Candlestick Morning Star Pattern

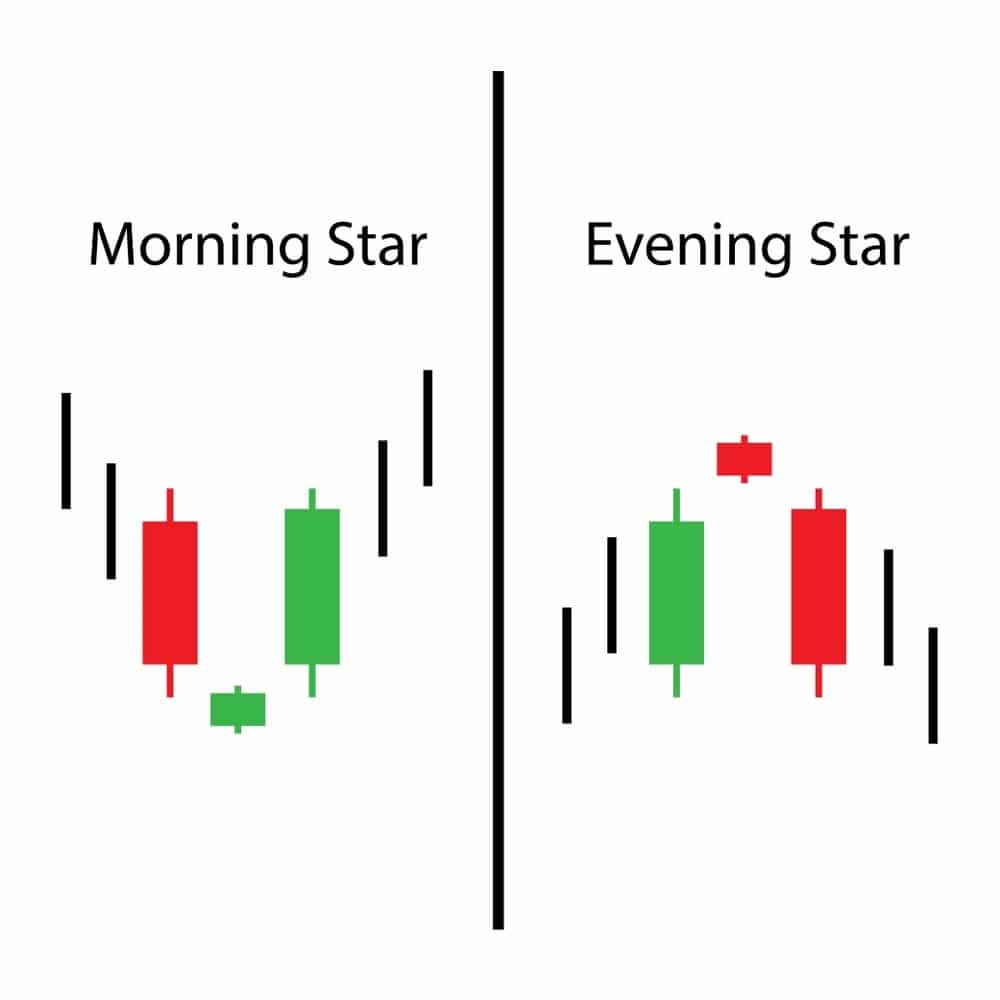

Candlestick Morning Star Pattern - The pattern is bullish because we expect to have a bull move after a morning star appears at the right location. The pattern begins with a tall red (bearish) candlestick, followed by a smaller red or green candlestick with a short body and long. It is a downtrend reversal pattern. This pattern is considered a strong signal for a reversal in market sentiment from bearish to bullish. Back to all stocks candlestick patterns. Web a morning star is a candlestick pattern commonly used in forex trading to identify a potential bullish reversal in a downtrend. Web the morning star pattern is a series of three candlesticks on a market’s chart that indicate an upcoming bullish reversal. Web illustration of the morningstar pattern. The first candle is bearish and followed by a doji that gaps down. In the encyclopedia of candlestick charts, thomas bulkowski first introduced the pattern to the western world. It is a signal of a reversal in the prior price trend. Bullish reversal pattern in which a stock which had a long white body a 2 days ago, then opened lower with a doji a day ago and finally closed above the previous day. Web illustration of the morningstar pattern. It reveals a slowing down of downward momentum before. Usually, it appears after a price decline and shows rejection from lower prices. Web updated 27 jul 2022. Web morning star candlestick pattern. This means if this pattern gets formed at the bottom of the downtrend, then it reverses the trend to up. Morning star has three candlestick patterns: If a technical trader sees a morning star appear after a downtrend, they take it as a sign that selling sentiment may be losing ground to buyers. Web the morning star is a bullish reversal pattern that occurs at the bottom of a downtrend. Four elements to consider for a morning star formation. It reveals a slowing down of downward. Web morning star candlestick patterns #candlestickpatterns #chartpatterns #morning #chartanalysis #bitcoinnews. Trend prior to the pattern: Morning star candlestick patterns #candlestickpatterns #chartpatterns #morning #chartanalysis #bitcoinnews. It is a signal of a reversal in the prior price trend. The pattern is formed by combining 3 consecutive candlesticks. The pattern is bullish because we expect to have a bull move after a morning star appears at the right location. Web a morning star is a candlestick pattern commonly used in forex trading to identify a potential bullish reversal in a downtrend. It appears in a downtrend and forms a small wick on the upper and lower end. It. Web the morning star pattern is a series of three candlesticks on a market’s chart that indicate an upcoming bullish reversal. Published on january 9, 2024. A morning star is formed after a downward trend and signals the beginning of an upward movement of prices. A morning star forms following a downward trend and it. Web morning star candlestick pattern. The first candle is a large bearish can. Web the morning star is a bullish reversal pattern that occurs at the bottom of a downtrend. Web the morning star pattern is a series of three candlesticks on a market’s chart that indicate an upcoming bullish reversal. Four elements to consider for a morning star formation. Web a morning star is. Stock passes all of the below filters in cash segment: Morning star candlestick patterns #candlestickpatterns #chartpatterns #morning #chartanalysis #bitcoinnews. Scanner guide scan examples feedback. It appears in a downtrend and forms a small wick on the upper and lower end. The third candle gaps up and finishes as a big, positive candle. The pattern is bullish because we expect to have a bull move after a morning star appears at the right location. Check our candlescanner software and start trading candlestick patterns! Back to all stocks candlestick patterns. Web the morning star is a bullish reversal pattern that occurs at the bottom of a downtrend. This pattern indicates a trend reversal from. Web the morning star candlestick pattern is a price action analysis tool used to identify potential trend reversals on the price charts. The pattern begins with a tall red (bearish) candlestick, followed by a smaller red or green candlestick with a short body and long. Published on january 9, 2024. A morning star forms following a downward trend and it.. A morning star forms over three periods. Web morning star candlestick pattern. Usually, it appears after a price decline and shows rejection from lower prices. Web a morning star is a three candle reversal candlestick pattern that forms after a downtrend. Web the morning star is a bullish candlestick pattern which evolves over a three day period. Web a morning star is a visual pattern consisting of three candlesticks that are interpreted as bullish signs by technical analysts. Web illustration of the morningstar pattern. This pattern indicates a trend reversal from down to up. The pattern is bullish because we expect to have a bull move after a morning star appears at the right location. Web the morning star is a bullish reversal pattern that occurs at the bottom of a downtrend. If a technical trader sees a morning star appear after a downtrend, they take it as a sign that selling sentiment may be losing ground to buyers. Morning star has three candlestick patterns: Web what is morning star candlestick pattern? A morning star forms over three periods. It reveals a slowing down of downward momentum before a large. It is a downtrend reversal pattern.

What Is Morning Star Candlestick Pattern? How To Use In Trading How

Understanding The Morning Star Candlestick Pattern InvestoPower

Morning Star Candlestick Pattern How to Identify Perfect Morning Star

Morning Star Candlestick Pattern definition and guide

Morning Star Candlestick Pattern definition and guide

What Is Morning Star Candlestick Pattern? How To Use In Trading How

Morning Star Candlestick Pattern

What Is Morning Star Candlestick Pattern? How To Use In Trading How

How To Trade Blog Morning Star Candlestick Pattern How To Trade and

A Tutorial On The Morning Star Candlestick Pattern Forex Training Group

Web Updated 27 Jul 2022.

This Pattern Is Composed Of Three Candlesticks, With The First One Being A Tall Bearish Candle.

In The Chart Below The Morning, The Star Is Encircled.

Trend Prior To The Pattern:

Related Post: