Continuation Candlestick Patterns

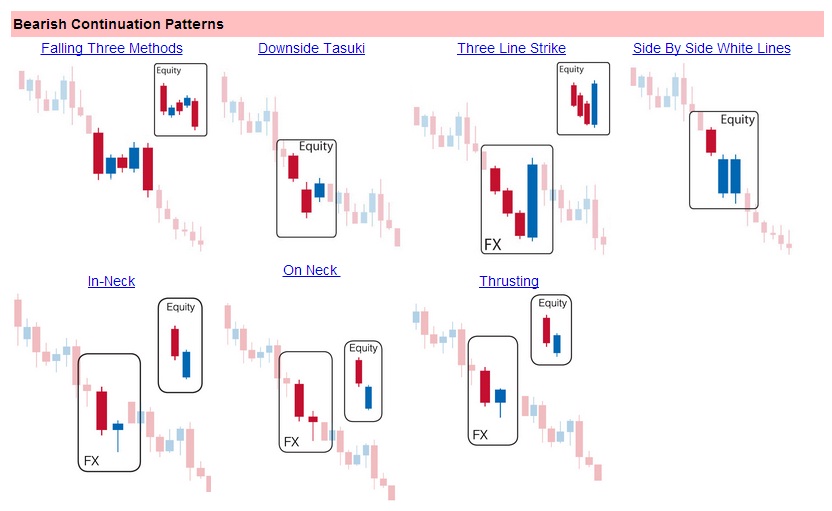

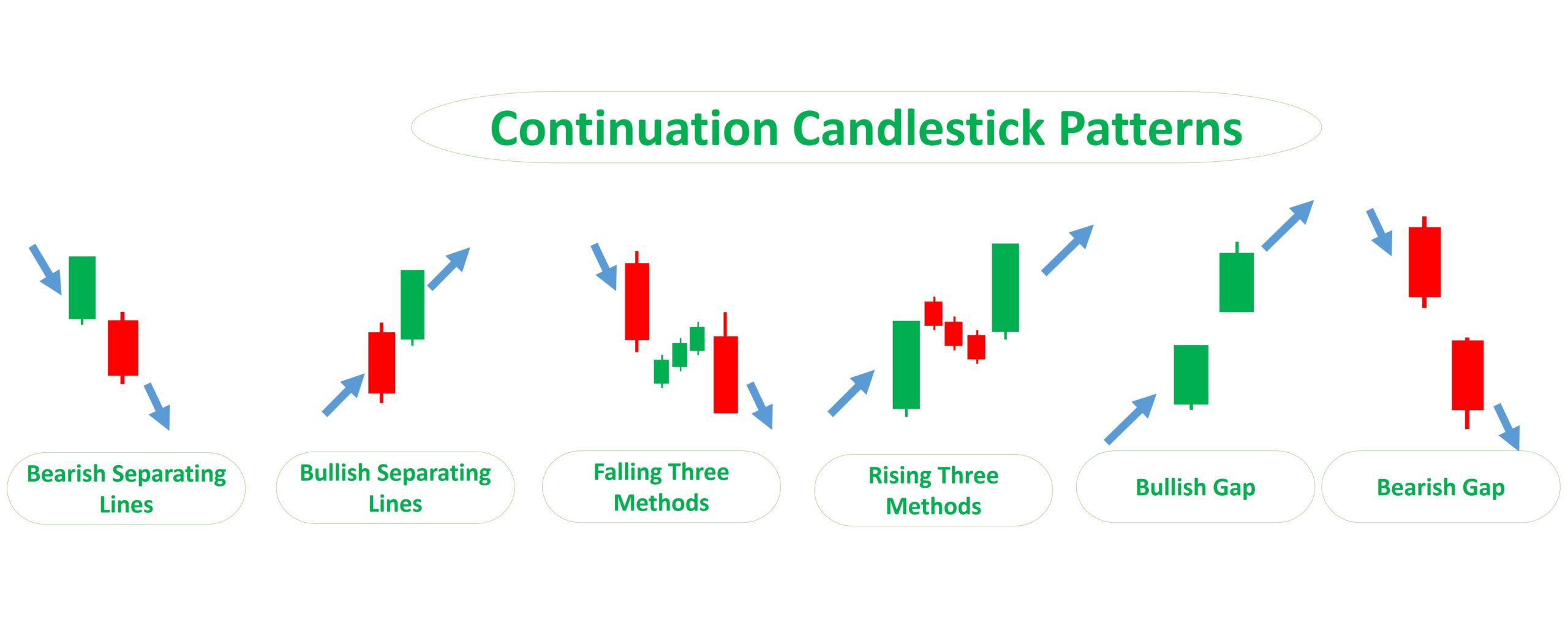

Continuation Candlestick Patterns - A doji candlestick pattern is distinguished by its narrow body, in which the open and close are quite near to one another. A technical analysis pattern that suggests a trend is exhibiting a temporary diversion in behavior, and will eventually continue on its existing trend. But the bulls returned stronger, and took charge from there. Web candlestick pattern explained. Here is a long list of all the major continuation candlestick patterns: Continuations tend to resolve in the same direction as the prevailing trend: Web here are 7 powerful continuation candlestick patterns: White marubozu & black marubozu pattern; Web continuation candlestick patterns. Stay updated with the latest trends and insights in the finance world. White marubozu & black marubozu pattern; Rising three methods & falling three methods;. Candlestick continuation patterns are a signal that the short term trend over the prior few candles will resume in its current direction. However, it takes time and effort to master these tools, and traders should always exercise caution and risk management when trading. The triangle pattern comes. Rising three methods & falling three methods;. Continuations tend to resolve in the same direction as the prevailing trend: The triangle pattern comes in three forms: In this blog post, we will look at five. Web continuation candlestick patterns. Candlestick charts are a technical tool that packs data for multiple time frames into single price bars. Let’s study the characteristics of the separating lines bullish continuation candlestick pattern. This makes them more useful than traditional open, high, low. The pattern is made up of higher lows and lower highs until it converges to form the pattern. This is true. Double candlestick patterns that are classified as continuation patterns include: Web continuation patterns, which include triangles, flags, pennants and rectangles, provide some logic on what the market may potentially do. Web continuation candlestick patterns, which form the basis of one of the most popular strategies used by traders on a daily basis, signal that the prevailing trend is likely to. Continuations tend to resolve in the same direction as the prevailing trend: These can help traders to identify a period of rest in the market, when there is market indecision or neutral price movement. This is true of reversals and continuations. Three white soldiers & three black crows; They often occur when buyers and sellers pause to reassess their trading. Web bullish continuation candlestick patterns. They often occur when buyers and sellers pause to reassess their trading positions, allowing the market to gather momentum for the next move in the direction of the trend. The pattern is made up of higher lows and lower highs until it converges to form the pattern. These can help traders to identify a period. Rising three methods & falling three methods;. It develops during a period of brief consolidation, before. White marubozu & black marubozu pattern; They often occur when buyers and sellers pause to reassess their trading positions, allowing the market to gather momentum for the next move in the direction of the trend. The triangle pattern comes in three forms: These can help traders to identify a period of rest in the market, when there is market indecision or neutral price movement. Let’s explore a few commonly observed bearish. But just like with reversal patterns, there are a few things to keep in mind with continuation patterns: If a candlestick pattern doesn’t indicate a change in market direction, it is. Web in either event, a candlestick continuation pattern represents an opportunity to enter into a trade in the direction of the prevailing trend as it indicates that the continuation of the existing trend is far more likely than a reversal of that trend. Three white soldiers & three black crows; Web candlestick pattern explained. Web bearish continuation candlestick patterns form. Let’s study the characteristics of the separating lines bullish continuation candlestick pattern. They often occur when buyers and sellers pause to reassess their trading positions, allowing the market to gather momentum for the next move in the direction of the trend. Web bearish continuation candlestick patterns. Let’s explore a few commonly observed bearish. These can help traders to identify a. Web as seen, continuation candlestick patterns and other trend identifiers are useful tools that traders could use to identify market trends and make informed trading decisions. Let’s explore a few commonly observed bearish. Let’s study the characteristics of the separating lines bullish continuation candlestick pattern. This is episode 4 of the ultimate guide to candlestick patterns course. When a trend is taking a breather, it may be time to look for signs of continuations. Web candlestick pattern explained. Web these are some of the major candlestick patterns traders work with: The bearish pennant is a continuation chart pattern that appears after a security experiences a large, sudden drop. Learn to identify over 50 candlestick chart patterns. Candlestick continuation patterns are a signal that the short term trend over the prior few candles will resume in its current direction. If a candlestick pattern doesn’t indicate a change in market direction, it is what is known as a continuation pattern. Rising three methods & falling three methods;. Continuations tend to resolve in the same direction as the prevailing trend: Stay updated with the latest trends and insights in the finance world. And there are candlestick patterns that may identify potential trend continuations. They pushed prices up by $26 (6%) in 2.5 weeks.

Bearish Continuation Candle Patterns Free Trading Signals

Forex Pips Centre Bearish Continuation Candlestick Pattern

Trend Continuation Candlesticks Patterns for HUOBIBTCUSDT by EXCAVO

E04 Continuation Candlestick Patterns (The Ultimate Guide To

CANDLESTICK PATTERNS LEARNING = LIVING

Forex Candlestick Continuation Patterns Forex Strategies Bank

Continuation Pattern Meaning, Types & Working Finschool

FOUR CONTINUATION CANDLESTICK PATTERNS YouTube

Guide To Continuation Candlestick Patterns May 2023 forex crypto

Top Continuation Candlestick Patterns

Web Here Are 7 Powerful Continuation Candlestick Patterns:

These Patterns Give Insights Into The Market Sentiment And The Potential Strength Of The Sellers.

Web Four Continuation Candlestick Patterns.

Candlestick Charts Are A Technical Tool That Packs Data For Multiple Time Frames Into Single Price Bars.

Related Post: