Cup Stock Pattern

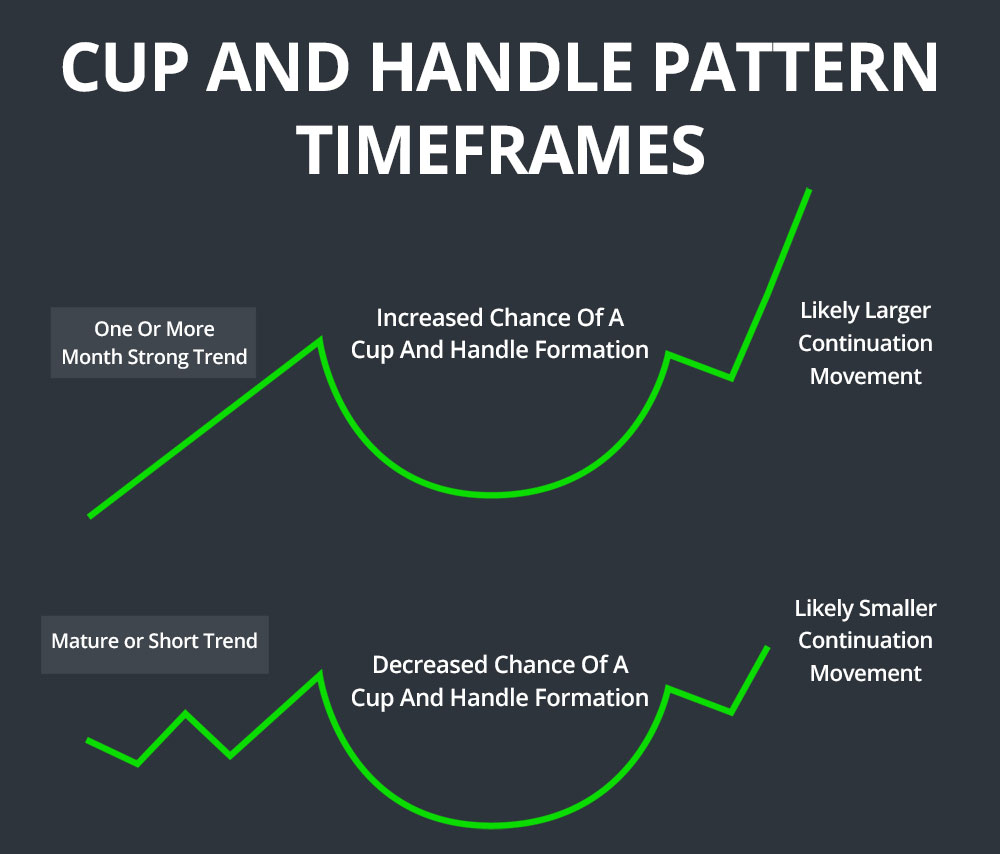

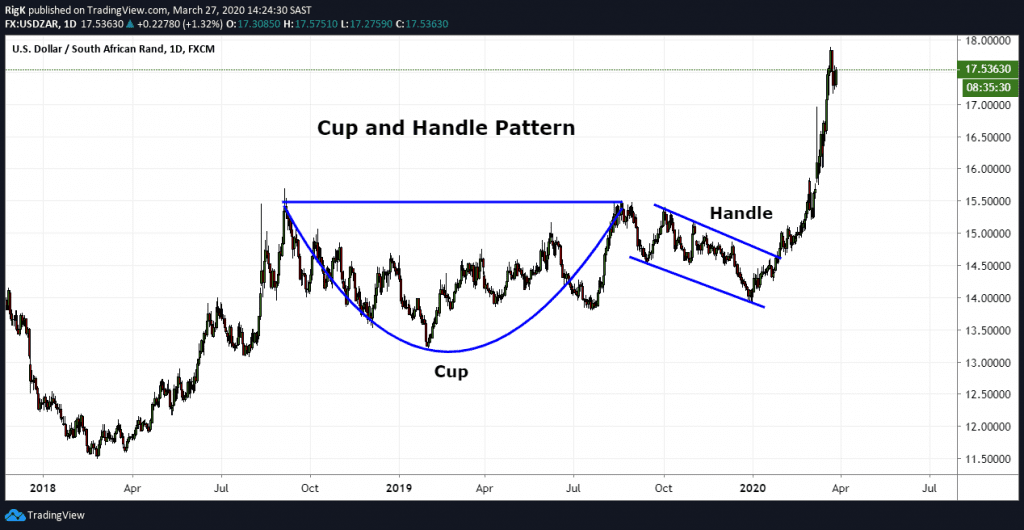

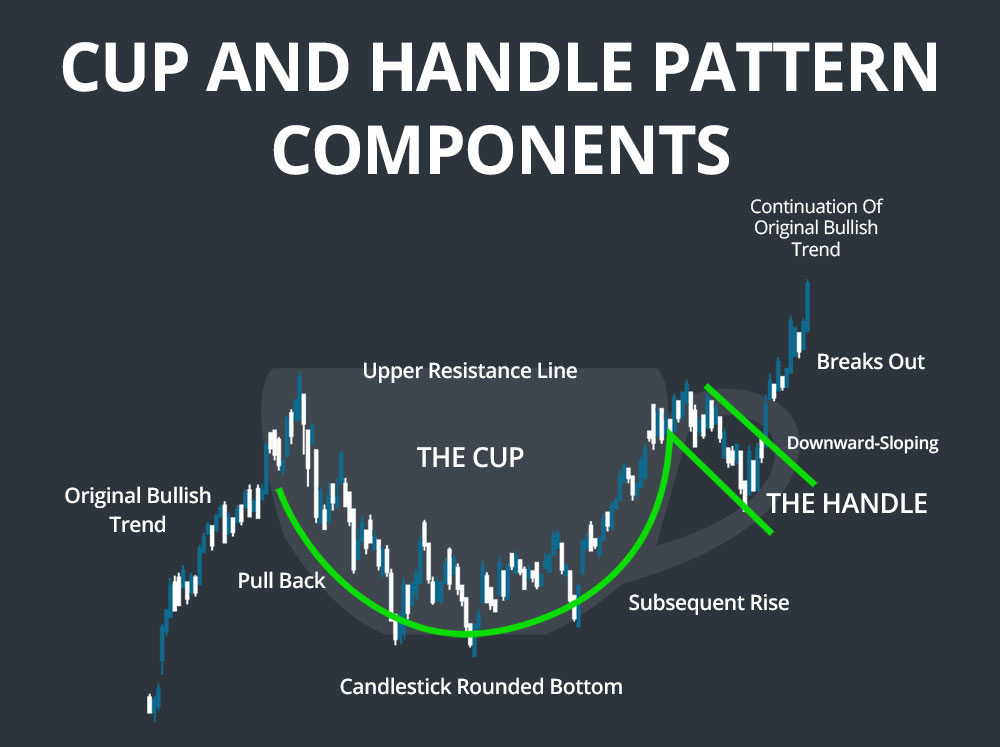

Cup Stock Pattern - Web what is the cup and handle pattern? The cup and the handle. Once the pattern is complete, the stock should continue to trade upward, in the direction it was previously. Web the cup and handle pattern is a bullish continuation pattern that consists of two parts, the cup and the handle. One of the most famous chart patterns when trading stocks is the cup with handle. Web the cup and handle is one of many chart patterns that traders can use to guide their strategy. When the pattern appears on a stock chart, it shows a period of price consolidation followed by a price breakout. The price then chops around, forming a sideways triangle pattern or a shallow descending channel. Well, if you look at the pattern from its side, it looks like a cup with a handle. The implication is that the downward trend from the previous move has ended and that prices will resume their uptrend. Where did it get its name? But how do you recognize when a cup is forming a handle? It is marked by a consolidation, followed by a breakout. One of the most famous chart patterns when trading stocks is the cup with handle. Web a cup and handle can be used as an entry pattern for the continuation of an. It was developed by william o'neil and introduced in his 1988 book, how to make money in stocks. It gets its name from the tea cup shape of the pattern. Web a cup and handle is a chart pattern made by an asset’s price indicative of a future uptrend. Web cup & handle pattern technical & fundamental stock screener, scan. Web among the eight principal base patterns — including the ascending base , base on base , double bottom , flat base , high, tight flag , ipo base and saucer — the cup with handle remains to. But how do you recognize when a cup is forming a handle? It is marked by a consolidation, followed by a breakout.. The cup typically takes shape as a pull back and subsequent rise, with the candlesticks in the center of the cup giving it the form of a rounded bottom. Web the cup and handle security trading pattern is a bullish continuation pattern used in technical analysis. Web a cup and handle is a technical chart pattern that resembles a cup. It’s a technical chart pattern made popular by william o’neil in his book “ how to make money in stocks.” it’s a continuation pattern that may indicate future gains. After forming the cup, price pulls back to about ⅓ of the cups advance, forming the handle. When the pattern appears on a stock chart, it shows a period of price. Web the cup and handle is one of many chart patterns that traders can use to guide their strategy. Learn how to trade this pattern to improve your odds of making profitable trades. The funny thing about the formation is that while the handle is the smallest portion of the pattern, it is actually the most important. Web the cup. Web the cup and handle is one of many chart patterns that traders can use to guide their strategy. The cup forms after an advance and looks like a bowl or rounding bottom. The cup typically takes shape as a pull back and subsequent rise, with the candlesticks in the center of the cup giving it the form of a. The cup and the handle. Web the cup and handle security trading pattern is a bullish continuation pattern used in technical analysis. Well, if you look at the pattern from its side, it looks like a cup with a handle. It can be used to spot shares potentially poised for growth if correctly identified and also caught in time. Then. The pattern is called cup and handle because it has two distinct parts: One of the most important chart patterns in the stock market is the cup and handle pattern, invented by william o’neill. Web the cup and handle security trading pattern is a bullish continuation pattern used in technical analysis. It’s a technical chart pattern made popular by william. This top chart pattern is a favorite among swing traders, who have been relying on this pattern for decades to spot potential opportunities for profit. Let's consider the market mechanics of a typical cup and. Web what is the cup and handle pattern? It´s one of the easiest patterns to identify. Deconstructing the cup and handle. The cup and handle is a bullish continuation pattern. When the pattern appears on a stock chart, it shows a period of price consolidation followed by a price breakout. The buy signal is confirmed when the stock breaks above the resistance level that capped the uptrend during the handle formation. The cup typically takes shape as a pull back and subsequent rise, with the candlesticks in the center of the cup giving it the form of a rounded bottom. One of the most important chart patterns in the stock market is the cup and handle pattern, invented by william o’neill. Web the cup and handle security trading pattern is a bullish continuation pattern used in technical analysis. Web the cup and handle pattern is a technical analysis charting pattern that appears in financial markets, particularly in stock trading. Deconstructing the cup and handle. Well, if you look at the pattern from its side, it looks like a cup with a handle. Web william o'neil's cup with handle is a bullish continuation pattern that marks a consolidation period followed by a breakout. Web the cup and handle is one of many chart patterns that traders can use to guide their strategy. Then there is a drop. Web a cup and handle is a technical chart pattern that resembles a cup and handle where the cup is in the shape of a u and the handle has a slight downward drift. The pattern starts out with an uptrend. It’s a technical chart pattern made popular by william o’neil in his book “ how to make money in stocks.” it’s a continuation pattern that may indicate future gains. The cup and the handle.

Cup and Handle Patterns Comprehensive Stock Trading Guide

.png)

Cup and Handle Chart Pattern How To Use It in Crypto Trading Bybit Learn

Cup and Handle Patterns Comprehensive Stock Trading Guide

Cup and Handle Patterns Comprehensive Stock Trading Guide

Cup and Handle Pattern Trading Strategy Guide Synapse Trading

The Cup and Handle Chart Pattern (Trading Guide)

Cup And Handle Pattern How To Verify And Use Efficiently How To

Cup and Handle Patterns Comprehensive Stock Trading Guide

:max_bytes(150000):strip_icc()/CupandHandleDefinition1-c721e47fd1f7451997d0d5d941f6e174.png)

Cup and Handle Pattern How to Trade and Target with an Example

Cup And Handle Pattern How To Verify And Use Efficiently How To

The Price Then Chops Around, Forming A Sideways Triangle Pattern Or A Shallow Descending Channel.

It Can Be Used To Spot Shares Potentially Poised For Growth If Correctly Identified And Also Caught In Time.

Web Among The Eight Principal Base Patterns — Including The Ascending Base , Base On Base , Double Bottom , Flat Base , High, Tight Flag , Ipo Base And Saucer — The Cup With Handle Remains To.

Once The Pattern Is Complete, The Stock Should Continue To Trade Upward, In The Direction It Was Previously.

Related Post: