Cp2000 Response Letter Template

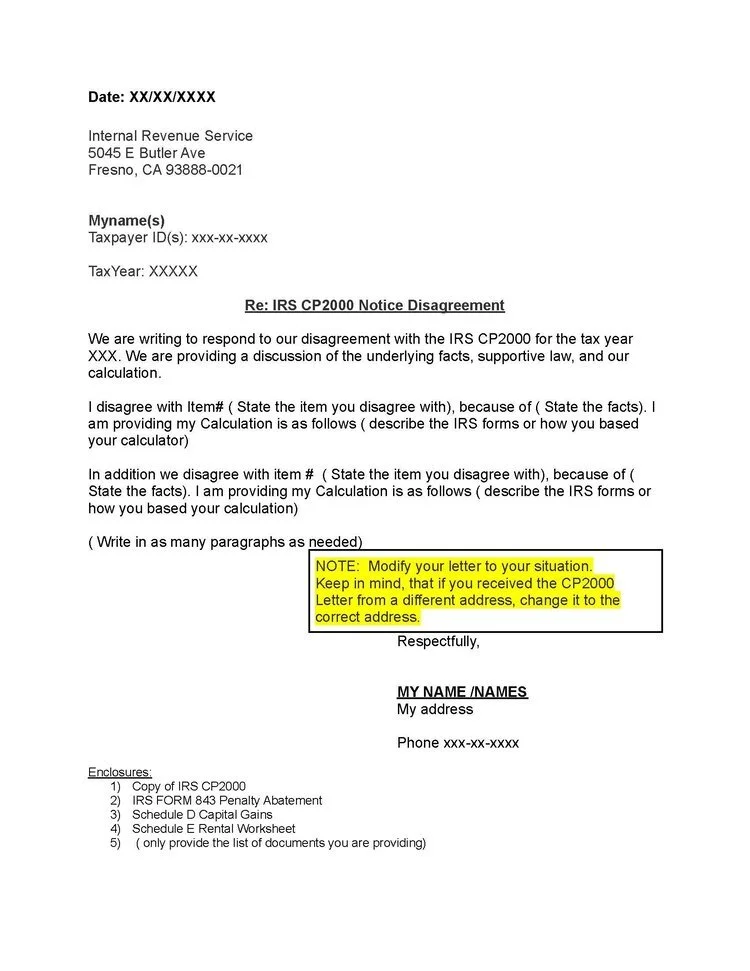

Cp2000 Response Letter Template - Web here’s what to do. If a taxpayer agrees with the cp2000 notice — they can follow the instructions on the response form or notice, sign,. Web a cp2000 notice is an underreporter inquiry that gets issued when the filed tax return does not resemble income information reported to the irs by third parties. Go through the “explanation of changes to your form 1040” section and. Carefully read through the cp2000 letter, including the proposed. We'll send you a letter proposing changes…. There are several ways to respond: Web respond to the notice. Web cp2000 response letter sample for unreported cryptocurrency transactions. Response to cp2000 notice dated month, xx, year. Read the entire notice so you understand the problem. Make sure you actually earned the income that the irs is claiming you did not report. Send your response to the notice within 30 days of the date on the notice. Web irs sends audit letters to taxpayers when tax returns and reported data from employers or banks do not match.. Web cp2000 response letter sample for unreported cryptocurrency transactions. Web here's what to expect and how to handle each one. If a taxpayer agrees with the cp2000 notice — they can follow the instructions on the response form or notice, sign,. There are several ways to respond: Web three ways to respond to irs notice cp2000: If a taxpayer agrees with the cp2000 notice — they can follow the instructions on the response form or notice, sign,. Read the entire notice so you understand the problem. There are several ways to respond: Web an irs cp2000 notice is a document sent by the irs notifying you of discrepancies between the income, credits, or deductions reported on. Web an irs cp2000 notice is a document sent by the irs notifying you of discrepancies between the income, credits, or deductions reported on your tax return. Carefully read through the cp2000 letter, including the proposed. Web a cp2000 notice is a letter indicating a discrepancy between the information in the tax return the irs has on file for you. Send your response to the notice within 30 days of the date on the notice. Read the entire notice so you understand the problem. Web a cp2000 notice is a letter indicating a discrepancy between the information in the tax return the irs has on file for you and the information provided by an employer. It’s always best to respond. Web respond to the notice. Web a cp2000 notice is an underreporter inquiry that gets issued when the filed tax return does not resemble income information reported to the irs by third parties. Carefully read through the cp2000 letter, including the proposed. Web the first page of the notice provides a summary of proposed changes to your tax, a phone. Web an irs cp2000 notice is a document sent by the irs notifying you of discrepancies between the income, credits, or deductions reported on your tax return. Cp2000 notices (underreporter inquiries) have a. Response to cp2000 notice dated month, xx, year. Web the first page of the notice provides a summary of proposed changes to your tax, a phone number. Web a cp2000 notice is an underreporter inquiry that gets issued when the filed tax return does not resemble income information reported to the irs by third parties. There are several ways to respond: Read the entire notice so you understand the problem. Response to cp2000 notice dated month, xx, year. Web respond to the notice. Send your response to the notice within 30 days of the date on the notice. If a taxpayer agrees with the cp2000 notice — they can follow the instructions on the response form or notice, sign,. Read the entire notice so you understand the problem. There are several ways to respond: Go through the “explanation of changes to your form. Web cp2000 response letter sample for unreported cryptocurrency transactions. Web respond to the notice. We'll send you a letter proposing changes…. Changes to your tax return and the supporting documentation. It’s always best to respond to an irs notice before the deadline in the notice, but you can ask for more time. Go through the “explanation of changes to your form 1040” section and. It’s always best to respond to an irs notice before the deadline in the notice, but you can ask for more time. March 28, 2022 | last updated: Request for verification of unreported income, payments, and/or credits. To whom it may concern, i received your notice dated month, xx, year, a copy of which is enclosed as well as. The irs generally sends three waves of cp2000. Make sure you actually earned the income that the irs is claiming you did not report. Web the irs cp2000 notice is a notification sent to taxpayers when their tax returns do not match the income and tax payments reported by their employers or. Web a cp2000 notice is an underreporter inquiry that gets issued when the filed tax return does not resemble income information reported to the irs by third parties. Web respond to the notice. Web cp2000 response letter sample for unreported cryptocurrency transactions. Web a cp2000 notice is a letter indicating a discrepancy between the information in the tax return the irs has on file for you and the information provided by an employer. By mail, by fax (the fax number is. Web irs sends audit letters to taxpayers when tax returns and reported data from employers or banks do not match. A cp2000 letter, “notice of underreported income,” is not a formal audit that would require a full tax examination by the irs. Web when our records don't match what you reported on your tax return….

Cp2000 Response Letter Template Resume Letter

Irs Cp2000 Response Form Pdf Elegant Outstanding Payment with Irs

Cp2000 Response Letter Template Samples Letter Template Collection

Irs Cp2000 Example Response Letter amulette

Cp2000 Response Letter Template

Cp2000 response letter sample Fill out & sign online DocHub

.jpeg)

Cp2000 Response Template

IRS Audit Letter CP2000 Sample 2

IRS Audit Letter CP2000 Sample 4

Cp2000 Response Letter Template Samples Letter Template Collection

Web The First Page Of The Notice Provides A Summary Of Proposed Changes To Your Tax, A Phone Number To Call For Assistance, And The Steps You Should Take To Respond.

Send Your Response To The Notice Within 30 Days Of The Date On The Notice.

Web The Cp2000 Notice Is Sent By The Irs When There Is A Discrepancy Between The Income, Payments, Or Credits Reported On Your Tax Return And The Information The Irs.

If A Taxpayer Agrees With The Cp2000 Notice — They Can Follow The Instructions On The Response Form Or Notice, Sign,.

Related Post: