Crypto Trade Patterns

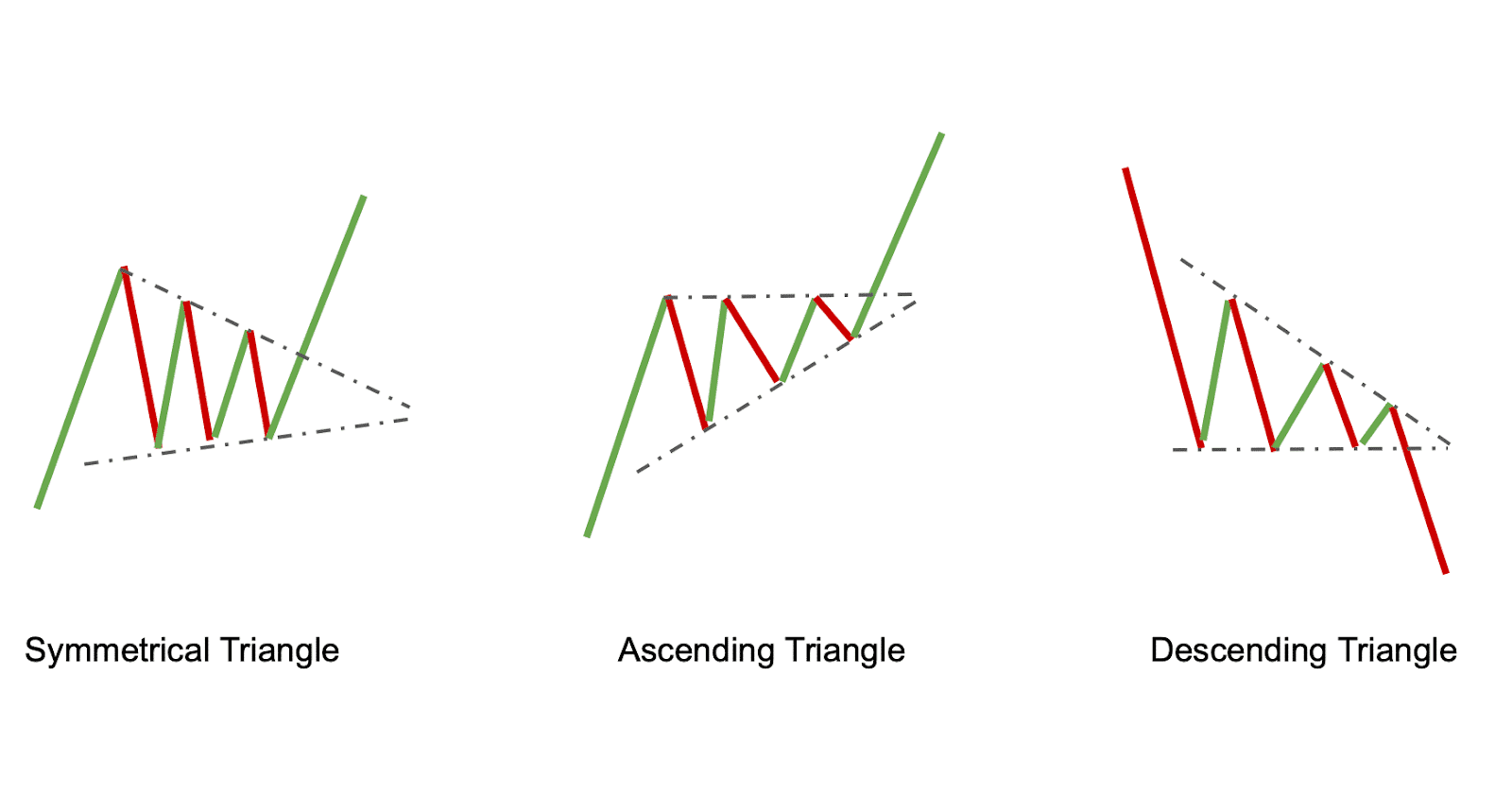

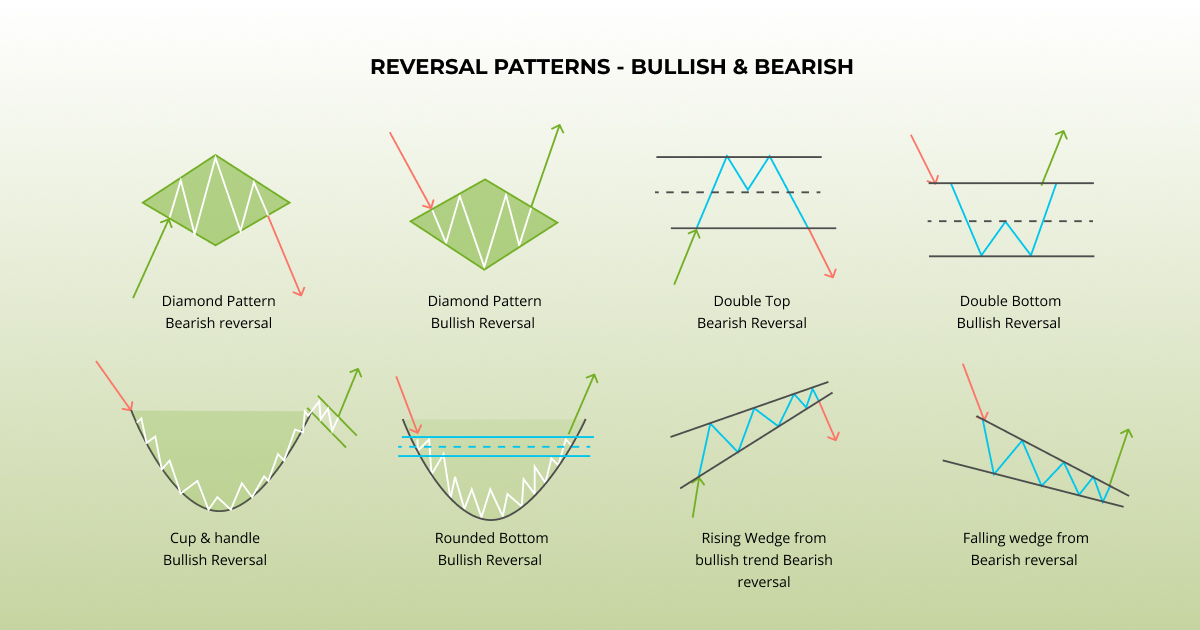

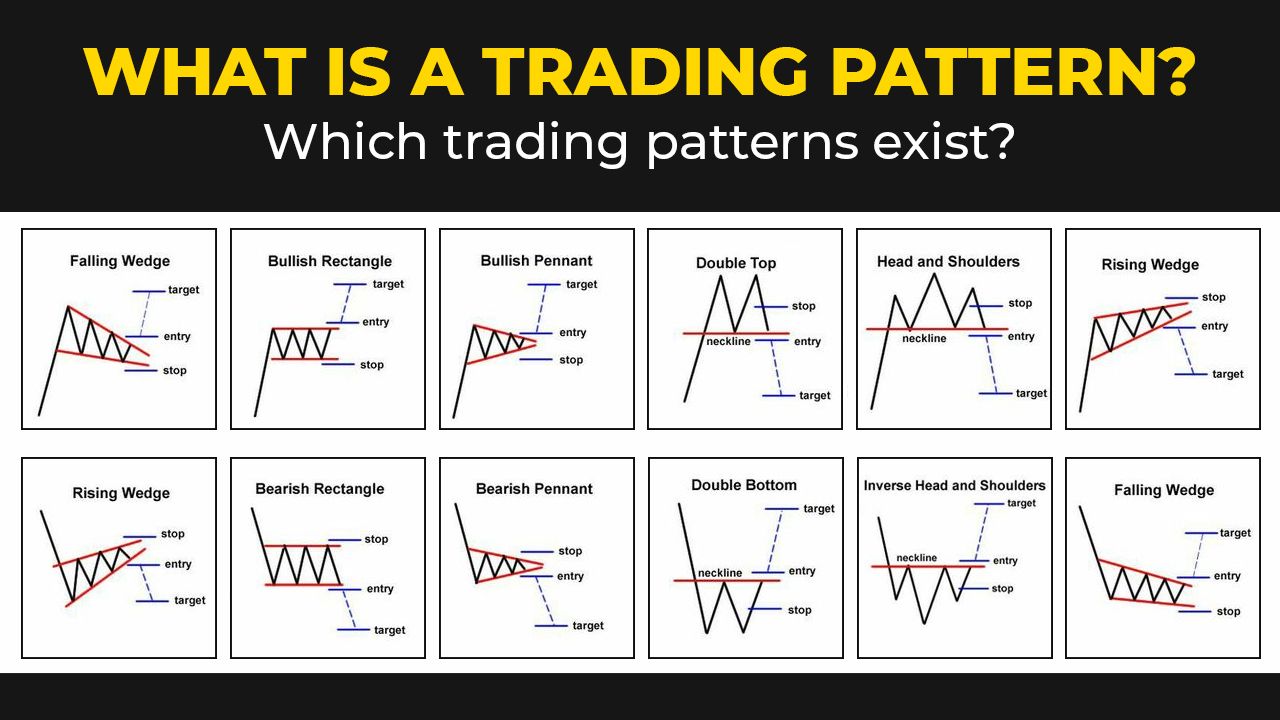

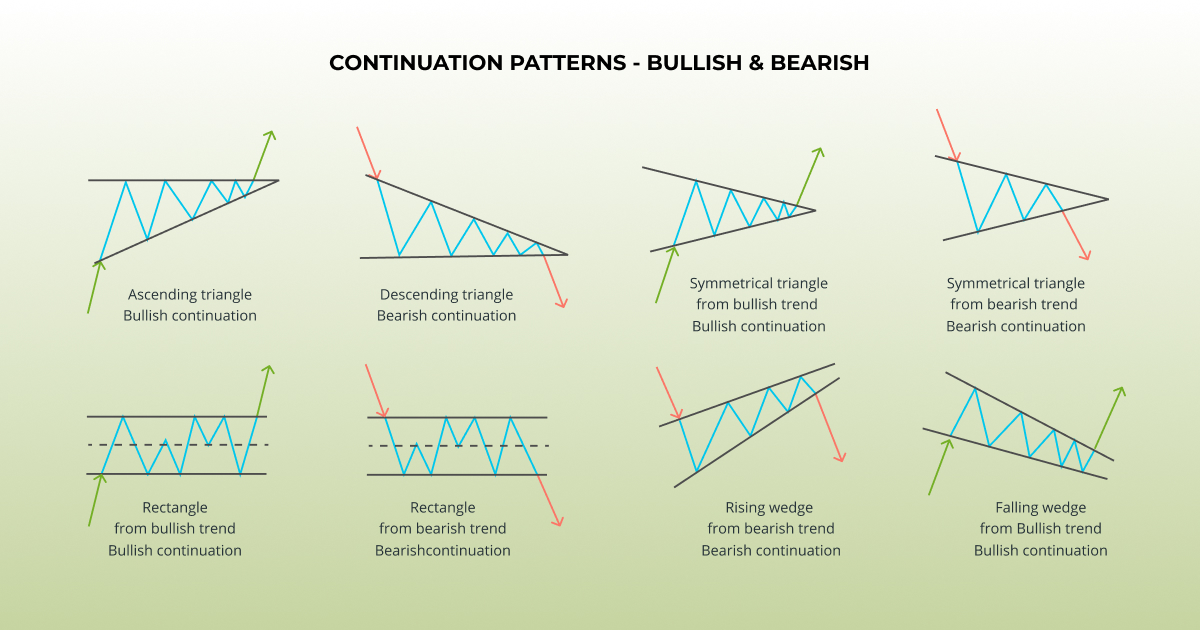

Crypto Trade Patterns - Web published may 5, 2023 updated dec 12, 2023. These twenty trading patterns are categorized into four groupings: 🖨 every trader must print this cheatsheet and keep it on the desk 👍 🖼 printable picture below (right click > save image as…) in finance. In fact, this skill is what traders use to determine the strength of a current trend during key market movements. Web what are crypto trading patterns? Price channels are built by creating two ascending, descending, or horizontal parallel lines that connect a series of highs and lows. Familiarize yourself with the most common patterns, like head and shoulders, cup and handle, flags, and triangles. Although 20 patterns may sound like a lot, it’s only 10 different patterns (as the others are inverted). Altfins analyzes the top 500 coins (by market cap) and this list is updated every quarter. Here are the top options for traders in 2024. Web typically, in the market, we see the following types of trading patterns: Continuation patterns indicate that a trend will almost certainly continue in the same direction. The head and shoulders chart pattern is one of the easiest crypto trading signals to identify and is one of the most popular forms of technical analysis. Altfins’ automated chart pattern recognition engine. Here are the top options for traders in 2024. These charts are a standard visual tool for depicting price fluctuations in the stock, forex, and cryptocurrency markets. Candlestick charts are a popular tool used in technical analysis to identify potential buying and selling opportunities. Price channels crypto chart patterns. These are areas of support (lower) and resistance (higher) and prices. Trend reversal patterns fall into two distinctive categories: Which assets are used for pattern recognition? Price channels crypto chart patterns. These patterns can be seen on a trading chart and should form the basis of any cryptocurrency trading strategy. A candlestick pattern is a great tool for technical analysis. Altfins’ automated chart pattern recognition engine identifies 26 trading patterns across multiple time intervals (15 min, 1h, 4h, 1d), saving traders a ton of time, including: Bullish reversal patterns, bearish reversal patterns, and candlestick continuation patterns. Price channels crypto chart patterns. Candlestick patterns are visual representations of price movements in crypto market, commonly used in technical analysis. Web in fact,. Even if you're unfamiliar with trading, you've probably encountered candlestick charts. Price channels crypto chart patterns. Familiarize yourself with the most common patterns, like head and shoulders, cup and handle, flags, and triangles. Bullish candlestick patterns form at a market downturn and signal that the price of an asset is likely to reverse. Triangle chart patterns (6) ascending triangle. Triangle chart patterns (6) ascending triangle. These patterns can be seen on a trading chart and should form the basis of any cryptocurrency trading strategy. Web in the world of crypto trading, recognizing patterns can yield more than insights. Even if you're unfamiliar with trading, you've probably encountered candlestick charts. Web chart patterns are formations that appear on the price. Hey here is technical patterns cheat sheet for traders. Crypto trading charts can look intimidating at first. These twenty trading patterns are categorized into four groupings: At the time of writing, the meme coin was trading at $0.000008732 with a market capitalization of over $3.67 billion. Web in fact, crypto tony, a popular crypto analyst, also pointed out this development. Bullish candlestick patterns form at a market downturn and signal that the price of an asset is likely to reverse. We consider trading fees, liquidity, security features, and regulatory compliance, as these factors can all define and impact the trading experience. Why are crypto chart patterns so important? These patterns can indicate potential price movements. Web crypto trading patterns are. Even if you're unfamiliar with trading, you've probably encountered candlestick charts. At the time of writing, the meme coin was trading at $0.000008732 with a market capitalization of over $3.67 billion. Familiarize yourself with the most common patterns, like head and shoulders, cup and handle, flags, and triangles. These patterns can indicate potential price movements. These charts are a standard. Which assets are used for pattern recognition? Web published may 5, 2023 updated dec 12, 2023. Patterns are identified over 4 time intervals (1d, 4h, 1h, 15 min). This article will look at the 5 top patterns that you should know. Interestingly, these shame shapes and patterns often form on the price charts of cryptocurrencies like bitcoin and other financial. Altfins analyzes the top 500 coins (by market cap) and this list is updated every quarter. Due to some chart patterns signaling different things depending on when they occur, there are multiple entries for the same stock chart patterns. Analysts said the path of least resistance for bitcoin is on the higher side. 🖨 every trader must print this cheatsheet and keep it on the desk 👍 🖼 printable picture below (right click > save image as…) in finance. Candlestick patterns are visual representations of price movements in crypto market, commonly used in technical analysis. Web what are crypto trading patterns? Web crypto trading patterns are common movements in the way the price of a cryptocurrency tends to trend. Web crypto chart patterns to help you earn money. First, let’s cover reversal chart patterns as they usually trigger higher trading volumes and can help you make good amounts of profit. Price channels are built by creating two ascending, descending, or horizontal parallel lines that connect a series of highs and lows. These charts are a standard visual tool for depicting price fluctuations in the stock, forex, and cryptocurrency markets. Familiarize yourself with the most common patterns, like head and shoulders, cup and handle, flags, and triangles. Pionex is a unique crypto trading app that offers access to 16 different crypto trading bots. Continuation patterns indicate that a trend will almost certainly continue in the same direction. Hey here is technical patterns cheat sheet for traders. Web crypto chart patterns appear when traders are buying and selling at certain levels, and therefore, price oscillates between these levels, creating candlestick patterns.

Top Chart Patterns For Crypto Trading

Crypto Trading Patterns Cheat Sheet The Cryptonomist

Chart Patterns for Crypto Trading. Crypto Chart Patterns Explained

Top Chart Patterns For Crypto Trading

Chart Patterns for Crypto Trading. Trading Patterns Explained

5 Crypto Chart Patterns For Crypto Trading ZenLedger

Trading Range Crypto Pattern what it is and how to trade it

Chart Patterns for Crypto Trading. Trading Patterns Explained

Chart Patterns for Crypto Trading. Crypto Chart Patterns Explained

A Beginner's Guide to Crypto Chart Patterns and Cheat Sheet Margex

These Patterns Can Be Seen On A Trading Chart And Should Form The Basis Of Any Cryptocurrency Trading Strategy.

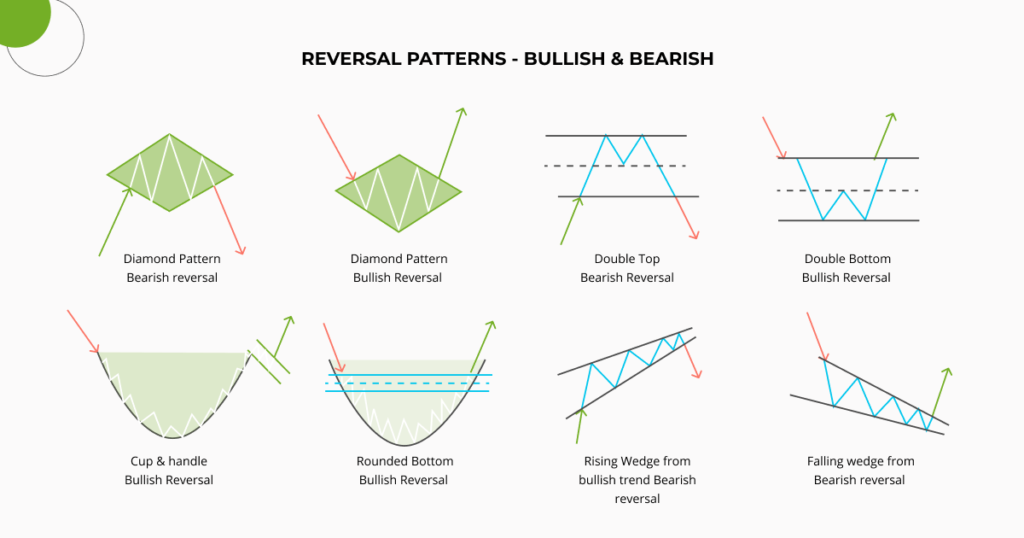

Bullish Reversal Patterns, Bearish Reversal Patterns, And Candlestick Continuation Patterns.

Web Published May 5, 2023 Updated Dec 12, 2023.

Reversal Patterns Indicate The Occurrence Of A Trend Reversal.

Related Post: