Candlestick Hammer Pattern

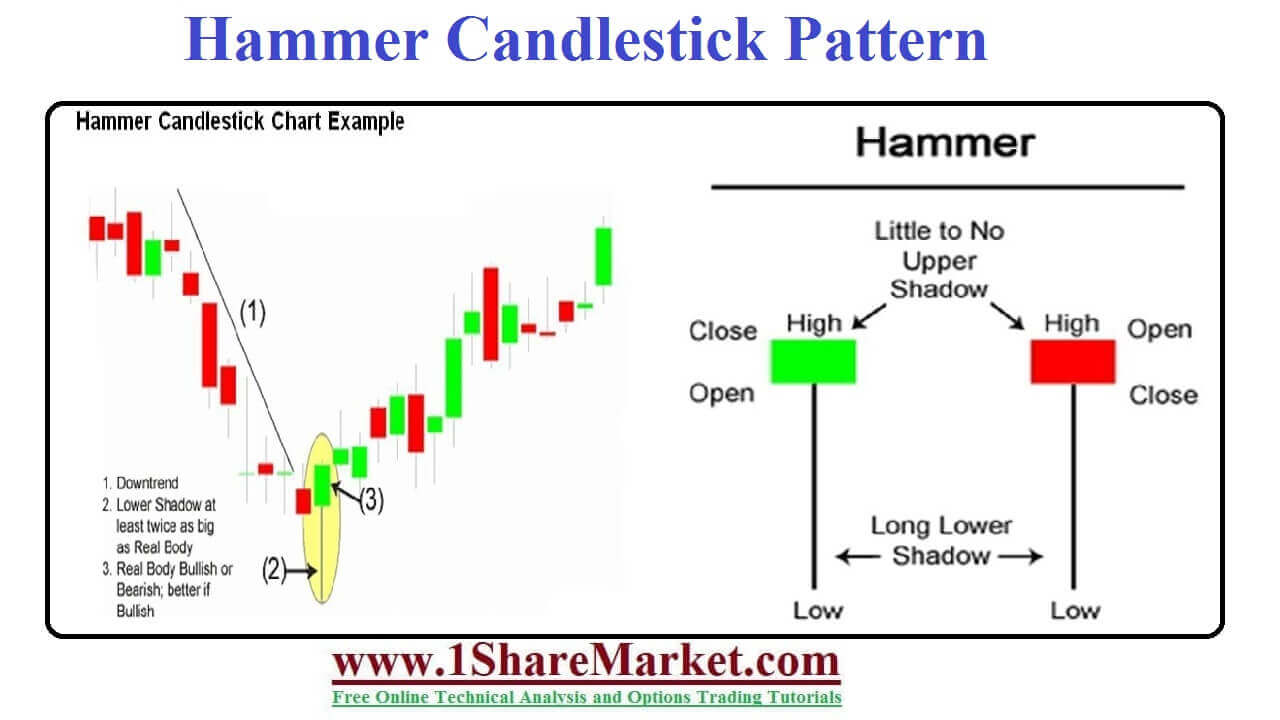

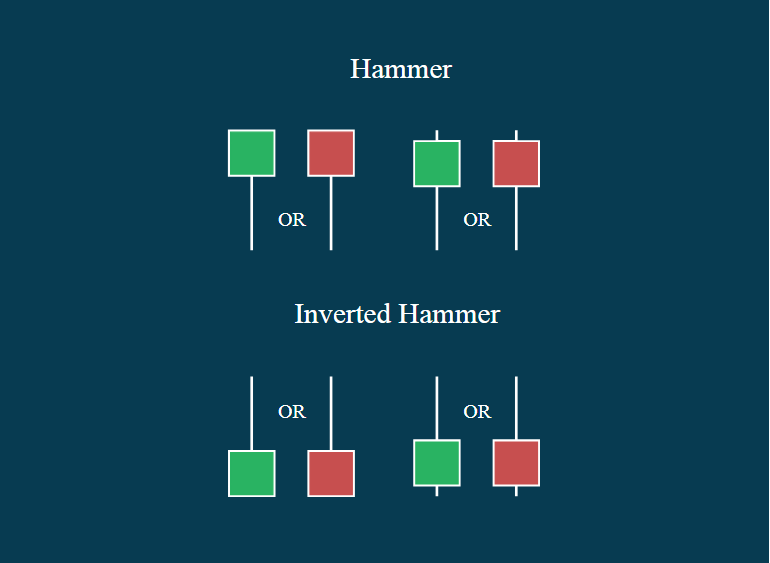

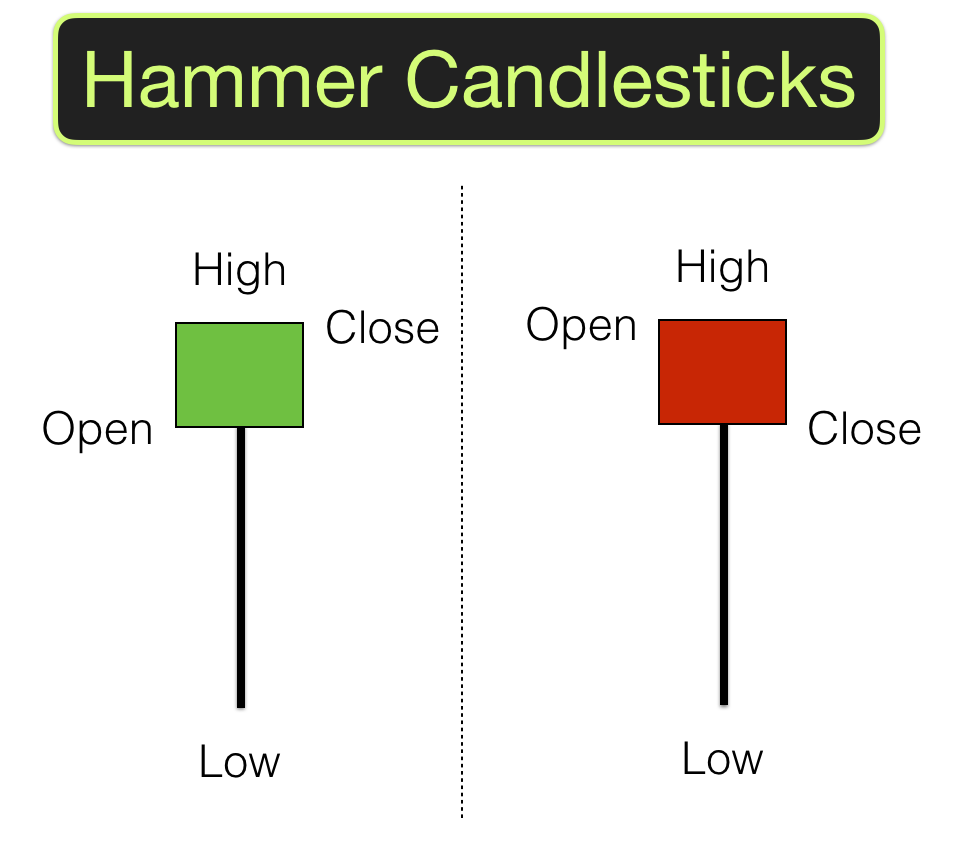

Candlestick Hammer Pattern - The hammer pattern is a single candle pattern that occurs quite frequently within the financial markets. The following characteristics can identify it: After a downtrend, the hammer can signal to traders that the downtrend. To identify the hammer candlestick pattern, consider the following points: If you’re a candlestick technician, you might be surprised to learn that traditional trading advice points you in the. Web the hammer candlestick pattern is a popular trading strategy in the stock market, where traders go long when a bullish hammer forms after a downtrend or go short when a bearish hammer appears after an uptrend in the stock market. It appears during the downtrend and signals that the bottom is near. In short, a hammer consists of a small real body that is found in the upper half of the candle’s range. The hanging man and the hammer are both candlestick. Web in financial technical analysis, a candlestick pattern is a movement in prices shown graphically on a candlestick chart that some believe can help to identify repeating patterns of a particular market movement. This is one of the popular price patterns in candlestick charting. Web it is important to note that the inverted pattern is a warning of potential price change, not a signal, by itself, to buy. A minor difference between the opening and closing prices forms a small candle body. Expand your knowledge of investment and trading strategies by discovering different. Hammer candlestick patterns can also occur during range bound market conditions, near the. Web what is a hammer chart and how to trade it? It is often seen at the end of a downtrend or at the end of a corrective leg in the context of an uptrend. Web the hammer candlestick appears at the bottom of a down trend. This is one of the popular price patterns in candlestick charting. The hanging man and the hammer are both candlestick. A hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies later in the day to close either above or near its. This article will focus on the other. Web a hammer candlestick pattern is typically considered a bullish reversal signal, although it looks just like a bearish hanging man candle, characterized by a small body at the top and a long lower. Web the hammer candlestick is a bullish reversal pattern that signals a potential price bottom and ensuing upward move. Web what is a hammer chart and. Web identifying the hammer candlestick is easy. Look for a break above the. These candles are typically green or white on stock charts. The hammer pattern is a single candle pattern that occurs quite frequently within the financial markets. This is one of the popular price patterns in candlestick charting. #reels #explore #candlestickpatterns #candlesticks #candlestick #stockmarket #sharemarket #instagram. A long lower shadow, typically two times or more the length of the body. Web hammer pattern in technical analysis. These candles are typically green or white on stock charts. Web hammer (1) inverted hammer (1) morning star (3) bullish abandoned baby (3) the hammer and inverted hammer were covered in the. Web the hammer candlestick is a bullish reversal pattern that signals a potential price bottom and ensuing upward move. Web in financial technical analysis, a candlestick pattern is a movement in prices shown graphically on a candlestick chart that some believe can help to identify repeating patterns of a particular market movement. Web hammer (1) inverted hammer (1) morning star. The hammer candlestick formation is viewed as a bullish reversal candlestick pattern that mainly occurs at the bottom of downtrends. Web the hammer and the inverted hammer candlestick patterns are among the most popular trading formations. Web the hammer candlestick pattern is a bullish reversal pattern that indicates a potential price reversal to the upside. To identify the hammer candlestick. This is one of the popular price patterns in candlestick charting. The hammer or the inverted hammer. Look for a break above the. The colour of the body can vary, but green hammers indicate a stronger. Web identifying the hammer candlestick is easy. The opening price, close, and top are. This shows a hammering out of a base and reversal setup. A hammer shows that although there were selling pressures during the day, ultimately a strong buying pressure drove the price back up. Web the hammer is candlestick with a small body and a long lower wick. Web what is the hammer candlestick. If you’re a candlestick technician, you might be surprised to learn that traditional trading advice points you in the. The opening price, close, and top are. Web we will focus on five bullish candlestick patterns that give the strongest reversal signal. Look for a break above the. This shows a hammering out of a base and reversal setup. It has a lower shadow of at least twice the size of the. The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the bottom of a downward trend. This is one of the popular price patterns in candlestick charting. Web in financial technical analysis, a candlestick pattern is a movement in prices shown graphically on a candlestick chart that some believe can help to identify repeating patterns of a particular market movement. The hammer or the inverted hammer. A minor difference between the opening and closing prices forms a small. Web hammer candlesticks are a popular reversal pattern formation found at the bottom of downtrends. They consist of small to medium size lower shadows, a real body, and little to no upper wick. It has a small or absent upper wick, and a long lower wick. A minor difference between the opening and closing prices forms a small candle body. Web hammer candlestick patterns occur when the price of an asset falls to levels that are far below the opening price of the trading period before rallying back to recover some (or all) of those losses as the charting period completes.

Hammer Candlestick Pattern Trading Guide

How to Read the Inverted Hammer Candlestick Pattern? Bybit Learn

Candlestick Patterns The Definitive Guide (2021)

Hammer Candlestick Patterns (Types, Strategies & Examples)

Mastering the Hammer Candlestick Pattern A StepbyStep Guide to

Mastering the Hammer Candlestick Pattern A StepbyStep Guide to

Hammer candlestick pattern Defination with Advantages and limitation

Hammer Candlestick What Is It and How to Use It in Trend Reversal

Hammer Candlesticks Shooting Star Candlesticks

Hammer Candlestick Pattern Trading Guide

Web What Is A Hammer Chart And How To Trade It?

Web It Is Important To Note That The Inverted Pattern Is A Warning Of Potential Price Change, Not A Signal, By Itself, To Buy.

Web The Hammer Candlestick Is A Bullish Reversal Pattern That Signals A Potential Price Bottom And Ensuing Upward Move.

Web The Hammer Candlestick Appears At The Bottom Of A Down Trend And Signals A Bullish Reversal.

Related Post: