Dcf Template Excel

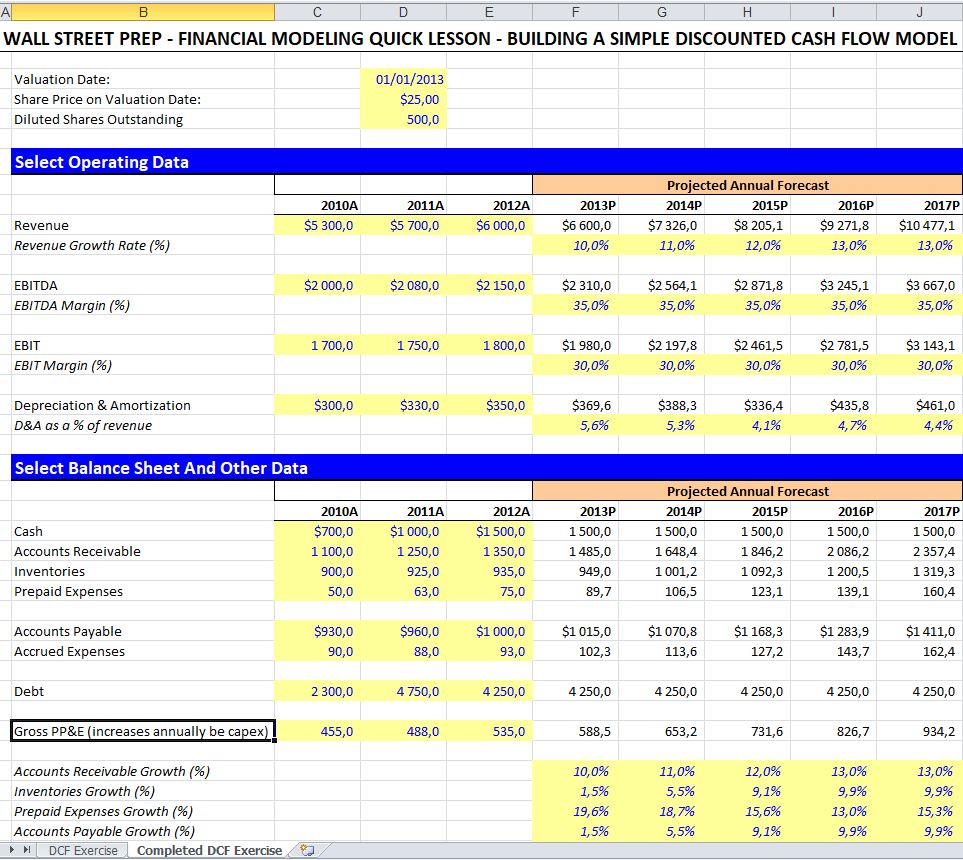

Dcf Template Excel - By simply changing the company along with different assumptions, you can quickly get a good idea of what that. Add or cut line items as needed (select the row with your mouse, right click and choose insert, or delete) ensure that the formulas in the black font color cells include all your new line items. This template allows you to build your own discounted cash flow model with different assumptions. Web download wso's free discounted cash flow (dcf) model template below! Web the macabacus discounted cash flow template implements key concepts and best practices related to dcf modeling. While there are many types of “free cash flow,” in a standard dcf model, you almost always use unlevered free cash flow (ufcf), also known as free cash flow to firm (fcff), because it produces the most consistent results and does not depend on the company’s capital structure. Web dcf model, step 1: Input your own numbers in place of the example numbers in the blue font color cells. Web download our free dcf model template. The dcf model enables users to. Web dcf model, step 1: The dcf model enables users to. The template uses the method, which discounts future cash flows back to present value. Add or cut line items as needed (select the row with your mouse, right click and choose insert, or delete) ensure that the formulas in the black font color cells include all your new line. Discover the intrinsic value of any company using our free discounted cash flow (dcf) template. Web dcf model, step 1: Web steps for using the dcf template. Web download wso's free discounted cash flow (dcf) model template below! By simply changing the company along with different assumptions, you can quickly get a good idea of what that. Web download wso's free discounted cash flow (dcf) model template below! The template also includes other tabs for. Web download our free dcf model template. Web steps for using the dcf template. Web discounted cash flow template. Use the form below to. Web the macabacus discounted cash flow template implements key concepts and best practices related to dcf modeling. Web discounted cash flow template. The template also includes other tabs for. It computes the perpetuity growth rate implied by the terminal multiple method and vice versa and sensitizes the analysis over a range of assumed terminal multiples. Web download wso's free discounted cash flow (dcf) model template below! This template allows you to build your own discounted cash flow model with different assumptions. Add or cut line items as needed (select the row with your mouse, right click and choose insert, or delete) ensure that the formulas in the black font color cells include all your new. It computes the perpetuity growth rate implied by the terminal multiple method and vice versa and sensitizes the analysis over a range of assumed terminal multiples and perpetuity growth rates without the use of slow excel. Web the dcf template is an excel spreadsheet that allows you to input data and perform calculations to determine the intrinsic value of a. Use the form below to. However, if cash flows are different each year, you will have to discount each cash flow separately: Web the macabacus discounted cash flow template implements key concepts and best practices related to dcf modeling. It computes the perpetuity growth rate implied by the terminal multiple method and vice versa and sensitizes the analysis over a. This template allows you to build your own discounted cash flow model with different assumptions. Add or cut line items as needed (select the row with your mouse, right click and choose insert, or delete) ensure that the formulas in the black font color cells include all your new line items. Web steps for using the dcf template. Web dcf. The template also includes other tabs for. The template uses the method, which discounts future cash flows back to present value. Web dcf model, step 1: The dcf model enables users to. Web discounted cash flow valuation model: Discover the intrinsic value of any company using our free discounted cash flow (dcf) template. Web discounted cash flow valuation model: Add or cut line items as needed (select the row with your mouse, right click and choose insert, or delete) ensure that the formulas in the black font color cells include all your new line items. Web discounted cash. Discover the intrinsic value of any company using our free discounted cash flow (dcf) template. Web the macabacus discounted cash flow template implements key concepts and best practices related to dcf modeling. Over 1.8 million professionals use cfi to learn accounting, financial analysis, modeling and more. Web in excel, you can calculate this using the pv function (see below). By simply changing the company along with different assumptions, you can quickly get a good idea of what that. Web download wso's free discounted cash flow (dcf) model template below! However, if cash flows are different each year, you will have to discount each cash flow separately: Web dcf model, step 1: This template allows you to build your own discounted cash flow model with different assumptions. Add or cut line items as needed (select the row with your mouse, right click and choose insert, or delete) ensure that the formulas in the black font color cells include all your new line items. It computes the perpetuity growth rate implied by the terminal multiple method and vice versa and sensitizes the analysis over a range of assumed terminal multiples and perpetuity growth rates without the use of slow excel. The dcf model enables users to. Web steps for using the dcf template. Web discounted cash flow template. The template also includes other tabs for. The template uses the method, which discounts future cash flows back to present value.

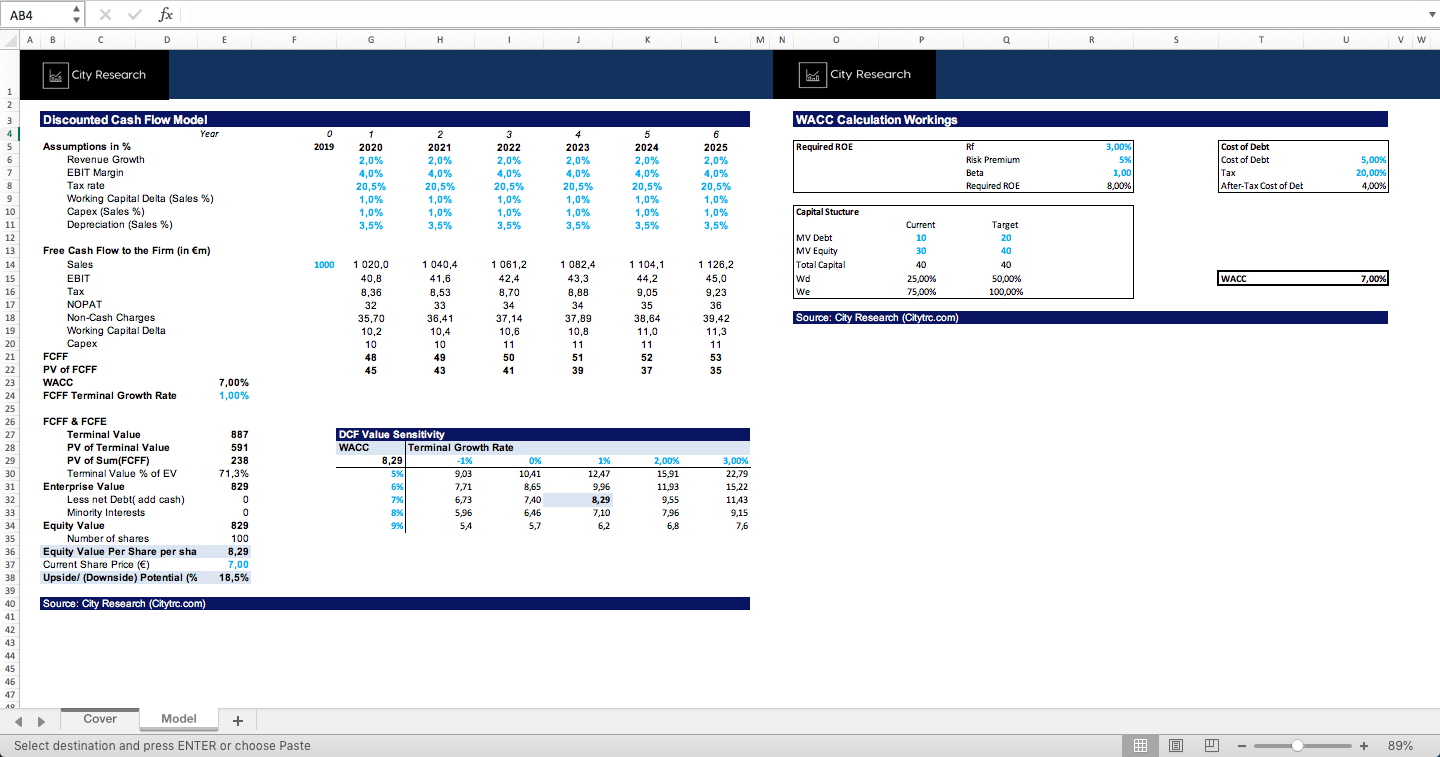

Discounted Cash Flow Excel Calculator Template DCF Model excel

Simple Discounted Cashflow (DCF) Excel Model Template Eloquens

![Free DCF Template Excel [Download & Guide] Wisesheets Blog](https://cdn-eaclf.nitrocdn.com/osNuHhBvVdZeEkSNJhSMrIuyqQJMcjPL/assets/static/optimized/rev-09e077f/wp-content/uploads/2022/07/Screen-Shot-2022-07-03-at-11.57.05-AM-1024x539.png)

Free DCF Template Excel [Download & Guide] Wisesheets Blog

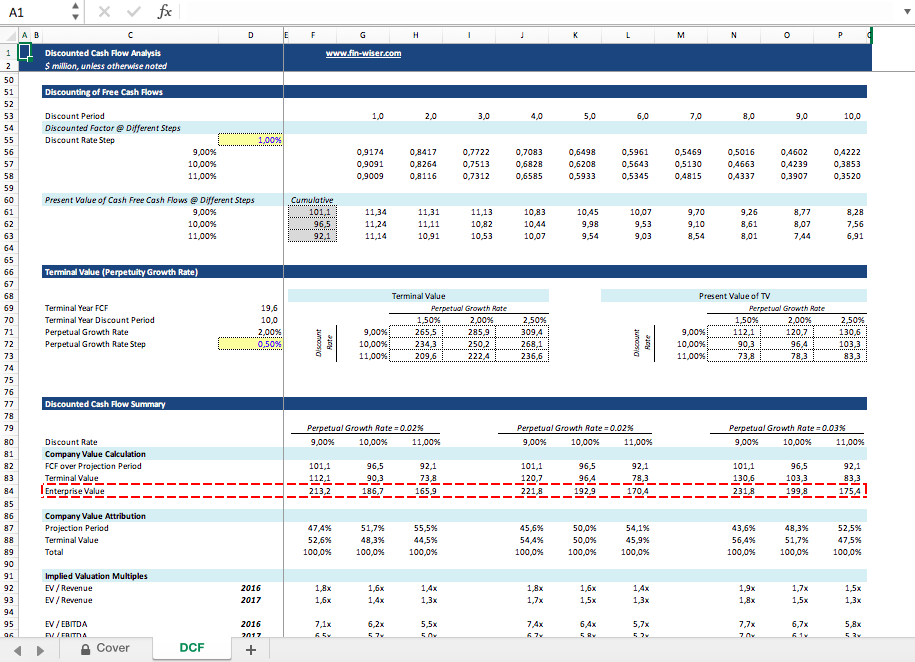

Discounted Cash Flow (DCF) Model Free Excel Template Macabacus

Single Sheet DCF (Discounted Cash Flow) Excel Template Eloquens

Discounted Cash Flow (DCF) Model Free Excel Template Macabacus

DCF Discounted Cash Flow Model Excel Template Eloquens

How To Use Excel To Calculate Discounted Cash Flow Rate Of Return

DCF model tutorial with free Excel

Single Sheet DCF (Discounted Cash Flow) Excel Template

Web The Dcf Template Is An Excel Spreadsheet That Allows You To Input Data And Perform Calculations To Determine The Intrinsic Value Of A Stock.

Web Discounted Cash Flow Valuation Model:

While There Are Many Types Of “Free Cash Flow,” In A Standard Dcf Model, You Almost Always Use Unlevered Free Cash Flow (Ufcf), Also Known As Free Cash Flow To Firm (Fcff), Because It Produces The Most Consistent Results And Does Not Depend On The Company’s Capital Structure.

Use The Form Below To.

Related Post: