Candlestick Patterns Explained With Examples

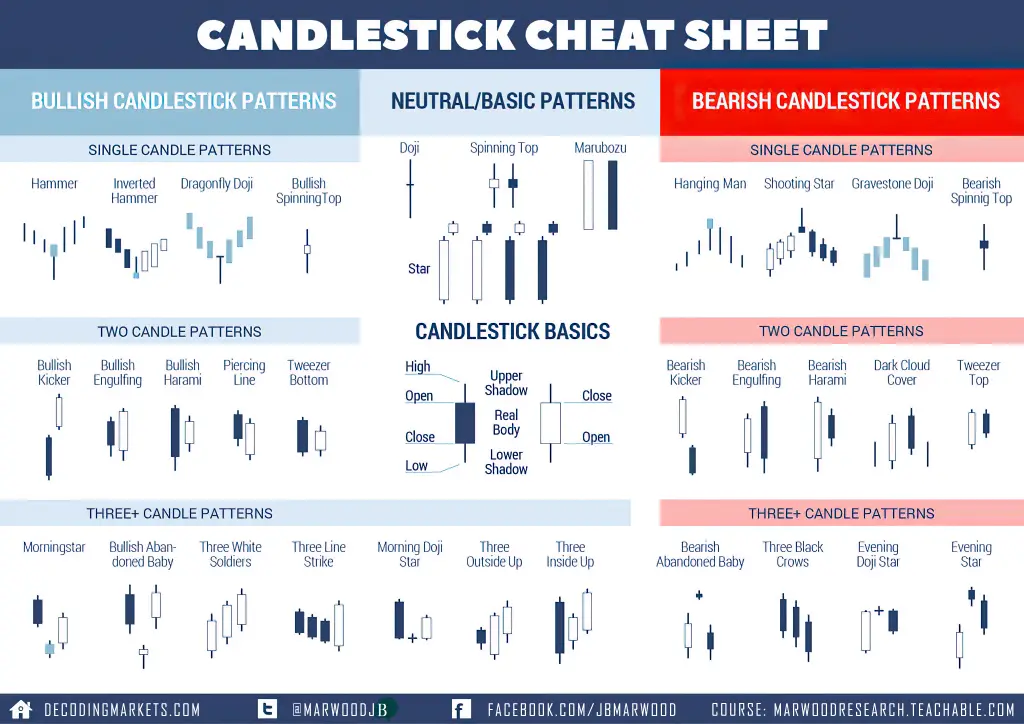

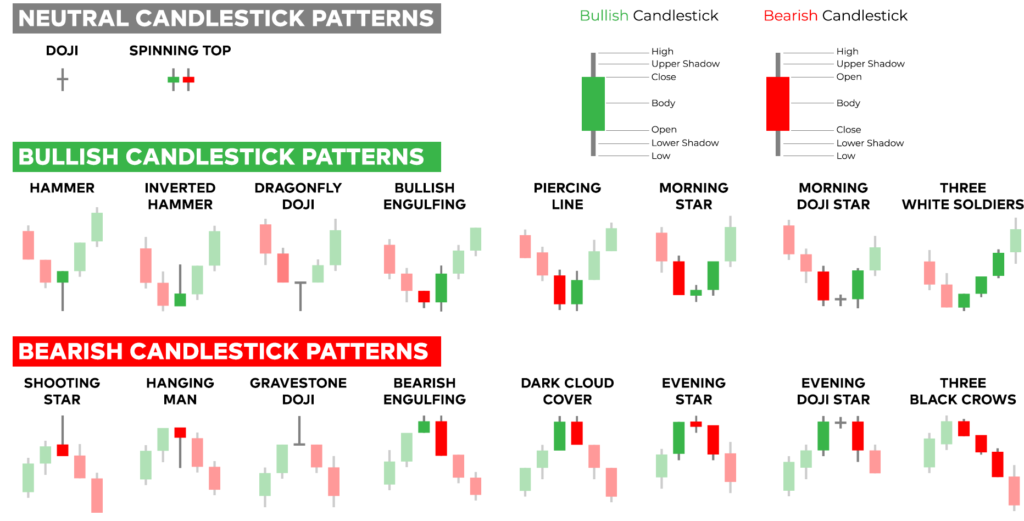

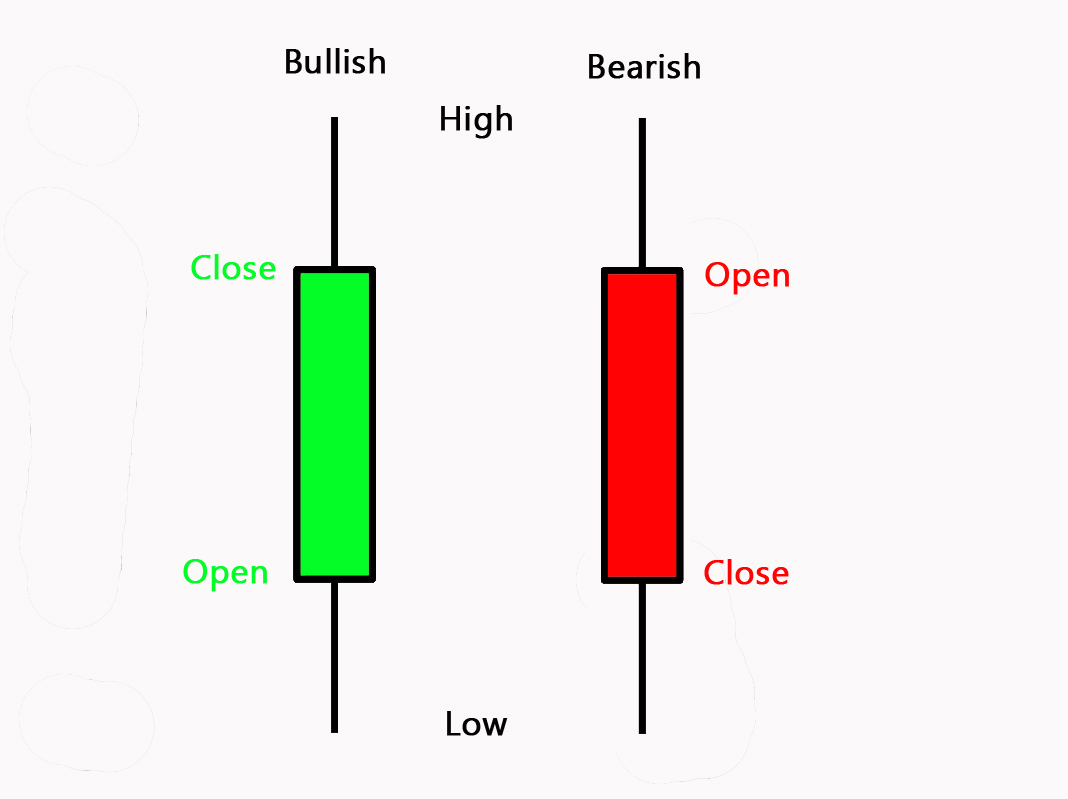

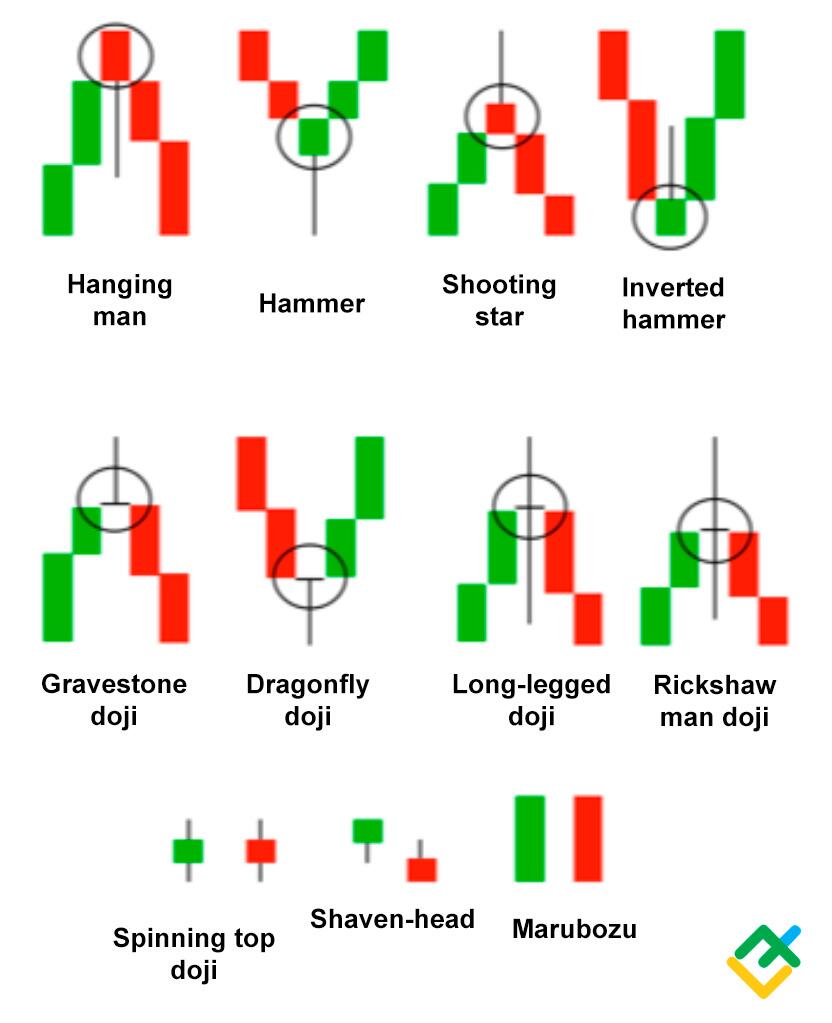

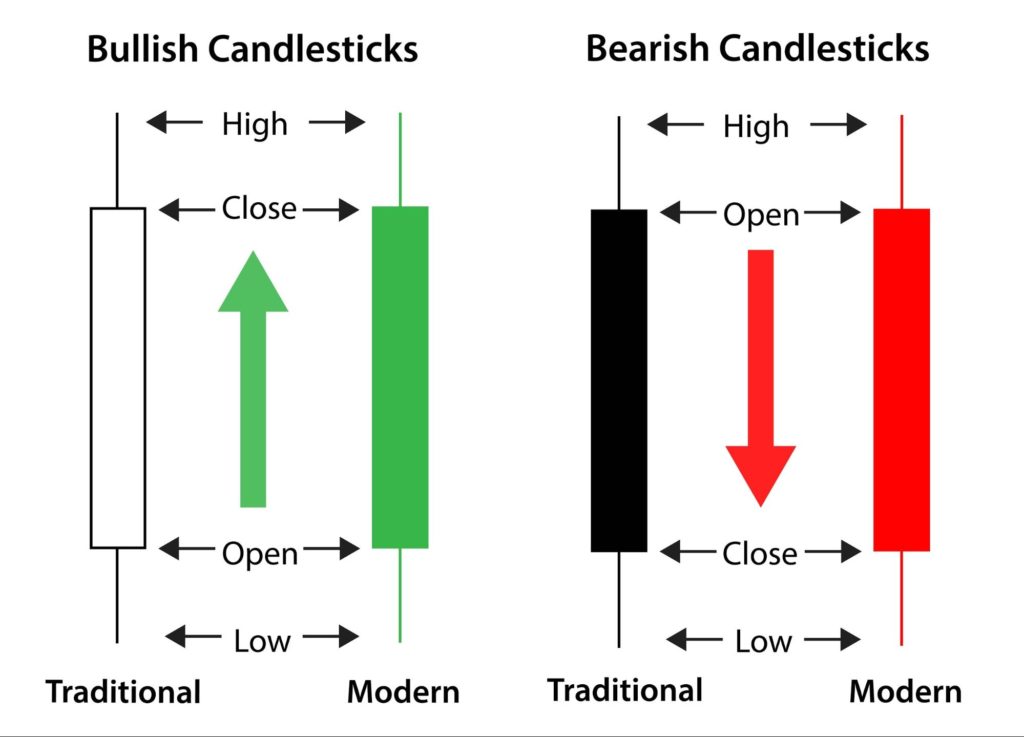

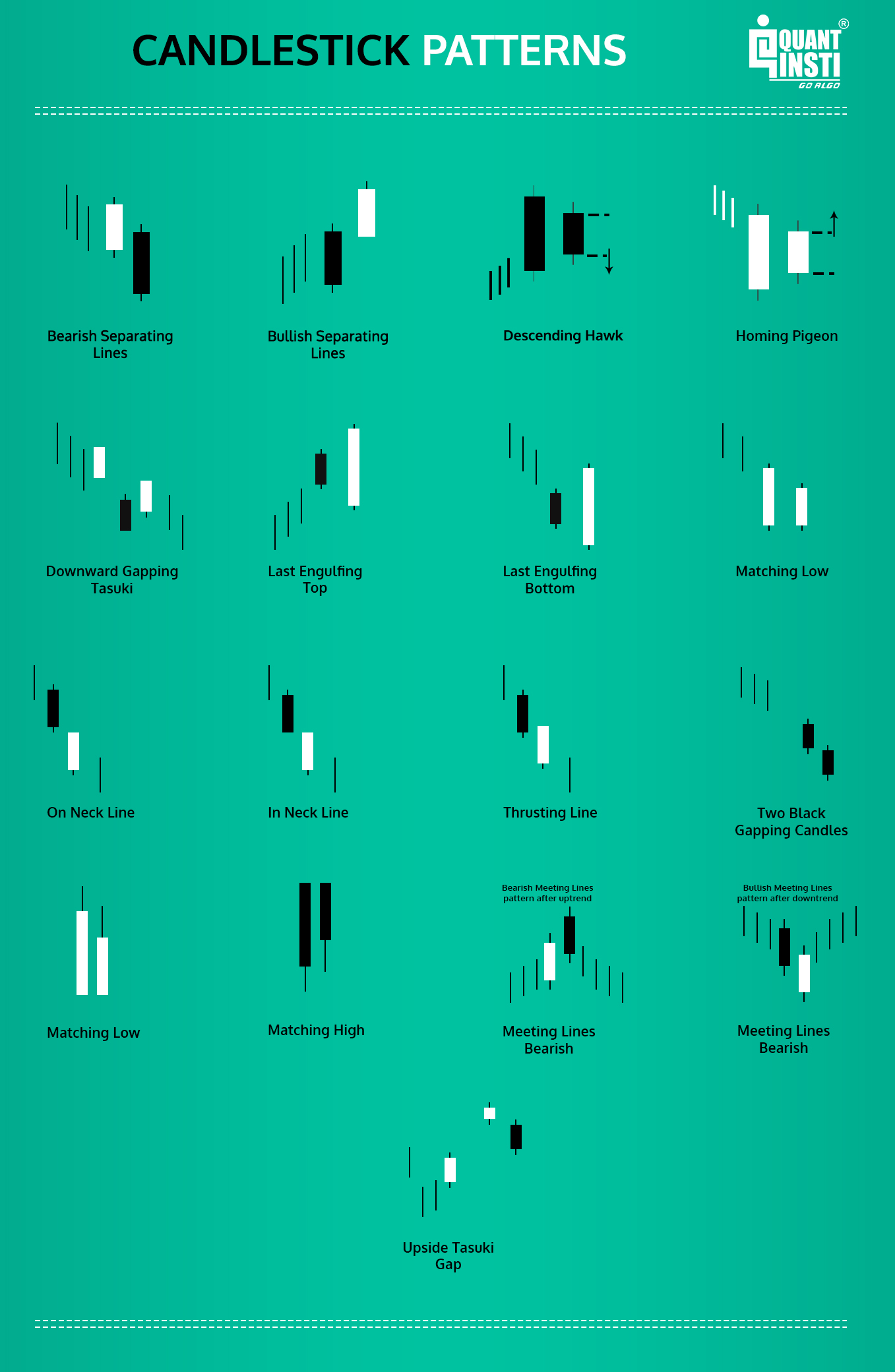

Candlestick Patterns Explained With Examples - The origins of candlestick charting can be traced to the. Web learn how to read a candlestick chart and spot candlestick patterns that aid in analyzing price direction, previous price movements, and trader sentiments. A picture is worth a thousand words, so let’s use a few to shine a light on candlesticks. Bullish, bearish, reversal, continuation and indecision with examples and explanation. Below you’ll find the ultimate database with every single candlestick pattern (and all the other types of pattern if you are interested). A candlestick is a type of price chart used in technical analysis that displays the high, low, open, and closing prices of a. Here there are detailed articles for each candlestick pattern. Web learn about all the trading candlestick patterns that exist: The open represents the opening price of the period, the high is the highest price of the period, the low represents the lowest low within the period, and the close is the closing price of the period. Web open, high, low, close. A candlestick is a type of price chart used in technical analysis that displays the high, low, open, and closing prices of a. Here there are detailed articles for each candlestick pattern. Web examples of candlestick patterns. The examples below include several candlestick patterns that perform exceptionally well as precursors of price direction and potential reversals. A candlestick always consists. Each candlestick pattern has a distinct name and a traditional trading strategy. A candlestick is a type of price chart used in technical analysis that displays the high, low, open, and closing prices of a. A candlestick always consists of four price points that are shown in a candlestick chart. Here there are detailed articles for each candlestick pattern. Candlestick. Web candlestick patterns typically represent one whole day of price movement, so there will be approximately 20 trading days with 20 candlestick patterns within a month. The open represents the opening price of the period, the high is the highest price of the period, the low represents the lowest low within the period, and the close is the closing price. They serve a purpose as they help analysts to predict future price movements in the market based on historical price patterns. Web what are candlestick patterns? Candlestick patterns are a technical trading tool used for centuries to help predict price moments. Each candlestick pattern has a distinct name and a traditional trading strategy. Bullish, bearish, reversal, continuation and indecision with. Web what are candlestick patterns? The open represents the opening price of the period, the high is the highest price of the period, the low represents the lowest low within the period, and the close is the closing price of the period. The examples below include several candlestick patterns that perform exceptionally well as precursors of price direction and potential. Web open, high, low, close. Candlestick patterns are a technical trading tool used for centuries to help predict price moments. Web every candlestick pattern detailed with their performance and reliability stats. A picture is worth a thousand words, so let’s use a few to shine a light on candlesticks. Web learn about all the trading candlestick patterns that exist: Web more importantly, we will discuss their significance and reveal 5 real examples of reliable candlestick patterns. Candlestick patterns are a technical trading tool used for centuries to help predict price moments. Web every candlestick pattern detailed with their performance and reliability stats. Web candlestick patterns typically represent one whole day of price movement, so there will be approximately 20. Web open, high, low, close. Also, feel free to download our candlestick pattern quick reference guide! A picture is worth a thousand words, so let’s use a few to shine a light on candlesticks. Each candlestick pattern has a distinct name and a traditional trading strategy. Candlestick patterns are a technical trading tool used for centuries to help predict price. Each candlestick pattern has a distinct name and a traditional trading strategy. The origins of candlestick charting can be traced to the. The examples below include several candlestick patterns that perform exceptionally well as precursors of price direction and potential reversals. Web learn how to read a candlestick chart and spot candlestick patterns that aid in analyzing price direction, previous. The open represents the opening price of the period, the high is the highest price of the period, the low represents the lowest low within the period, and the close is the closing price of the period. Web learn how to read a candlestick chart and spot candlestick patterns that aid in analyzing price direction, previous price movements, and trader. Web more importantly, we will discuss their significance and reveal 5 real examples of reliable candlestick patterns. The origins of candlestick charting can be traced to the. | updated march 6, 2024. Web examples of candlestick patterns. Each candlestick pattern has a distinct name and a traditional trading strategy. A candlestick always consists of four price points that are shown in a candlestick chart. A picture is worth a thousand words, so let’s use a few to shine a light on candlesticks. Candlestick patterns are a technical trading tool used for centuries to help predict price moments. Web open, high, low, close. Also, feel free to download our candlestick pattern quick reference guide! Below you’ll find the ultimate database with every single candlestick pattern (and all the other types of pattern if you are interested). The examples below include several candlestick patterns that perform exceptionally well as precursors of price direction and potential reversals. Web learn how to read a candlestick chart and spot candlestick patterns that aid in analyzing price direction, previous price movements, and trader sentiments. Web learn about all the trading candlestick patterns that exist: Here there are detailed articles for each candlestick pattern. Web what are candlestick patterns?

Candlestick Charts The ULTIMATE beginners guide to reading a

:max_bytes(150000):strip_icc()/UnderstandingBasicCandlestickCharts-01_2-7114a9af472f4a2cb5cbe4878c1767da.png)

Understanding a Candlestick Chart

Candlestick Patterns Explained HOW TO READ CANDLESTICKS

Candlestick Signals for Buying and Selling Stocks

![Candlestick Patterns Explained [Plus Free Cheat Sheet] TradingSim](https://f.hubspotusercontent10.net/hubfs/20705417/Imported_Blog_Media/CANDLESTICKQUICKGUIDE-Mar-18-2022-09-42-46-01-AM.png)

Candlestick Patterns Explained [Plus Free Cheat Sheet] TradingSim

How To Interpret Candlestick Chart Patterns Templates Printable Free

20 Candlestick Patterns You Need To Know, With Examples Timothy Sykes

Candlestick Patterns Explained with Examples NEED TO KNOW!

Candlestick Patterns How To Read Charts, Trading, and More

Candlestick Patterns The Definitive Guide (2021)

Web Candlestick Patterns Typically Represent One Whole Day Of Price Movement, So There Will Be Approximately 20 Trading Days With 20 Candlestick Patterns Within A Month.

They Serve A Purpose As They Help Analysts To Predict Future Price Movements In The Market Based On Historical Price Patterns.

A Candlestick Is A Type Of Price Chart Used In Technical Analysis That Displays The High, Low, Open, And Closing Prices Of A.

The Open Represents The Opening Price Of The Period, The High Is The Highest Price Of The Period, The Low Represents The Lowest Low Within The Period, And The Close Is The Closing Price Of The Period.

Related Post: