Chart Patterns Hammer

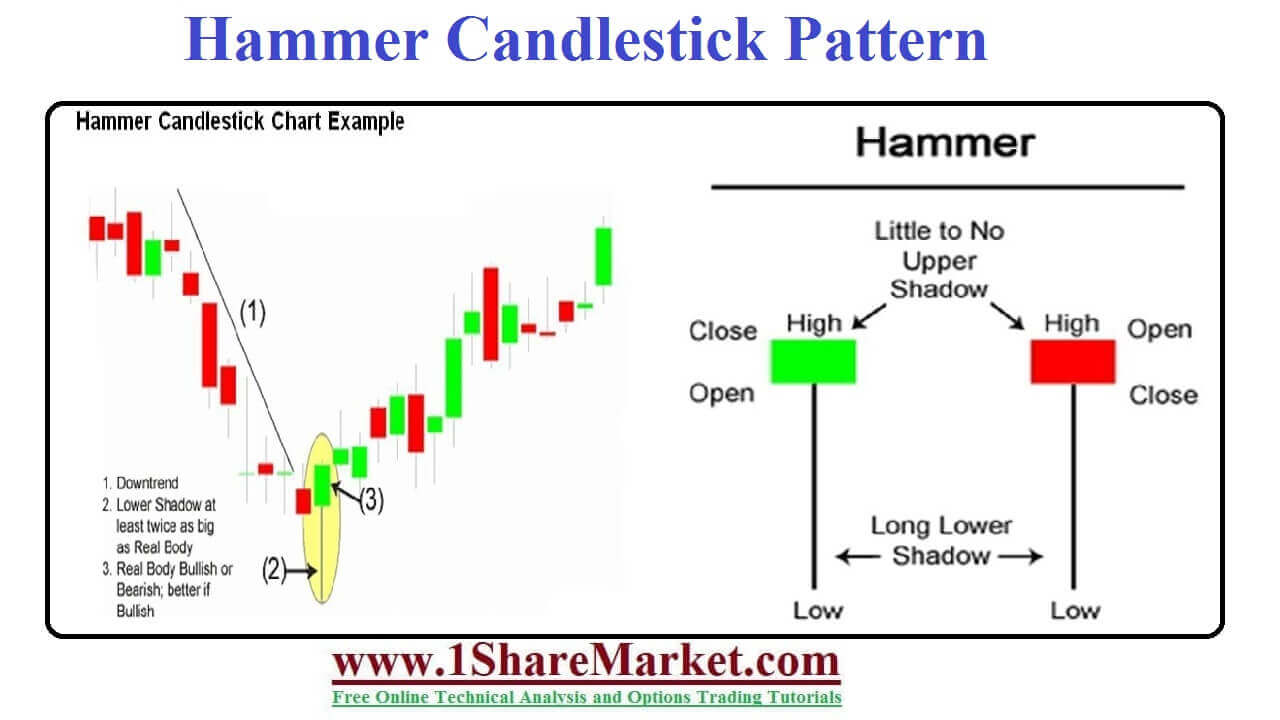

Chart Patterns Hammer - Illustrated guide to hammer candlestick patterns. Bullish engulfing (2) piercing pattern (2) bullish harami (2). Web the hammer candlestick pattern is a single candle formation that occurs in the candlestick charting of financial markets. Web a hammer candlestick is a chart formation that signals a potential bullish reversal after a downtrend, identifiable by its small body and long lower wick. Web over time, groups of daily candlesticks fall into recognizable patterns with descriptive names like three white soldiers, dark cloud cover, hammer, morning star,. Web understanding hammer chart and the technique to trade it. Web september 12, 2022 zafari. Web a hammer candle is a popular pattern in chart technical analysis. Web the hammer is a classic and easily identifiable candlestick chart pattern that often foreshadows a bullish reversal. A minor difference between the opening and. In financial technical analysis, a candlestick pattern is a movement in prices shown graphically on a candlestick chart that some believe can help to identify repeating patterns of a particular market movement. A minor difference between the opening and. A hammer candlestick pattern is a reversal structure that forms at the bottom of a chart. Web the hammer candle is. Web september 12, 2022 zafari. Web understanding hammer chart and the technique to trade it. Web the bullish hammer is a single candle pattern found at the bottom of a downtrend that signals a turning point from a bearish to a bullish market sentiment. As it is a bullish. To identify a hammer pattern,. Web the hammer is a classic and easily identifiable candlestick chart pattern that often foreshadows a bullish reversal. Web a hammer candlestick is a chart formation that signals a potential bullish reversal after a downtrend, identifiable by its small body and long lower wick. To identify a hammer pattern,. Web a hammer candle is a popular pattern in chart technical. Web the hammer is a classic and easily identifiable candlestick chart pattern that often foreshadows a bullish reversal. It is characterized by a small body and a long lower wick, resembling a hammer, hence its. Web the hammer candlestick pattern is a single candle formation that occurs in the candlestick charting of financial markets. Web the bullish hammer is a. Web below are some of the key bullish reversal patterns with the number of candlesticks required in parentheses. It’s a bullish reversal candlestick pattern, which. This is one of the popular price patterns in candlestick charting. Bullish engulfing (2) piercing pattern (2) bullish harami (2). Web the hammer is a classic bottom reversal pattern that warns traders that prices have. A hammer candlestick pattern is a reversal structure that forms at the bottom of a chart. Web the hammer is a classic bottom reversal pattern that warns traders that prices have reached the bottom and are going to move up. Web over time, groups of daily candlesticks fall into recognizable patterns with descriptive names like three white soldiers, dark cloud. The hammer candlestick pattern is. As it is a bullish. Web the bullish hammer is a single candle pattern found at the bottom of a downtrend that signals a turning point from a bearish to a bullish market sentiment. Web a hammer candlestick pattern is a bullish reversal pattern that is used to indicate a potential reversal of a downward. Web the hammer pattern is a crucial technical analysis tool used by traders to identify potential trend reversals in various financial markets. The marked black candle occurrence is preceded by a number of black candles formed at a high trading volume,. Web the hammer candlestick pattern is a single candle formation that occurs in the candlestick charting of financial markets.. It’s a bullish reversal candlestick pattern, which. A minor difference between the opening and. Web the hammer pattern is a crucial technical analysis tool used by traders to identify potential trend reversals in various financial markets. Illustrated guide to hammer candlestick patterns. Web a hammer candle is a popular pattern in chart technical analysis. Web the hammer pattern is a crucial technical analysis tool used by traders to identify potential trend reversals in various financial markets. The marked black candle occurrence is preceded by a number of black candles formed at a high trading volume,. Web the bullish hammer is a single candle pattern found at the bottom of a downtrend that signals a. In financial technical analysis, a candlestick pattern is a movement in prices shown graphically on a candlestick chart that some believe can help to identify repeating patterns of a particular market movement. Web understanding hammer chart and the technique to trade it. Web the bullish hammer is a single candle pattern found at the bottom of a downtrend that signals a turning point from a bearish to a bullish market sentiment. Web a hammer candlestick is a chart formation that signals a potential bullish reversal after a downtrend, identifiable by its small body and long lower wick. As it is a bullish. Web september 12, 2022 zafari. The marked black candle occurrence is preceded by a number of black candles formed at a high trading volume,. This is one of the popular price patterns in candlestick charting. Web the hammer is a classic bottom reversal pattern that warns traders that prices have reached the bottom and are going to move up. Like any other candlestick pattern, it can be. It is characterized by a small body and a long lower wick, resembling a hammer, hence its. Bullish engulfing (2) piercing pattern (2) bullish harami (2). Illustrated guide to hammer candlestick patterns. It’s a bullish reversal candlestick pattern, which. Web the hammer is a classic and easily identifiable candlestick chart pattern that often foreshadows a bullish reversal. Web the hammer candlestick pattern is a single candle formation that occurs in the candlestick charting of financial markets.

Hammer Candlestick Pattern Trading Guide

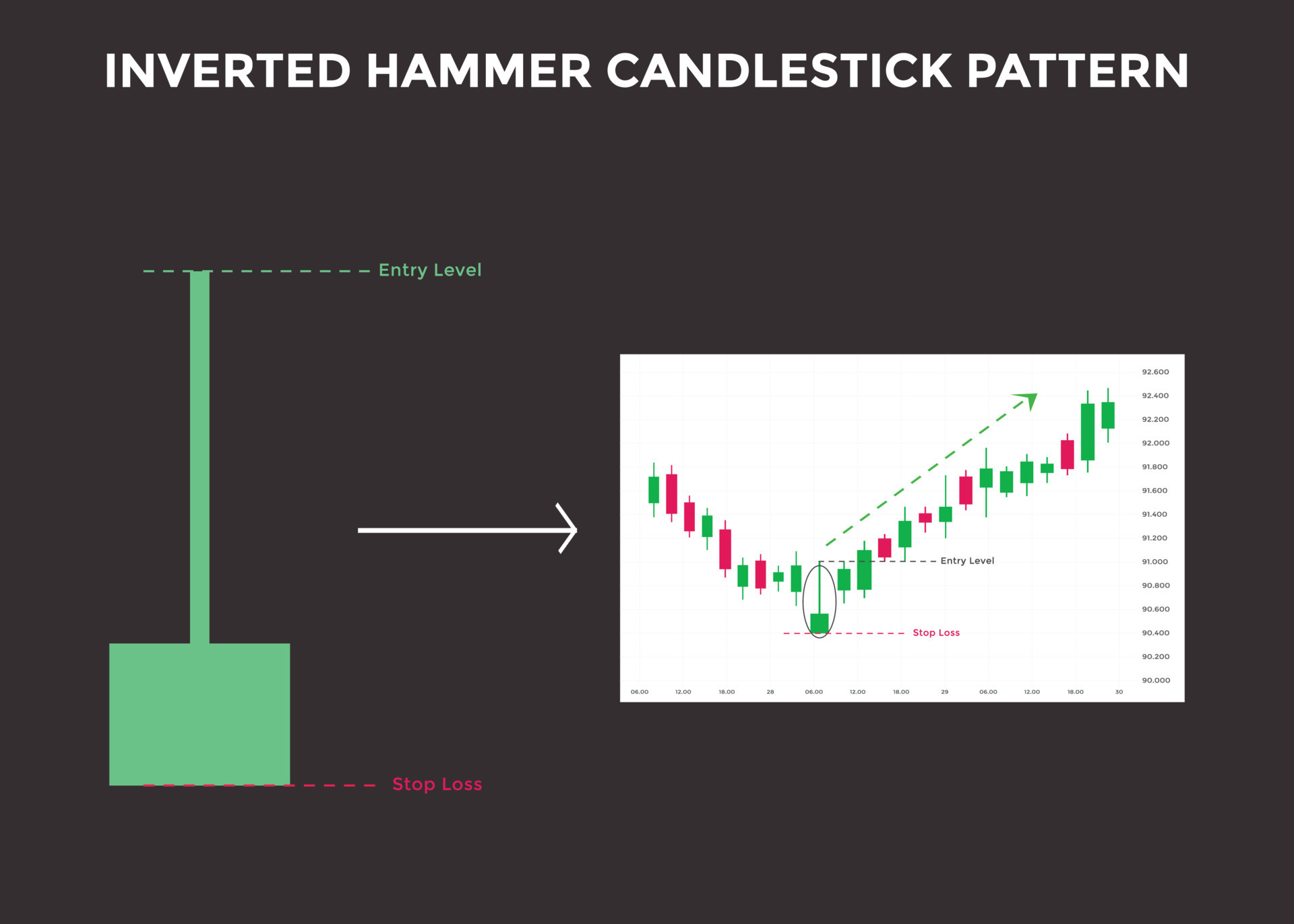

Inverted Hammer Candlestick Pattern Quick Trading Guide

Inverted Hammer candlestick chart pattern. Candlestick chart Pattern

Powerful Hammer Candlestick Pattern Formation, Example and

What is a Hammer Candlestick Chart Pattern? NinjaTrader

Hammer Candlestick Pattern Trading Guide

Mastering the Hammer Candlestick Pattern A StepbyStep Guide to

Hammer Patterns Chart 5 Trading Strategies for Forex Traders

Hammer candlestick pattern Defination with Advantages and limitation

Candle Patterns Picking the "RIGHT" Hammer Pattern YouTube

There Are Two Types Of Hammers:

A Minor Difference Between The Opening And.

Hammer Candlestick Pattern Is A Bullish Reversal Candlestick Pattern.

Web Over Time, Groups Of Daily Candlesticks Fall Into Recognizable Patterns With Descriptive Names Like Three White Soldiers, Dark Cloud Cover, Hammer, Morning Star,.

Related Post: