Debt Pay Off Template

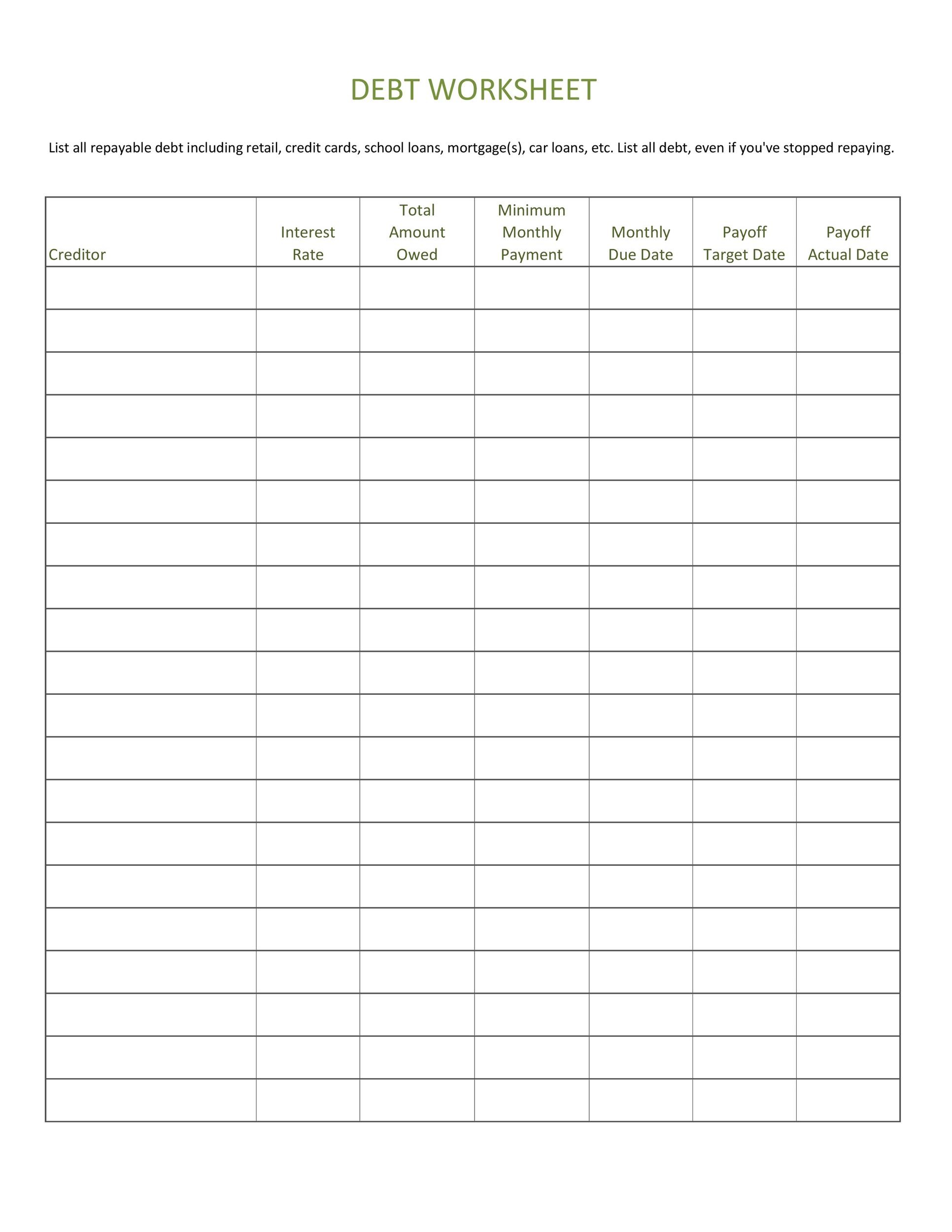

Debt Pay Off Template - It's 3% to 5% of the transferred balance, so it's something to budget for. Web there is no minimum direct deposit amount required to qualify for the 4.60% apy for savings. The debt payoff planner provides a focused. Web our guest shares her candid experience of managing finances with a good income but struggling to optimize savings and reduce debt. Web all you need to do is download the template and plug in a few numbers—the spreadsheet will do all the math. This includes any income you make each month after taxes (your paycheck, your side. Exceltemplates.com is your ultimate source of debt payoff spreadsheet, that are always completely free! If you are struggling to pay off your credit card debt and keep track of how much money you owe, it’s time to take. Web you typically have to pay a small fee. But if what you can stand to save on interest is higher. Have you ever heard of the snowball method? Web about the debt payoff template for google sheets. The first step in creating a plan to pay off debt is to calculate what debt you have, what you owe, and how much you owe. Web you typically have to pay a small fee. See every debt in one view. Web this template is built for google sheets, and it gives you the perfect space to list your debts and track your progress. Debt payoff template from medium for google sheets. Track and achieve your debt payoff goals with the flexible debt payoff planner spreadsheet. On top of that, it comes with instructions to guide. Check it out here for. Web how do you figure out which one to focus on paying off first? Web free printable debt payoff planner template. $ account name (optional) add debt. Check it out here for a free download. Web there is no minimum direct deposit amount required to qualify for the 4.60% apy for savings. $ account name (optional) add debt. Members without direct deposit will earn up to 1.20% annual. If you are struggling to pay off your credit card debt and keep track of how much money you owe, it’s time to take. Web this template is built for google sheets, and it gives you the perfect space to list your debts and. Web how do you figure out which one to focus on paying off first? This includes any income you make each month after taxes (your paycheck, your side. Members without direct deposit will earn up to 1.20% annual. Web you typically have to pay a small fee. How to calculate your credit card payoff in excel and google sheets—a sneak. We’ve built one of the best multiple credit card payoff. But if what you can stand to save on interest is higher. Web use this free debt payoff calculator to see how much you can pay down your debt each month, and to forecast your debt freedom date according to different. Web our guest shares her candid experience of managing. Use this free debt payoff calculator to see how much you can pay down your debt each month, and to forecast your debt freedom date according to. Web there is no minimum direct deposit amount required to qualify for the 4.60% apy for savings. It's 3% to 5% of the transferred balance, so it's something to budget for. Have you. Have you ever heard of the snowball method? With the debt snowball method, you simply start with the smallest debt first, and so you would order. $ account name (optional) add debt. Web the debt snowball method creates a snowball effect as you pay off each debt which helps you build up momentum toward becoming debt free. Use this free. If you are struggling to pay off your credit card debt and keep track of how much money you owe, it’s time to take. Use this free debt payoff calculator to see how much you can pay down your debt each month, and to forecast your debt freedom date according to. Web how do you figure out which one to. Web automatically track all your debt in a flexible template with a custom plan to pay it off. The debt payoff planner provides a focused. Track and achieve your debt payoff goals with the flexible debt payoff planner spreadsheet. See every debt in one view. The first step in creating a plan to pay off debt is to calculate what. Web about the debt payoff template for google sheets. The debt payoff template from medium for google. Use this free debt payoff calculator to see how much you can pay down your debt each month, and to forecast your debt freedom date according to. Web free printable debt payoff planner template. If you are struggling to pay off your credit card debt and keep track of how much money you owe, it’s time to take. Web use this free debt payoff calculator to see how much you can pay down your debt each month, and to forecast your debt freedom date according to different. With the debt snowball method, you simply start with the smallest debt first, and so you would order. The set includes a debt overview sheet, a debt payoff tracking. Members without direct deposit will earn up to 1.20% annual. We’ve built one of the best multiple credit card payoff. Exceltemplates.com is your ultimate source of debt payoff spreadsheet, that are always completely free! This includes any income you make each month after taxes (your paycheck, your side. Web automatically track all your debt in a flexible template with a custom plan to pay it off. $ account name (optional) add debt. Web how do you figure out which one to focus on paying off first? According to the fair credit reporting act (fcra), credit reporting agencies and creditors must investigate and respond to disputes within.

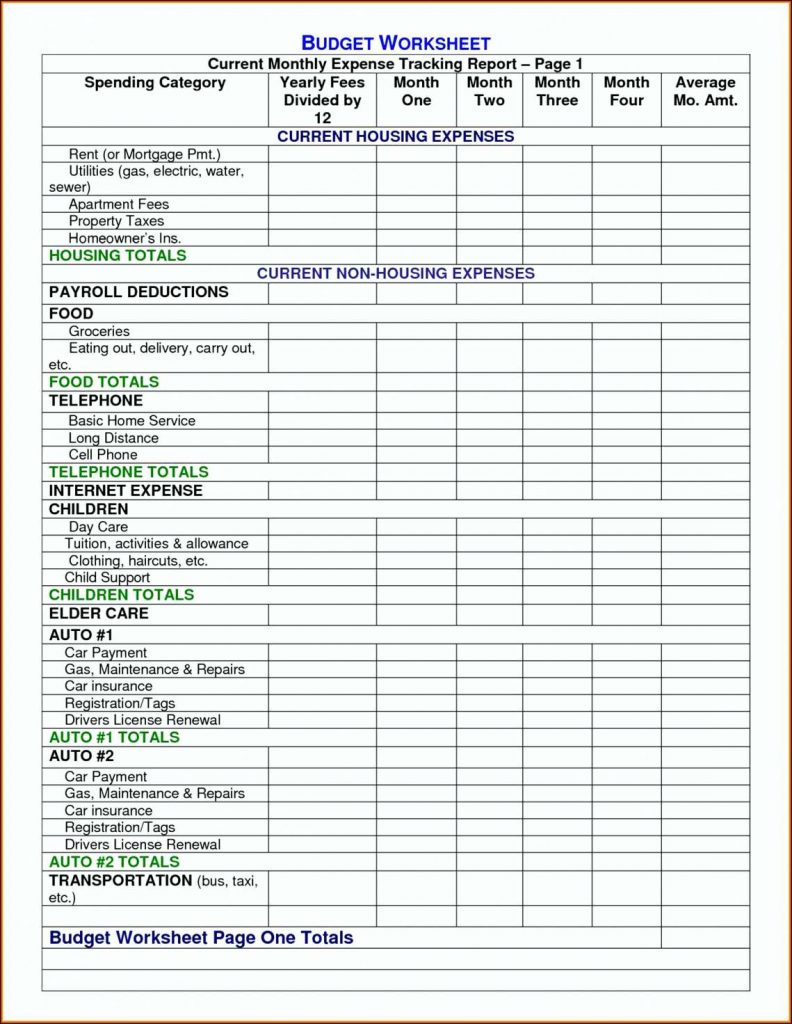

Budget To Pay Off Debt Spreadsheet within Debt Consolidation

Debt Snowball Tracker Printable Debt Payment Worksheet Debt Payoff

Debt Avalanche Payment Tracker Printable in 2021 Debt payoff

Debt Tracker Printable, Debt Payoff Log, Debt Tracker Sheets Etsy

Paying off Debt Worksheets

Debt Payment Tracker Printable Debt Payoff Planner Debt Etsy

Stationery Paper for up to 32 debts! The Best Debt Snowball Excel

![]()

Debt Payoff Tracker Printable

Debt Payoff Calculator Spreadsheet Debt Snowball Excel Etsy

![]()

FREE Printable Expense Tracker Downloadable Budget Binder The

Web This Template Is Built For Google Sheets, And It Gives You The Perfect Space To List Your Debts And Track Your Progress.

38 Debt Snowball Spreadsheets, Forms & Calculators.

On Top Of That, It Comes With Instructions To Guide.

Have You Ever Heard Of The Snowball Method?

Related Post: