Continuation Chart Patterns

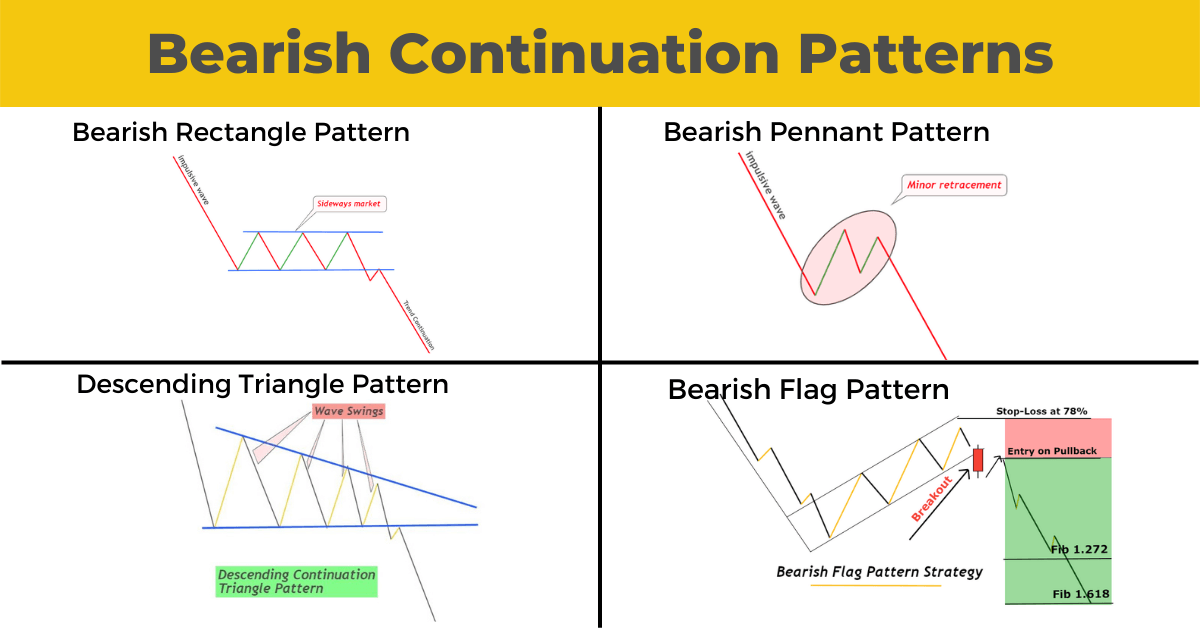

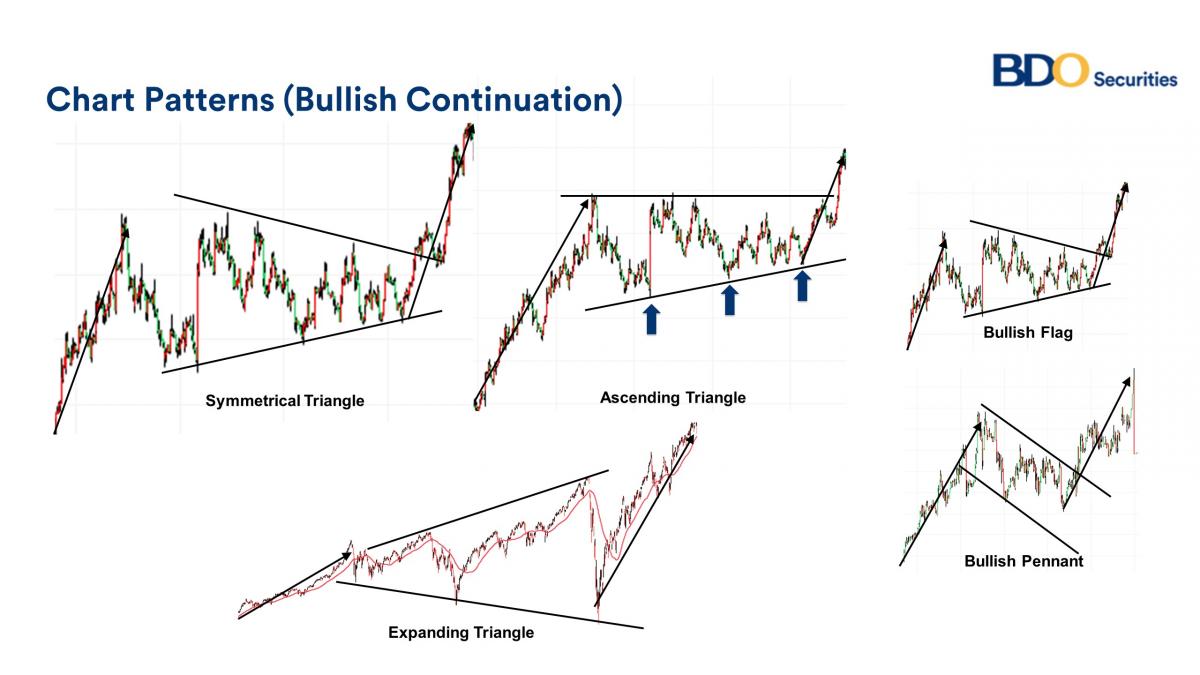

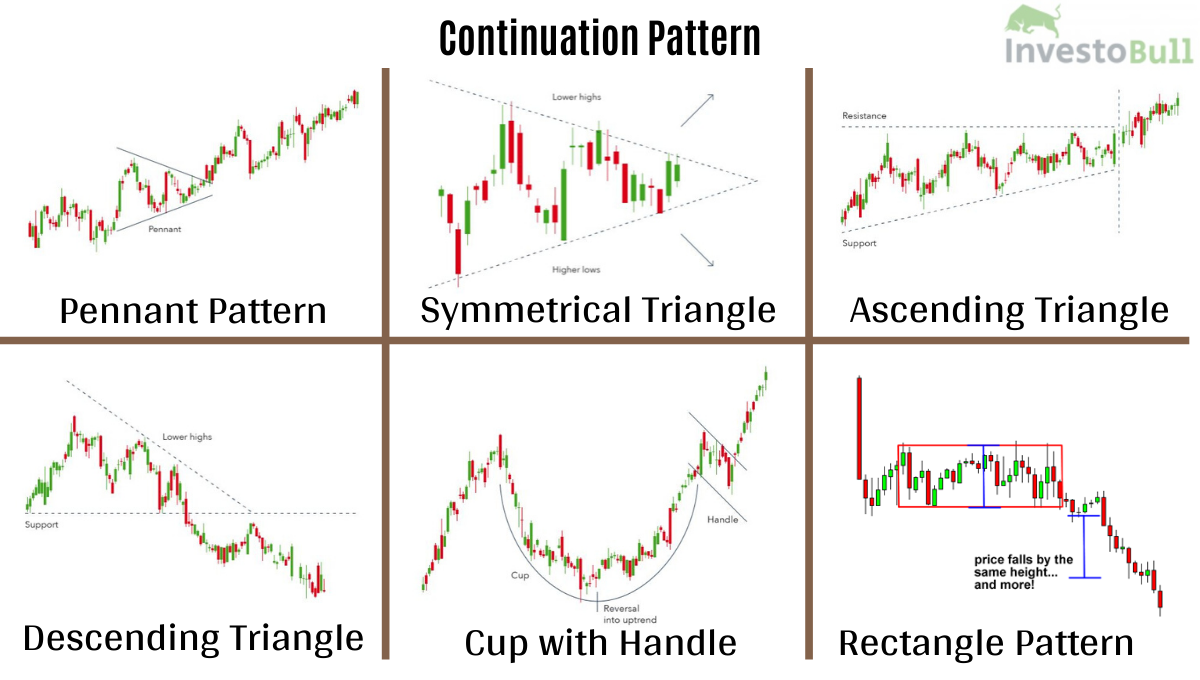

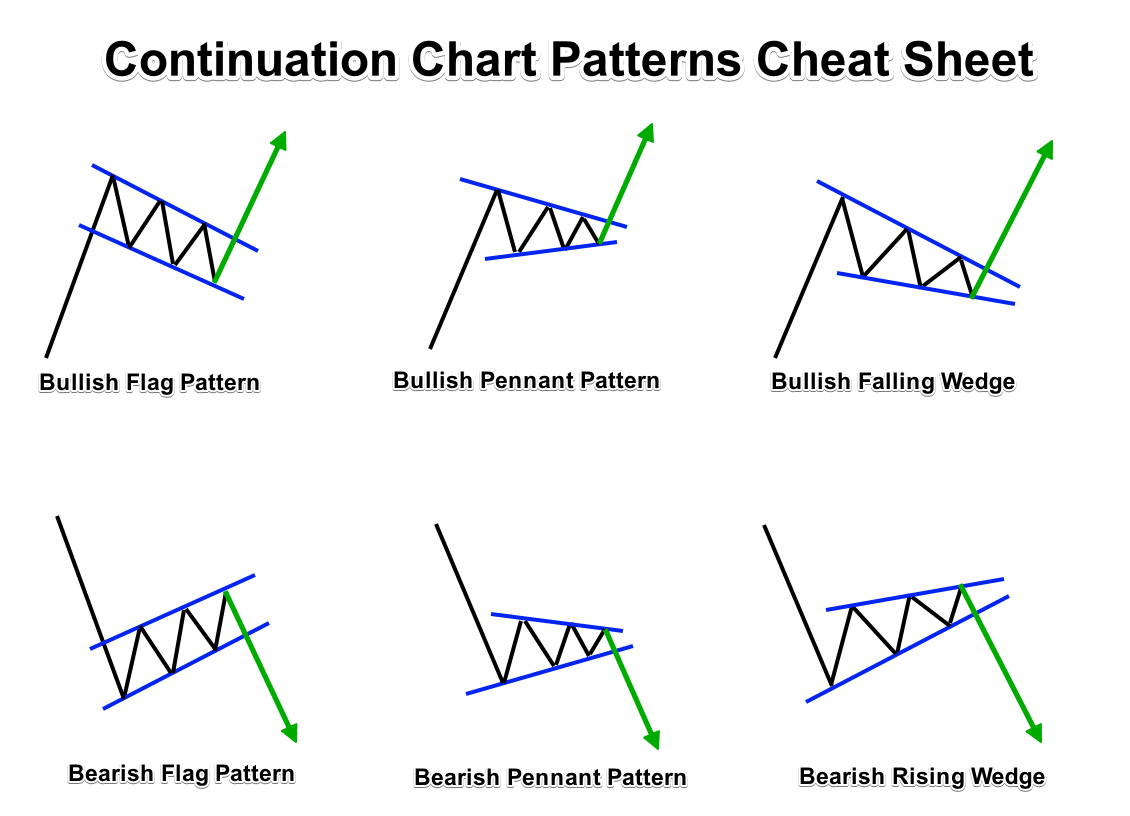

Continuation Chart Patterns - Web most reversal and continuation patterns have specific criteria. A doji is a candle where the opening price and closing. Web a continuation pattern is a chart pattern described as a series of price movements that indicate that there is a temporary halt in the current prevailing trend, but that the. Web learn how to identify and trade continuation patterns, which signal that the prevailing trend is likely to continue after a temporary pause. Triangles and wedges are intermediate term continuation patterns whereas. Web chart patterns are used as either reversal or continuation signals. Bullish continuation patterns are ascending triangles, bull flags, bullish. Web learn what continuation chart patterns are and how they indicate a trend continuation in the market. A continuation pattern can be considered a pause during a. Flags and pennants require evidence of a sharp advance or decline in heavy volume. A doji is a candle where the opening price and closing. Discover the features, benefits, and types of. Web updated 4/18/2022 16 min read. Two basic tenets of technical analysis are that prices trend and that history repeats itself. Web continuation candlestick patterns uptrend and downtrend. Web learn how to identify and trade continuation patterns in stocks. Find out the types of continuation patterns and how to trade them with. Web learn what continuation chart patterns are and how they indicate a trend continuation in the market. Included in this type are the most common patterns which have been. Triangles and wedges are intermediate term continuation. Web some of the most common continuation patterns include: Web continuation pattern types are triangles, flags, pennants, continuation gaps, and rectangles. Included in this type are the most common patterns which have been. Web a price pattern that denotes a temporary interruption of an existing trend is a continuation pattern. Why new traders with small accounts should learn continuation patterns…. In the stockcharts platform, you can. Web continuation candlestick patterns uptrend and downtrend. A doji is a candle where the opening price and closing. Find out how to spot, enter, and. Web learn how to identify and trade continuation patterns, which are chart formations that signal a temporary consolidation before a trend resumes. Web a price pattern that denotes a temporary interruption of an existing trend is a continuation pattern. Web learn what continuation chart patterns are and how they indicate a trend continuation in the market. Web learn how to identify and trade continuation patterns, which signal that the prevailing trend is likely to continue after a temporary pause. Web these chart. Web most reversal and continuation patterns have specific criteria. Find out the types of continuation patterns and how to trade them with. Web continuation candlestick patterns uptrend and downtrend. Two basic tenets of technical analysis are that prices trend and that history repeats itself. Web learn what continuation patterns are and how to spot them on price charts. Find out how triangles, flags, pennants and rectangles can help you predict the direction of a trend and. Web updated 4/18/2022 16 min read. Web continuation candlestick patterns uptrend and downtrend. Triangles and wedges are intermediate term continuation patterns whereas. Web chart patterns are used as either reversal or continuation signals. Bullish continuation patterns are ascending triangles, bull flags, bullish. Web pennants are continuation patterns where a period of consolidation is followed by a breakout used in technical analysis. Web most reversal and continuation patterns have specific criteria. Web learn how to identify and trade continuation patterns, which signal that the prevailing trend is likely to continue after a temporary pause.. Triangles and wedges are intermediate term continuation patterns whereas. Web pennants are continuation patterns where a period of consolidation is followed by a breakout used in technical analysis. See examples of bullish and. Find out how to spot, enter, and. Web learn how to identify and trade continuation patterns, which signal that the prevailing trend is likely to continue after. Web a continuation pattern is a chart pattern described as a series of price movements that indicate that there is a temporary halt in the current prevailing trend, but that the. Triangles and wedges are intermediate term continuation patterns whereas. Flags and pennants require evidence of a sharp advance or decline in heavy volume. Understanding these components enables traders to. Web learn how to identify and trade continuation patterns in the financial markets, such as triangles, pennants, flags, and rectangles. A continuation pattern can be considered a pause during a. Web pennants are continuation patterns where a period of consolidation is followed by a breakout used in technical analysis. These patterns indicate that the price trend. Why new traders with small accounts should learn continuation patterns… how to build a solid trading. Flags and pennants require evidence of a sharp advance or decline in heavy volume. Web learn how to identify and trade continuation patterns, which signal that the prevailing trend is likely to continue after a temporary pause. Web a price pattern that denotes a temporary interruption of an existing trend is a continuation pattern. Web ultimately, the mechanics of continuation patterns blend market psychology, volume analysis, and price action. Web learn how to use continuation patterns, such as flags, rectangles, pennants, and wedges, to identify and trade with the trend direction of an asset. Web updated 4/18/2022 16 min read. Web these chart patterns offer valuable insights into potential price movements, providing traders with opportunities to enter and exit positions strategically. Two basic tenets of technical analysis are that prices trend and that history repeats itself. These patterns signal that a trend will continue and give you clear entry signals. Find out the types of continuation patterns and how to trade them with. In the stockcharts platform, you can.

Bearish Continuation Chart Patterns And How To Trade Them Equitient Riset

Continuation Price Patterns vs. Reversal Price Patterns Synapse Trading

Continuation Patterns

Introduction to Chart Patterns Continuation and reversal patterns

Continuation Chart Patterns Stock Market Analysis Tutorial

Continuation Candlestick Patterns Cheat Sheet

UNDERSTANDING TREND CONTINUATION PATTERNS for FXCADCHF by AlanTradesFX

Continuation Patterns in Crypto Charts Understand the Basics

Continuation Chart Patterns

Continuation Forex Chart Patterns Cheat Sheet ForexBoat Trading Academy

Triangles Are Similar To Wedges And Pennants And Can Be Either A.

Find Out How To Spot, Enter, And.

Web Chart Patterns Are Used As Either Reversal Or Continuation Signals.

Web Learn How To Identify And Trade Continuation Patterns In Stocks.

Related Post: