Dark Cloud Cover Chart Pattern

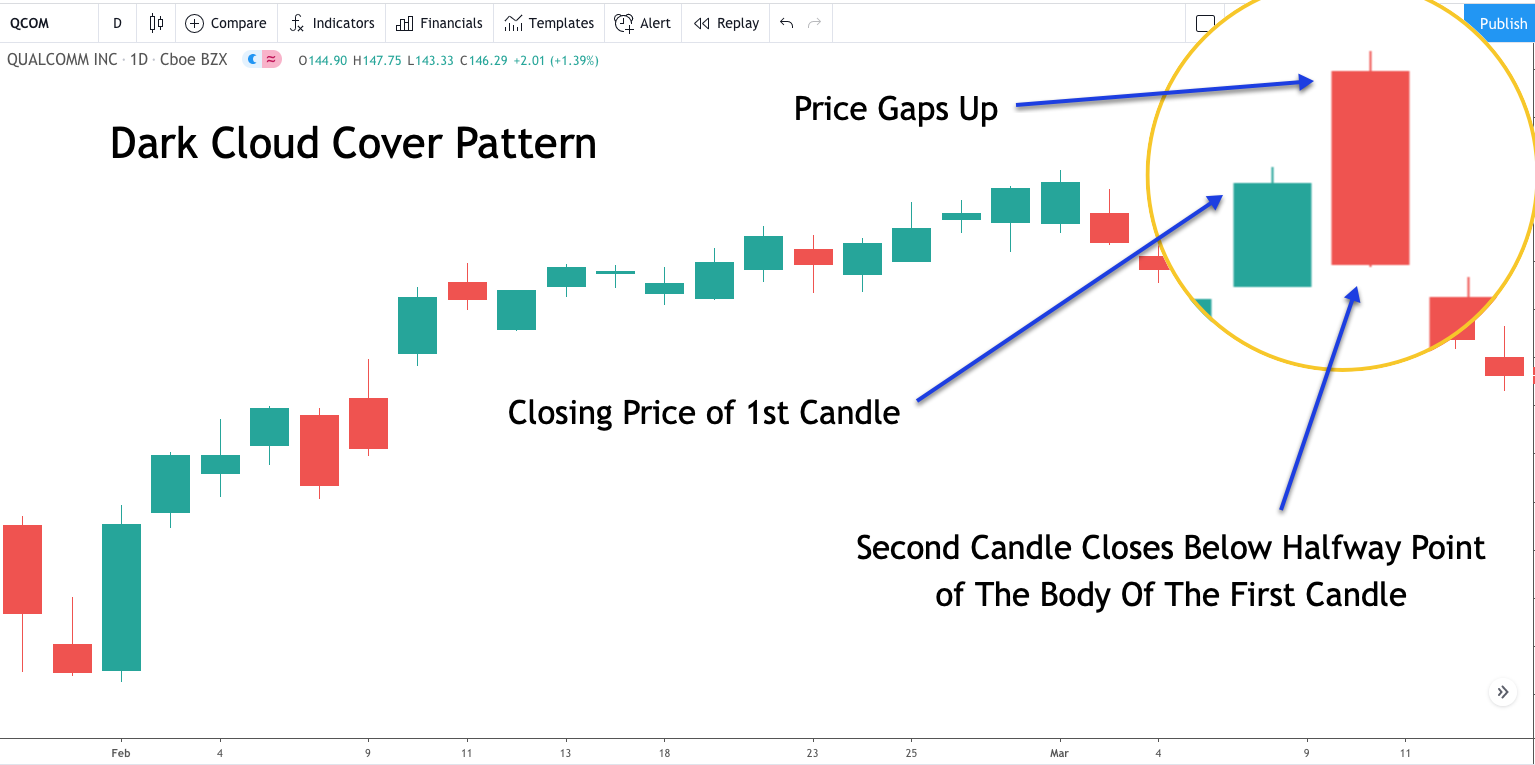

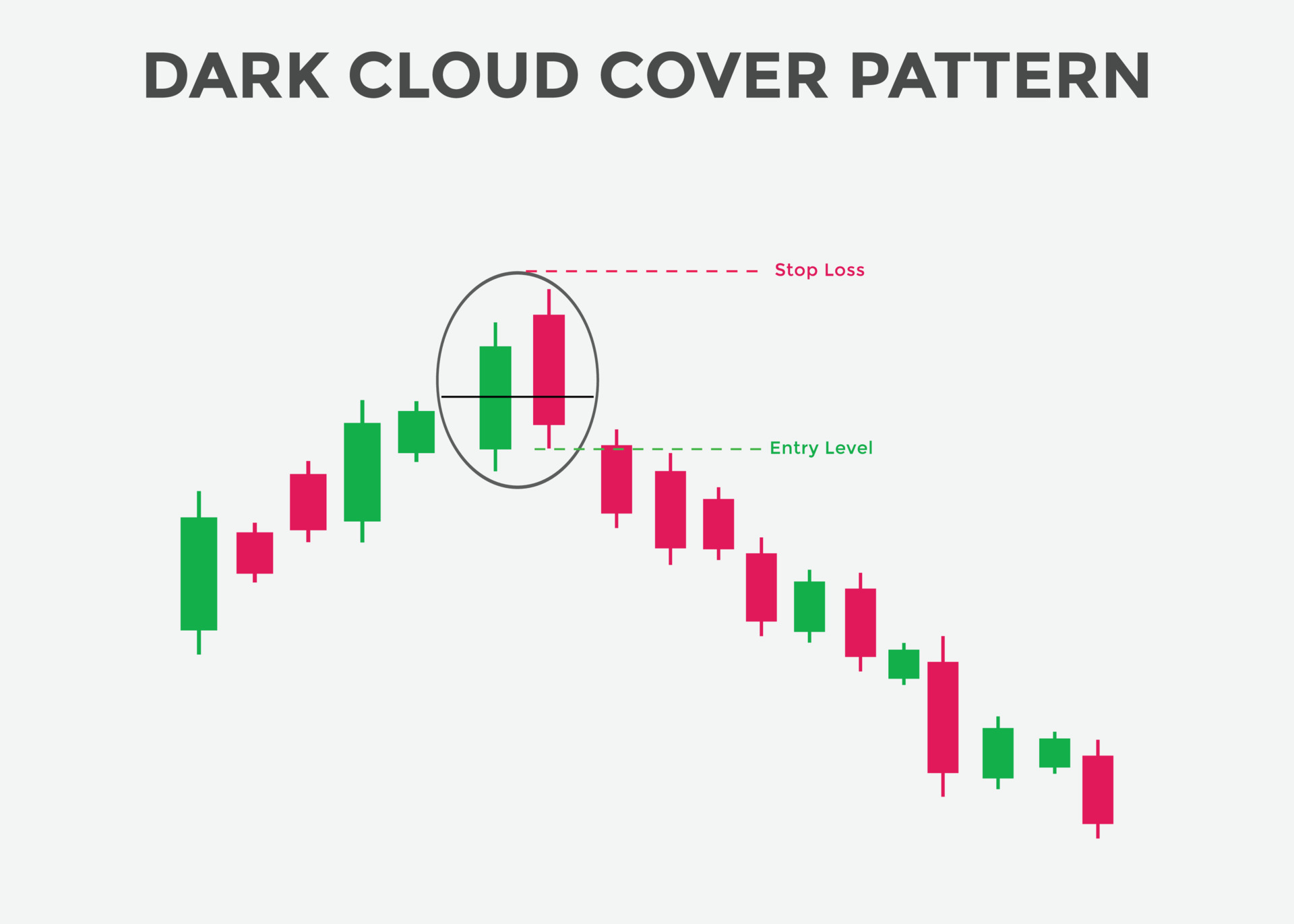

Dark Cloud Cover Chart Pattern - A dark cloud cover pattern consists of two candlesticks that form near resistance levels where the second candle covers half or part of the first candle. Web what is a dark cloud cover pattern in candlestick analysis? Web according to “bulkowski on the dark cloud cover candle pattern”, the dark cloud cover pattern signals a bearish reversal 60% of the time. It consists of a bullish candle followed by a bearish candle that gaps up but then closes below the midpoint of the preceding bullish candle. Web the dark cloud cover is a bearish reversal candlestick pattern whose presence indicates a probable reversal to a downward trend. Scanner guide scan examples feedback. Web the dark cloud cover pattern is known in japanese as kabuse, which means 'to get covered' or 'to hang over'. It’s a bearish reversal pattern. Web this article will cover the following: The best way to use this pattern in a trading strategy occurs during an upward recovery movement in. What is a dark cloud cover pattern? Web utilizing the dark cloud cover pattern here can help you time your entry to capture a trade opportunity that might have been missed earlier. Web we can see the dark cloud cover pattern occurring on the microsoft (msft) daily chart on february 11th, 2020. The reversal is confirmed when. Web the dark. Web this article will cover the following: Learn from this blog about its formation, features and how to use it for trading with examples. Web according to “bulkowski on the dark cloud cover candle pattern”, the dark cloud cover pattern signals a bearish reversal 60% of the time. Web dark cloud cover: The dark cloud cover is a bearish reversal. What is the dark cloud cover candlestick pattern. Web dark cloud cover is a candlestick pattern that shows a shift in momentum to the downside following a price rise. Web dark cloud cover is a japanese candlestick charting pattern that aids technical traders in identifying the exhaustion of bullish price action. It is the bearish signal on the daily chart.. Its ominous emergence pierces the veil of optimism, revealing vulnerabilities brewing beneath seemingly impenetrable market highs. What is a dark cloud cover pattern? How to trade using the dark cloud cover; Web this article will cover the following: It appears in an uptrend and is characterized by a long white (or green) candle followed by a black (or red) candle. Typically, when the second candle forms, it cannot hold above the first candle and causes a failure. The second candle opens higher than the previous close. It forms in an upswing when a red candlestick opens above the previous green candlestick’s closing price but closes below its midpoint, suggesting a shift from bullish to bearish sentiment. It starts with a. Classified as a bearish reversal pattern, dark cloud cover is commonly seen as a signal of an exhausted uptrend, or the end of bearish trend retracement. Its ominous emergence pierces the veil of optimism, revealing vulnerabilities brewing beneath seemingly impenetrable market highs. Dark cloud cover, circled in a, appears on the daily scale. Web dark cloud cover is a candlestick. Web this article will cover the following: It appears in an uptrend and is characterized by a long white (or green) candle followed by a black (or red) candle. Web the dark cloud cover is a bearish reversal candlestick pattern whose presence indicates a probable reversal to a downward trend. It’s a bearish reversal pattern. Web the dark cloud cover. The next day, the clouds move in forming a black candle that begins the day with a higher open but closes below the middle of the white candle. Web dark cloud cover is a japanese candlestick charting pattern that aids technical traders in identifying the exhaustion of bullish price action. Web dark cloud cover: It is a double candlestick pattern. Web learn the significance for traders of the dark cloud cover candlestick pattern, a bearish indicator closely related to the bearish engulfing pattern. Price moves in a brisk upward trend, forming a tall white candle. Web what is a dark cloud cover pattern in candlestick analysis? Image for illustration purposes only. The first day is an up candle bullish marubozu. Price moves in a brisk upward trend, forming a tall white candle. Learn from this blog about its formation, features and how to use it for trading with examples. Web learn the significance for traders of the dark cloud cover candlestick pattern, a bearish indicator closely related to the bearish engulfing pattern. Typically, when the second candle forms, it cannot. It usually comes about at the peak of an uptrend. It forms in an upswing when a red candlestick opens above the previous green candlestick’s closing price but closes below its midpoint, suggesting a shift from bullish to bearish sentiment. Web dark cloud cover is a japanese candlestick charting pattern that aids technical traders in identifying the exhaustion of bullish price action. Web according to “bulkowski on the dark cloud cover candle pattern”, the dark cloud cover pattern signals a bearish reversal 60% of the time. The first day is an up candle bullish marubozu. It consists of a bullish candle followed by a bearish candle that gaps up but then closes below the midpoint of the preceding bullish candle. Web learn the significance for traders of the dark cloud cover candlestick pattern, a bearish indicator closely related to the bearish engulfing pattern. It appears in an uptrend and is characterized by a long white (or green) candle followed by a black (or red) candle. The second candle opens higher than the previous close. Classified as a bearish reversal pattern, dark cloud cover is commonly seen as a signal of an exhausted uptrend, or the end of bearish trend retracement. Learn from this blog about its formation, features and how to use it for trading with examples. It’s highly regarded for its ability to flag a potential shift in market direction from bullish to bearish. The next day, the clouds move in forming a black candle that begins the day with a higher open but closes below the middle of the white candle. Usually, it appears after a price move to the upside and shows rejection from higher prices. A prior uptrend followed by a dark cloud cover pattern indicates a trend reversal towards a. The pattern is composed of a bearish candle that opens above but then closes.

Overview Of The Dark Cloud Cover Candlestick Pattern Forex Training Group

What Is Dark Cloud Cover Candlestick Pattern? How To Trade Blog

Dark cloud candlestick chart pattern. Japanese candlesticks pattern

How to Trade the Dark Cloud Cover Candlestick

Dark Cloud Cover Candle Stick Pattern

Tutorial on Dark Cloud Cover Candlestick Pattern YouTube

What Is Dark Cloud Cover Candlestick Pattern? How To Trade Blog

Dark Cloud Cover Definition and Example

How to Trade the Dark Cloud Cover Candlestick

:max_bytes(150000):strip_icc()/DarkCloudCover-2c6f2d7b211942019a87dbe632fb3d2b.png)

Dark Cloud Cover Definition and Example

It Starts With A Bullish (Green) Candle Followed By A Bearish (Red) Candle That Yields A New High.

Price Moves In A Brisk Upward Trend, Forming A Tall White Candle.

What Is The Dark Cloud Cover Candlestick Pattern.

The Dark Cloud Cover Is A Bearish Reversal Candlestick Pattern Formed After An Uptrend.

Related Post: