for guiding you through the debt snowball process of paying off your debt. Continue to pay only the minimum on your larger debts, and put all extra money toward the smallest debt. You put any extra money you can towards the first debt on your list. Repeat until each. Once the smallest debt is. 2.1 this method will build momentum as time goes by; You start by listing your debts from smallest to largest by payoff balance. You put any extra money you can towards the first debt on your list. Use a variety of payoff prioritization methods to build your debt payoff plan including: $4,000 ($75 minimum payment) for example, let's say you have $1,000 to pay towards. 2.2 you can negotiate the interest rates; Web trying to pay off $98,814 in debt is daunting, but paying off $1,766 doesn’t sound so bad. Use a variety of payoff prioritization methods to build your debt payoff plan including: Debt tracker template by spreadsheetpoint. The debt snowball worksheet from template lab for excel is a simplified template that can be used to work out successive payments due, starting from the. Use a variety of payoff prioritization methods to build your debt payoff plan including: Easily create a debt reduction schedule based on the popular debt snowball strategy, or experiment with your own custom strategy.. Using her debt snowball spreadsheet, founder kerry taylor paid off $17,000 in. If you don’t have that many debts, or if you just want to get a feel for the tool, we also offer a free debt snowball worksheet. Use our debt snowball calculator to help you eliminate your credit card, auto, student loan, and other debts. Web get the. List your debts from smallest to largest balance (ignore interest rate) list your minimum payment amounts for each debt. 2.1 this method will build momentum as time goes by; Web trying to pay off $98,814 in debt is daunting, but paying off $1,766 doesn’t sound so bad. Web with the debt snowball method, you simply start with the smallest debt first, and so you would order them accordingly: Pay as much as possible on your smallest debt. Use a variety of payoff prioritization methods to build your debt payoff plan including: If you don’t have that many debts, or if you just want to get a feel for the tool, we also offer a free debt snowball worksheet. Debt tracker template by spreadsheetpoint. Ensure you lift down your entire debts on this form sum them up to come up with your total debt. The debt payoff planner can model the debt snowball method, avalanche, or a custom ranking payoff strategy for up to 25 accounts for up to 30 years. Web click “new” in the upper left. Track and achieve your debt payoff goals with the flexible debt payoff planner spreadsheet. Web repeat this step for the other debts, but don’t include the extra payment yet. Easily create a debt reduction schedule based on the popular debt snowball strategy, or experiment with your own custom strategy. This spreadsheet includes additional information about. And then—once it opens—at the top of the file select “open with google sheets”.

Free Printable Snowball Debt Spreadsheet Printable Blank World

![Free Printable Debt Snowball Templates [PDF, Excel] Worksheet](https://www.typecalendar.com/wp-content/uploads/2023/02/Debt-Snowball.jpg)

Free Printable Debt Snowball Templates [PDF, Excel] Worksheet

38 Debt Snowball Spreadsheets, Forms & Calculators

![Free Printable Debt Snowball Templates [PDF, Excel] Worksheet](https://www.typecalendar.com/wp-content/uploads/2023/05/debt-snowball-excel.jpg?gid=443)

Free Printable Debt Snowball Templates [PDF, Excel] Worksheet

Debt Snowball Tracker Printable Debt Payment Worksheet Etsy

38 Debt Snowball Spreadsheets, Forms & Calculators

Free Printable Debt Snowball Worksheet Pay Down Your Debt —

Debt Snowball Tracker Printable Debt Free Chart Debt Payoff Etsy Israel

This Spreadsheet Calculates When You'll Pay Off Debt With The Snowball

9+ Debt Snowball Excel Templates Excel Templates

Using Her Debt Snowball Spreadsheet, Founder Kerry Taylor Paid Off $17,000 In.

$1,000 ($50 Minimum Payment) 2Nd Debt:

2 The Benefits Of Using The Debt Snowball Method.

We Can’t Help But Recommend Our Own Debt Snowball Worksheet ( You Can Download It For Free Here) As A Great Option If You’re Looking To Track Your Debt Payoff Journey.

Related Post: