Chart Patterns Flag

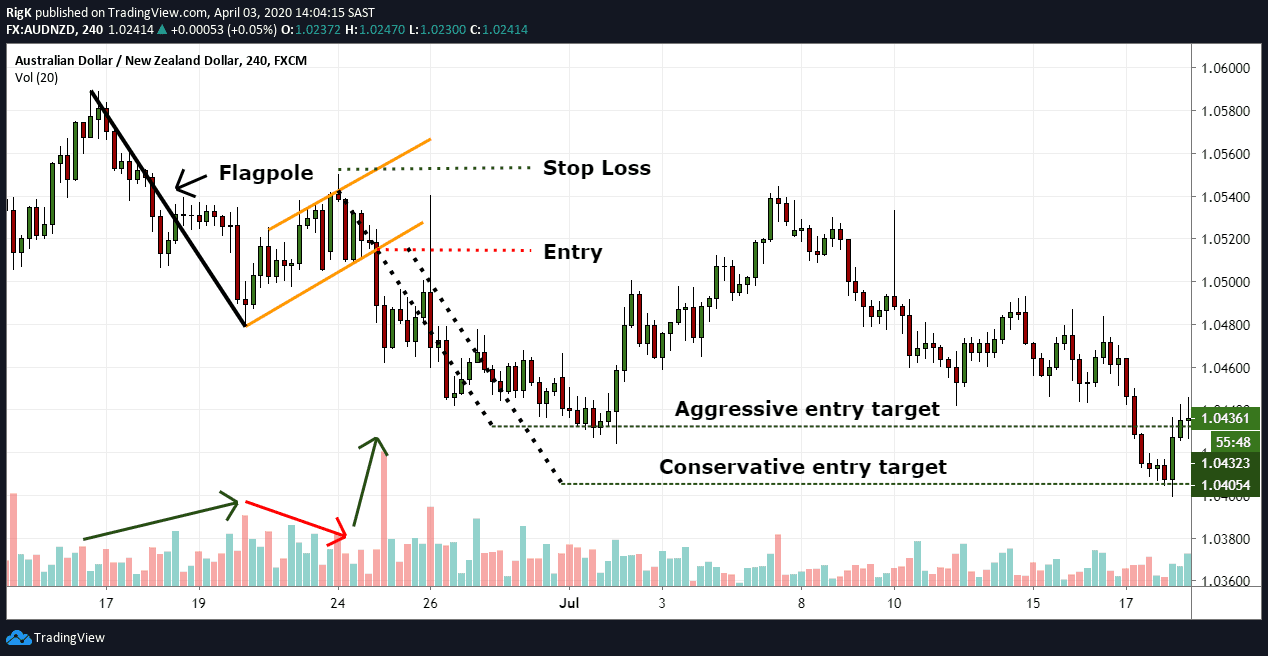

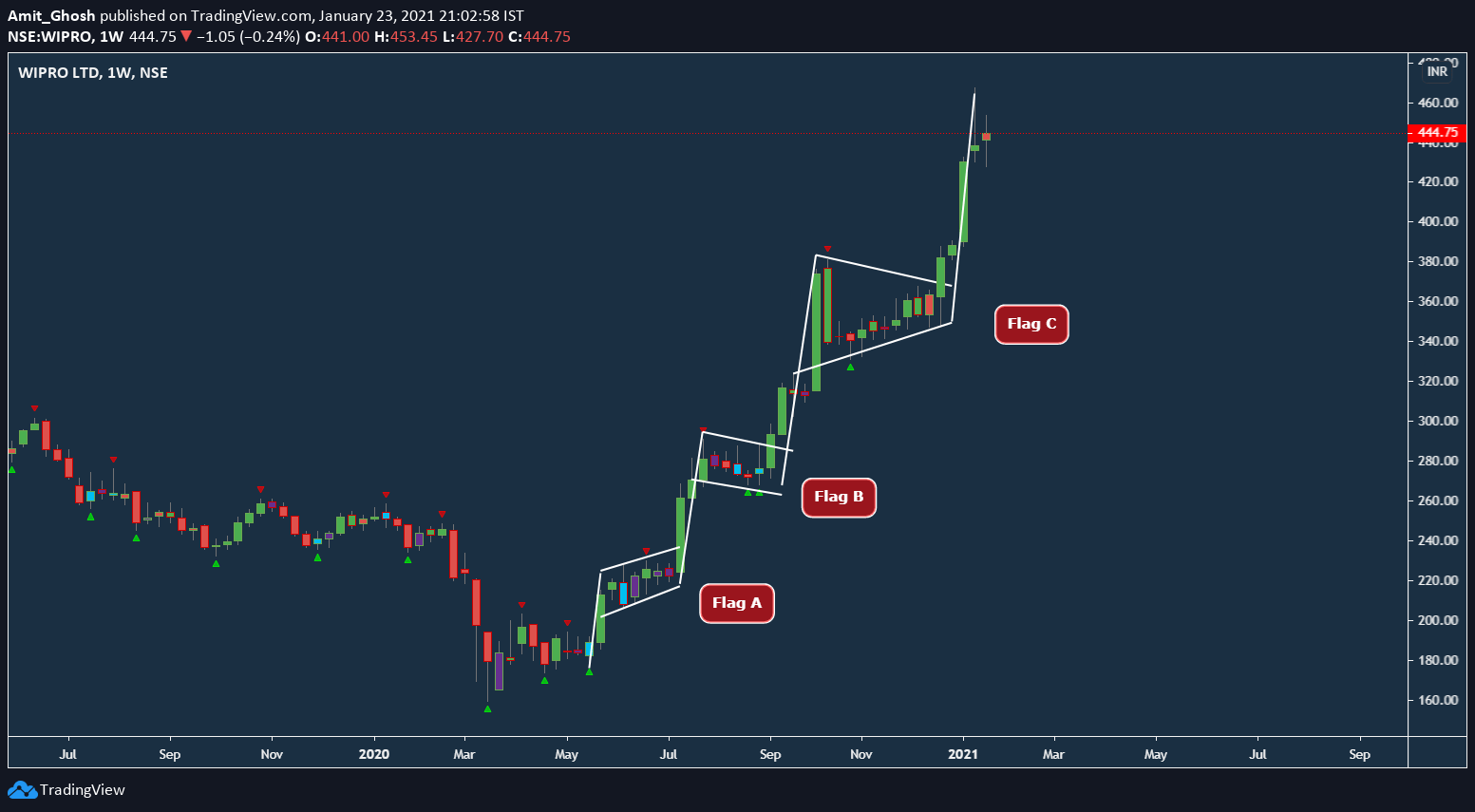

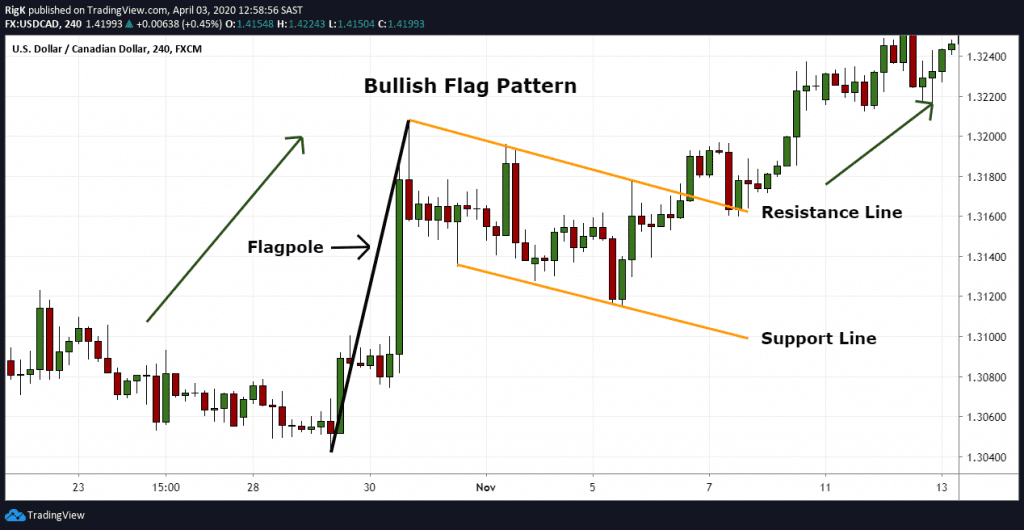

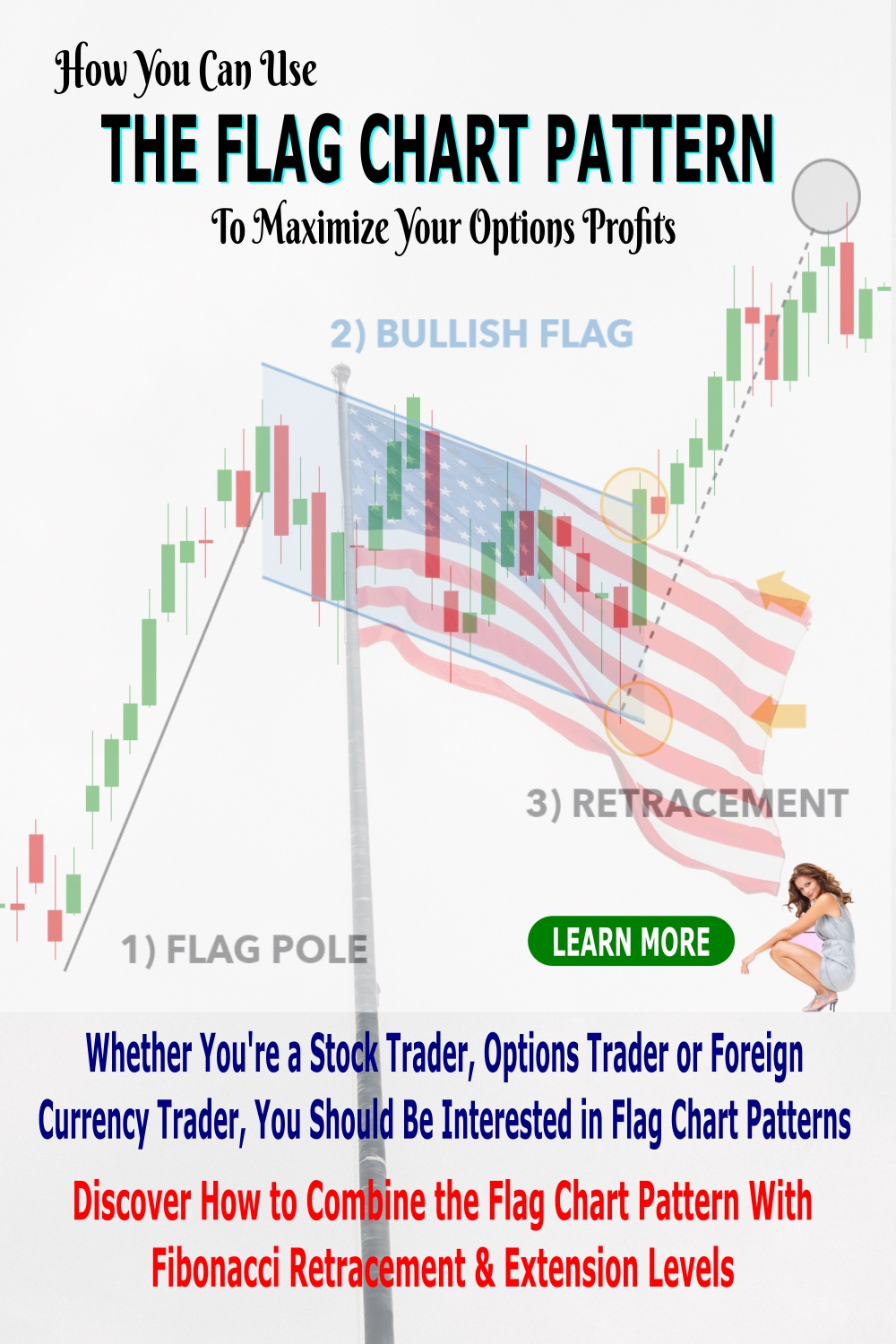

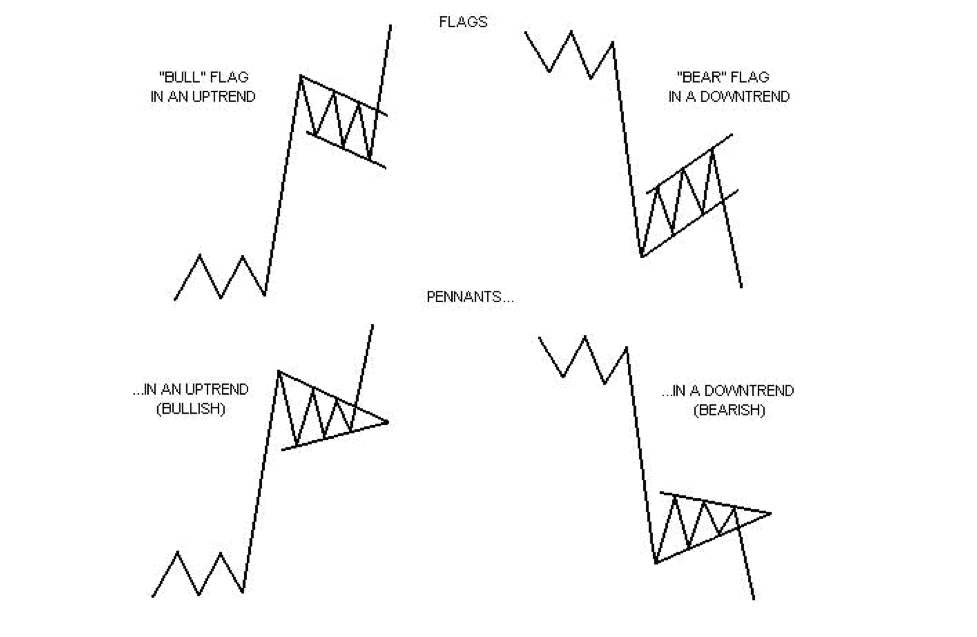

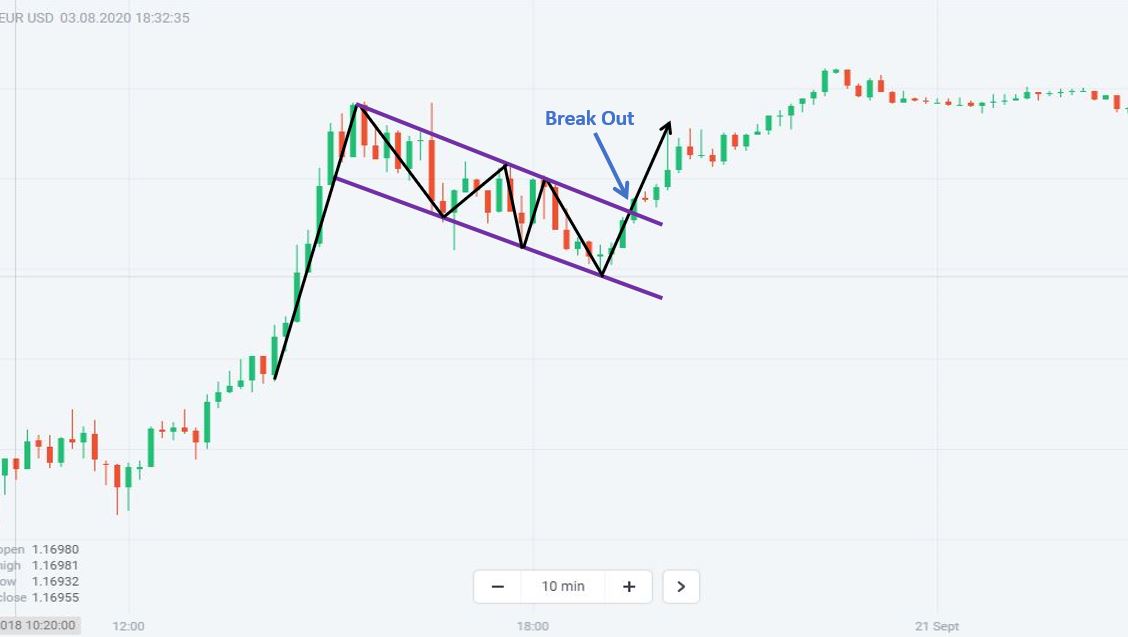

Chart Patterns Flag - Web this technical analysis guide teaches you about flag chart patterns. Once these patterns come to an end, the resulting move can often be strong and reach your target quickly, which is why it is so popular amongst technical traders. The formation usually occurs after a strong trending move that can contain gaps (this move is known as the mast or pole of the flag) where the flag represents a. It is not a reversal pattern. Then, we explore the flag pattern indicators that show potential buy or sell signals. Flag patterns have two variations: A bear flag pattern is a continuation pattern that resembles an upturned flag with a pole. Web what are flag and pennant chart patterns? Usually a breakout from the flag is in the form of continuation of the prior trend. (dell) pennant example chart from. It is not a reversal pattern. (chart examples of flag and pennant patterns using commodity charts.) (stock charts.) It signals that the prevailing vertical trend may be in the process of extending its range. The patterns are characterized by a clear direction of the price trend, followed by a consolidation and rangebound movement, which is then followed by a resumption. Web the flag pattern is a powerful trend continuation chart pattern that appears in all markets and timeframes. The patterns are characterized by a clear direction of the price trend, followed by a consolidation and rangebound movement, which is then followed by a resumption of the trend. Web a flag chart pattern is formed when the market consolidates in a. The flag pole, the flag, and the break of the price channel. Web this technical analysis guide teaches you about flag chart patterns. Web flag patterns are a useful visual tool to identify and evaluate changes in price over time. In the last 30 years, the city has undergone a transformation to. That’s because they reveal roadmaps for potential market. Web easy crochet pattern of israeli flag, with chart. Respectively, they show a strong directional trend, a period of consolidation, and a clear breakout structure. It is considered a continuation pattern, indicating that the prevailing trend is likely to continue after a brief consolidation or pause. A flag can be used as an entry pattern for the continuation of an. The flag portion of the pattern must run between parallel lines and can either be slanted up, down, or even sideways. The price swing leading to the flag begins at a and ends at the top of the flagpole, b. Web what is a bull flag chart pattern? Web what is a bear flag pattern : Once these patterns come. Web this is the third time that malmo, a city of 360,000 people on sweden’s southwest coast, has hosted the eurovision song contest. It is not a reversal pattern. Whenever you see this pattern form on a chart, it means that there are high chances of the price action breaking out in the direction of the prevailing trend. You’ve heard. It is considered a continuation pattern, indicating that the prevailing trend is likely to continue after a brief consolidation or pause. In the last 30 years, the city has undergone a transformation to. Web easy crochet pattern of israeli flag, with chart. It is not a reversal pattern. Flag patterns have two variations: Web a bull flag chart pattern is a continuation pattern that occurs in a strong uptrend. The formation usually occurs after a strong trending move that can contain gaps (this move is known as the mast or pole of the flag) where the flag represents a. Web what is a bull flag chart pattern? Once these patterns come to an. In the last 30 years, the city has undergone a transformation to. Web research has shown that these patterns are some of the most reliable continuation patterns. Then, we explore the flag pattern indicators that show potential buy or sell signals. Once these patterns come to an end, the resulting move can often be strong and reach your target quickly,. Web what are flag and pennant chart patterns? (dell) pennant example chart from. Web what is a bear flag pattern : Web flag patterns are a useful visual tool to identify and evaluate changes in price over time. Web this is the third time that malmo, a city of 360,000 people on sweden’s southwest coast, has hosted the eurovision song. In technical analysis, a pennant is a type of continuation pattern. The price swing leading to the flag begins at a and ends at the top of the flagpole, b. They represent pauses while a trend consolidates and are reliable continuation signals in a strong trend. The flag and pennant patterns are commonly found patterns in the price charts of financially traded assets ( stocks, bonds, futures, etc.). The flag pole, the flag, and the break of the price channel. Web a flag pattern is a technical analysis chart pattern that can be observed in the price charts of financial assets, such as stocks, currencies, or commodities. A short flag sees price consolidate for a few days before breaking out upward and trending higher. You’ve heard that chart patterns matter. Once these patterns come to an end, the resulting move can often be strong and reach your target quickly, which is why it is so popular amongst technical traders. Pennants look similar to flags. A bear flag pattern is a continuation pattern that resembles an upturned flag with a pole. Web this is the third time that malmo, a city of 360,000 people on sweden’s southwest coast, has hosted the eurovision song contest. Web a flag chart pattern is formed when the market consolidates in a narrow range after a sharp move. The bull flag is a clear technical pattern that has three distinct components: (chart examples of flag and pennant patterns using commodity charts.) (stock charts.) Web the above figure shows an example of a flag chart pattern.

Bull Flag Chart Patterns The Complete Guide for Traders

Flag Pattern Full Trading Guide with Examples

Flag Patterns Part I The Basics of Flag Pattern Unofficed

Multiple bullish flag chart patterns confirming a strong trend. Trend

Flag Pattern Full Trading Guide with Examples

Using the Flag Chart Pattern Effectively

What Is Flag Pattern? How To Verify And Trade It Efficiently

How to use the flag chart pattern for successful trading

Stock Trading Training Flag Patterns

What Is Flag Pattern? How To Verify And Trade It Efficiently

You Can Make It If You Know Single Crochet Stitch, Crocheting In Rows And Changing Colors (Fair Isle Technique).

Web This Technical Analysis Guide Teaches You About Flag Chart Patterns.

Web What Are Flag And Pennant Chart Patterns?

That’s Because They Reveal Roadmaps For Potential Market Movements… Alert You To Upcoming Reversals… Even Forecast Whether Trends Will.

Related Post: