Candlestick Pattern Test

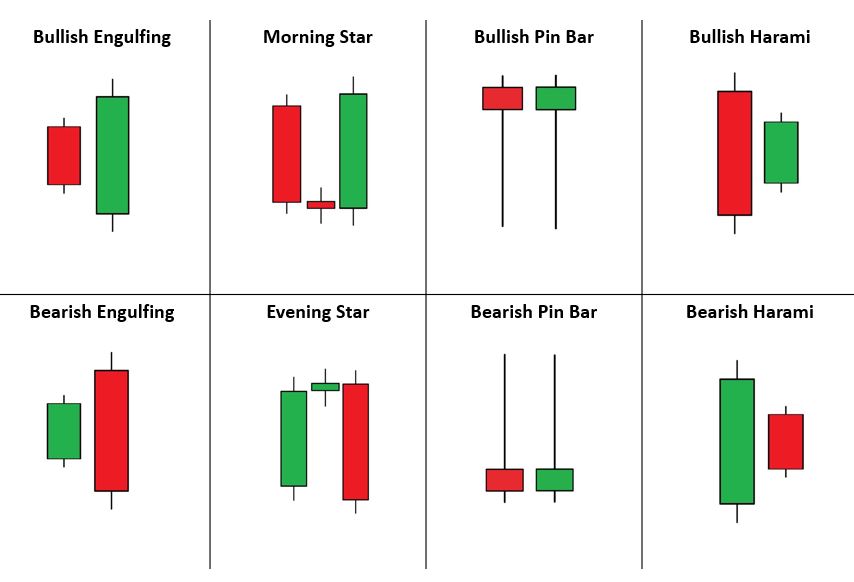

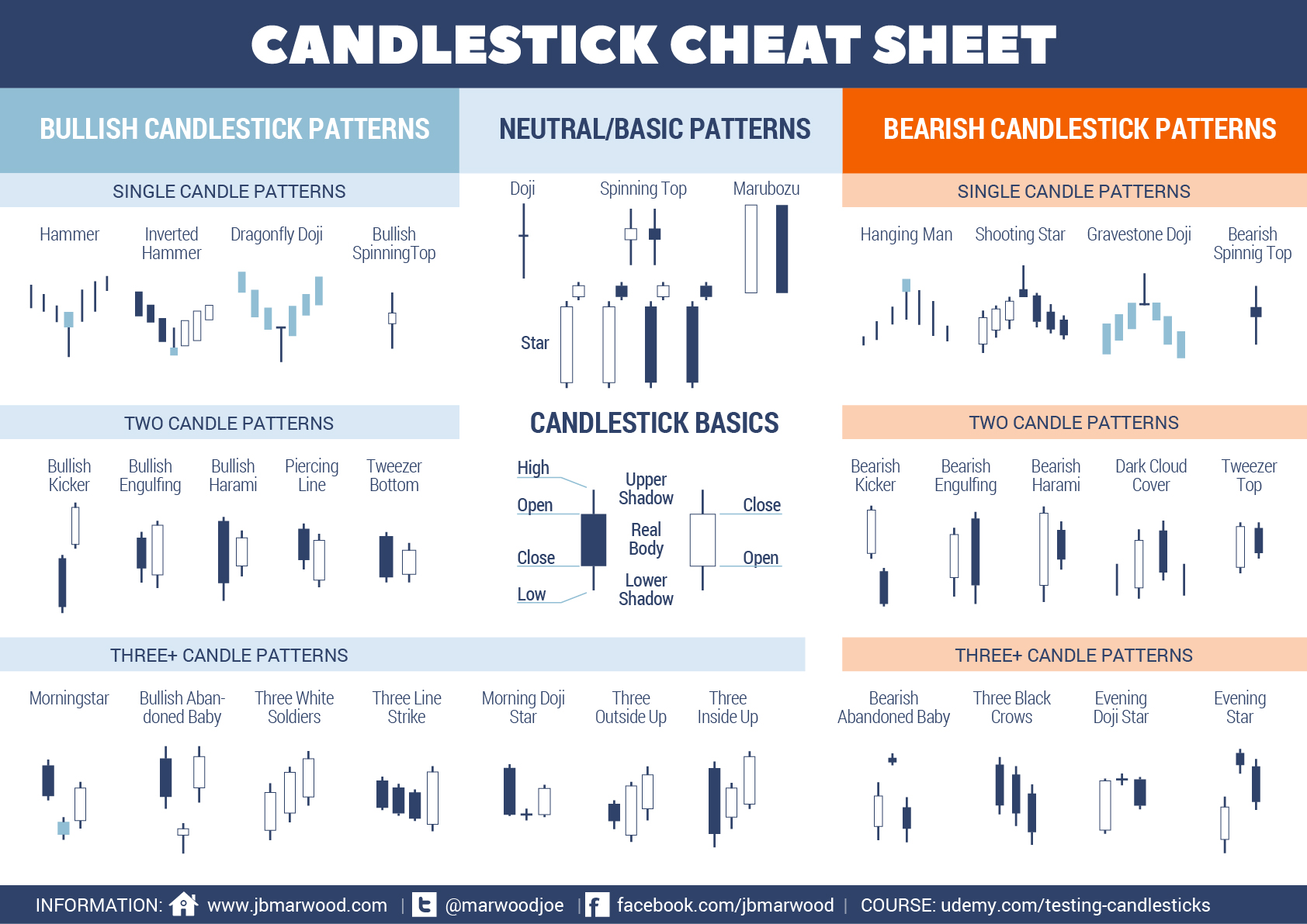

Candlestick Pattern Test - It is characterized by a very sharp reversal in price during the span of two candlesticks. Web in the example above, the proper entry would be below the body of the shooting star, with a stop at the high. Web it is identified by the last candle in the pattern opening below the previous day's small real body. The bullish hammer is were the support area will lie, prices may test the support area in further trends; Each candlestick pattern has a distinct name and a traditional trading strategy. They are commonly formed by the opening, high,. The doji and spinning top candles are typically found in a sideways consolidation patterns where price and trend are still trying to be discovered. The kicker pattern is one of the strongest and most reliable candlestick patterns. There are a ton of ways to build day trading. This can be either a continuation or reversal pattern. Web candlestick patterns are a technical trading tool used for centuries to help predict price moments. The pattern of the evening star is the reverse of that of the morning star. Bullish engulfing & bearish engulfing. Web we decided to find out and sat down to quantify all the candlestick patterns. Can you recognize these common japanese candlestick patterns? Web technical analysts employ candlestick patterns called evening stars to forecast future price reversals to the downside. It is characterized by a very sharp reversal in price during the span of two candlesticks. Mastering the art of reading these charts can significantly enhance your trading strategy, providing insights into market sentiment, trends, and potential reversals. There are a ton of. This makes them more useful than traditional open, high, low. Web the bullish candlestick is a reversal of the downtrend. Web yes, candlesticks work. We test 23 different candlestick patterns quantitatively with strict buy and sell signals. Test your knowledge of japanese candlesticks with the traders bulletin candlestick quiz. This makes them more useful than traditional open, high, low. By analyzing various candlestick patterns, traders and. The bullish hammer is were the support area will lie, prices may test the support area in further trends; It might look like this on a chart: How many candlestick patterns do you cover? Candlestick patterns here matter more and can signal real trend. The bullish hammer is were the support area will lie, prices may test the support area in further trends; Forex trading involves significant risk of loss and is not suitable for all investors. Here is a long list of all the major reversal candlestick patterns: Web the bullish candlestick is. Web candlestick patterns visually represent price movements in financial markets, commonly used in technical analysis to predict future price movements. The last candle closes deep. How many candlestick patterns do you cover? The bullish hammer is were the support area will lie, prices may test the support area in further trends; This quiz is perfect for both beginners and experienced. This can be either a continuation or reversal pattern. There are a ton of ways to build day trading. The pattern of the evening star is the reverse of that of the morning star. A hammer is characterized by a small body. Web the bullish candlestick is a reversal of the downtrend. Patterns might show quick changes in mood, but they don't hold as much weight. The bullish hammer is were the support area will lie, prices may test the support area in further trends; The doji and spinning top candles are typically found in a sideways consolidation patterns where price and trend are still trying to be discovered. The last candle. We test 23 different candlestick patterns quantitatively with strict buy and sell signals. Morning star & evening star. Web we decided to find out and sat down to quantify all the candlestick patterns. Web candlestick pattern explained. This makes them more useful than traditional open, high, low. Here is a long list of all the major reversal candlestick patterns: Web on super short charts, like 5 minutes, candlestick patterns change super fast. Web it is identified by the last candle in the pattern opening below the previous day's small real body. Web yes, candlesticks work. Web candlestick patterns are a technical trading tool used for centuries to. Web on super short charts, like 5 minutes, candlestick patterns change super fast. Web yes, candlesticks work. Bearish + bullish = a hammer (smaller then both of them); The result is a complete backtest of all 75. Test your knowledge of japanese candlesticks with the traders bulletin candlestick quiz. This can be either a continuation or reversal pattern. Each candlestick pattern has a distinct name and a traditional trading strategy. It might look like this on a chart: It is characterized by a very sharp reversal in price during the span of two candlesticks. Forex trading involves significant risk of loss and is not suitable for all investors. Web candlestick patterns visually represent price movements in financial markets, commonly used in technical analysis to predict future price movements. Web technical analysts employ candlestick patterns called evening stars to forecast future price reversals to the downside. We test 23 different candlestick patterns quantitatively with strict buy and sell signals. Perhaps surprisingly, some of the candlestick patterns work pretty well. This makes them more useful than traditional open, high, low. Web the aspects of a candlestick pattern.

37 Candlestick Patterns Dictionary PDF Guide ForexBee Candlestick

:max_bytes(150000):strip_icc()/UnderstandingBasicCandlestickCharts-01_2-7114a9af472f4a2cb5cbe4878c1767da.png)

Understanding a Candlestick Chart

Candlestick Patterns The Definitive Guide (2021)

Forex Candlestick Patterns Explained With Examples

![Candlestick Patterns Explained [Plus Free Cheat Sheet] TradingSim](https://f.hubspotusercontent10.net/hubfs/20705417/Imported_Blog_Media/CANDLESTICKQUICKGUIDE-Mar-18-2022-09-42-46-01-AM.png)

Candlestick Patterns Explained [Plus Free Cheat Sheet] TradingSim

Printable Candlestick Chart

Candlestick Patterns Cheat Sheet New Trader U

Forex Candlestick Pattern Recognition Indicator Fx Trading Thailand

Candlestick Patterns The Definitive Guide (2021)

Candlesticks with Support and Resistance forextk

And The Candlestick Patterns That Work So Well At That Time Seemed To Be Hit And Miss After 3Pm.

Over The Last Weeks, We Tracked Down All Candlestick Patterns And Backtested Them.

This Pattern Indicates Indecision In The Market And Often Precedes A Trend Reversal.

There Are A Ton Of Ways To Build Day Trading.

Related Post: