Cryptocurrency Candlestick Patterns

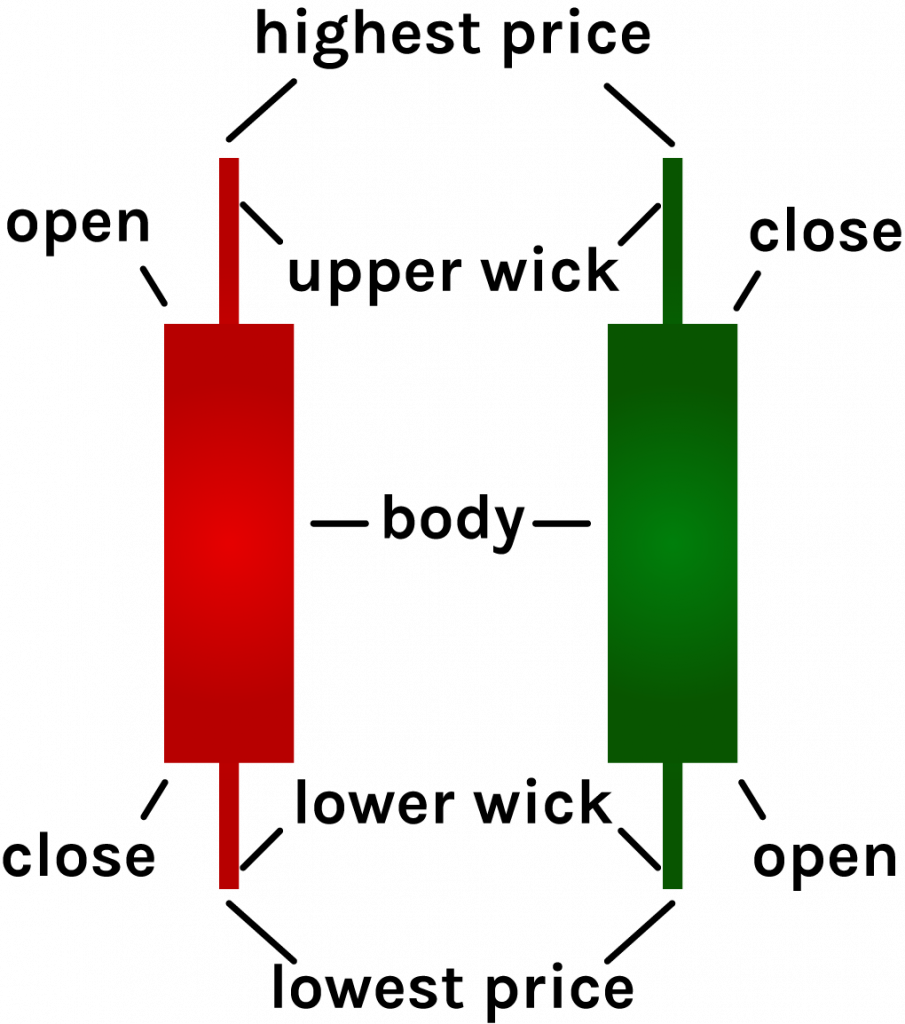

Cryptocurrency Candlestick Patterns - Patterns detected on the last closed/completed candlestick. A candlestick denotes an asset’s price activity during a specified period. Candlestick patterns are widely used to represent trading prices in the crypto market. Web this guide explores bullish candlestick patterns, a form of technical analysis used to watch out for upcoming uptrends in the crypto markets. Web a candlestick chart is a combination of multiple candles a trader uses to anticipate the price movement in any market. Similar to more familiar line and bar graphs, candlesticks show time across the horizontal axis, and price data on the vertical axis. The ability to assess price movements and recognise patterns in the charts is crucial to doing what in finance is called technical analysis. In other words, a candlestick chart is a technical tool that gives traders a complete visual representation of. This provides insight into market sentiment and potential trading opportunities. Web there are three sections to a candlestick: Reading a crypto token chart is one of the most important skills to have when trading crypto. Web there are three sections to a candlestick: The ability to assess price movements and recognise patterns in the charts is crucial to doing what in finance is called technical analysis. What candlesticks are and why they are important. Traders can choose the. See the latest candlestick patterns detected on various cryptocurrencies and timeframes. Thomas bukowski, an author and trader, lists 103 such formations that can provide insight into trend direction. So it’s good to take a little time to learn how these work. What are candlesticks in cryptocurrency trading? Pros and cons of relying on candlestick patterns for crypto trading. The chart, as the name implies, consists of candles, that is, shapes that look like candlesticks and are made up of four points. Web latest candlestick patterns detected. Web top 20 crypto chart patterns. Each candlestick represents a particular time. Candlestick patterns serve as visual representations of price movements within cryptocurrency markets. Reading a crypto token chart is one of the most important skills to have when trading crypto. So it’s good to take a little time to learn how these work. The open, close, high and low. Web six bearish candlestick patterns. Web latest candlestick patterns detected. Web six bearish candlestick patterns. Pros and cons of relying on candlestick patterns for crypto trading. Web a candlestick pattern is a movement in an asset’s price shown graphically on the candlestick chart to anticipate a specific market behavior. Web this guide explores bullish candlestick patterns, a form of technical analysis used to watch out for upcoming uptrends in the. The body is either green (market rising) or red (market falling) in hue, and in some charts, they appear to be black (market falling) and white (market rising). Web this guide explores bullish candlestick patterns, a form of technical analysis used to watch out for upcoming uptrends in the crypto markets. Most patterns have descriptive names and the opposite variation. The open of a candlestick. Web latest candlestick patterns detected. The chart, as the name implies, consists of candles, that is, shapes that look like candlesticks and are made up of four points. Web crypto chart patterns appear when traders are buying and selling at certain levels, and therefore, price oscillates between these levels, creating candlestick patterns. Web today, cryptocurrency. The open of a candlestick. Triangle chart patterns (6) ascending triangle. The chart, as the name implies, consists of candles, that is, shapes that look like candlesticks and are made up of four points. Web to understand candlesticks within the context of the crypto chart, it is essential to learn: Web candlestick charting is a technique that allows you to. Triangle chart patterns (6) ascending triangle. — crypto candlestick charts provide data such as the highest and lowest price, opening and closing price, and the general price movement of an asset over time. What are candlesticks in cryptocurrency trading? Web candlestick patterns are used by crypto traders to attempt to predict whether the market will trend “bullishly” or “bearishly.” “bullish”. Pros and cons of relying on candlestick patterns for crypto trading. Web this guide explores bullish candlestick patterns, a form of technical analysis used to watch out for upcoming uptrends in the crypto markets. Generally, bearish patterns on crypto candlestick charts take place after an uptrend. Patterns detected on the last closed/completed candlestick. Being able to read a candlestick chart. Web this guide explores bullish candlestick patterns, a form of technical analysis used to watch out for upcoming uptrends in the crypto markets. Purposecandlestick charts are a key tool for the technical analysis. Web a candlestick pattern is a movement in an asset’s price shown graphically on the candlestick chart to anticipate a specific market behavior. Traders can choose the periods they want to examine based on whether they are making low or high timeframe decisions. Keep reading to learn more. Web a candlestick chart is a combination of multiple candles a trader uses to anticipate the price movement in any market. Generally, bearish patterns on crypto candlestick charts take place after an uptrend. Although 20 patterns may sound like a lot, it’s only 10 different patterns (as the others are inverted). Test your knowledge & trade without risks with demo accounts. Web when you research crypto assets, you may run into a special type of price graph called a candlestick chart. But unlike simpler graphs, candlesticks. Web candlestick charting is a technique that allows you to visually display the change in the price of an asset, be it a stock, an entire fund, or a cryptocurrency, over time. The open, close, high and low. These twenty trading patterns are categorized into four groupings: A candlestick denotes an asset’s price activity during a specified period. Similar to more familiar line and bar graphs, candlesticks show time across the horizontal axis, and price data on the vertical axis.

Cryptocurrency Trading Candlesticks & Chart Patterns for Beginners

The 8 Most Important Candlestick Patterns in Crypto Trading (How to

3 Simple Ways To Use Candlestick Patterns In Trading Crypto YouTube

Candlestick pattern stock forex crypto with eps svg pdf Etsy

Cryptocurrency Trading How to read a candle stick chart Candlestick

Candlestick Patterns Cheat sheet r/CryptoMarkets

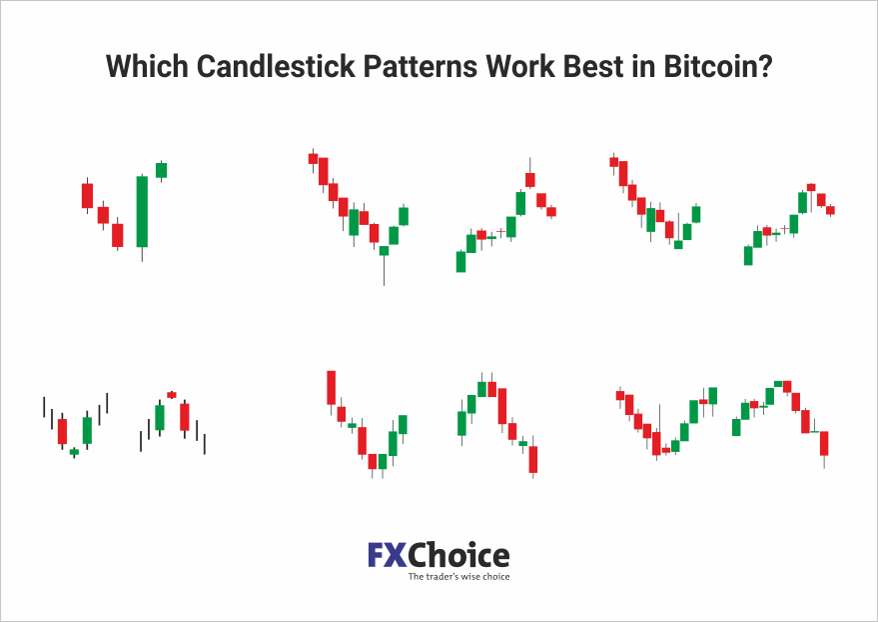

Which candlestick patterns work best in Bitcoin?

Crypto Candlestick Patterns Cheat Sheet PDF 2024

Ultimate Candlestick Cheat Sheet For Crypto for KRAKENEURUSD by Skyrex

The 8 Most Important Crypto Candlesticks Patterns Phemex Academy

Web Crypto Chart Patterns Appear When Traders Are Buying And Selling At Certain Levels, And Therefore, Price Oscillates Between These Levels, Creating Candlestick Patterns.

— Crypto Candlestick Charts Provide Data Such As The Highest And Lowest Price, Opening And Closing Price, And The General Price Movement Of An Asset Over Time.

So It’s Good To Take A Little Time To Learn How These Work.

Different Types Of Candlesticks And Their Meaning.

Related Post: