Continuation Pattern

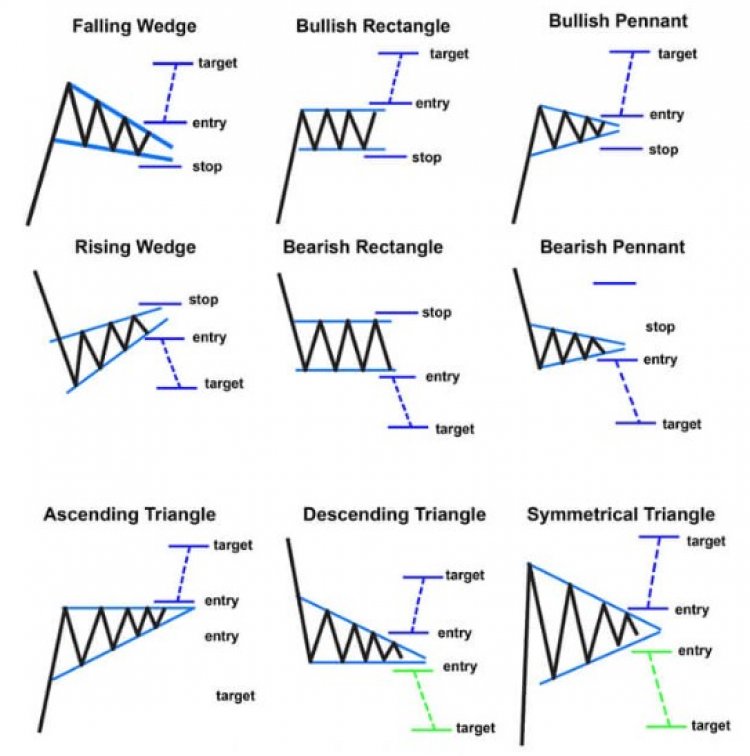

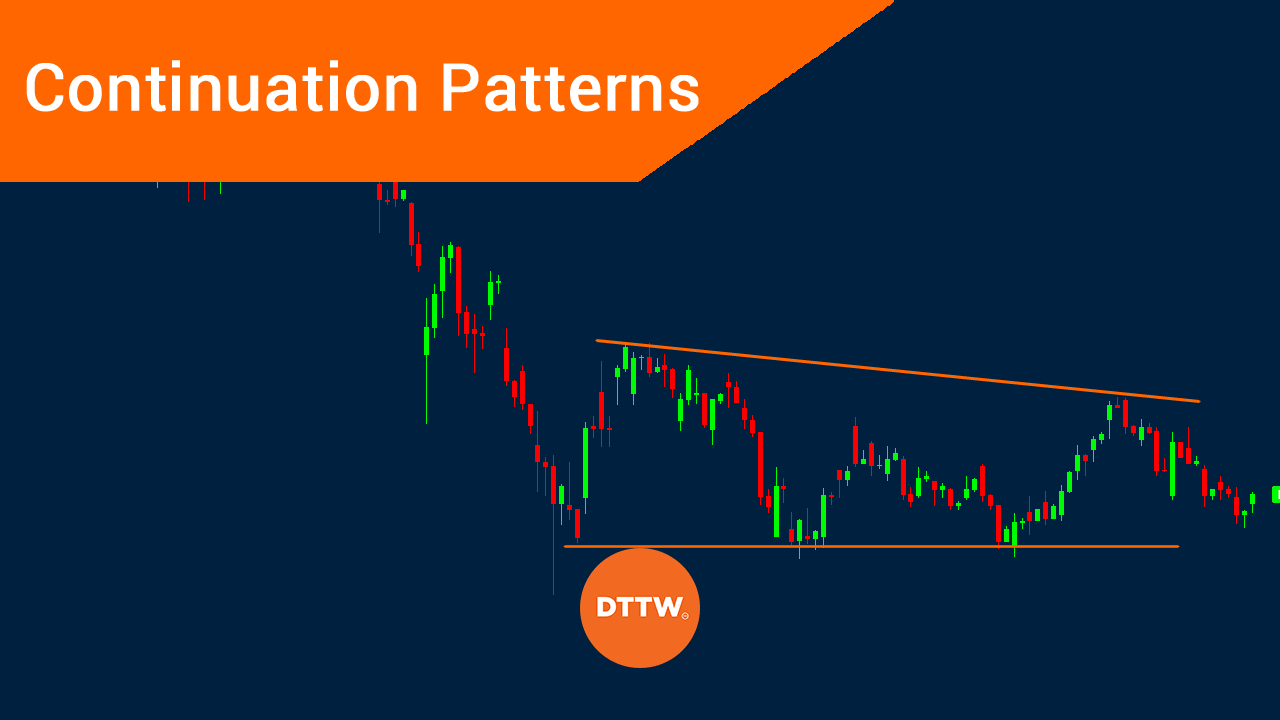

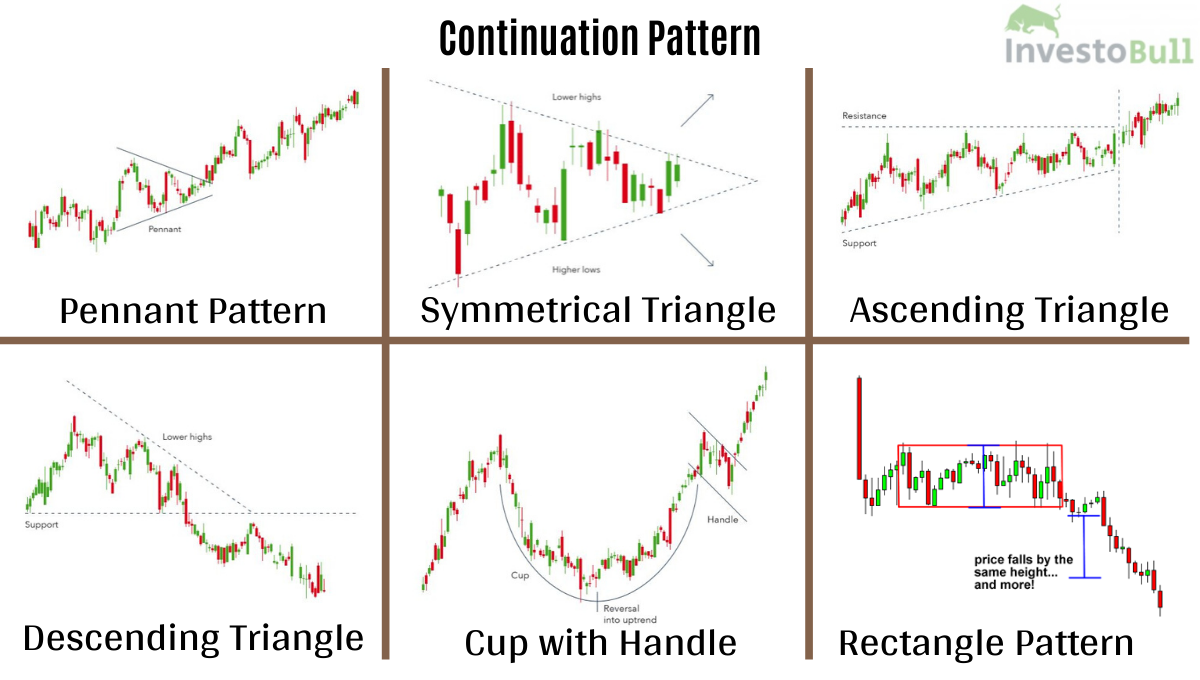

Continuation Pattern - It develops during a period of brief consolidation, before. These patterns suggest that the forex market is taking a. However, not all continuation patterns result in a continuation of the trend; Web continuation patterns are technical analysis formations that signal a temporary consolidation in the middle of a trend, suggesting the likelihood of the trend’s continuation. The bearish pennant is a continuation chart pattern that appears after a security experiences a large, sudden drop. Some common continuation patterns include the ascending triangle, descending triangle, flag, and pennant. If it’s bearish, the price is going down. It’s a great afternoon pattern for new traders. Some continuation patterns are flags, pennants, rectangles, and triangles. Continuation patterns are similar whether you’re looking at bullish or bearish trends. These patterns suggest that the forex market is taking a. Continuation patterns are similar whether you’re looking at bullish or bearish trends. The bearish pennant is a continuation chart pattern that appears after a security experiences a large, sudden drop. Web continuation patterns are technical analysis formations that signal a temporary consolidation in the middle of a trend, suggesting the. Web a continuation pattern is a chart pattern that indicates the direction of movement of a financial instrument’s price will remain the same even when the continuation pattern is complete. Web continuation patterns are a type of chart pattern that forms during a temporary pause in an existing market trend before it resumes. Traders should watch for these patterns in. The bearish pennant is a continuation chart pattern that appears after a security experiences a large, sudden drop. Ascending, descending, and symmetrical triangle patterns. Continuation patterns are similar whether you’re looking at bullish or bearish trends. A technical analysis pattern that suggests a trend is exhibiting a temporary diversion in behavior, and will eventually continue on its existing trend. The. Some continuation patterns are flags, pennants, rectangles, and triangles. It develops during a period of brief consolidation, before. The reliability of these patterns is influenced by the strength of the preceding trend and the size of the continuation pattern. For traders aiming to leverage trend continuations, understanding these patterns is crucial. These patterns suggest that the forex market is taking. Some may lead to reversals. Web a pattern is considered complete when the pattern has formed (can be drawn) and then breaks out of that pattern, potentially continuing on with the former trend. Web continuation patterns are technical analysis formations that signal a temporary consolidation in the middle of a trend, suggesting the likelihood of the trend’s continuation. If it’s. Web a pattern is considered complete when the pattern has formed (can be drawn) and then breaks out of that pattern, potentially continuing on with the former trend. Some common continuation patterns include the ascending triangle, descending triangle, flag, and pennant. Continuation patterns are similar whether you’re looking at bullish or bearish trends. If it’s bearish, the price is going. If it’s bearish, the price is going down. Some common continuation patterns include the ascending triangle, descending triangle, flag, and pennant. Traders should watch for these patterns in the. Some continuation patterns are flags, pennants, rectangles, and triangles. Triangles, formed by converging trendlines, come in three types: These patterns suggest that the forex market is taking a. Web continuation patterns are a type of chart pattern that forms during a temporary pause in an existing market trend before it resumes. Ascending, descending, and symmetrical triangle patterns. A technical analysis pattern that suggests a trend is exhibiting a temporary diversion in behavior, and will eventually continue on its. The reliability of these patterns is influenced by the strength of the preceding trend and the size of the continuation pattern. Web a pattern is considered complete when the pattern has formed (can be drawn) and then breaks out of that pattern, potentially continuing on with the former trend. Some common continuation patterns include the ascending triangle, descending triangle, flag,. These patterns suggest that the forex market is taking a. Ascending, descending, and symmetrical triangle patterns. The bearish pennant is a continuation chart pattern that appears after a security experiences a large, sudden drop. Web continuation patterns are a type of chart pattern that forms during a temporary pause in an existing market trend before it resumes. Traders should watch. Some continuation patterns are flags, pennants, rectangles, and triangles. Web continuation patterns are technical analysis formations that signal a temporary consolidation in the middle of a trend, suggesting the likelihood of the trend’s continuation. Triangles are similar to wedges and pennants and can be either a continuation pattern, if. It’s a great afternoon pattern for new traders. Some may lead to reversals. A technical analysis pattern that suggests a trend is exhibiting a temporary diversion in behavior, and will eventually continue on its existing trend. Ascending, descending, and symmetrical triangle patterns. Web a pattern is considered complete when the pattern has formed (can be drawn) and then breaks out of that pattern, potentially continuing on with the former trend. Continuation patterns are similar whether you’re looking at bullish or bearish trends. Triangles, formed by converging trendlines, come in three types: Web continuation patterns manifest in several forms, each offering unique insights into market behavior. Web continuation patterns are a type of chart pattern that forms during a temporary pause in an existing market trend before it resumes. If it’s bearish, the price is going down. However, not all continuation patterns result in a continuation of the trend; These patterns suggest that the forex market is taking a. The reliability of these patterns is influenced by the strength of the preceding trend and the size of the continuation pattern.

Top Continuation Patterns Every Trader Should Know

Mengenal Continuation pattern dalam trading Asiaprofx

Chart Patterns Continuation and Reversal Patterns AxiTrader

Continuation Forex Chart Patterns Cheat Sheet ForexBoat Trading Academy

Top Continuation Patterns for Day Trading! How to Use Them? DTTW™

What Are Continuation Patterns Charts to Success Phemex Academy

Continuation Price Patterns vs. Reversal Price Patterns Synapse Trading

Introduction to Chart Patterns Continuation and reversal patterns

Continuation Chart Patterns

:max_bytes(150000):strip_icc()/dotdash_INV_final-Continuation-Pattern_Feb_2021-01-95fbac627c854af09b03bc60e11dfca3.jpg)

Continuation Pattern Definition

If A Trend Is Bullish, That Means The Price Is Going Up.

For Traders Aiming To Leverage Trend Continuations, Understanding These Patterns Is Crucial.

The Bearish Pennant Is A Continuation Chart Pattern That Appears After A Security Experiences A Large, Sudden Drop.

Traders Should Watch For These Patterns In The.

Related Post: