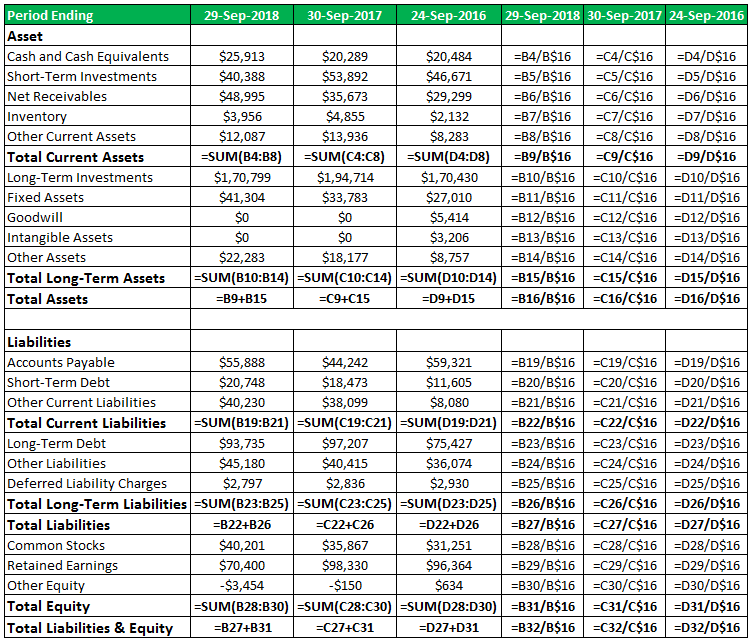

Common Size Balance Sheet Template

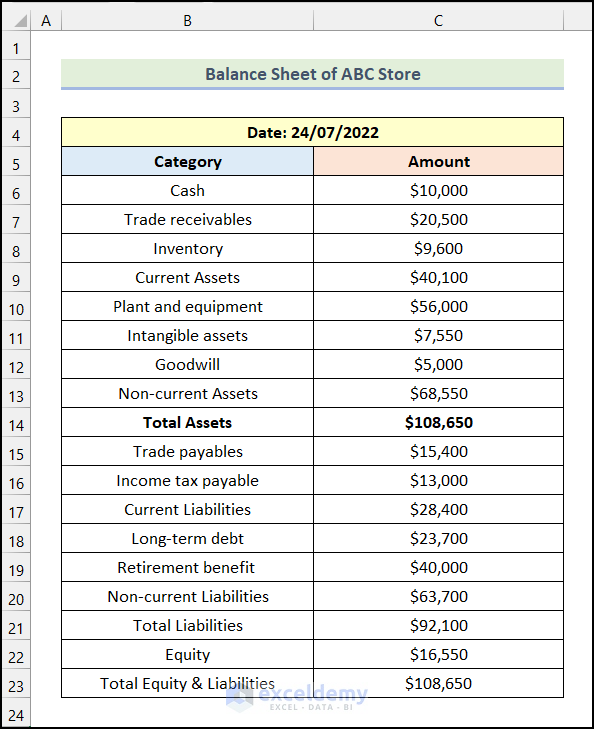

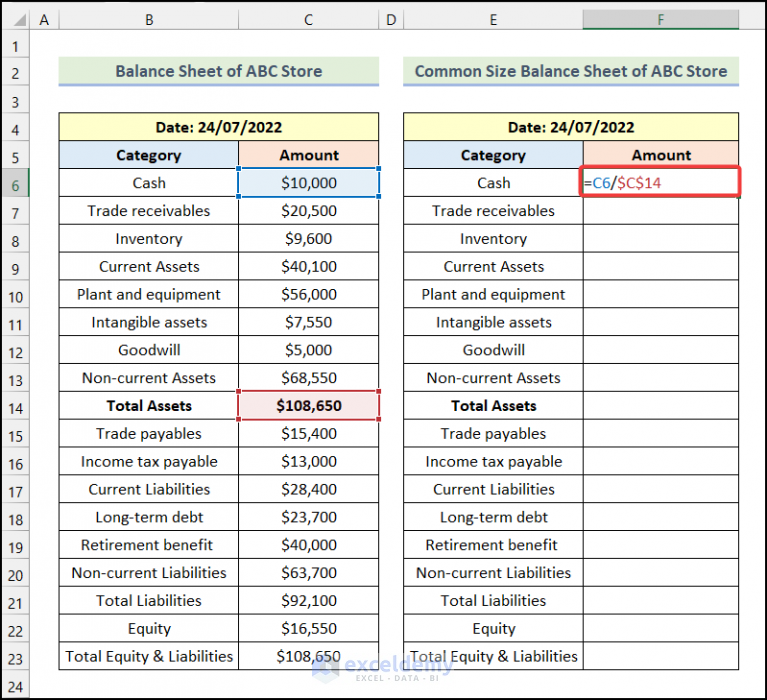

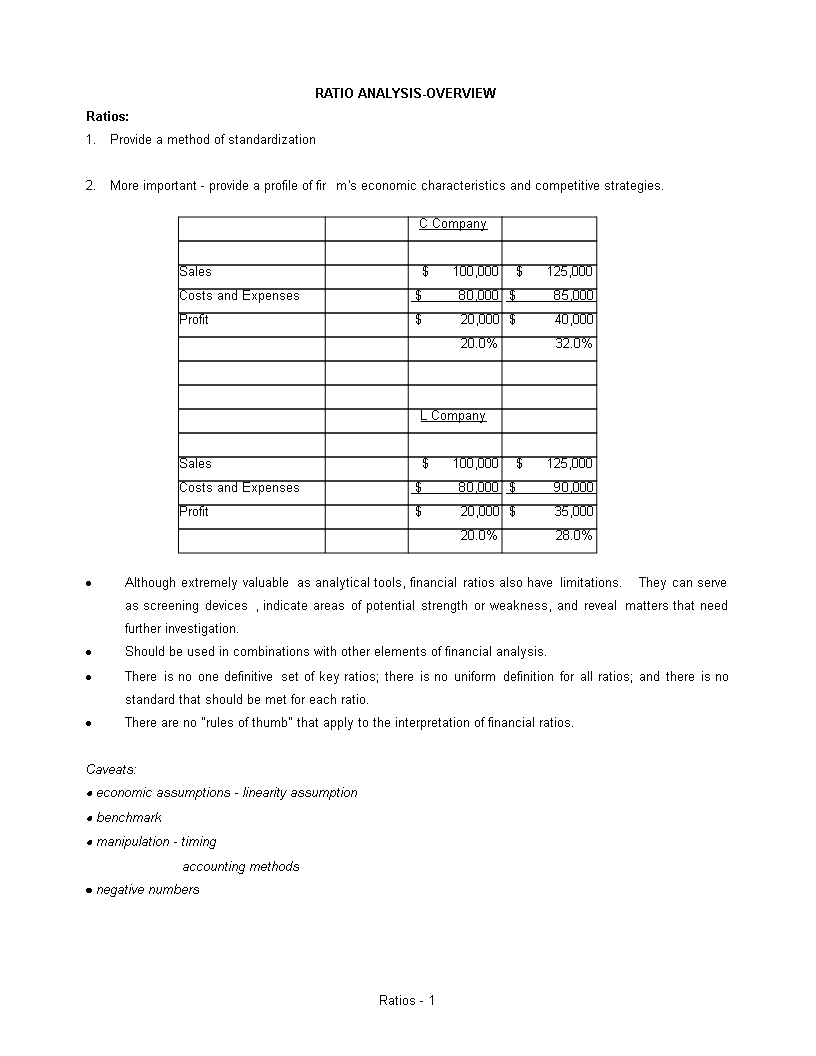

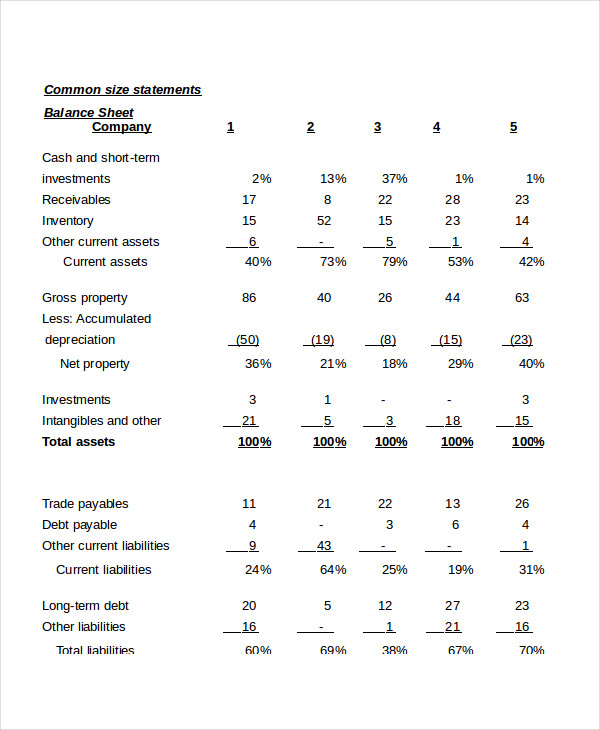

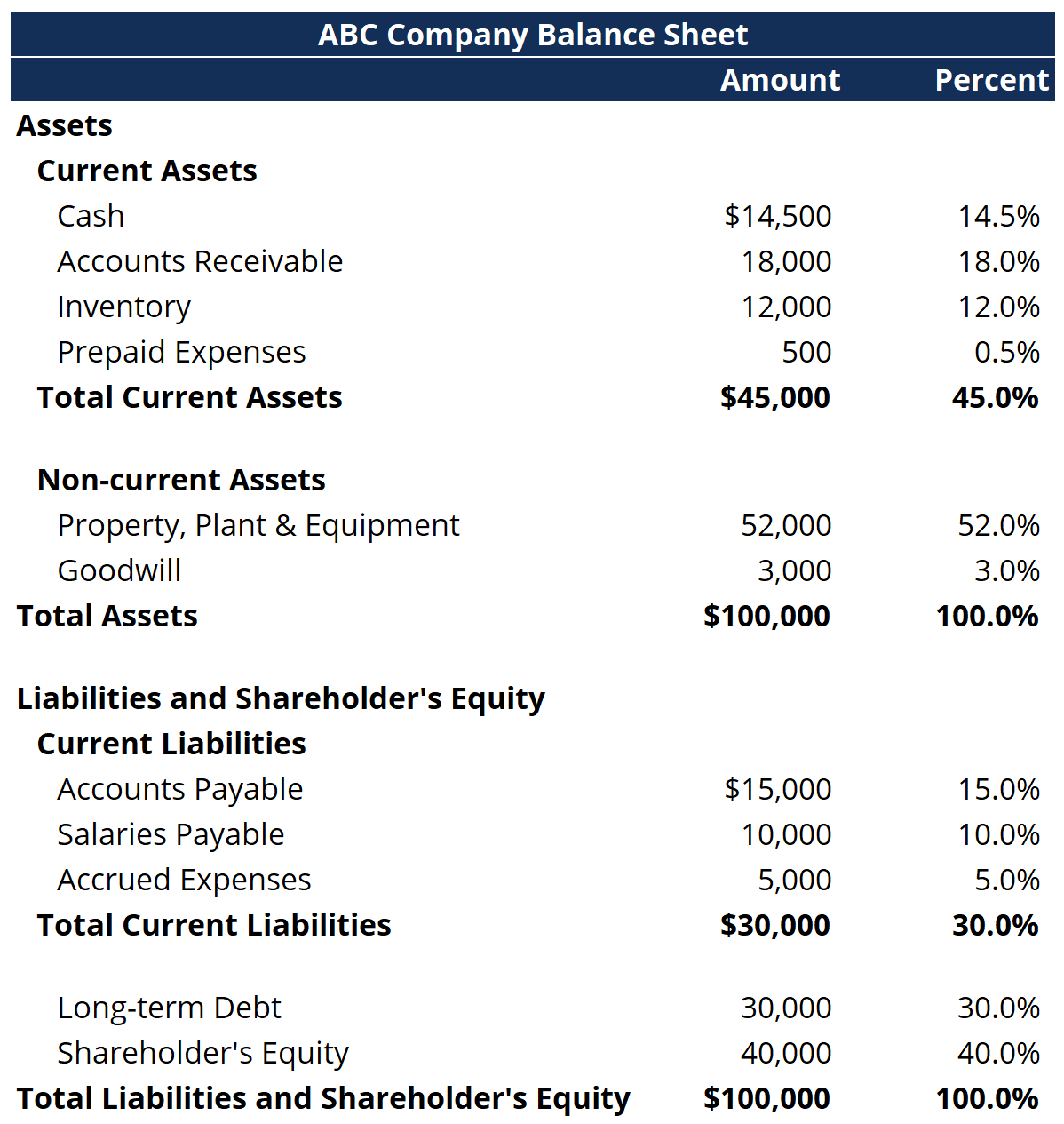

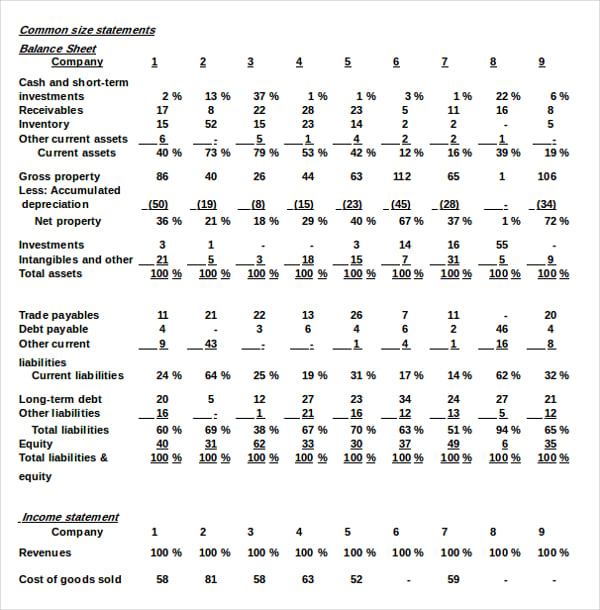

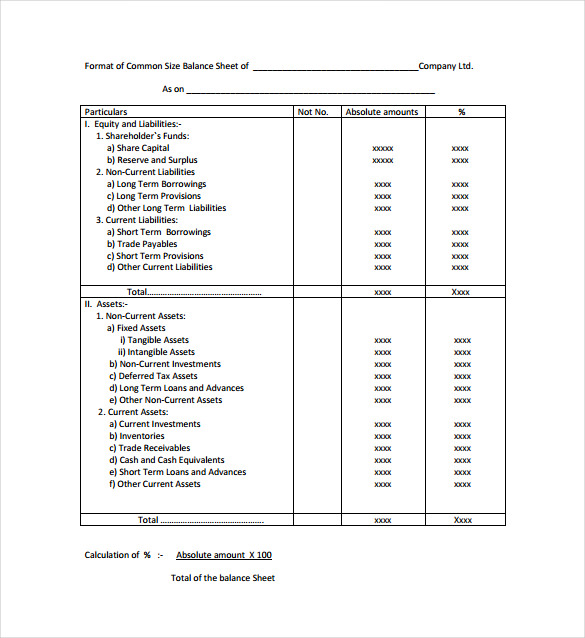

Common Size Balance Sheet Template - Thus, just insert the respective amounts of the balance sheet in the light blue columns. Expressing each item on the balance sheet as a percentage of total assets allows for easy comparison of different categories and helps identify trends over time. You can use it for financial analysis to compare the relative results away two or more companies. The use of the common size balance sheet as a comparison tool is discussed more fully in. Web in microsoft excel, common size financial statements compare cells against the balance total to determine what percent those figures have increased or decreased. Here is an example of how useful information is revealed by the common size balance sheets. To express the amounts as the percentage of the total, the total assets or total equity and liabilities are taken as 100. A financial manager or investor can use the common size analysis to see how a firm’s capital structure compares to rivals. Web the common size balance sheet shows the makeup of a company’s various assets and liabilities through the presentation of percentages, in addition to absolute dollar values. For balance sheets, all assets are expressed as a percentage of total assets, while liabilities and equity are expressed as a percentage of total liabilities and shareholders’ equity. Expressing each item on the balance sheet as a percentage of total assets allows for easy comparison of different categories and helps identify trends over time. Web the common size balance sheet shows the makeup of a company’s various assets and liabilities through the presentation of percentages, in addition to absolute dollar values. Web balance sheet template in excel, openoffice. You can use it for financial analysis to compare the relative results away two or more companies. Web this common size analysis template allows you to compare the financial performance of companies in different sizes on the same scale. Example of common size balance sheet. You can use it in financial analysis to compare the. The template will automatically do. The common size income statement divides all the entries on an income statement by total revenue, letting you see which. Web the common size balance sheet shows the makeup of a company’s various assets and liabilities through the presentation of percentages, in addition to absolute dollar values. Download it today and manage your pro forma balance sheet effortlessly! To express. You can use it for financial analysis to compare the relative results away two or more companies. The template will automatically do the vertical analysis for you. Web balance sheet template in excel, openoffice calc & google sheet to make informed business decisions based on comparative yearly analysis. The use of the common size balance sheet as a comparison tool. Web in microsoft excel, common size financial statements compare cells against the balance total to determine what percent those figures have increased or decreased. All companies must report their common stock outstanding on their balance sheet. This template categorizes all types of assets, liabilities, and equity based on the size of the business. Example of common size balance sheet. Common. You can use it for financial analysis to compare the relative results away two or more companies. The balance sheet common size analysis mostly uses the total assets value as the base value. The easiest way to calculate the. Example of common size balance sheet. A financial manager or investor can use the common size analysis to see how a. Web the formula for calculating a balance sheet into a common size balance sheet you must divide each line item by total assets. Web what is a common size balance sheet? The easiest way to calculate the. Web this video shows you how to create a common size income statement in excel. Web in microsoft excel, common size financial statements. Web this video describes how to perform an income statement and balance sheet common size analysis using the financial statements of johnson & johnson and pfizer. Excel creates a new blank. Web thanks to the sec, common stock outstanding is straightforward to calculate. Here is an example of how useful information is revealed by the common size balance sheets. Each. The easiest way to calculate the. Web a common size balance sheet, which includes a regular size balance sheet, and separate reports listing asset line items as a percentage of total assets, and liability line items as a percentage of total liabilities. Each line item on the balance sheet is restated as a percentage of total assets. Excel creates a. Excel creates a new blank. Each line item on the balance sheet is restated as a percentage of total assets. Web this video describes how to perform an income statement and balance sheet common size analysis using the financial statements of johnson & johnson and pfizer. Download it today and manage your pro forma balance sheet effortlessly! A financial manager. It's used to determine how the company is using its assets. Let’s say, we have the balance sheet of abc store as our dataset. Common size balance sheet format type ii. Common size balance sheet format type i. Each line item on the balance sheet is restated as a percentage of total assets. You can use it for financial analysis to compare the relative results away two or more companies. All companies must report their common stock outstanding on their balance sheet. The easiest way to calculate the. Web in microsoft excel, common size financial statements compare cells against the balance total to determine what percent those figures have increased or decreased. Web this video shows you how to create a common size income statement in excel. Excel creates a new blank. Web this common size analysis template allows you to compare the financial performance of companies in different sizes on the same scale. You can use it in financial analysis to compare the. The balance sheet common size analysis mostly uses the total assets value as the base value. Web the common size balance sheet calculator allows for two balance sheets to be entered so that comparisons can be made. The common size income statement divides all the entries on an income statement by total revenue, letting you see which.

How to Create Common Size Balance Sheet in Excel (3 Simple Steps

Common Size Balance Sheet Calculator Double Entry Bookkeeping

How to Create Common Size Balance Sheet in Excel ExcelDemy

Common Size Balance Sheet Templates at

Simple Balance Sheet 24+ Free Word, Excel, PDF Documents Download

Common Size Analysis Overview, Examples, How to Perform

Commonsize Balance Sheet Excel Template 365 Financial Analyst

22+ Balance Sheet Examples Download in Word, PDF

Balance Sheet Templates 18+ Free Word, Excel, PDF Documents Download!

Common Size Balance Sheet Analysis (Format, Examples)

To Express The Amounts As The Percentage Of The Total, The Total Assets Or Total Equity And Liabilities Are Taken As 100.

Common Size Statements Examine The Proportion Of A Single Line Item To The Total Statement.

A Financial Manager Or Investor Can Use The Common Size Analysis To See How A Firm’s Capital Structure Compares To Rivals.

Web Balance Sheet Common Size Analysis.

Related Post: