Common Candlestick Patterns

Common Candlestick Patterns - 14 candlestick patterns explained | zfx. The shadows on the doji must completely gap below or above the shadows of the first and. They can create bullish candles or bearish candles. Free download todayoption trading principlesoptions trading course How to read candlestick patterns. In the context of a trend, a harami/inside bar can be indicative of exhaustion. Understanding candlestick patterns can help you get a sense of whether the bulls or the bears are dominant in the market at a given. Here’s a quick rundown of each category: Three advancing white soldiers (aws) final tip. Some of them predict bullish price movements, and others suggest bearish price movements. A rare reversal pattern characterized by a gap followed by a doji, which is then followed by another gap in the opposite direction. What are spot trading and futures. Candles help traders understand how the buying and selling pressure is applied during the given time interval. Candlestick patterns are a technical trading tool used for centuries to help predict price. Discover 16 of the most common candlestick patterns and how you can use them to identify trading opportunities. These patterns emerge from the open, high, low, and close prices of a security within a given period and are crucial for making informed trading decisions. The 12 chart patterns every trader should know. Web candlestick patterns are used to predict the. In this guide, you will learn how to use candlestick patterns to make your investment decisions. Discover 16 of the most common candlestick patterns and how you can use them to identify trading opportunities. Web the upper shadow is from the body top to the highest price, the lower shadow is the opposite. In the context of a trend, a. Each candlestick pattern has a distinct name and a traditional trading strategy. Web candlestick patterns consist of small clusters of 1 to 5 candlestick bars, which offer predictive value on the direction of the short term price action. This makes them more useful than traditional open, high, low. Web more importantly, we will discuss their significance and reveal 5 real. Candlestick patterns are a technical trading tool used for centuries to help predict price moments. They can create bullish candles or bearish candles. Web the upper shadow is from the body top to the highest price, the lower shadow is the opposite. A rare reversal pattern characterized by a gap followed by a doji, which is then followed by another. Web 35 types of candlestick patterns: Three advancing white soldiers (aws) final tip. Also, feel free to download our candlestick pattern quick reference guide! Here’s a quick rundown of each category: A rare reversal pattern characterized by a gap followed by a doji, which is then followed by another gap in the opposite direction. Candlestick patterns are key indicators on financial charts, offering insights into market sentiment and price movements. Web our candlestick pattern dictionary provides brief descriptions of many common candlestick patterns. How can they help you enhance your trading strategy? Candlestick patterns in forex and what do they mean. In the context of a trend, a harami/inside bar can be indicative of. Web 35 types of candlestick patterns: A picture is worth a thousand words, so let’s use a few to shine a light on candlesticks. A rare reversal pattern characterized by a gap followed by a doji, which is then followed by another gap in the opposite direction. An indication that an increase in volatility is imminent. Web there are many. Each candlestick pattern has a distinct name and a traditional trading strategy. Web candlestick patterns consist of small clusters of 1 to 5 candlestick bars, which offer predictive value on the direction of the short term price action. 14 common candlestick patterns explained. Web candlestick patterns are used to predict the future direction of price movement. Web our candlestick pattern. Discover 16 of the most common candlestick patterns and how you can use them to identify trading opportunities. Web candlestick pattern explained. Web candlestick patterns are used to predict the future direction of price movement. Candlestick patterns are key indicators on financial charts, offering insights into market sentiment and price movements. These are called japanese candlesticks, and we’re going to. Also, feel free to download our candlestick pattern quick reference guide! These patterns emerge from the open, high, low, and close prices of a security within a given period and are crucial for making informed trading decisions. Web candlestick pattern explained. Web common candlestick chart patterns. How can they help you enhance your trading strategy? What are spot trading and futures. Free animation videos.master the fundamentals.learn finance easily.learn at no cost. What comprises a financial market? An indication that an increase in volatility is imminent. Web candlestick patterns are used to predict the future direction of price movement. Some of them predict bullish price movements, and others suggest bearish price movements. Candlestick patterns in forex and what do they mean. A picture is worth a thousand words, so let’s use a few to shine a light on candlesticks. 14 common candlestick patterns explained. In this guide, you will learn how to use candlestick patterns to make your investment decisions. Web the upper shadow is from the body top to the highest price, the lower shadow is the opposite.

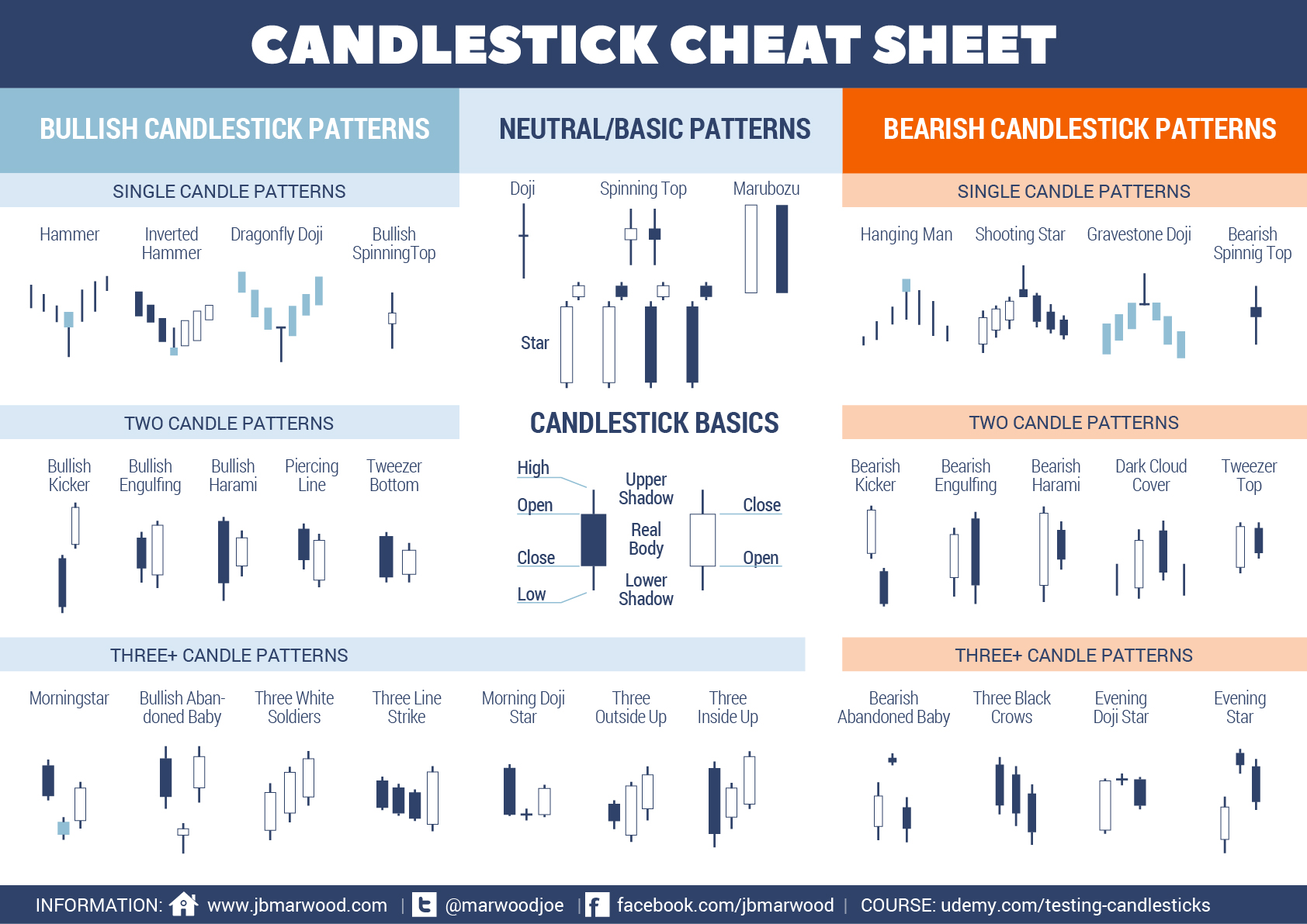

Candlestick Patterns Cheat Sheet New Trader U

How to read candlestick patterns What every investor needs to know

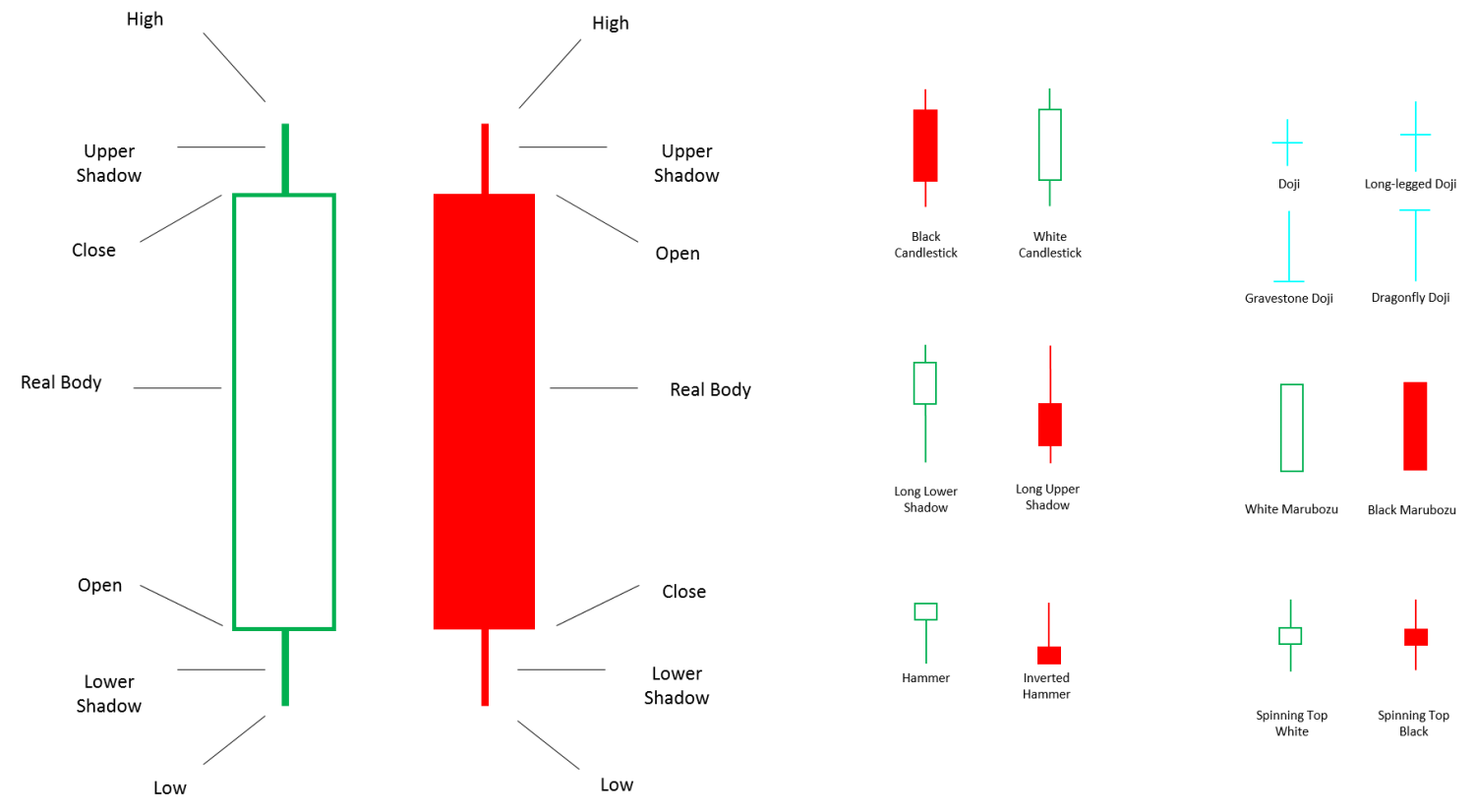

What Are Candlestick Patterns? Understanding Candlesticks Basics

(How to read a candlestick and What a candlestick meant)

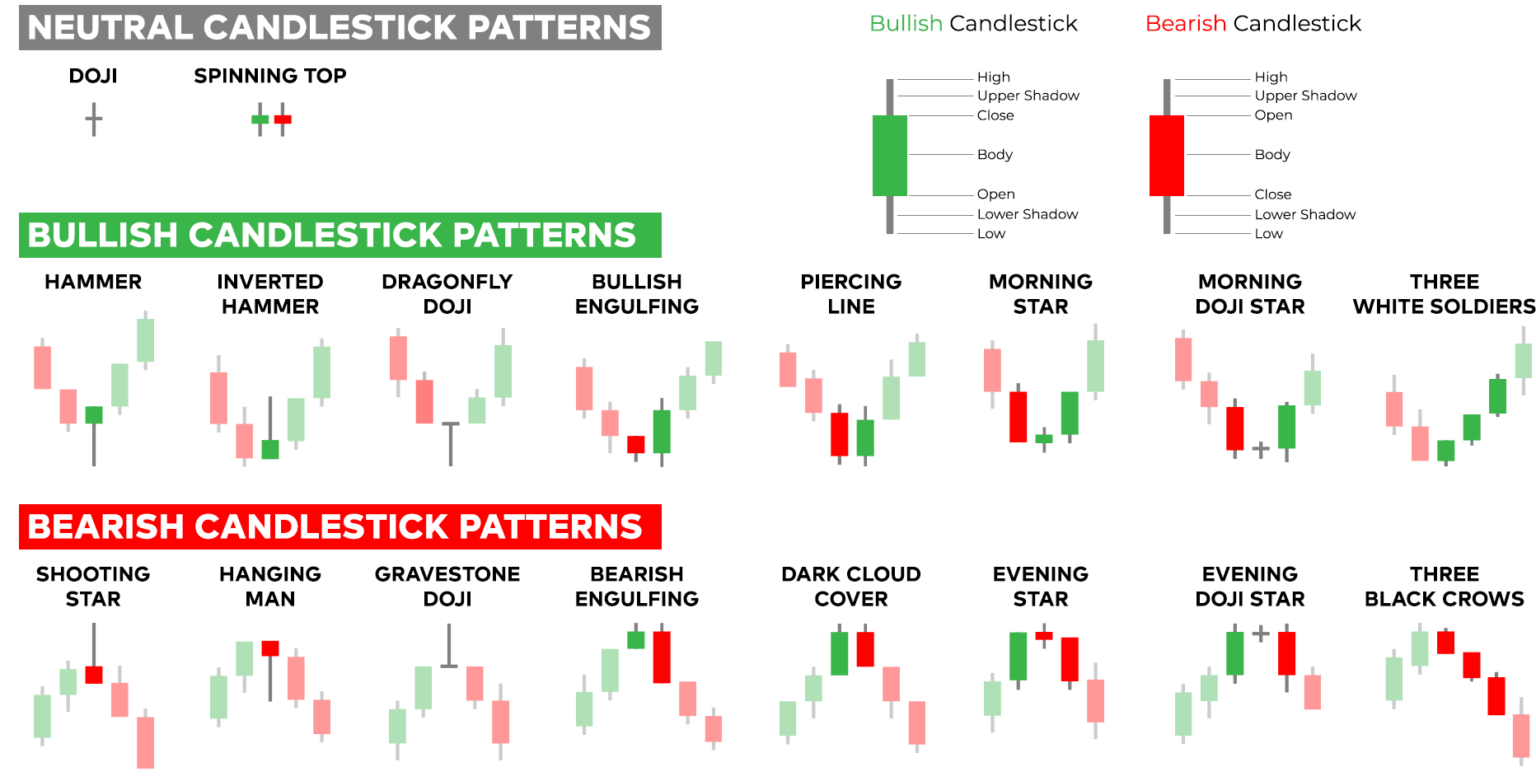

Trading 101 Common Candlestick Patterns BullBear Blog

Trading Candlestick Patterns 101 Introduction and Common Candlesticks

Candlestick Patterns Explained HOW TO READ CANDLESTICKS

What Are Candlestick Patterns? Understanding Candlesticks Basics

Trading Candlestick Patterns 101 Introduction and Common Candlesticks

![Candlestick Patterns Explained [Plus Free Cheat Sheet] TradingSim](https://www.tradingsim.com/hubfs/Imported_Blog_Media/CANDLESTICKQUICKGUIDE-Mar-18-2022-09-42-46-01-AM.png)

Candlestick Patterns Explained [Plus Free Cheat Sheet] TradingSim

Three Advancing White Soldiers (Aws) Final Tip.

Japanese Candlesticks Often Form Patterns That Predict Future Price Movements.

Web There Are Many Forms Of Charts, But Probably The Most Commonly Used Are Candlestick Charts Generally Consisting Of Red And Green Rectangles That Look Similar To A Box And Whisker Plot.

Discover 16 Of The Most Common Candlestick Patterns And How You Can Use Them To Identify Trading Opportunities.

Related Post: