Chart Pattern Double Top

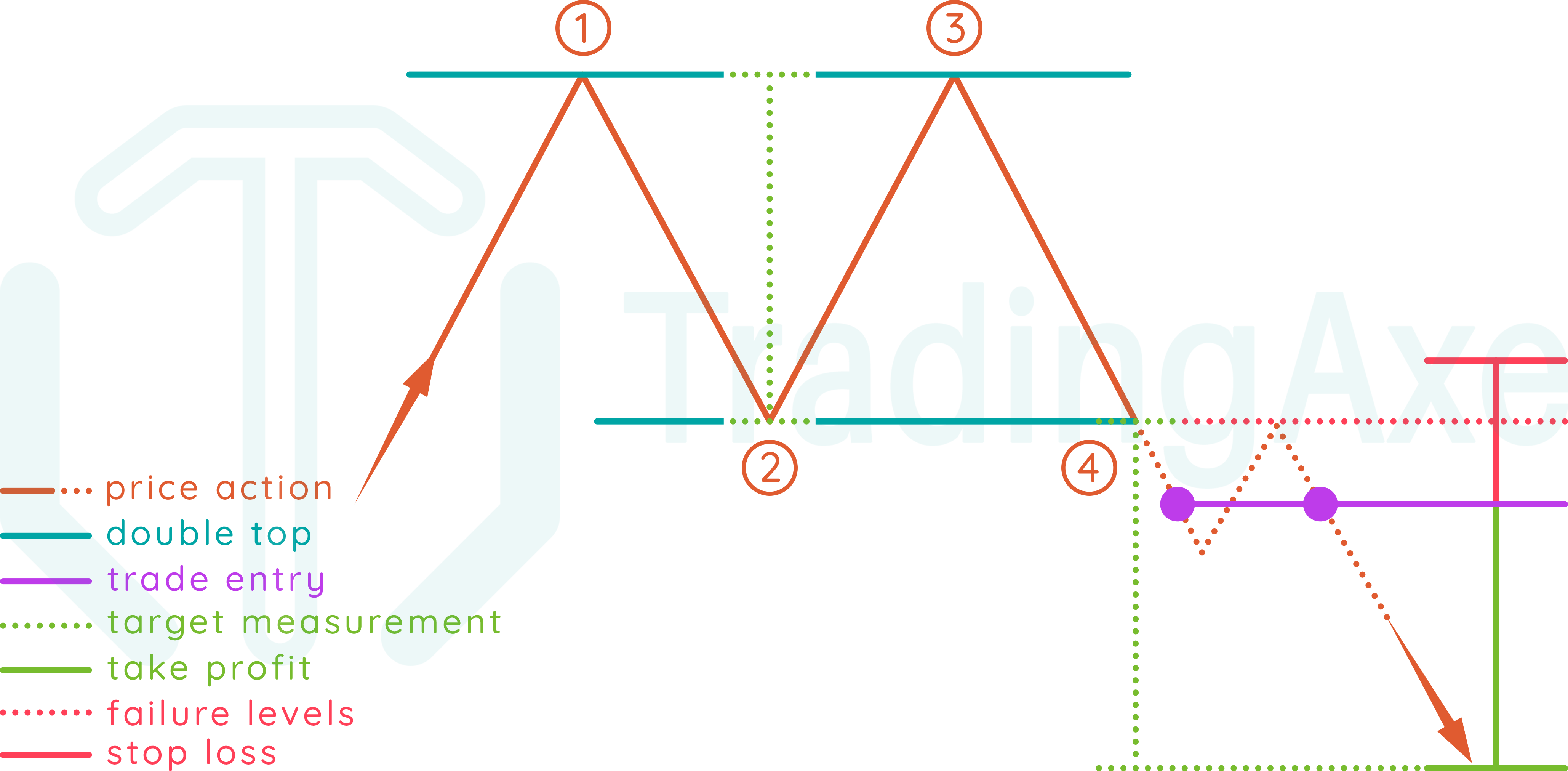

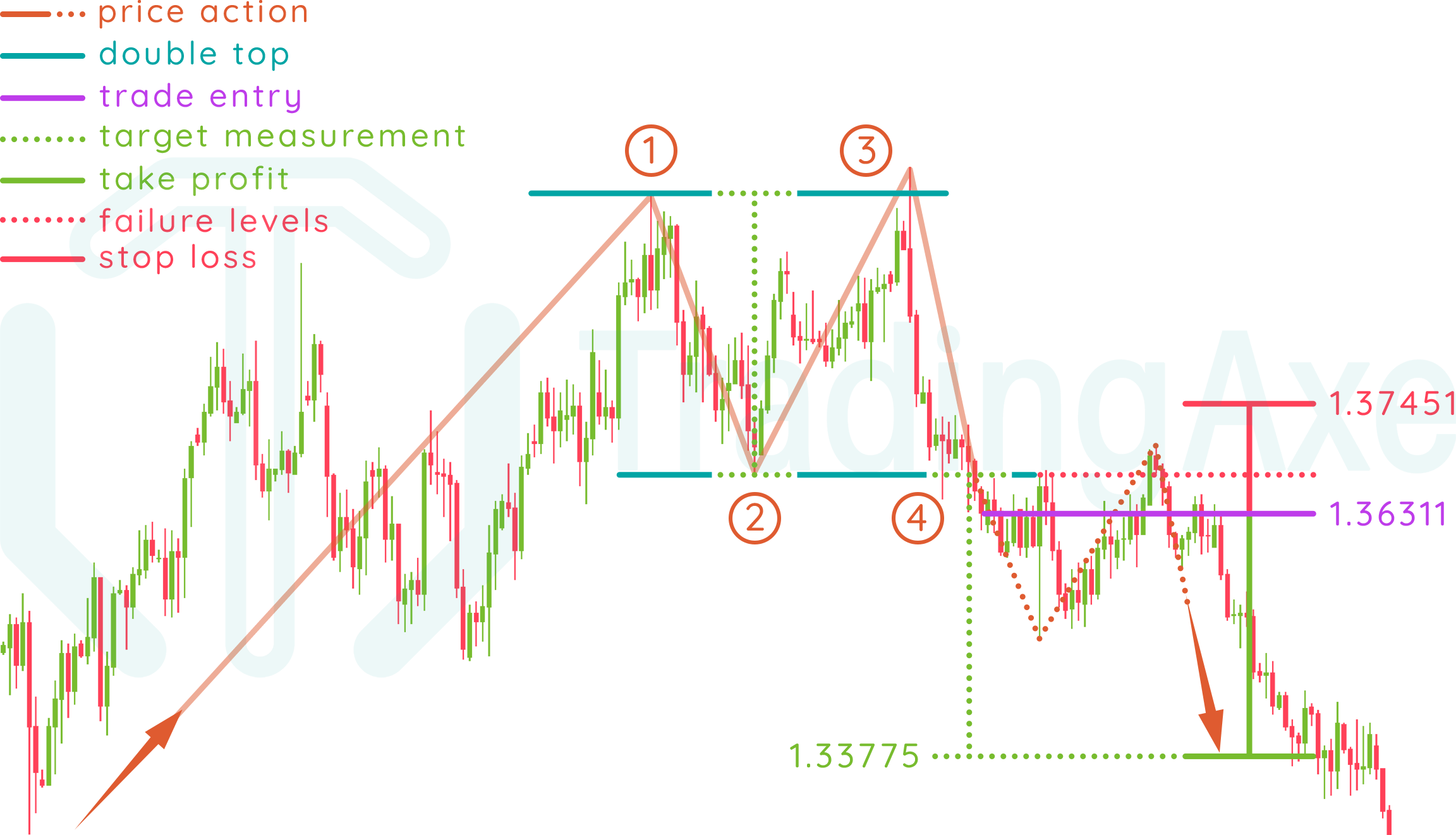

Chart Pattern Double Top - Web double tops a double top is a bearish reversal pattern, typically found when an uptrend returns back to a prior peak. These formations suggest that asset prices have hit a bottom or a top twice before continuing on the trend reversal path. Web a double top pattern consists of several candlesticks that form two peaks or resistance levels that are either equal or near equal height. Meaning of the pattern and identification rules. No chart pattern is more common in trading than the double bottom or double top. [1] [2] double top confirmation. Web double bottoms and tops are chart patterns that take the shape of a “w” for double bottoms and an “m” for double tops. Web a double top is a chart pattern characterized by two price highs that are rejected by a resistance level, signaling a potential bearish reversal trend. A double top chart pattern is a bearish reversal chart pattern that is formed after an uptrend. They are formed by twin highs that can’t break above to form new highs. [1] [2] double top confirmation. A double top chart pattern is a bearish reversal chart pattern that is formed after an uptrend. Web the double top chart pattern is a bearish reversal pattern typically found on bar charts, line charts, and candlestick charts. Web a double top pattern is a bearish pattern in technical analysis that signals a bearish reversal. A double top is an extremely bearish technical reversal pattern that forms after an asset reaches a high price two. Web a double top is a chart pattern characterized by two price highs that are rejected by a resistance level, signaling a potential bearish reversal trend. It is confirmed once the asset price falls below a support level equal to. Web double top is a bearish reversal chart pattern that occurs after a stock reaches similar high prices in two sessions with a drop in price in between. What is double top and bottom? This chart pattern occurs after an extended price increase in financial markets and consists of two swing high peaks at approximately the same price level, separated. No chart pattern is more common in trading than the double bottom or double top. Web the double top reversal is a bearish reversal pattern typically found on bar charts, line charts, and candlestick charts. This chart pattern occurs after an extended price increase in financial markets and consists of two swing high peaks at approximately the same price level,. They are formed by twin highs that can’t break above to form new highs. Protradingart updated jul 10, 2023. Look at an illustration in the image below: Identify the two distinct peaks of similar width and height. It signifies a potential turning point or resistance level and could potentially reverse in. Web when a double top or double bottom chart pattern appears, a trend reversal has begun. The double top is a. It signifies a potential turning point or resistance level and could potentially reverse in. Web how to identify a double top pattern on forex charts. Web a double top pattern is a bearish pattern in technical analysis that signals. After reaching back to its neckline. Typically, when the second peak forms, it can’t break above the first peak and causes a double top failure. Web double top is a bearish reversal chart pattern that occurs after a stock reaches similar high prices in two sessions with a drop in price in between. This pattern is formed with two peaks. Entry selection / stop placement / target selection explained. Web double top is a bearish reversal chart pattern that occurs after a stock reaches similar high prices in two sessions with a drop in price in between. It signifies a potential turning point or resistance level and could potentially reverse in. Meaning of the pattern and identification rules. Web a. Protradingart updated jul 10, 2023. Typically, when the second peak forms, it can’t break above the first peak and causes a double top failure. Usually, a double top pattern indicates a potential reversal in an upward trend. This pattern is formed with two peaks above a support level which is also known as the neckline. Two peaks that are near. Web double top is a reversal pattern formed by two consecutive highs that are at the same level (slight difference in values is allowed) and an intermediate low between them. It signifies a potential turning point or resistance level and could potentially reverse in. Usually, a double top pattern indicates a potential reversal in an upward trend. Traders typically look. Web updated june 28, 2021. Web double tops a double top is a bearish reversal pattern, typically found when an uptrend returns back to a prior peak. Protradingart updated jul 10, 2023. A double top is a reversal pattern that is formed after there is an extended move up. The first peak is formed after a strong uptrend and then retrace back to the neckline. Web the double top is a chart pattern with two swing highs very close in price. Look at an illustration in the image below: A double top is an extremely bearish technical reversal pattern that forms after an asset reaches a high price two. Web updated april 06, 2024. A double top chart pattern is a bearish reversal chart pattern that is formed after an uptrend. No chart pattern is more common in trading than the double bottom or double top. Web the double top chart pattern is a bearish reversal pattern typically found on bar charts, line charts, and candlestick charts. The double top is a. [1] [2] double top confirmation. As its name implies, the pattern is made up of two consecutive peaks that are roughly at the same level and a moderate trough in between. Between these two peaks, the price declines, which creates a support level or neckline.

Double Top Pattern Your Complete Guide To Consistent Profits

What Is A Double Top Pattern? How To Trade Effectively With It

How To Trade Double Top Chart Pattern TradingAxe

Double Top Pattern Definition How to Trade Double Tops & Bottoms?

Double Top Pattern Your Complete Guide To Consistent Profits

How To Trade Double Top Chart Pattern TradingAxe

Double Top Chart Pattern Trading charts, Stock chart patterns, Candle

Double Top Pattern A Forex Trader’s Guide

The Double Top Chart Pattern Pro Trading School

The Double Top Trading Strategy Guide

The “Tops” Are Peaks That Are Formed When The Price Hits A Certain Level That Can’t Be Broken.

Web What Is Double Top Pattern?

Web A Double Top Is A Chart Pattern Characterized By Two Price Highs That Are Rejected By A Resistance Level, Signaling A Potential Bearish Reversal Trend.

It Visually Represents A Period In The Market Where The Price Hits A Certain High Twice, But Fails To Break Through This Resistance Level.

Related Post: