Compound Interest In Excel Template

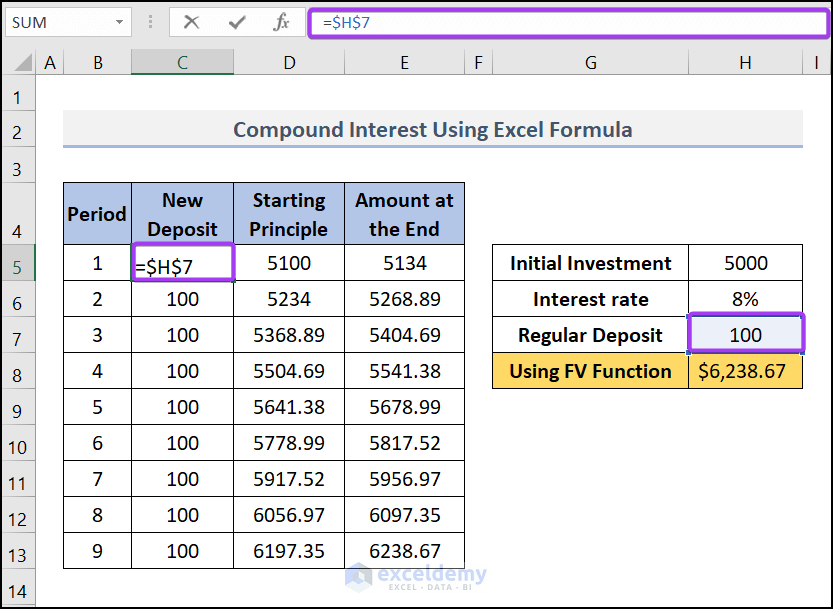

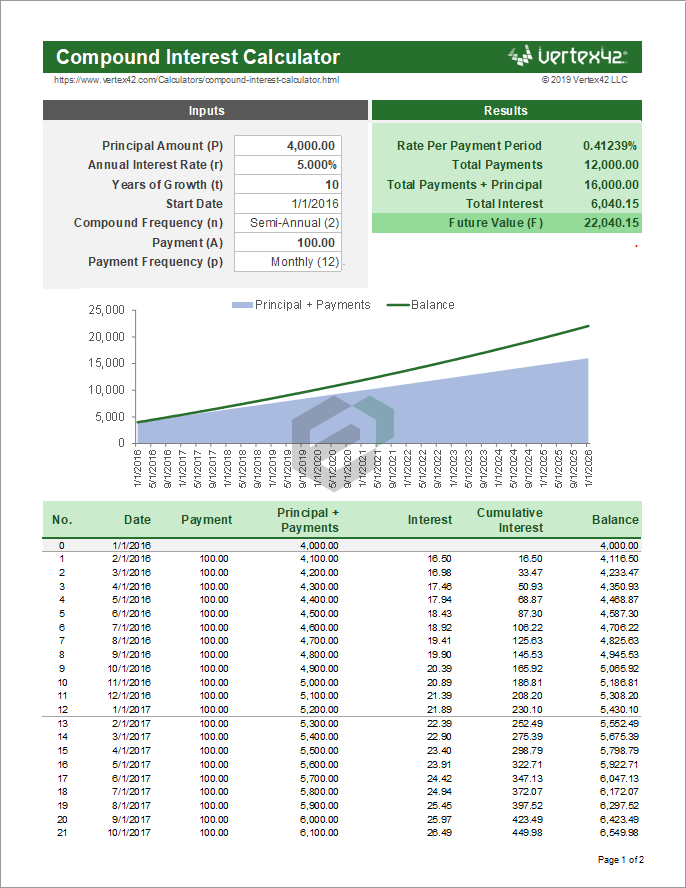

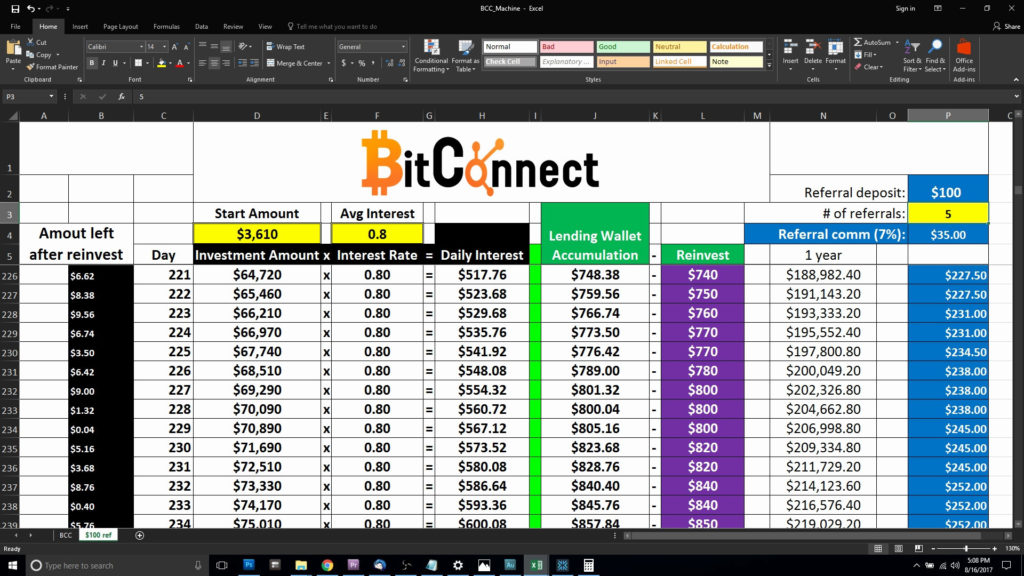

Compound Interest In Excel Template - =fv (rate, nper, pmt, [pv], [type]) where: In the meantime, let's build a fv formula using the same source data as in monthly compound interest example and see whether we get the same result. Web contents of compound interest calculator excel template. In the example shown, the formula in c10 is: Insert your irregular deposits manually in the “new deposit” column. This example assumes that $1000 is invested for 10 years at an annual interest rate of 5%, compounded monthly. We can extend the previous template to calculate compound interest with irregular deposits. If interest is compounded quarterly, then t =4. Note that the rate needs to be in percentage in excel. Open a new spreadsheet and enter the required values. Enter the formula to calculate compound interest. How much will your investment be worth after 5 years at an annual interest rate of 8%? P(1+r/t) (n*t) here, t is the number of compounding periods in a year. As you may remember, we deposited $2,000 for 5 years into a savings account at 8% annual. After that, it will show you. All excel templates and tools are sole property of xlsxtemplates.com. For example, when the compound interest is 10%, use 10% or.1, or 10/100 as r. =b1* (1+b2/b4)^ (b4*b3) you will get the future value using the compound interest formula when you press “enter”. Open a new spreadsheet in excel and enter the principal amount, annual interest rate, number of times. Web the detailed explanation of the arguments can be found in the excel fv function tutorial. Open a new spreadsheet in excel and enter the principal amount, annual interest rate, number of times interest is compounded, and the number of years for which interest is calculated. =p+(p*effect(effect(k,m)*n,n)) the general equation to calculate compound interest is as follows. Web now that. Now, to calculate the gained interest, simply type the following in cell c10: Assume you put $100 into a bank. If interest is compounded on a monthly basis, then t =12. Web this means we can further generalize the compound interest formula to: Beginning value x [1 + (interest rate ÷ number of compounding periods per year)] ^ (years x. =p*(1+(k/m))^(m*n) where the following is true: Open a new spreadsheet and enter the required values. P(1+r/t) (n*t) here, t is the number of compounding periods in a year. All templates provided by xlsx templates are free and no payment is asked. In excel, you can use the fv function to calculate the future value of an investment based on multiple. Web in year two, the interest rate (10%) is applied to the principal ($100, resulting in $10 of interest) and the accumulated interest ($10, resulting in $1 of interest), for a total of $11 in. How much will your investment be worth after 5 years at an annual interest rate of 8%? Web suppose we have the following information to. Say, you’re going to run a savings scheme with one of your trusted banks. First, type the following formula in cell c9: Use excel fv function to calculate monthly compound interest. In excel, set up the formula like below. P is the principal or the initial investment. In excel, you can use the fv function to calculate the future value of an investment based on multiple deposits and multiple compounding periods. Web now, follow the simple steps to find the daily compound interest in excel. Formula relating pv, rate, nper, pmt, fv in excel. If interest is compounded quarterly, then t =4. Web now that we've understood. However, in this example, the interest is paid monthly. The compound interest formula is: There is no special function for compound interest in excel. Web here’s the formula for daily compounding in excel: Web free compound interest excell spreadsheet calculator. Web the equation reads: P is the principal or the initial investment. In excel, set up the formula like below. We can extend the previous template to calculate compound interest with irregular deposits. Web free compound interest excell spreadsheet calculator. For example, when the compound interest is 10%, use 10% or.1, or 10/100 as r. However, in this example, the interest is paid monthly. Web now, follow the simple steps to find the daily compound interest in excel. Open a new spreadsheet in excel and enter the principal amount, annual interest rate, number of times interest is compounded, and the number of years for which interest is calculated. Web suppose we have the following information to calculate compound interest in a table excel format (systematically). Say, you’re going to run a savings scheme with one of your trusted banks. =b1*(1+b2/365)^(b3*365) in daily compounding interest is compounded 365 days a year, so the interest rate is divided by 365. K = annual interest rate paid. Note that the rate needs to be in percentage in excel. All excel templates and tools are sole property of xlsxtemplates.com. Future value = p* (1+ r/12)^ (n*12) the annual interest rate (r) is divided by 12, because the interest payout is compounded on a monthly basis, the no. You already know the answer. P is the principal or the initial investment. =fv (rate, nper, pmt, [pv], [type]) where: You can use the excel template provided above as your compound interest calculator. Web to calculate compound interest in excel, you can use the fv function.

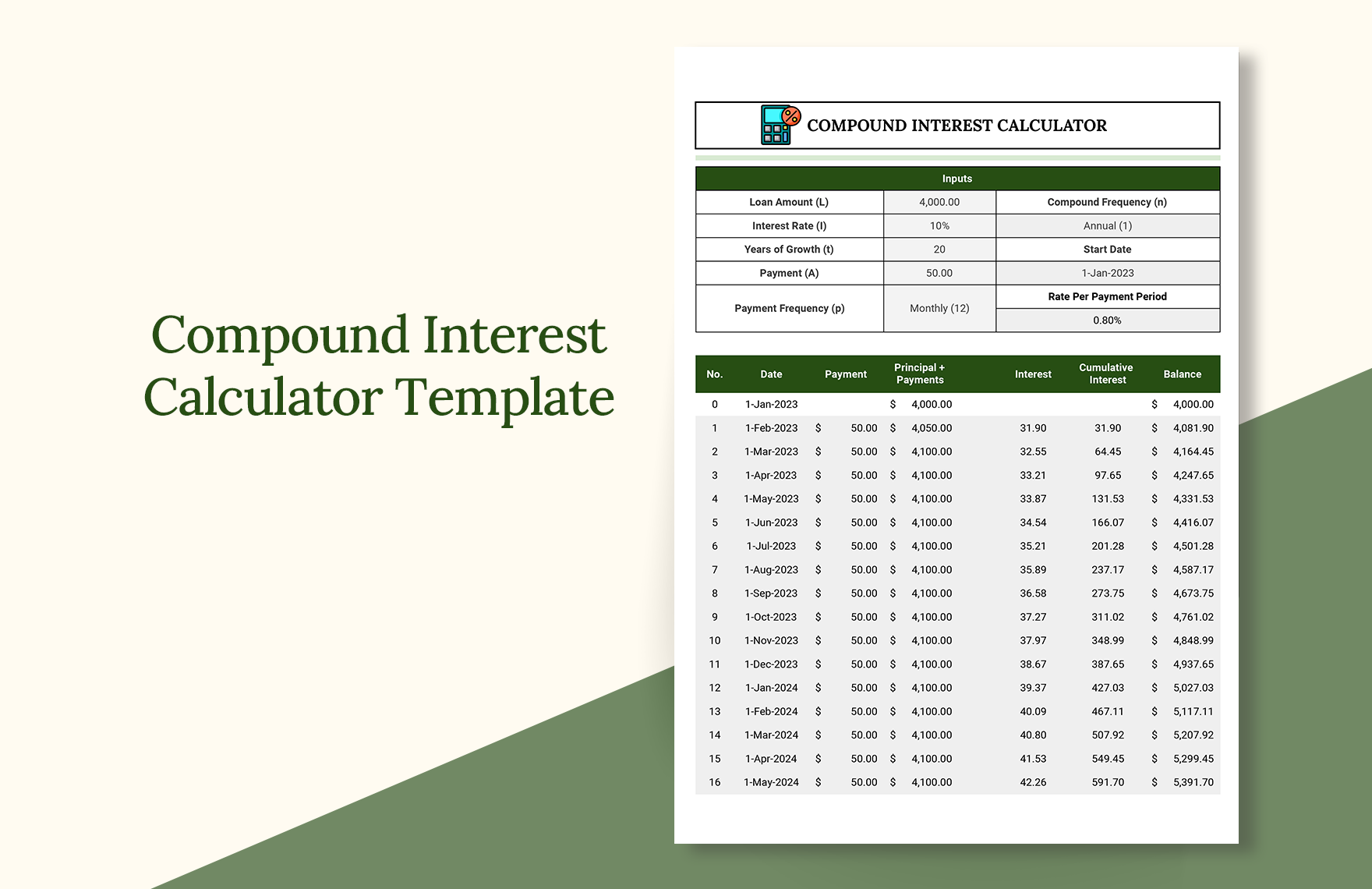

Compound Interest Calculator Template Excel, Google Sheets

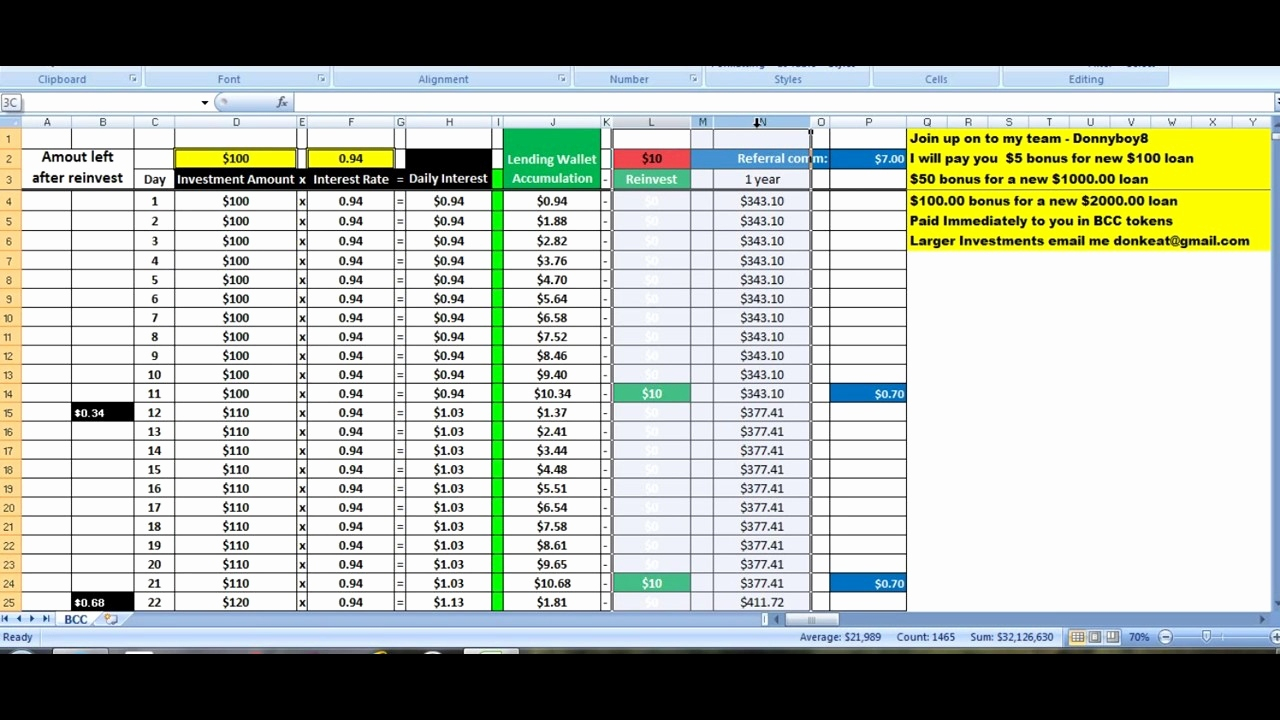

Excel Formula to Calculate Compound Interest with Regular Deposits

Compound Interest Calculator Template in Excel & Spreadsheet

How to Calculate Monthly Compound Interest in Excel Statology

Calculate compound interest Excel formula Exceljet

Printable Compound Interest Excel Template with Compound Interest Excel

Compound Interest Spreadsheet within Compound Interest Calculator Excel

Finance Basics 2 Compound Interest in Excel YouTube

How to Use Compound Interest Formula in Excel Sheetaki

How to Make a Compound Interest Calculator in Microsoft Excel by

=P+(P*Effect(Effect(K,M)*N,N)) The General Equation To Calculate Compound Interest Is As Follows.

Open A New Spreadsheet And Enter The Required Values.

Web The Detailed Explanation Of The Arguments Can Be Found In The Excel Fv Function Tutorial.

Now, To Calculate The Gained Interest, Simply Type The Following In Cell C10:

Related Post: