Candlestick Flag Pattern

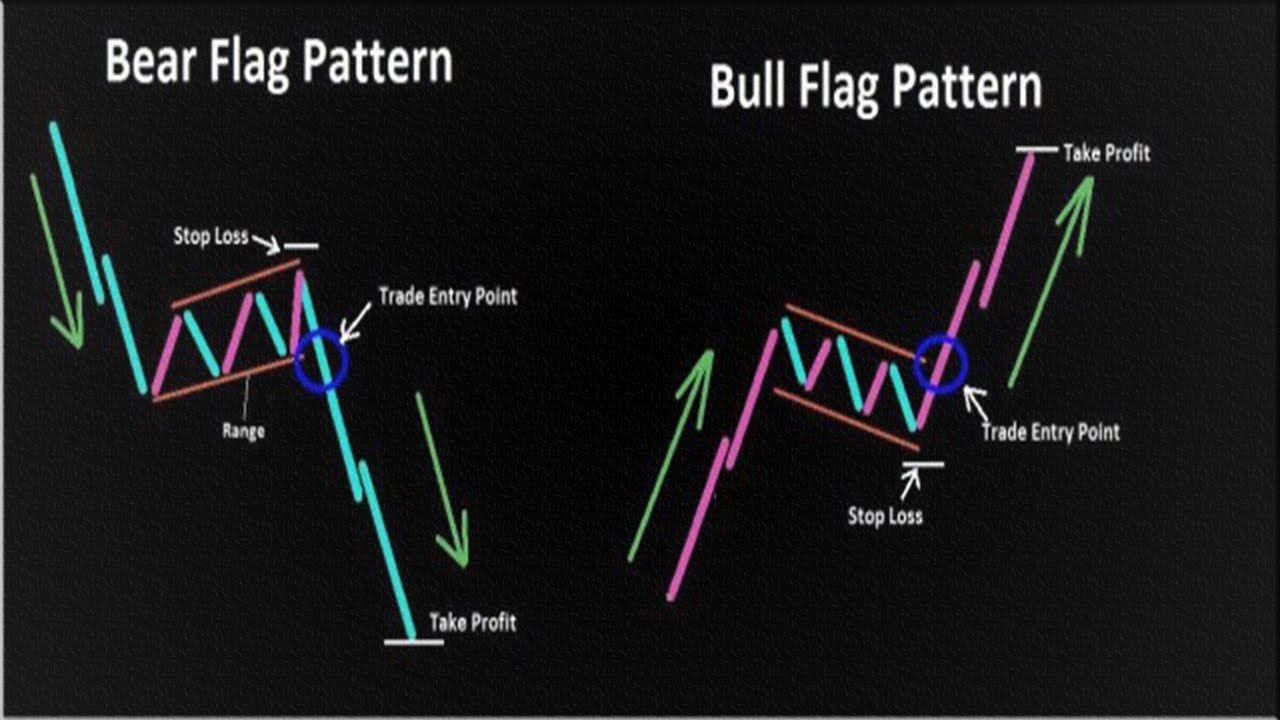

Candlestick Flag Pattern - You need candles to spot certain chart patterns. The price action consolidates within the two parallel trend lines in the opposite direction of the uptrend, before breaking out and continuing the uptrend. Web a candlestick always consists of four price points that are shown in a candlestick chart. Also, feel free to download our candlestick pattern quick reference guide! In the context of technical analysis, a flag is a price pattern that, in a shorter time frame, moves counter to the prevailing price trend observed in a longer time frame on a price chart. Usually, these candles are moving up or down, just a little bit in a tight range after the “flag pole.” Web for example, a long bullish (green or white) candlestick indicates strong buying pressure. Web the bull flag pattern is a piece of price action that occurs on candlestick charts after a major upward move. Web the bullish flag is a continuation chart pattern that facilitates an extension of the uptrend. Web updated december 10, 2023. The price action consolidates within the two parallel trend lines in the opposite direction of the uptrend, before breaking out and continuing the uptrend. Bearish flag pattern candlestick chart pattern#chartpatternsandtechnicalanalysis#nseindia#bse#bseindia#. Web the bull flag pattern is a continuation chart pattern that facilitates an extension of the uptrend. In a bullish flag pattern, the market consolidates between two parallel lines of. Web for example, a long bullish (green or white) candlestick indicates strong buying pressure. A bull flag is a bullish chart pattern that resembles a flag, with a strong flag pole, a pullback, and a breakout. The flag pattern is used to identify the possible. Web it is characterized by strong price action in the upward direction (price increase), with. Web it is characterized by strong price action in the upward direction (price increase), with high volume, followed by the aforementioned price consolidation, where for a period of time the price of the asset will move mostly sideways or decline, on relatively lower volume, resembling a flag. In financial technical analysis, a candlestick pattern is a movement in prices shown. Web a candlestick always consists of four price points that are shown in a candlestick chart. For example, the bullish engulfing, hammer, and morning star are just a few of many candlestick patterns that can give traders an edge. A candlestick is a type of price chart used in technical analysis that displays the high, low, open, and closing. Web. Web flag patterns are a useful visual tool to identify and evaluate changes in price over time. The flag pattern is used to identify the possible. A bull flag is a bullish chart pattern that resembles a flag, with a strong flag pole, a pullback, and a breakout. The price action consolidates within the two parallel trend lines in the. In a bullish flag pattern, the market consolidates between two parallel lines of support and resistance, before eventually breaking out through resistance and resuming the original uptrend. Web it is characterized by strong price action in the upward direction (price increase), with high volume, followed by the aforementioned price consolidation, where for a period of time the price of the. The price action consolidates within the two parallel trend lines in the opposite direction of the uptrend, before breaking out and continuing the uptrend. The open represents the opening price of the period, the high is the highest price of the period, the low represents the lowest low within the period, and the close is the closing price of the. The price action consolidates within the two parallel trend lines in the opposite direction of the uptrend, before breaking out and continuing the uptrend. They represent a pattern of two parallel trendlines that meet at both the upper and lower points of an asset’s price, forming an approximate flag shape. In the context of technical analysis, a flag is a. Web it is characterized by strong price action in the upward direction (price increase), with high volume, followed by the aforementioned price consolidation, where for a period of time the price of the asset will move mostly sideways or decline, on relatively lower volume, resembling a flag. A bull flag is a bullish chart pattern that resembles a flag, with. Whilst using one and two candlestick patterns such as the pin bar reversal are extremely popular for finding trade setups, they are only as good as the area that the trade is being taken from. Web the bull flag pattern is a continuation chart pattern that facilitates an extension of the uptrend. Web the bullish flag is a continuation chart. In financial technical analysis, a candlestick pattern is a movement in prices shown graphically on a candlestick chart that some believe can help to identify repeating patterns of a particular market movement. In technical analysis, a pennant is a type of continuation pattern. Web a candlestick always consists of four price points that are shown in a candlestick chart. The open represents the opening price of the period, the high is the highest price of the period, the low represents the lowest low within the period, and the close is the closing price of the period. In a bullish flag pattern, the market consolidates between two parallel lines of support and resistance, before eventually breaking out through resistance and resuming the original uptrend. They represent a pattern of two parallel trendlines that meet at both the upper and lower points of an asset’s price, forming an approximate flag shape. You need candles to spot certain chart patterns. The flag pattern is used to identify the possible. Web flag patterns are a useful visual tool to identify and evaluate changes in price over time. Also, feel free to download our candlestick pattern quick reference guide! Usually, these candles are moving up or down, just a little bit in a tight range after the “flag pole.” Web the bull flag pattern is a continuation chart pattern that facilitates an extension of the uptrend. Web it is characterized by strong price action in the upward direction (price increase), with high volume, followed by the aforementioned price consolidation, where for a period of time the price of the asset will move mostly sideways or decline, on relatively lower volume, resembling a flag. The price action consolidates within the two parallel trend lines in the opposite direction of the uptrend, before breaking out and continuing the uptrend. In the context of technical analysis, a flag is a price pattern that, in a shorter time frame, moves counter to the prevailing price trend observed in a longer time frame on a price chart. Web the bull flag pattern is a piece of price action that occurs on candlestick charts after a major upward move.

Flag Pattern Full Trading Guide with Examples

How to use the flag chart pattern for successful trading

Flag Pattern Forex Trading

Learn about Bull Flag Candlestick Pattern ThinkMarkets EN

The Common Forex Candlestick Patterns

Flag Candlestick Pattern Candlestick Pattern Tekno

How To Trade Flag Pattern Basics Candlestick Chart The Waverly

How To Trade Flag Pattern Basics Candlestick Chart The Waverly

10 Powerful Candlesticks Patterns And Strategies You Need To Know

What Is Flag Pattern? How To Verify And Trade It Efficiently

Followed By At Least Three Or More Smaller Consolidation Candles, Forming The Flag.

Web The Bullish Flag Is A Continuation Chart Pattern That Facilitates An Extension Of The Uptrend.

Web For Example, A Long Bullish (Green Or White) Candlestick Indicates Strong Buying Pressure.

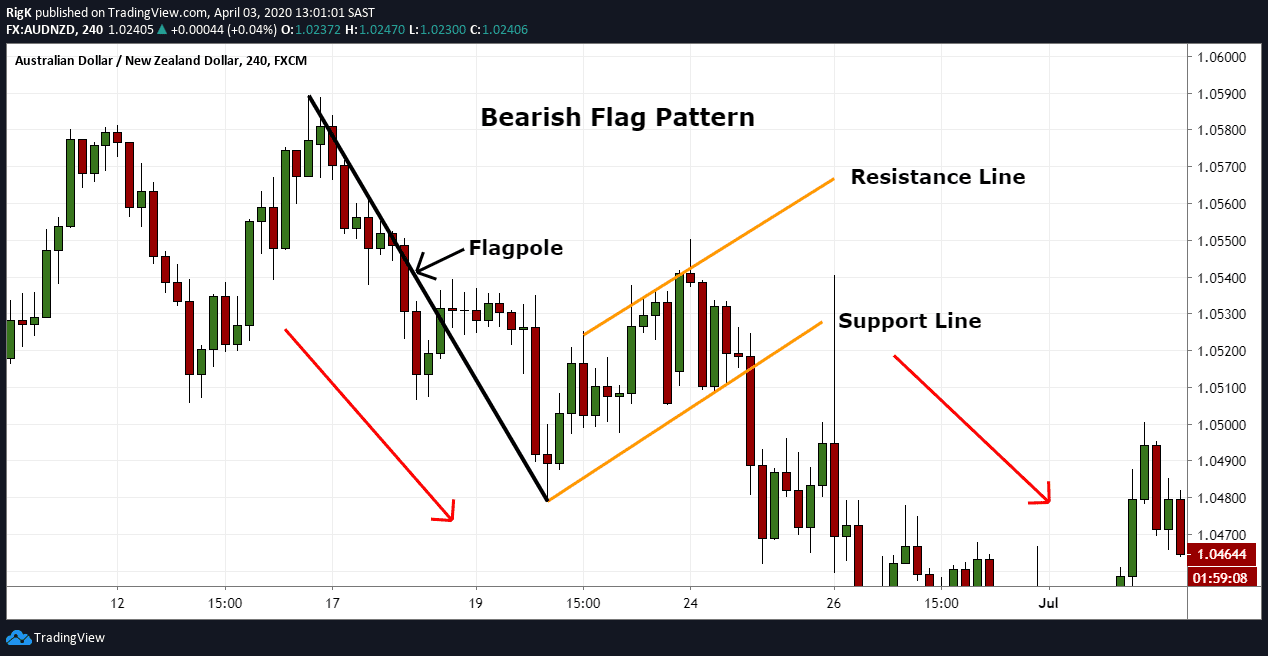

Web A Bear Flag Pattern Consists Of A Larger Bearish Candlestick (Going Down In Price), Which Forms The Flag Pole.

Related Post: