Dark Cloud Cover Pattern

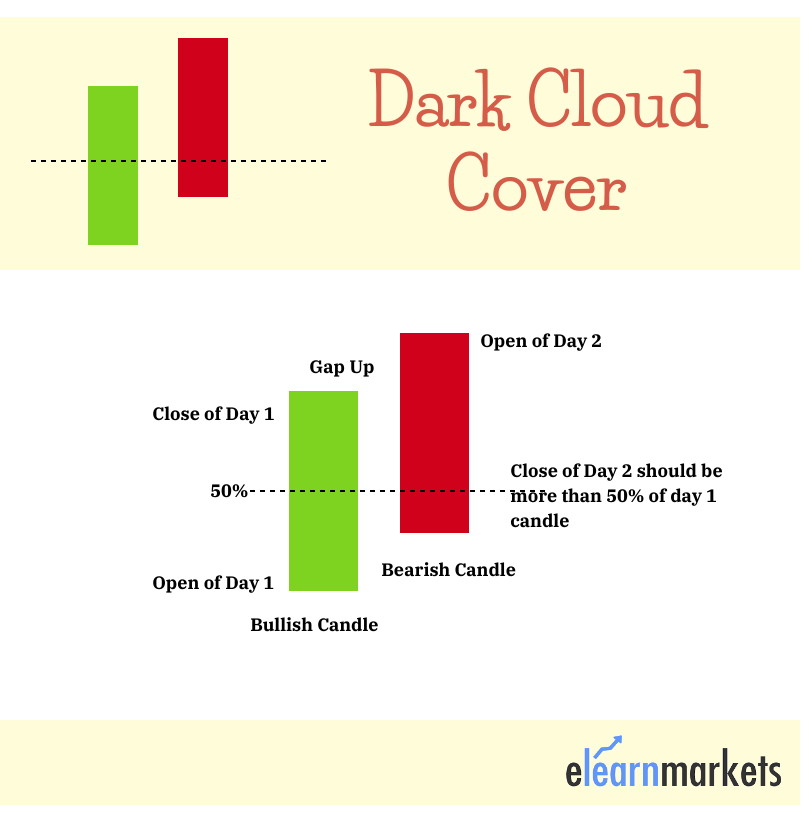

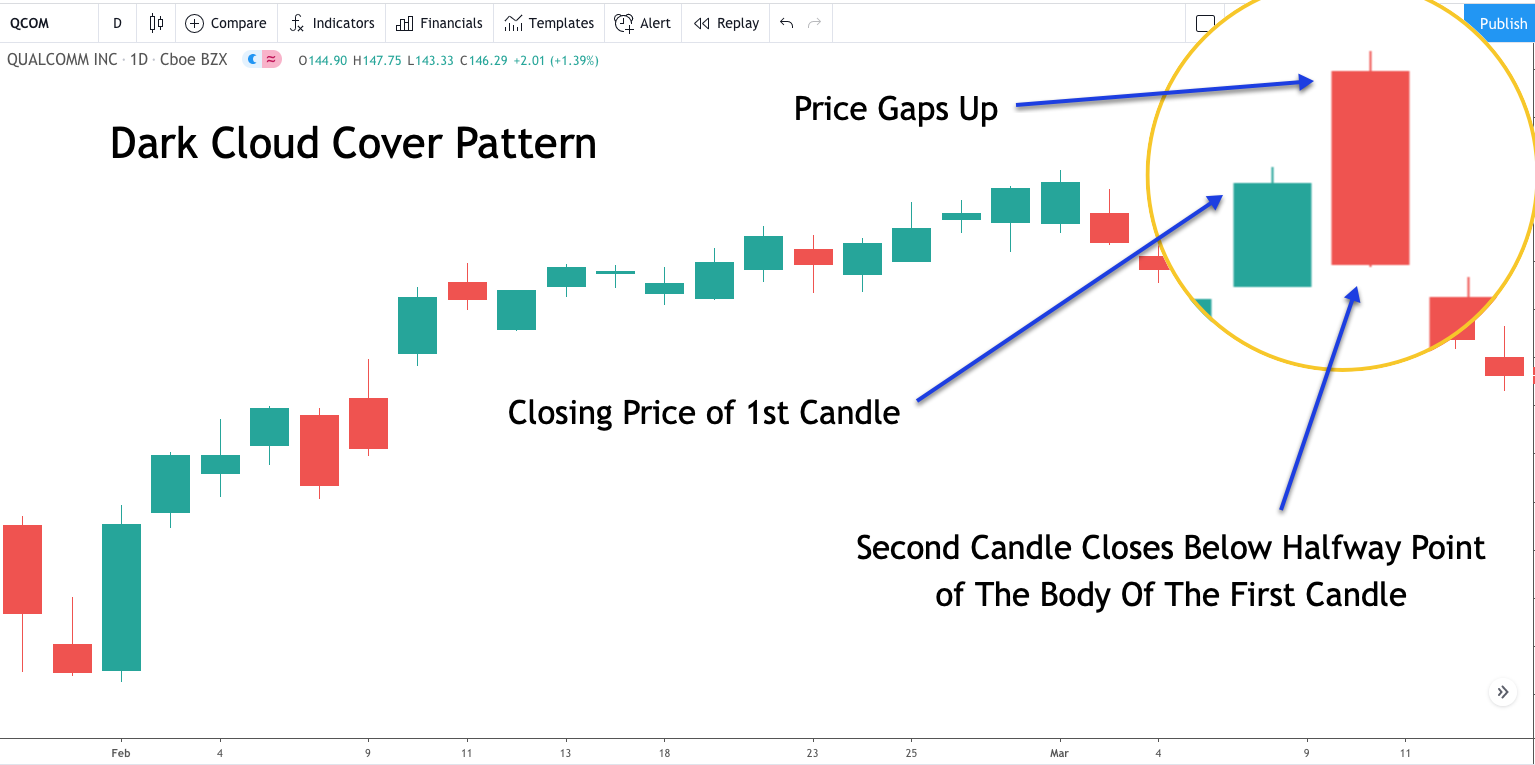

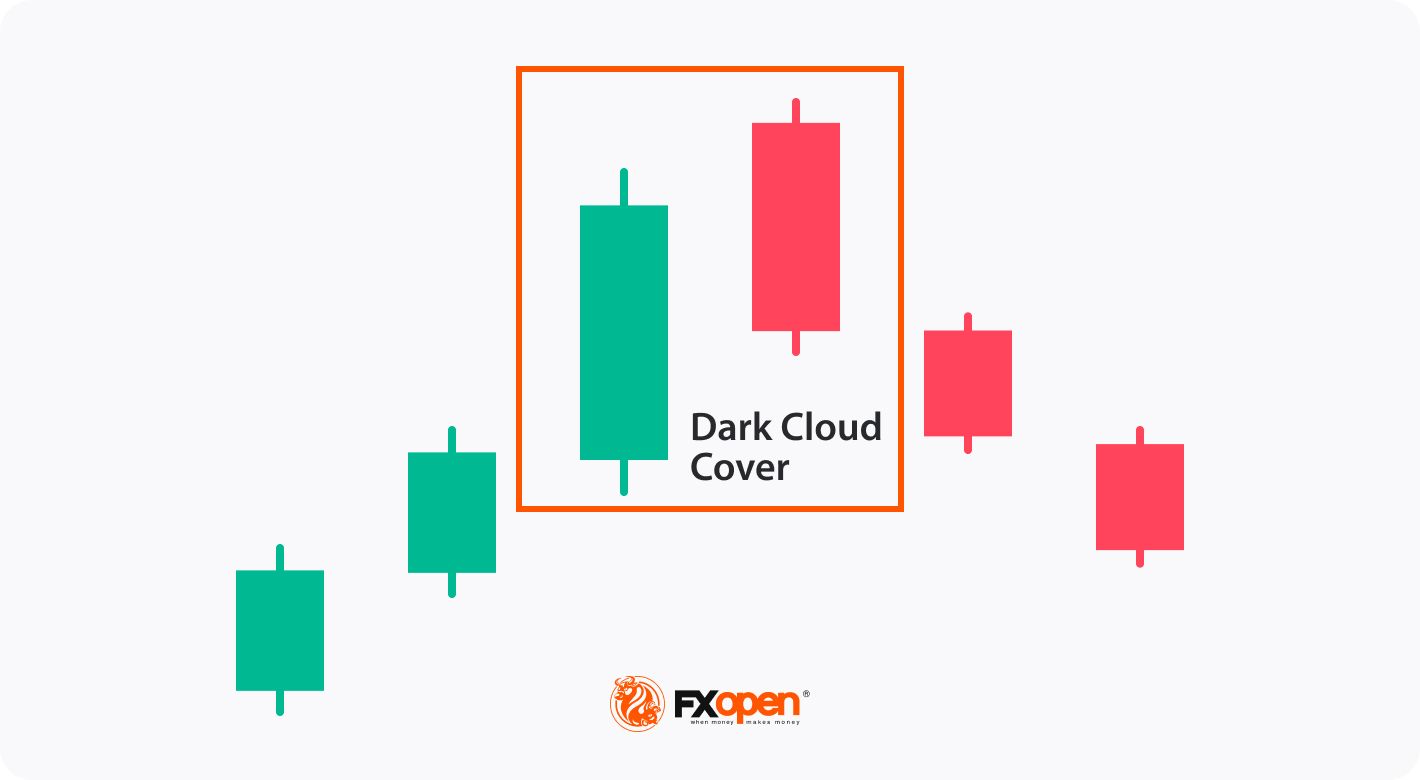

Dark Cloud Cover Pattern - However, once the turn is made and price breaks out, price trends, ranking 22nd out of 103 candle patterns, where 1 is best. Web dark cloud cover is a bearish trend reversal candlestick pattern consisting of two candles. Web the dark cloud cover candlestick pattern is a type of bearish reversal candlestick pattern used by traders to analyse the price movement of securities. The dark cloud cover is a bearish reversal candlestick pattern formed after an uptrend. It usually comes about at the peak of an uptrend. It consists of a bullish candle followed by a bearish candle that gaps up but then closes below the midpoint of the preceding bullish candle. Originating from japanese candlestick charting, the dark cloud cover candlestick pattern is easily recognizable by its distinct formation. It consists of a large white candlestick followed by a larger black candlestick that opens higher than the previous day’s close and closes well into the body of the previous day’s candle. In this guide to understanding the dark cloud cover candlestick pattern, we’ll show you what this chart looks like, explain its components, teach you how to interpret it, and provide examples. You can identify a dark cloud cover candlestick pattern when a large black candle forms a “dark cloud” over the previous day’s candle. Here, a down candle opens above the prior up candle’s close and closes below the midpoint of the up candle. The dark cloud cover is a bearish reversal candlestick pattern formed after an uptrend. Web dark cloud cover is a bearish reversal candlestick pattern that is formed at the end of an uptrend. It usually comes about at the peak. The dark cloud cover candlestick pattern involves just two candles and acts as the opposite of the piercing pattern. As with a bearish engulfing pattern, buyers push the price higher at the open,. The first candle is long and bullish and continues the uptrend; Updated on october 13, 2023. Web the dark cloud cover candlestick pattern is a significant tool. Originating from japanese candlestick charting, the dark cloud cover candlestick pattern is easily recognizable by its distinct formation. The first candle is long and bullish and continues the uptrend; What is dark cloud cover? It starts with a bullish (green) candle followed by a bearish (red) candle that yields a new high. The pattern shows a change in momentum from. The first candle is long and bullish and continues the uptrend; What is dark cloud cover? Web updated october 31, 2022. Web what is a dark cloud cover pattern in candlestick analysis? Web the dark cloud cover pattern involves a large black candle forming a dark cloud over the preceding up candle. Web what is a dark cloud cover pattern in candlestick analysis? So, while the first candle is bullish and can take various shapes and sizes….it’s the second candle that matters most! Yet, being able to recognize it can prevent traders from major losses that amount when the price begins to tumble towards a new support level. Updated on october 13,. It denotes a switch to the lower side after a price rise. Dark cloud cover is a two line candlestick that has poor reversal performance. The dark cloud cover candlestick pattern is recognized if: They show a particular security’s opening, closing, and high, and low. However, once the turn is made and price breaks out, price trends, ranking 22nd out. Web what is a dark cloud cover pattern in candlestick analysis? The first candlestick is a bullish candlestick and the second one is a bearish candlestick. Web updated october 31, 2022. Web the dark cloud cover candlestick pattern is a bearish reversal pattern that signals a potential trend reversal in a stock or any other security. The traders find this. The second candle is bearish and it opens above the first candle's high price; Originating from japanese candlestick charting, the dark cloud cover candlestick pattern is easily recognizable by its distinct formation. Web the dark cloud cover is a candlestick pattern that signals a momentum shift to bearish. It is made of two candlesticks. Web what is the dark cloud. The dark cloud cover appears mostly after a prolonged uptrend indicating a trend reversal to a downtrend. Web the dark cloud cover pattern involves a large black candle forming a dark cloud over the preceding up candle. It denotes a switch to the lower side after a price rise. As with a bearish engulfing pattern, buyers push the price higher. It can provide insight into potential market shifts and is crucial for stock trading and analysis. Web the dark cloud cover forex pattern consists of two candlesticks where the first candlestick creates a bullish green candle that is immediately followed by a second red reversal candlestick. The dark cloud cover appears mostly after a prolonged uptrend indicating a trend reversal. It forms in an upswing when a red candlestick opens above the previous green candlestick’s closing price but closes below its midpoint, suggesting a shift from bullish to bearish sentiment. Web the dark cloud cover is a bearish reversal candlestick pattern whose presence indicates a probable reversal to a downward trend. It can provide insight into potential market shifts and is crucial for stock trading and analysis. It denotes a switch to the lower side after a price rise. As with a bearish engulfing pattern, buyers push the price higher at the open,. Its ominous emergence pierces the veil of optimism, revealing vulnerabilities brewing beneath seemingly impenetrable market highs. Web the dark cloud cover pattern involves a large black candle forming a dark cloud over the preceding up candle. Web the formation of the dark cloud cover the dark cloud cover in technical analysis understanding the confirmation of the dark cloud cover trading strategies using the dark cloud cover limitations and cautions with the dark cloud cover dark cloud cover vs other bearish reversal patterns final thoughts dark cloud cover faqs. It starts with a bullish (green) candle followed by a bearish (red) candle that yields a new high. Web updated october 31, 2022. The dark cloud cover appears mostly after a prolonged uptrend indicating a trend reversal to a downtrend. The traders find this pattern important as it signals the reversal of uptrend into a downtrend. Web dark cloud cover is a bearish reversal candlestick pattern that is formed at the end of an uptrend. Web the dark cloud cover candlestick pattern is a bearish reversal pattern that signals a potential trend reversal in a stock or any other security. Web what is the dark cloud cover candlestick pattern? Web dark cloud cover patterns are two candlestick patterns found at the top of uptrends or near resistance levels and signal a reversal to the downside.

How to Trade the Dark Cloud Cover Candlestick

Dark Cloud Cover Candlestick Pattern Best Analysis

Dark Cloud Cover How to trade with this powerful candlestick Pattern2022

:max_bytes(150000):strip_icc()/DarkCloudCover-2c6f2d7b211942019a87dbe632fb3d2b.png)

Dark Cloud Cover Definition and Example

Overview Of The Dark Cloud Cover Candlestick Pattern Forex Training Group

How To Trade Blog What Is A Dark Cloud Cover Candlestick? Meaning And

Dark Cloud Cover Candlestick Pattern Full Guide for Traders DTTW™

How To Trade Blog What Is Dark Cloud Cover Candlestick Pattern

How To Trade Blog What Is Dark Cloud Cover Candlestick Pattern

How to Trade with a Dark Cloud Cover Pattern Market Pulse

It Is Often Followed By Another Down Candle, Which Shows A Downtrend Confirmation.

A Prior Uptrend Followed By A Dark Cloud Cover Pattern Indicates A.

Yet, Being Able To Recognize It Can Prevent Traders From Major Losses That Amount When The Price Begins To Tumble Towards A New Support Level.

Look For Price Action To Fall Below The Second Candlestick And Hold To Confirm Bearish Continuation.

Related Post: