Charitable Contribution Receipt Template

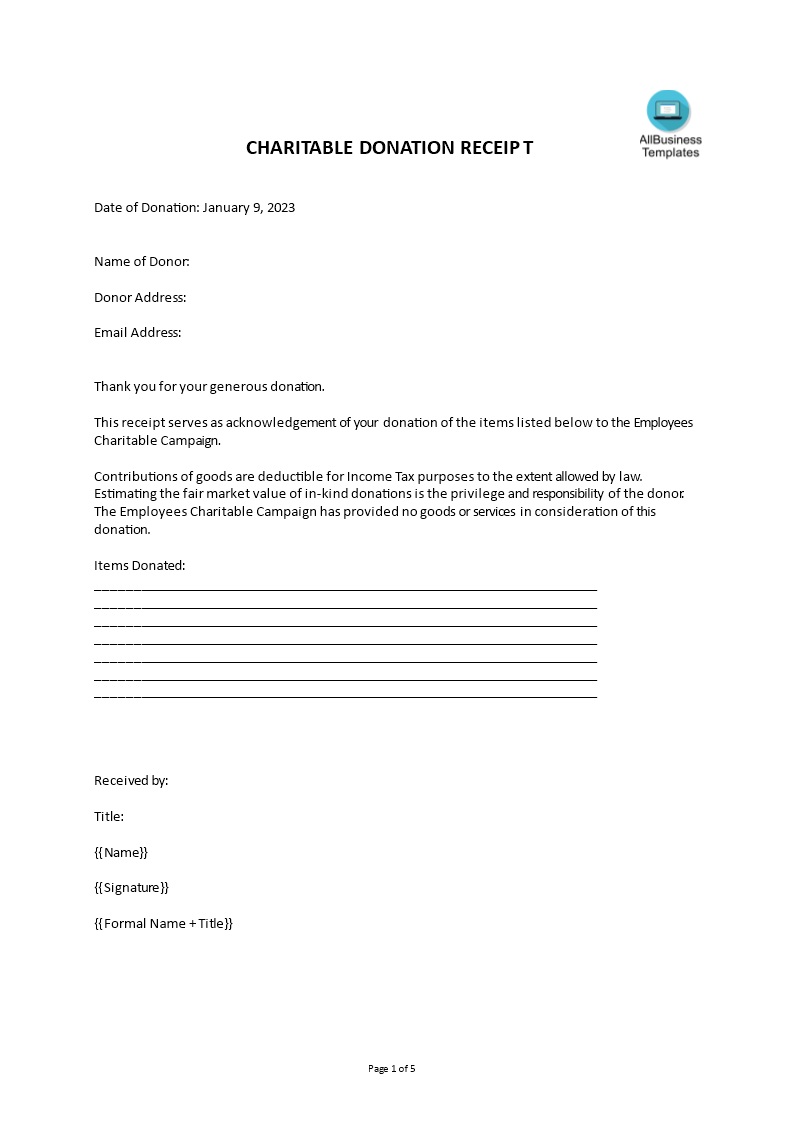

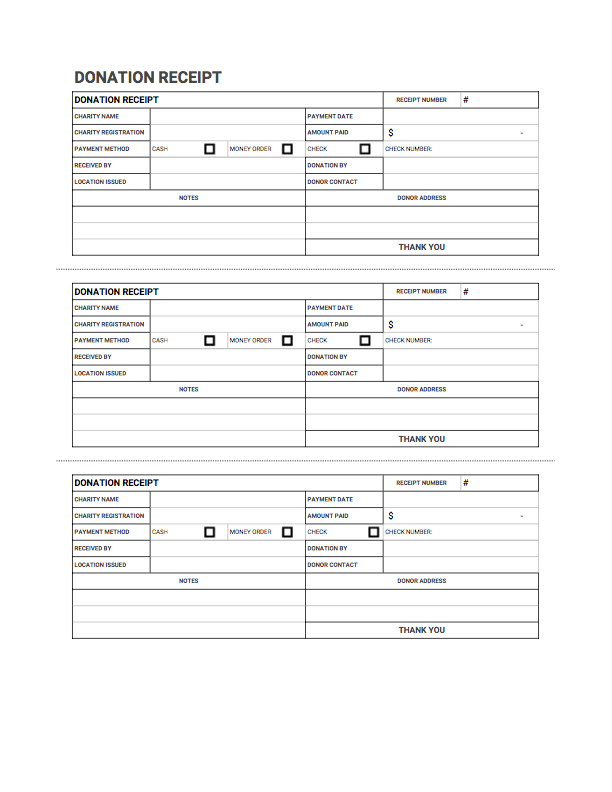

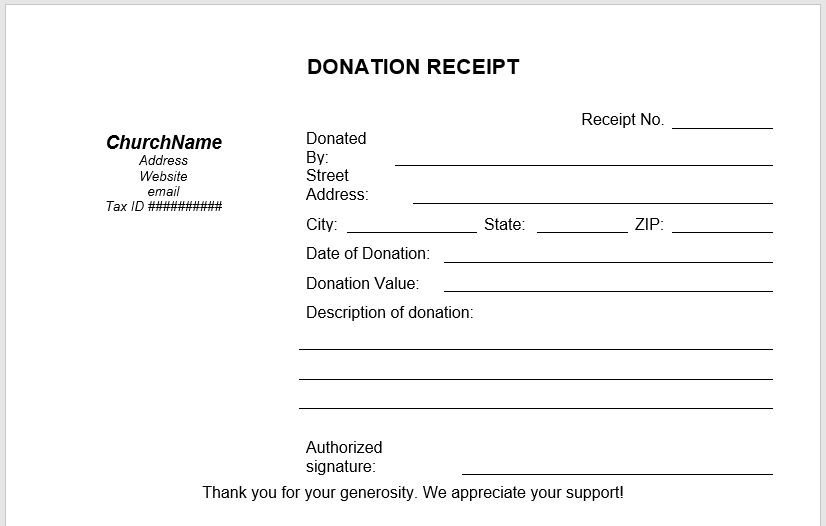

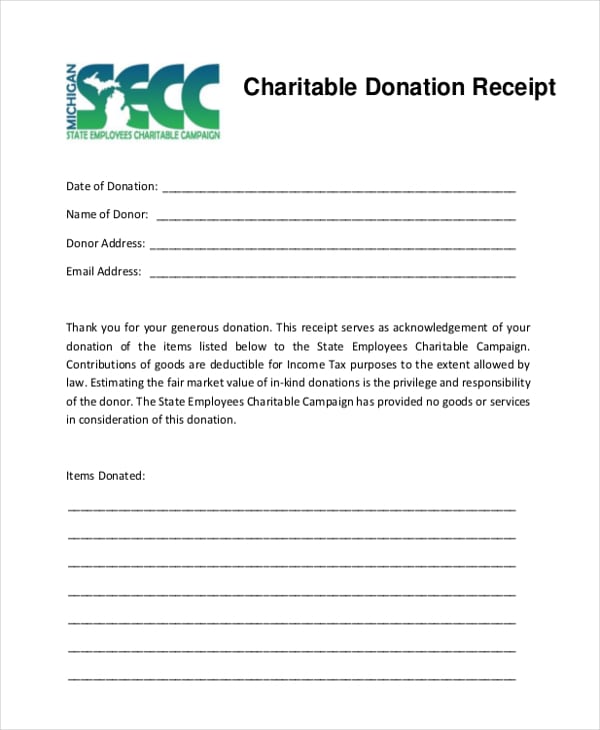

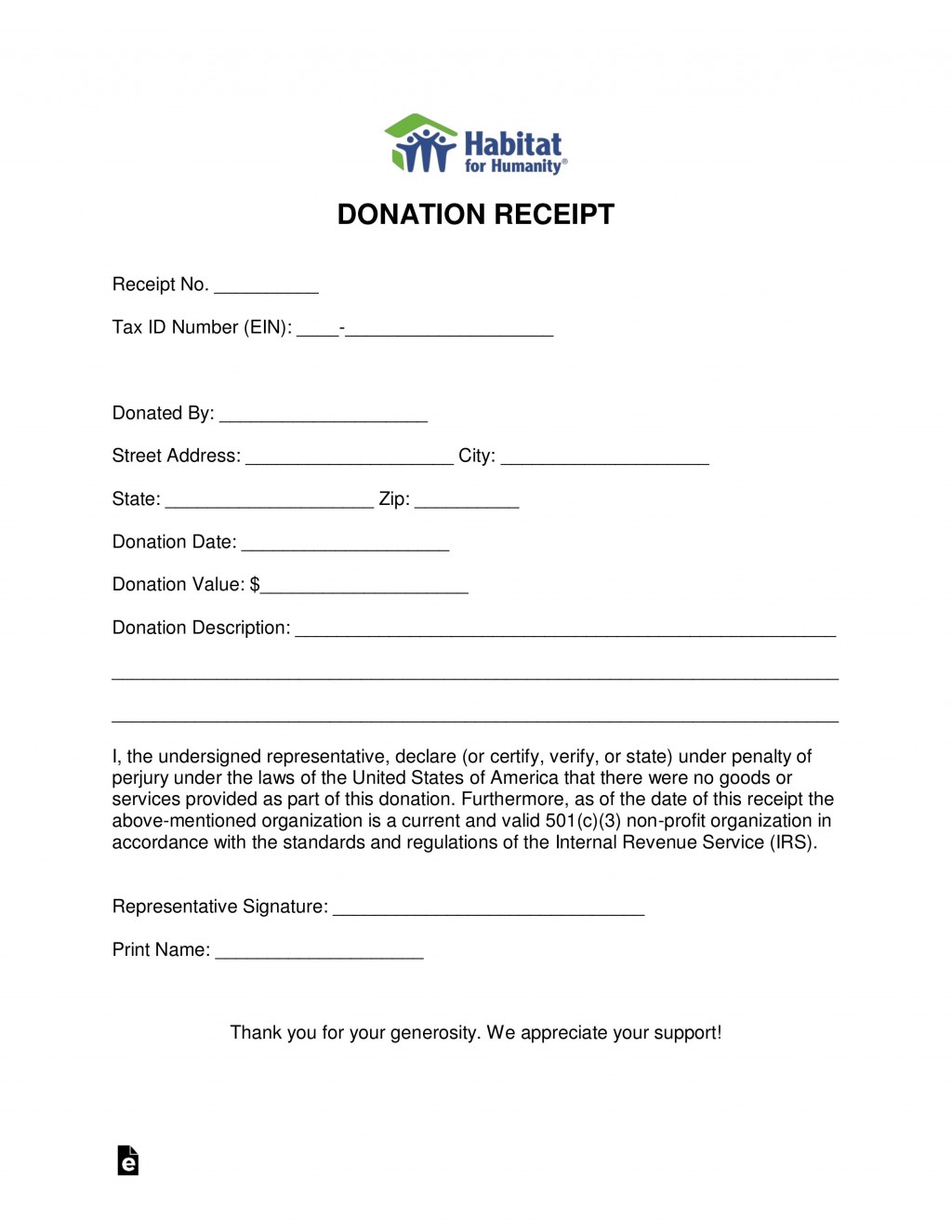

Charitable Contribution Receipt Template - Primarily, the receipt is used by organizations for filing purposes and individual taxpayers to provide a. Web updated april 24, 2024. Web these email and letter templates will help you create compelling donation receipts without taking your time away from your donors: A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business, or organization. If your organization has a program with regular monthly donations or giving that occurs at recurring intervals, you'll need a receipt template that acknowledges the nature of this type of donation. What to include in a donation receipt. What are charitable donation receipts. 4.5/5 (7,518 reviews) Receipt for recurring charitable donations. Web donation receipt templates | samples. Web in this article, you’ll discover some do’s and don’ts to keep in mind as you create receipts that are irs (and donor) approved—plus a series of receipt templates that you can download for free! Registered charities and other qualified donees can use these samples to prepare official donation receipts that meet the requirements of the income tax act and. If a donor wishes to claim the donation on their taxes, they will need to provide a donation receipt as proof. Registered charities and other qualified donees can use these samples to prepare official donation receipts that meet the requirements of the income tax act and its regulations. This can include cash donations, personal property, or a vehicle. Putting it. Web these email and letter templates will help you create compelling donation receipts without taking your time away from your donors: If your organization has a program with regular monthly donations or giving that occurs at recurring intervals, you'll need a receipt template that acknowledges the nature of this type of donation. It’s utilized by an individual that has donated. If a donor wishes to claim the donation on their taxes, they will need to provide a donation receipt as proof. 30 day free trialpaperless workflowfree mobile appcancel anytime What are charitable donation receipts. Putting it simply, a nonprofit donation receipt is a formal acknowledgement that a donation was made to your organization. When you make a charitable donation, it’s. If your organization has a program with regular monthly donations or giving that occurs at recurring intervals, you'll need a receipt template that acknowledges the nature of this type of donation. When to issue donation receipts. The cash donation receipt assists in proving the authenticity of the transaction to the government should the donor wish to deduct the contribution from. Web a donation receipt is a form of receipt that shows concrete evidence that a benefactor had donated a given value to a beneficiary. It is often presented to donors as a letter or email after the donation is received. Primarily, the receipt is used by organizations for filing purposes and individual taxpayers to provide a. Web a donation receipt. What are the best donation receipt templates for nonprofits? Keep accurate records and tax purposes. What are charitable donation receipts. What to include in a donation receipt. Statement that no goods or services were provided by the organization, if. Web using a donation receipt template—which we will share a few of below—is a convenient way to make sure your nonprofit nurtures these relationships and remains in compliance with the internal revenue service. Lovetoknow editable donation receipt template. Your donors may expect a note at the end of the year totaling their donations. Web a donation receipt is a form. Donorbox tax receipts are highly editable and can be customized to include important details regarding the donation. Web in the us, it is required that an organization gives a donation receipt for any contribution that is $250 or more. The charity organization that receives the donation should provide a receipt with their details included. Registered nonprofit organizations can issue both. What to include in a donation receipt. What are the best donation receipt templates for nonprofits? If your organization has a program with regular monthly donations or giving that occurs at recurring intervals, you'll need a receipt template that acknowledges the nature of this type of donation. An opportunity to engage with donors. These donation receipts are written records that. Web these free printable templates in pdf and word format simplify the process of giving and receiving charitable contributions, benefiting both donors and organizations alike. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Web updated april 24, 2024. Web donation receipts are quite simply the act of providing a donor with a receipt for their monetary contribution to an organization, such as a charity or foundation. Web so to make things easier we’ve created charitable donation receipt templates you can use for every occasion. Primarily, the receipt is used by organizations for filing purposes and individual taxpayers to provide a. This helps them track their donations and enables you to see how much each person contributed to your charity. These are given when a donor donates to a nonprofit organization. Web donation receipt templates | samples. What are the best donation receipt templates for nonprofits? A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business, or organization. Web the written acknowledgment required to substantiate a charitable contribution of $250 or more must contain the following information: Web sample 501(c)(3) donation receipt (free template) all of these rules and regulations can be confusing. A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. What are charitable donation receipts. Putting it simply, a nonprofit donation receipt is a formal acknowledgement that a donation was made to your organization.

Charitable Donation Receipt Templates at

Ultimate Guide to the Donation Receipt 7 MustHaves & 6 Templates

Charitable Donation Receipt Template FREE DOWNLOAD Aashe

![40 Donation Receipt Templates & Letters [Goodwill, Non Profit]](https://templatearchive.com/wp-content/uploads/2017/05/donation-receipt-template-10.jpg)

40 Donation Receipt Templates & Letters [Goodwill, Non Profit]

Donation Receipt Free, Downloadable Templates Invoice Simple

5 Free Donation Receipt Templates in MS Word Templates

Charitable Donation Receipt Template FREE DOWNLOAD Aashe

![Charitable Donation Receipt Template Printable [Pdf & Word] Receipt](https://i.pinimg.com/736x/7c/0d/ce/7c0dce1ffdb817eb448883eb9367255c.jpg)

Charitable Donation Receipt Template Printable [Pdf & Word] Receipt

Donation Receipt Donation Receipt Forms , Donation Receipt Template Etsy

45 free donation receipt templates 501c3 non profit charitable

Donorbox Tax Receipts Are Highly Editable And Can Be Customized To Include Important Details Regarding The Donation.

Here’s What’s Included In This Article:

It Is Often Presented To Donors As A Letter Or Email After The Donation Is Received.

Nonprofits And Charitable Organizations Use These To Acknowledge And Record Contributions From Donors.

Related Post: