Cup With Handle Pattern Chart

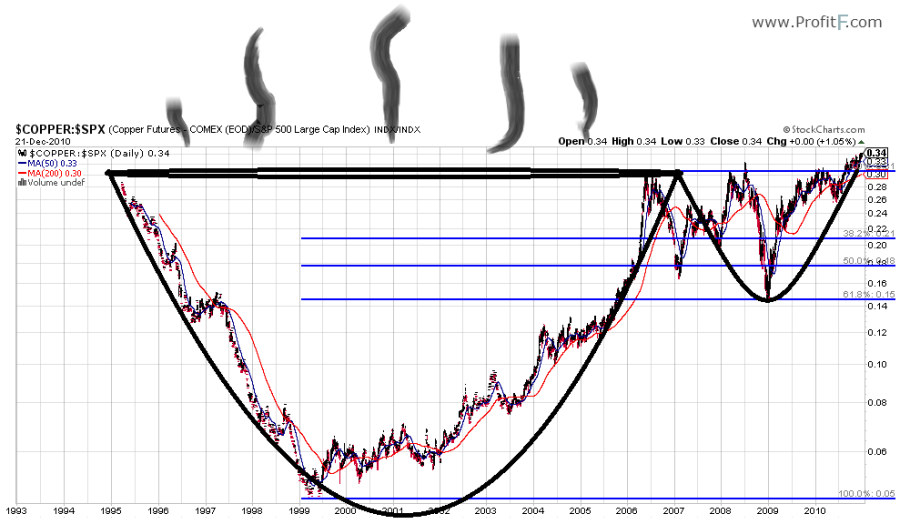

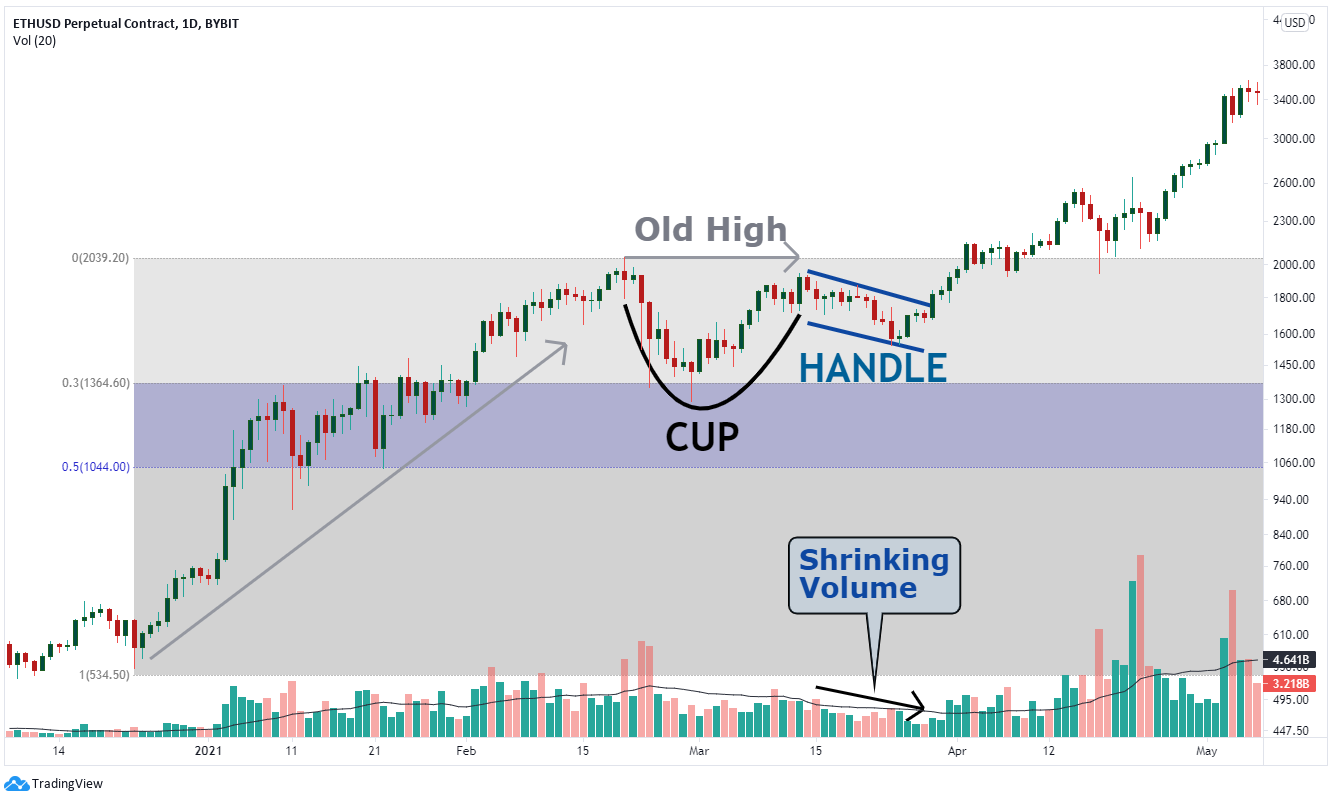

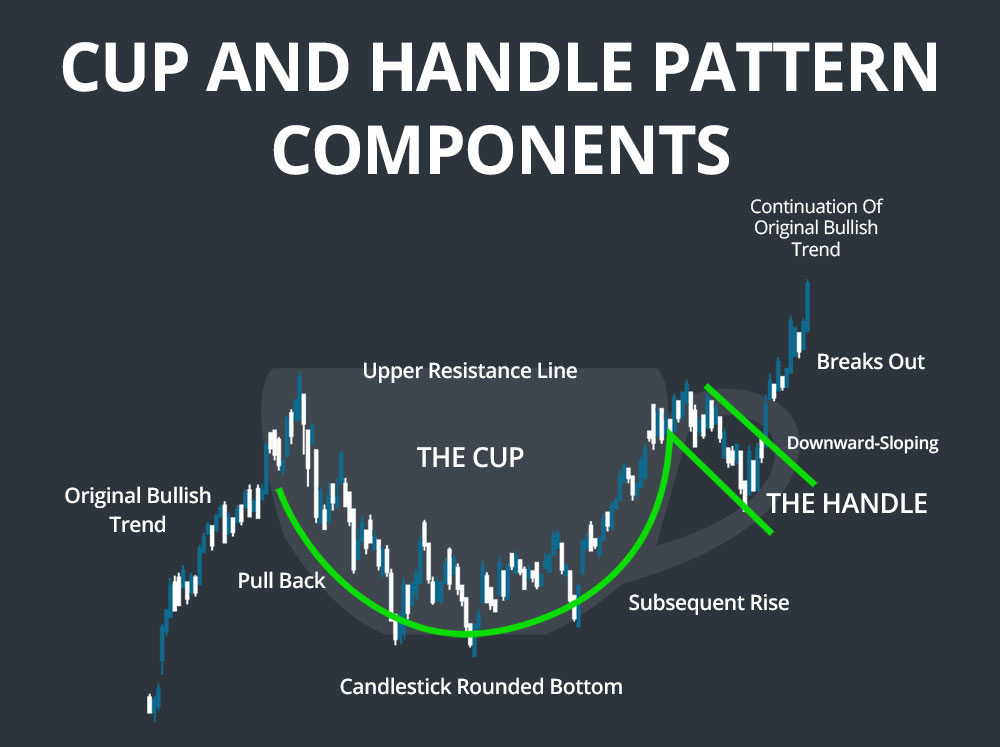

Cup With Handle Pattern Chart - The cup pattern happens first and then a handle happens next. Web the cup and handle pattern strategy is a formation on the price chart of an asset that resembles a cup with a handle. Web william o'neil's cup with handle is a bullish continuation pattern that marks a consolidation period followed by a breakout. The price drop in a proper handle should be within 12% of its peak. Web cup and handle. Almost a quarter (23%) of cup with handles see price rise no more than 15% before dropping. The first phase of the pattern is the formation of a “cup” shape. Technical/fundamental analysis charts & tools provided for research purpose. Web how to success in swing trading?cup and handle chart pattern is one of the best price action patterns for swing trading forex.learn how to identify bullish a. The handle should generally by anywhere from a. The cup looks like a “u” or a bowl with a. Financial data sourced from cmots internet technologies pvt. Cup with handle chart pattern. The cup forms after an advance and looks like a bowl or rounding bottom. The cup pattern happens first and then a handle happens next. It is a bullish continuation pattern that marks a pause (sideways trend) in the bullish trend. Sometimes it forms within a few days, but it can take up to a year for the pattern to fully form. Web cup and handle chart pattern. Almost a quarter (23%) of cup with handles see price rise no more than 15% before dropping.. Web cup and handle: Please be aware of the risk. A “u” shaped bottom is preferred over a “v” shaped bottom as it indicates more consolidation. Web let's take the cup with handle fashioned by baidu (see the chart below) in 2007. Web when the cup and handle follows through, it typically generates gains of +20% to 30% over several. The cup and the handle. As the name suggests, the pattern is made up of two sections; In the cup base, the high was 134.10 and the low was 92.80. The entire pattern can be anywhere between 1 month to a little more than year. Web william o'neil's cup with handle is a bullish continuation pattern that marks a consolidation. As its name implies, there are two parts to the pattern—the cup and the handle. The cup and handle pattern, also sometimes known as the cup with handle pattern was first identified by stockbroker william o'neil in 1988. The cup is shaped as a u and the handle has a slight downward drift. Web cup and handle. From ibm in. Learn to spot it on a chart, and — crucially — learn to spot fatal flaws. The cup forms after an advance and looks like a bowl or rounding bottom. Web to identify the cup and handle pattern, traders should keep an eye out for the following key elements: Web the cup and handle pattern is a pattern that traders. Web elitetradingsignals nov 28, 2022. The cup forms after an advance and looks like a bowl or rounding bottom. The price drop in a proper handle should be within 12% of its peak. Identify the cup and handle on a price chart. Web the cup and handle pattern strategy is a formation on the price chart of an asset that. Web william o'neil's cup with handle is a bullish continuation pattern that marks a consolidation period followed by a breakout. The first cup and handle pattern trading step is to identify the pattern on a market chart by manually browsing finance charts or by using a pattern scanner. In the cup base, the high was 134.10 and the low was. A cup and handle can be used as an entry pattern for the continuation of an established bullish trend. Web let's take the cup with handle fashioned by baidu (see the chart below) in 2007. It´s one of the easiest patterns to identify. In the cup base, the high was 134.10 and the low was 92.80. After forming the cup,. The cup and the handle. In the cup base, the high was 134.10 and the low was 92.80. The cup forms after an advance and looks like a bowl. Web let's take the cup with handle fashioned by baidu (see the chart below) in 2007. This chart pattern is shaped like and resembles like a cup and handle that's why. The cup and handle pattern, also sometimes known as the cup with handle pattern was first identified by stockbroker william o'neil in 1988. The cup is shaped as a u and the handle has a slight downward drift. Web the cup with handle is a bullish continuation pattern that marks a consolidation period followed by a breakout. As the name suggests, the pattern is made up of two sections; Chart patterns form when the price of an asset moves in a way that resembles a common shape, like a rectangle, flag, pennant, head and shoulders, or, like in this example, a cup and handle. Technical/fundamental analysis charts & tools provided for research purpose. Web let's take the cup with handle fashioned by baidu (see the chart below) in 2007. Identify the cup and handle on a price chart. Please be aware of the risk. The cup looks like a “u” or a bowl with a. Web elitetradingsignals nov 28, 2022. Web cup and handle chart patterns can last anywhere from seven to 65 weeks. Web the cup and handle chart pattern does have a few limitations. It is a bullish continuation pattern that marks a pause (sideways trend) in the bullish trend. It starts when a stock’s price runs up at least 30%. A cup and handle is a bullish continuation chart pattern that marks a consolidation period followed by a breakout..png)

Cup and Handle Chart Pattern How To Use It in Crypto Trading Bybit Learn

Trading the Cup and Handle Chart pattern

Cup And Handle Pattern How To Verify And Use Efficiently How To

Cup and handle chart pattern How to trade the cup and handle IG UK

Cup and Handle Patterns Comprehensive Stock Trading Guide

Cup And Handle Pattern How To Verify And Use Efficiently How To

Cup And Handle Pattern How To Verify And Use Efficiently How To

Cup and Handle Chart Pattern How To Use It in Crypto Trading Bybit Learn

Cup and Handle Patterns Comprehensive Stock Trading Guide

Cup and Handle Patterns Comprehensive Stock Trading Guide

Web Cup & Handle Pattern Technical & Fundamental Stock Screener, Scan Stocks Based On Rsi, Pe, Macd, Breakouts, Divergence, Growth, Book Vlaue, Market Cap, Dividend Yield Etc.

Cup And Handle Pattern Rules:

The First Phase Of The Pattern Is The Formation Of A “Cup” Shape.

In The Cup Base, The High Was 134.10 And The Low Was 92.80.

Related Post: