Candlestick Patterns Hammer

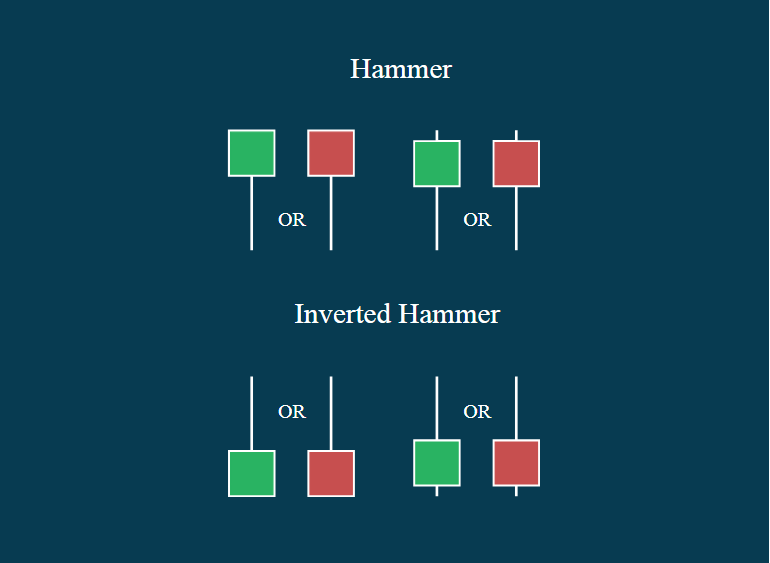

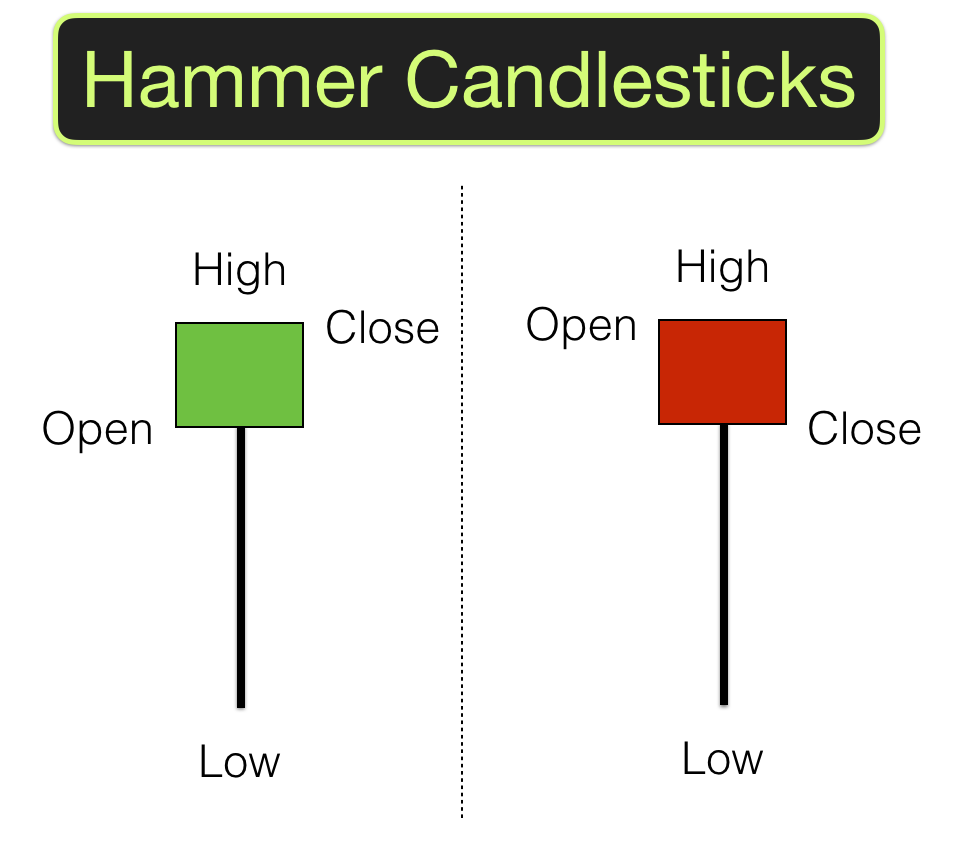

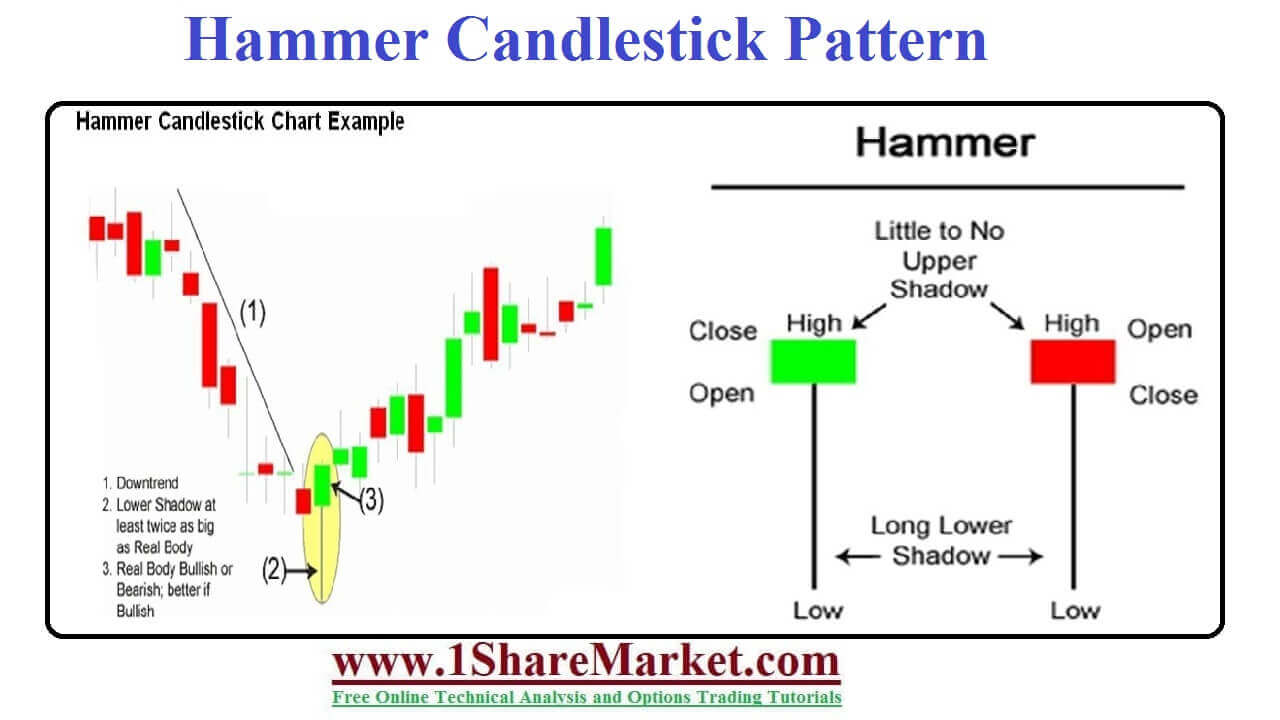

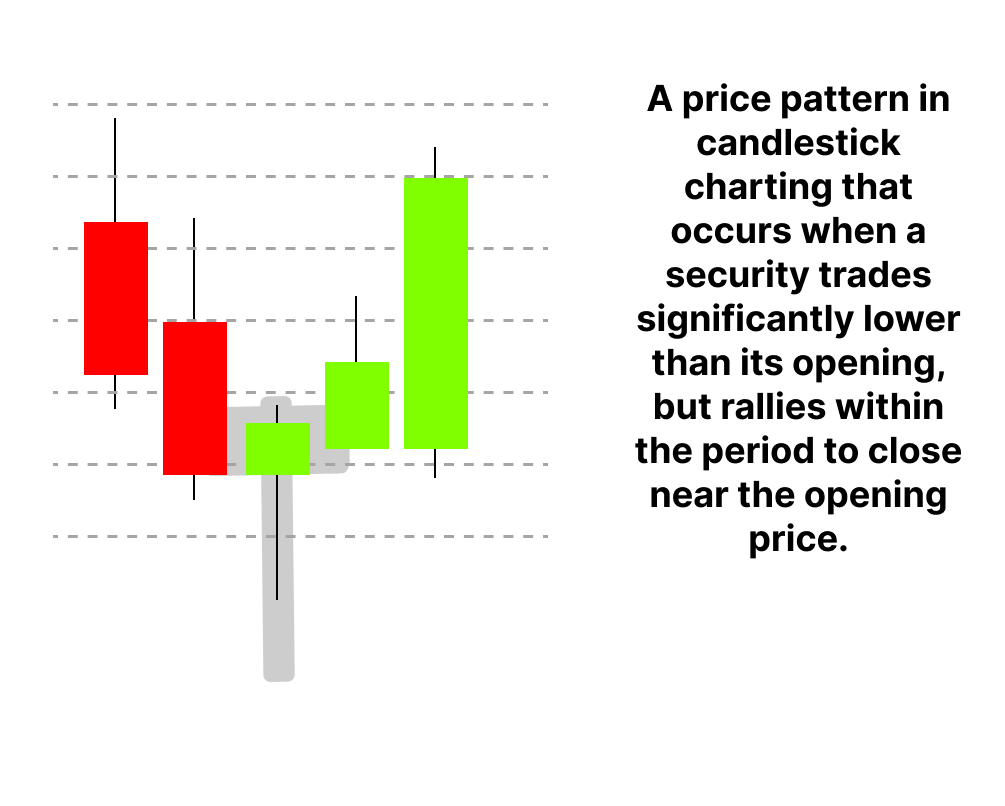

Candlestick Patterns Hammer - A long lower shadow, typically two times or more the length of the body. Web understanding hammer chart and the technique to trade it. A small body at the upper end of the trading range. This pattern is typically seen as a bullish reversal signal, indicating that a downward price swing has likely reached its bottom and is poised to move higher. This shows a hammering out of a base and reversal setup. Steve nison is credited with bringing japanese candlestick charting to the west. Web a hammer candlestick pattern is a reversal structure that forms at the bottom of a chart. Web by leo smigel. There are two types of hammers: You will improve your candlestick analysis skills and be able to apply them in trading. As it is a bullish reversal candlestick pattern, it occurs at the bottom of a downtrend. And, what is an inverted hammer? Download free pdf view pdf. This pattern is typically seen as a bullish reversal signal, indicating that a downward price swing has likely reached its bottom and is poised to move higher. This candlestick is formed when the. As it is a bullish reversal candlestick pattern, it occurs at the bottom of a downtrend. They consist of small to medium size lower shadows, a real body, and little to no upper wick. Web these are the top 5 candlestick patterns for binary options trading: Web the hammer candlestick pattern refers to the shape of a candlestick that resembles. Web a hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close near the opening price. In financial technical analysis, a candlestick pattern is a movement in prices shown graphically on a candlestick chart that some believe can help to identify repeating patterns of. Web these are the top 5 candlestick patterns for binary options trading: Web the hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the bottom of a downward trend. Web understanding hammer chart and the technique to trade it. Traders use this pattern as an early indication that the previous is. Web the hammer candlestick pattern refers to the shape of a candlestick that resembles that of a hammer. Web the hammer candlestick pattern is a technical analysis tool used by traders to identify potential reversals in price trends. Download free pdf view pdf. This article illustrates these patterns in this order: A long lower shadow, typically two times or more. Web these are the top 5 candlestick patterns for binary options trading: And, what is an inverted hammer? It manifests as a single candlestick pattern appearing at the bottom of a downtrend and signals a. Web the hammer candlestick pattern is a technical analysis tool used by traders to identify potential reversals in price trends. Web the hammer candle is. A small body at the upper end of the trading range. It consists of a lower shadow which is twice long as the real body. A hammer shows that although there were selling pressures during the day, ultimately a strong buying pressure drove the price back up. How to trade a hammer? Knowing how to read candlestick charts can help. A small body at the upper end of the trading range. Hammer candlestick pattern is a bullish reversal candlestick pattern. Web the hammer candlestick pattern refers to the shape of a candlestick that resembles that of a hammer. It consists of a lower shadow which is twice long as the real body. Our guide includes expert trading tips and examples. Web the inverted hammer pattern emerges when bears initially drive the price down during the session. Web the hammer is a classic bottom reversal pattern that warns traders that prices have reached the bottom and are going to move up. Web a hammer candlestick pattern is a reversal structure that forms at the bottom of a chart. Web understanding hammer. Download free pdf view pdf. Web the hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the bottom of a downward trend. Steve nison is credited with bringing japanese candlestick charting to the west. Web by leo smigel. Web the hammer candlestick pattern refers to the shape of a candlestick that. It consists of a lower shadow which is twice long as the real body. Web a hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close near the opening price. Steve nison is credited with bringing japanese candlestick charting to the west. This article illustrates these patterns in this order: Web candlestick patterns are used in all forms of trading, including forex. Knowing how to read candlestick charts can help you to identify or. And, what is an inverted hammer? Updated on october 13, 2023. Web the hammer candlestick is a significant pattern in the realm of technical analysis, vital for predicting potential price reversals in markets. It’s a bullish reversal candlestick pattern, which indicates the end of a downtrend and the start of a new uptrend. Web a hammer candlestick pattern is a reversal structure that forms at the bottom of a chart. Web the hammer candlestick pattern refers to the shape of a candlestick that resembles that of a hammer. This pattern is typically seen as a bullish reversal signal, indicating that a downward price swing has likely reached its bottom and is poised to move higher. These candles are typically green or white on stock charts. They consist of small to medium size lower shadows, a real body, and little to no upper wick. Look for a break above the candle to.

Hammer Candlestick What Is It and How to Use It in Trend Reversal

Hammer Candlestick Pattern Trading Guide

Candlestick Patterns The Definitive Guide (2021)

Mastering the Hammer Candlestick Pattern A StepbyStep Guide to

Hammer Candlesticks Shooting Star Candlesticks

Hammer Candlestick Patterns (Types, Strategies & Examples)

Mastering the Hammer Candlestick Pattern A StepbyStep Guide to

Hammer candlestick pattern Defination with Advantages and limitation

Hammer Candlestick Pattern Meaning, Examples & Limitations Finschool

Hammer Candlestick Pattern Trading Guide

A Long Lower Shadow, Typically Two Times Or More The Length Of The Body.

Web Understanding Hammer Chart And The Technique To Trade It.

A Hammer Shows That Although There Were Selling Pressures During The Day, Ultimately A Strong Buying Pressure Drove The Price Back Up.

Web The Bullish Hammer Is A Single Candle Pattern Found At The Bottom Of A Downtrend That Signals A Turning Point From A Bearish To A Bullish Market Sentiment.

Related Post: