Continuation Patterns

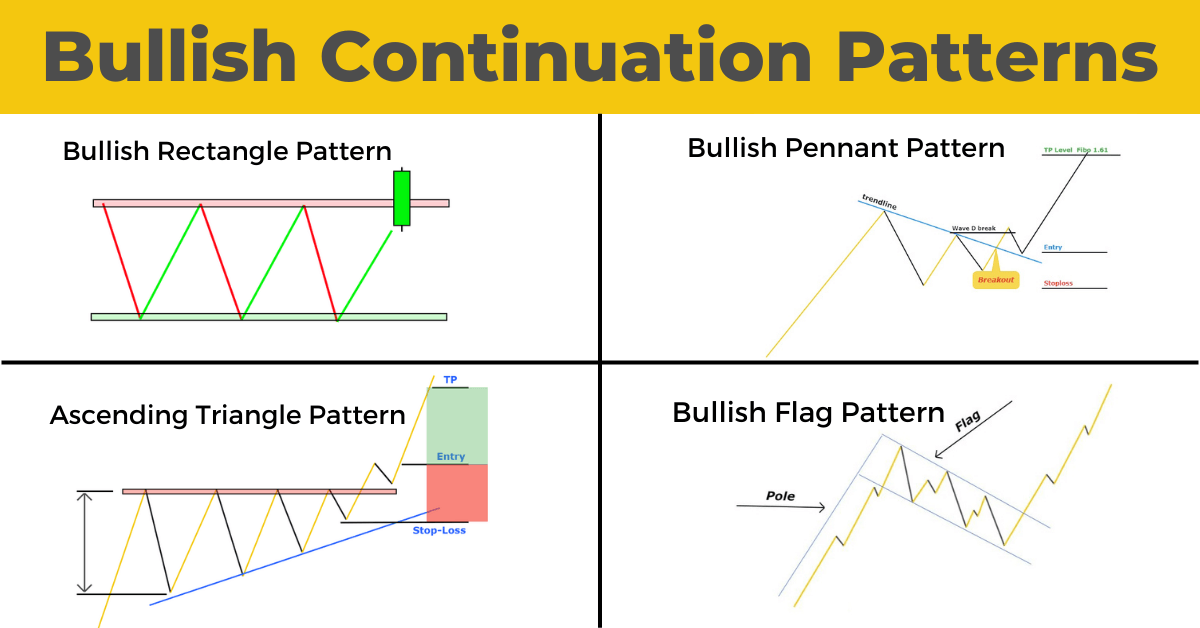

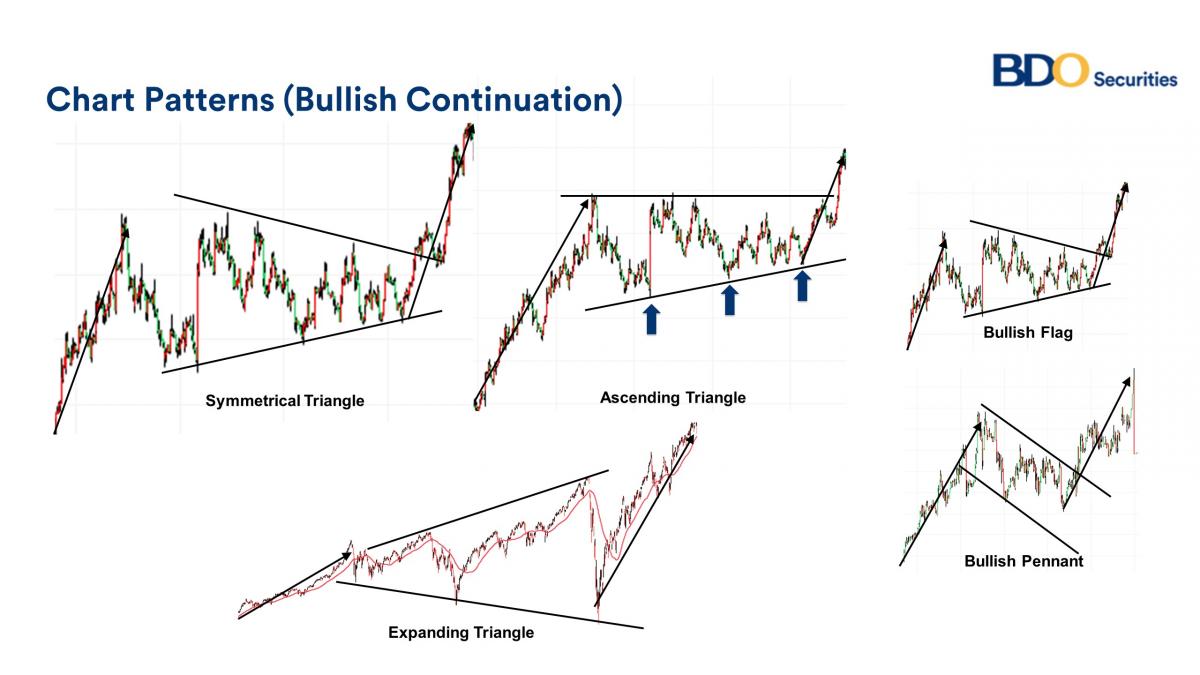

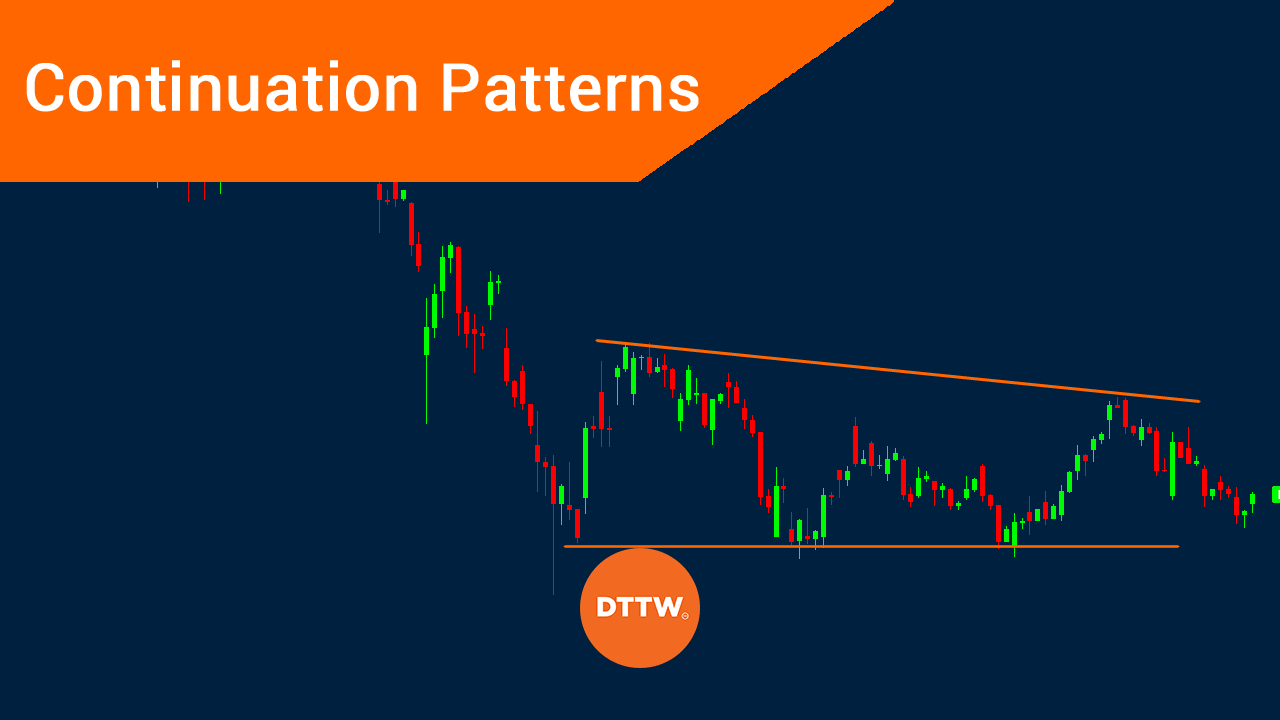

Continuation Patterns - Web learn how to trade continuation patterns, which signal that the prevailing trend is likely to continue after a temporary pause. Each one of these patterns can be identified on charts of the timeframe of your choice. Web a continuation pattern suggests that the existing trend is likely to persist after the completion of the pattern. This article explores various continuation patterns, including triangles, flags, pennants, and rectangles, shedding light on their significance in technical analysis. Learn how to identify, trade, and profit from triangles, pennants, flags, and rectangles, the most common types of continuation patterns. Find out how to spot and trade with flag, rectangle, pennant, wedge, and rising/falling wedge patterns in price charts. Understanding their strengths and weaknesses, being cautious of false signals, and using them alongside other indicators can help you build solid trading strategies and avoid getting lost in. Web continuation patterns are geometric shapes in the price data that indicate a price trend is likely to continue. It’s not complicated to figure out the reversal pattern. Web there was a break below a bearish flag pattern with support near $60,950 on the hourly chart of the btc/usd pair (data feed from kraken). Web continuation patterns are geometric shapes in the price data that indicate a price trend is likely to continue. In this fxopen guide, we explain how candlestick continuation patterns work and how you can use them to identify market trends and make informed trading decisions. In contrast to reversal patterns, continuation patterns signal a temporary consolidation in the middle of. Web a continuation pattern is a chart pattern described as a series of price movements that indicate that there is a temporary halt in the current prevailing trend, but that the current trend should continue after the break. The precious metal is likely to find buyers on dips, says fawad razaqzada, market analyst at city index and forex.com in. These. Web what are continuation patterns? It’s not complicated to figure out the reversal pattern. It’s a shape the stock chart makes. Web what is a continuation pattern? Web continuation candlestick patterns are a common tool traders use in technical analysis of price charts to identify when a prevailing trend is likely to continue after a pause. Web there are two main types of chart patterns that you are likely to know: These patterns are recognizable chart formations that signal a temporary period of consolidation within an ongoing trend. Each one of these patterns can be identified on charts of the timeframe of your choice. But why does the price go through a period of consolidation? You. In this fxopen guide, we explain how candlestick continuation patterns work and how you can use them to identify market trends and make informed trading decisions. Web a continuation pattern suggests that the existing trend is likely to persist after the completion of the pattern. Web learn what continuation patterns are, how to use them, and what types of continuation. Web a continuation pattern is a chart pattern described as a series of price movements that indicate that there is a temporary halt in the current prevailing trend, but that the current trend should continue after the break. Web continuation patterns are a type of chart pattern that forms during a temporary pause in an existing market trend before it. Chart patterns can be divided into two broad categories: In contrast to reversal patterns, continuation patterns signal a temporary consolidation in the middle of a trend. Continuation patterns form in the intermediate (middle) part of a price trend. Web learn how to trade continuation patterns, which signal that the prevailing trend is likely to continue after a temporary pause. Web. In this fxopen guide, we explain how candlestick continuation patterns work and how you can use them to identify market trends and make informed trading decisions. Web continuation patterns are geometric shapes in the price data that indicate a price trend is likely to continue. In contrast to reversal patterns, continuation patterns signal a temporary consolidation in the middle of. Web what are continuation patterns? Triangles are similar to wedges and pennants and can be either a continuation pattern,. Learn how to spot and trade these patterns with. The precious metal is likely to find buyers on dips, says fawad razaqzada, market analyst at city index and forex.com in. These patterns are recognizable chart formations that signal a temporary period. A continuation pattern can be considered a pause during a prevailing. A continuation pattern signals a trend continuation. Web there are two main types of chart patterns that you are likely to know: But why does the price go through a period of consolidation? You can identify a triangle from bars on a chart by drawing two lines from the. It’s not complicated to figure out the reversal pattern. 0004 gmt — gold edges higher in the early morning asian session. They help identify ideal exit/sell or entry/buy price levels in the market. Web continuation patterns are a type of chart pattern that forms during a temporary pause in an existing market trend before it resumes. Learn how to spot and trade these patterns with. Web a continuation pattern is a recognizable chart pattern denoting temporary consolidation during a period before carrying on in the original trend’s direction. In this fxopen guide, we explain how candlestick continuation patterns work and how you can use them to identify market trends and make informed trading decisions. Web a continuation pattern is when a price action trend is broken by a consolidation period and then resumes again. Web a price pattern that denotes a temporary interruption of an existing trend is a continuation pattern. Continuation patterns are recognizable chart patterns that signify a period of temporary consolidation before continuing in the direction of the original trend. Web a continuation pattern suggests that the existing trend is likely to persist after the completion of the pattern. Chart patterns can be divided into two broad categories: A continuation pattern signals a trend continuation. It indicates that a market trend will reverse once the pattern is finished. Continuation patterns form in the intermediate (middle) part of a price trend. You can identify a triangle from bars on a chart by drawing two lines from the price bars that look like the shape of a triangle.

Bullish Continuation Patterns Overview ForexBee

The Forex Chart Patterns Guide (with Live Examples) ForexBoat

What are Continuation Patterns in Technical Analysis? Espresso Bootcamp

Continuation Patterns

Continuations Explained FxExplained

Top Continuation Patterns for Day Trading! How to Use Them? DTTW™

Introduction to Technical Analysis Price Patterns 2.Continuation patterns

Continuation Patterns in Crypto Charts Understand the Basics

Continuation Patterns chartpatterns Stock market Price Action

Continuation Price Patterns vs. Reversal Price Patterns Synapse Trading

Web Continuation Candlestick Patterns Are A Common Tool Traders Use In Technical Analysis Of Price Charts To Identify When A Prevailing Trend Is Likely To Continue After A Pause.

Web There Are Two Main Types Of Chart Patterns That You Are Likely To Know:

Web Continuation Patterns Are Geometric Shapes In The Price Data That Indicate A Price Trend Is Likely To Continue.

The Pair Could Gain Bearish Momentum If There Is A Close Below The $60,000 Level.

Related Post: