Crypto Candlestick Patterns

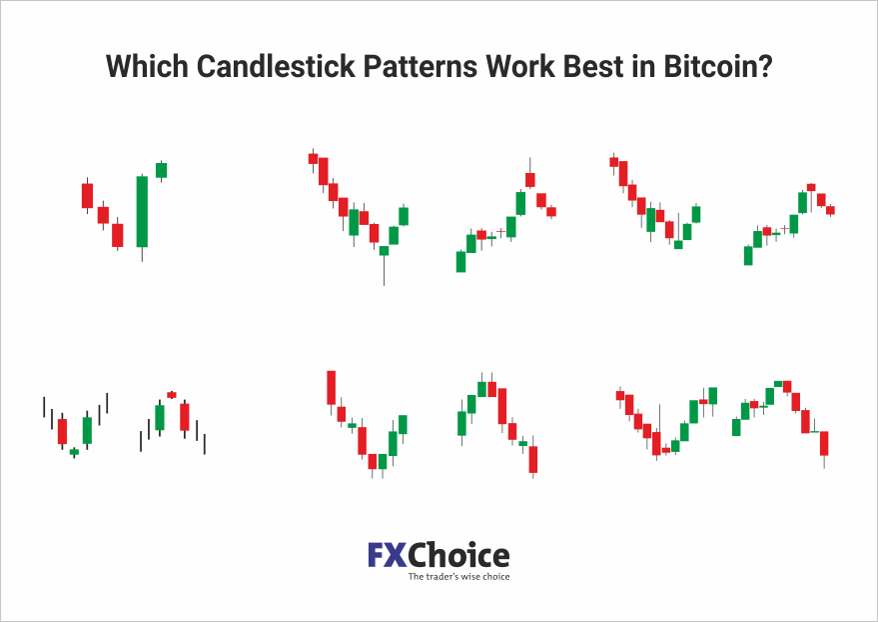

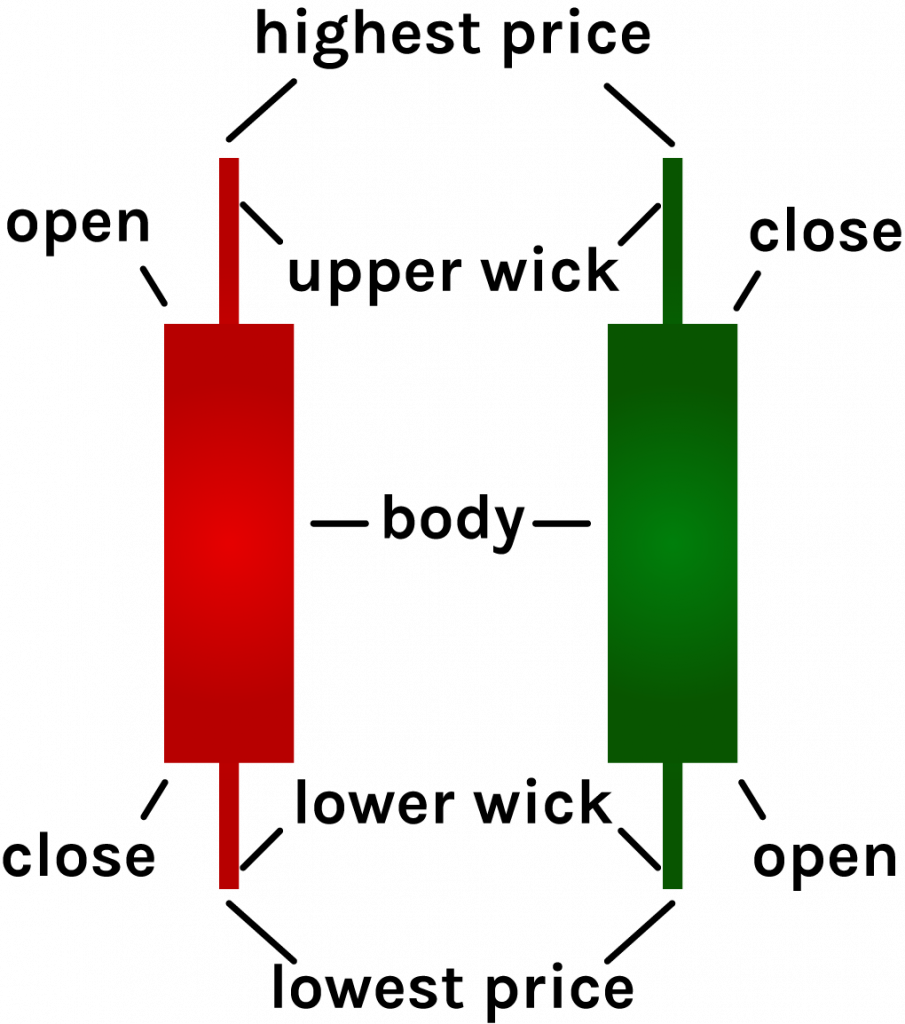

Crypto Candlestick Patterns - Keep reading to learn more. They are divided into five groups: Web how do you read crypto candlestick patterns? Technical analysis is an essential tool in a crypto trader’s toolbox, aiding in finding entry and exit levels for cryptocurrency trades. Web candlestick patterns are visual representations of price movements in crypto market, commonly used in technical analysis. The neckline coincides with the previously outlined resistance trend line. Most patterns have descriptive names and the opposite variation with the same name. Thomas bukowski, an author and trader, lists 103 such formations that can provide insight into trend direction. With a circulating supply of 0, eth/btc price action candlestick set's price movement is currently negative. Web our candlestick pattern cheat sheet will help you with your technical analysis. Thomas bukowski, an author and trader, lists 103 such formations that can provide insight into trend direction. Web crypto chart patterns — investing strategies — beginner's guide to cryptocurrency investing. Web here is the cheat sheet for the candlestick patterns. He recalled that ethereum (eth) managed. Each candlestick represents a particular time. This provides insight into market sentiment and potential trading opportunities. Web candlestick patterns are universal tools in the arsenal of any cryptocurrency trader. The neckline coincides with the previously outlined resistance trend line. Web the xrp/btc ratio currently stands at 0.00000803, a dramatic fall of 81.44% from its january level of 0.00001457. Purposecandlestick charts are a key tool for the. Each candlestick represents a particular time. Key trading patterns to know. Technical analysis is an essential tool in a crypto trader’s toolbox, aiding in finding entry and exit levels for cryptocurrency trades. The creation of an inverse head and shoulders pattern and the daily macd supports the bullish bitcoin scenario. By this time yesterday, bitcoin [btc] was barely hanging onto. Web a reversal candle pattern is a type of candlestick grouping or positioning that tells us that the current price change might try and change direction. What candlesticks are and why they are important. In this potential inverse head and shoulders pattern, btc is completing the right shoulder. With a circulating supply of 0, eth/btc price action candlestick set's price. Candlestick patterns can be explained as patterns that are visually represented on financial charts and provide information about price movements. These patterns can help predict future price movements of an asset and are often used in technical analysis. The body is either green (market rising) or red (market falling) in hue, and in some charts, they appear to be black. The creation of an inverse head and shoulders pattern and the daily macd supports the bullish bitcoin scenario. Web when you research crypto assets, you may run into a special type of price graph called a candlestick chart. Pros and cons of relying on candlestick patterns for crypto trading. Individual candlesticks form candlestick patterns that can indicate whether prices are. The neckline coincides with the previously outlined resistance trend line. Web eth/btc price action candlestick set currently sits at a price of $0.000000000000000000 (eth/btc price action candlestick set/usd) with a live market capitalization of 0. A candlestick chart is a method of displaying the historical price movement of an asset over time. Each “candle” depicted on a crypto trader’s chart. A beginner's guide to candlesticks. Web how do you read crypto candlestick patterns? What candlesticks are and why they are important. In other words, a candlestick chart is a technical tool that gives traders a complete visual representation of how the price of an asset has moved over a. Usd) 18.74% in the same period. Web there are three sections to a candlestick: Understanding them, and the various historical chart patterns are what allows crypto traders to interpret and analyze the trend of the market and make pattern trading decisions. Key trading patterns to know. This guide explores bullish candlestick patterns, a form of technical analysis used to watch out for upcoming uptrends in the. Web the xrp/btc ratio currently stands at 0.00000803, a dramatic fall of 81.44% from its january level of 0.00001457. Different types of candlesticks and their meaning. The body of a candlestick represents the opening and closing prices for a given time period. For example, the candlestick patterns included in the cheat sheet can help you identify reversal signals, bullish and. Candlestick patterns help with technical analysis, and they are often used to figure out how the price of cryptocurrencies is changing. Individual candlesticks form candlestick patterns that can indicate whether prices are likely to rise, fall, or remain unchanged. Understanding them, and the various historical chart patterns are what allows crypto traders to interpret and analyze the trend of the market and make pattern trading decisions. Keep reading to learn more. In other words, a candlestick chart is a technical tool that gives traders a complete visual representation of how the price of an asset has moved over a. The body of a candlestick represents the opening and closing prices for a given time period. In this potential inverse head and shoulders pattern, btc is completing the right shoulder. The body is either green (market rising) or red (market falling) in hue, and in some charts, they appear to be black (market falling) and white (market rising). At press time, it was worth $63,111, up by 4% on the daily chart. Web i analyzed over seven hundred million japanese candlestick pattern trades in the crypto, forex, and stock market spanning multiple decades to determine what works and doesn’t. Web bullish btc pattern leads to breakout. Similar to more familiar line and bar graphs, candlesticks show time across the horizontal axis, and price data on the vertical axis. Web then knowing about (crypto) technical analysis candlestick patterns can help you. The neckline coincides with the previously outlined resistance trend line. Web a candlestick chart is a combination of multiple candles a trader uses to anticipate the price movement in any market. They are divided into five groups:

Candlestick pattern stock forex crypto with eps svg pdf Etsy

Ultimate Candlestick Cheat Sheet For Crypto for KRAKENEURUSD by Skyrex

Candlestick Patterns Crypto Bruin Blog

A Beginner Crypto Trader's Guide to Reading Candlestick Patterns

The 8 Most Important Crypto Candlesticks Patterns Phemex Academy

How to read Crypto Candlestick Charts Crypto Trading 101

Chart Patterns for Crypto Trading. Part 1 Candlestick Patterns Explained

Candlestick Patterns Cheat sheet r/CryptoMarkets

How to Read Crypto Candlesticks Charts

Crypto Candlestick Patterns Cheat Sheet PDF 2024

Web In This Article, We Break Down The Basic Anatomy Of The Candlestick, Along With Some Of The Most Important Patterns A Crypto Trader Should Know.

Traders Use These Patterns To Identify Potential Trend Reversals Or Continuations In Market Behavior.

Each Candlestick Represents A Particular Time.

For Example, The Candlestick Patterns Included In The Cheat Sheet Can Help You Identify Reversal Signals, Bullish And Bearish Candle Types And More.

Related Post: