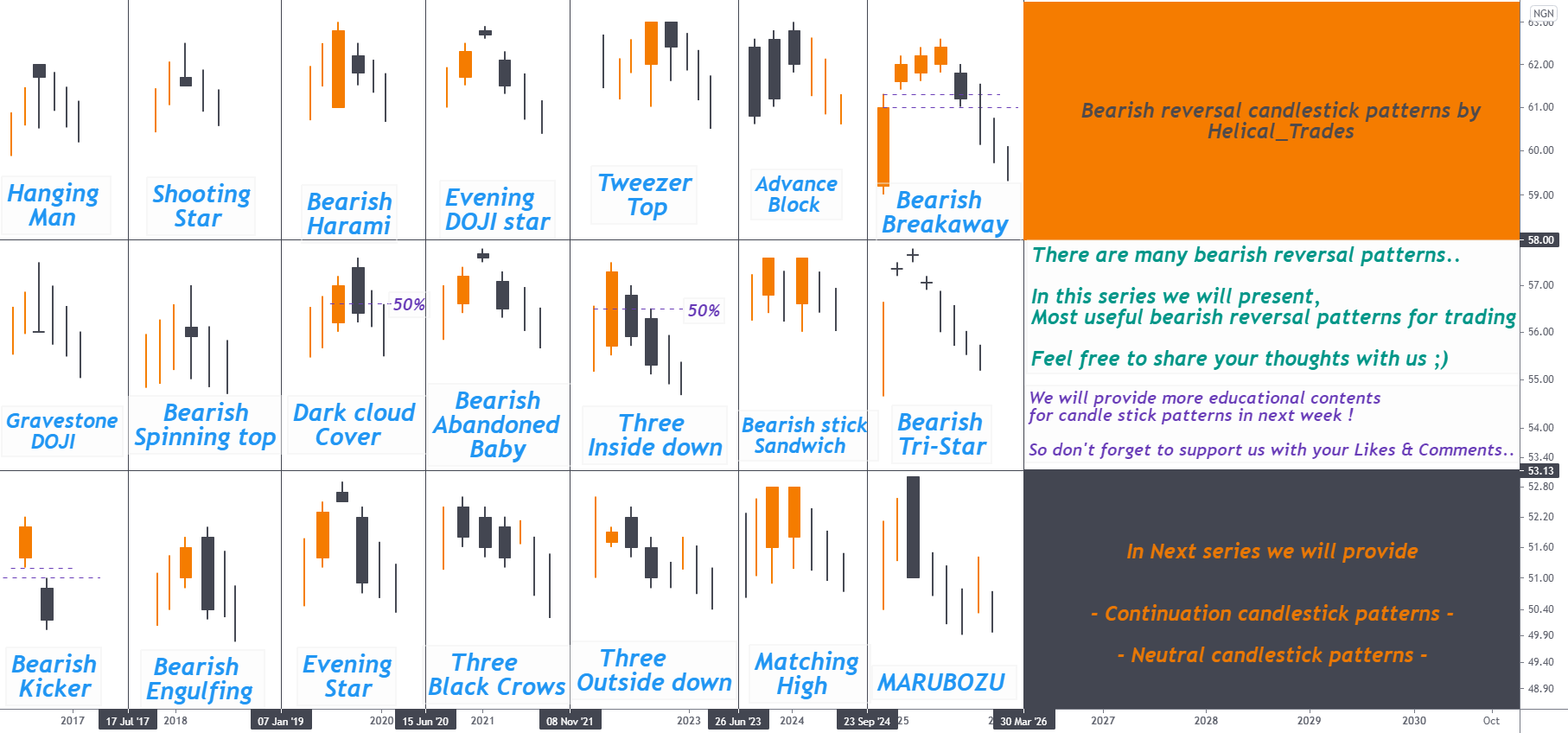

Candlestick Bearish Reversal Patterns

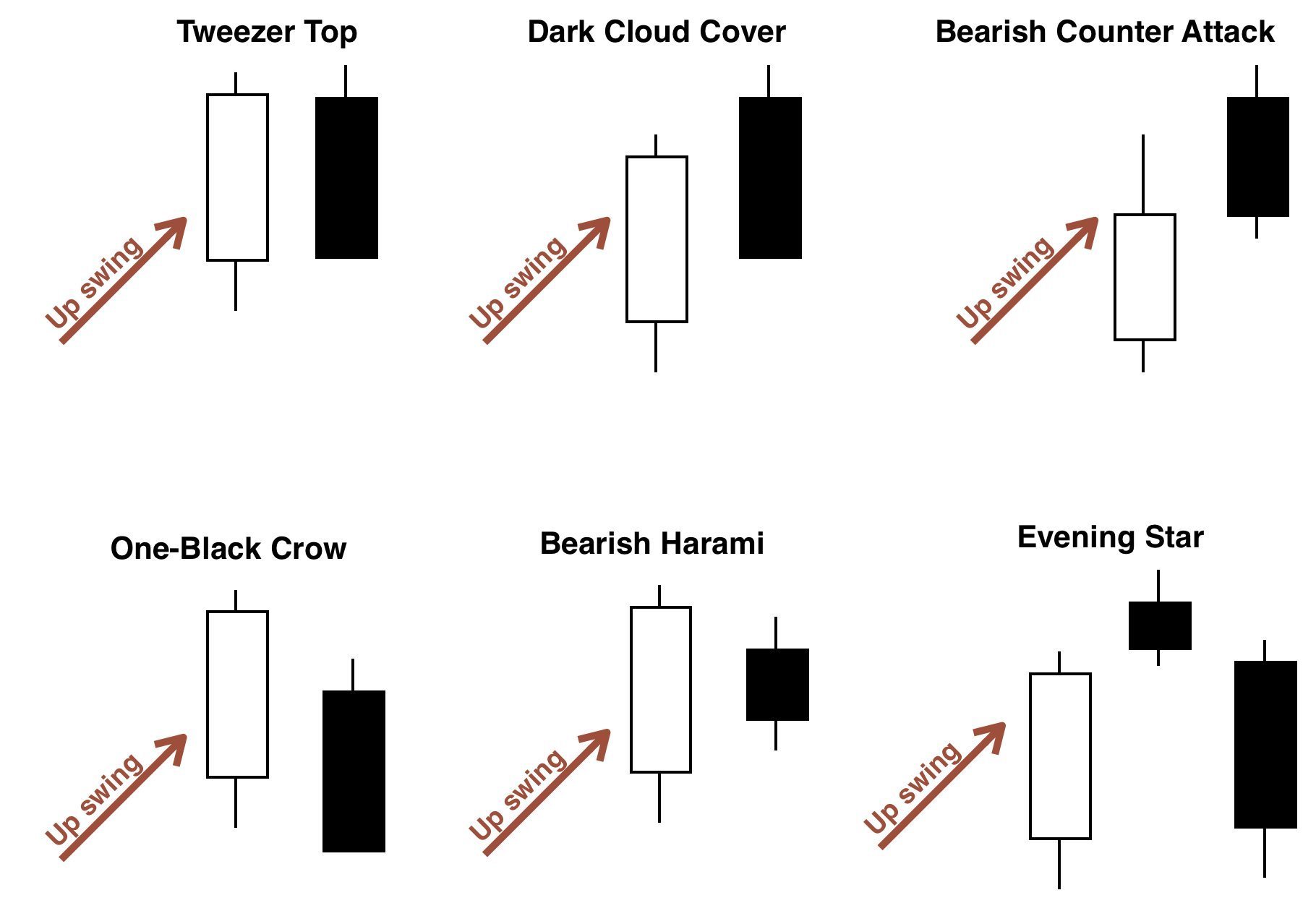

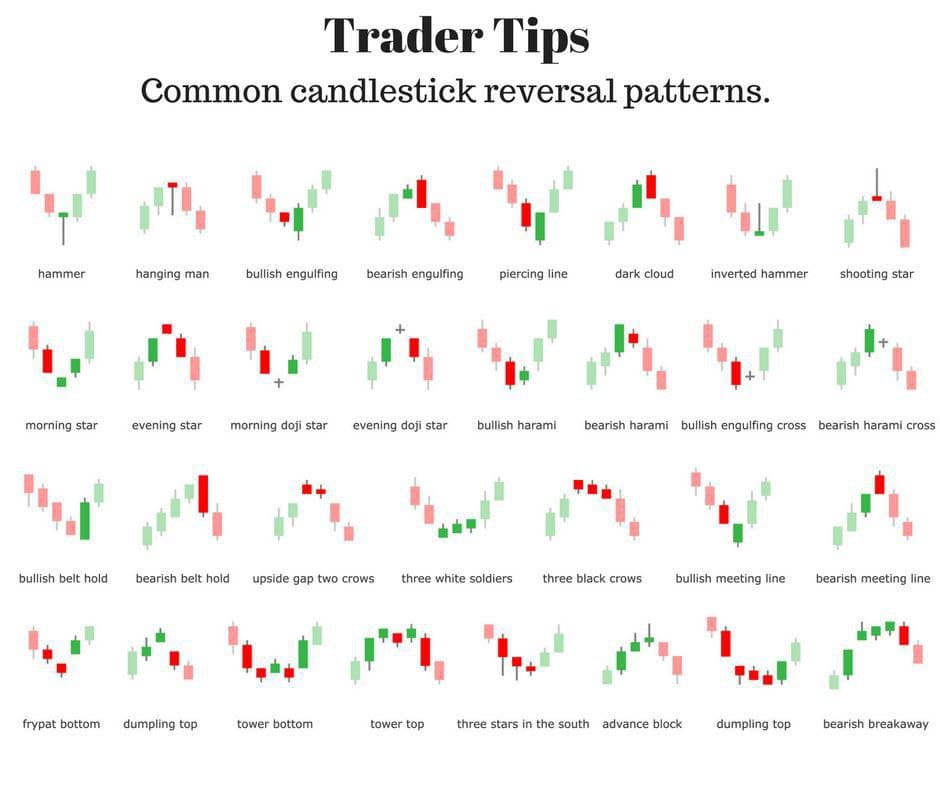

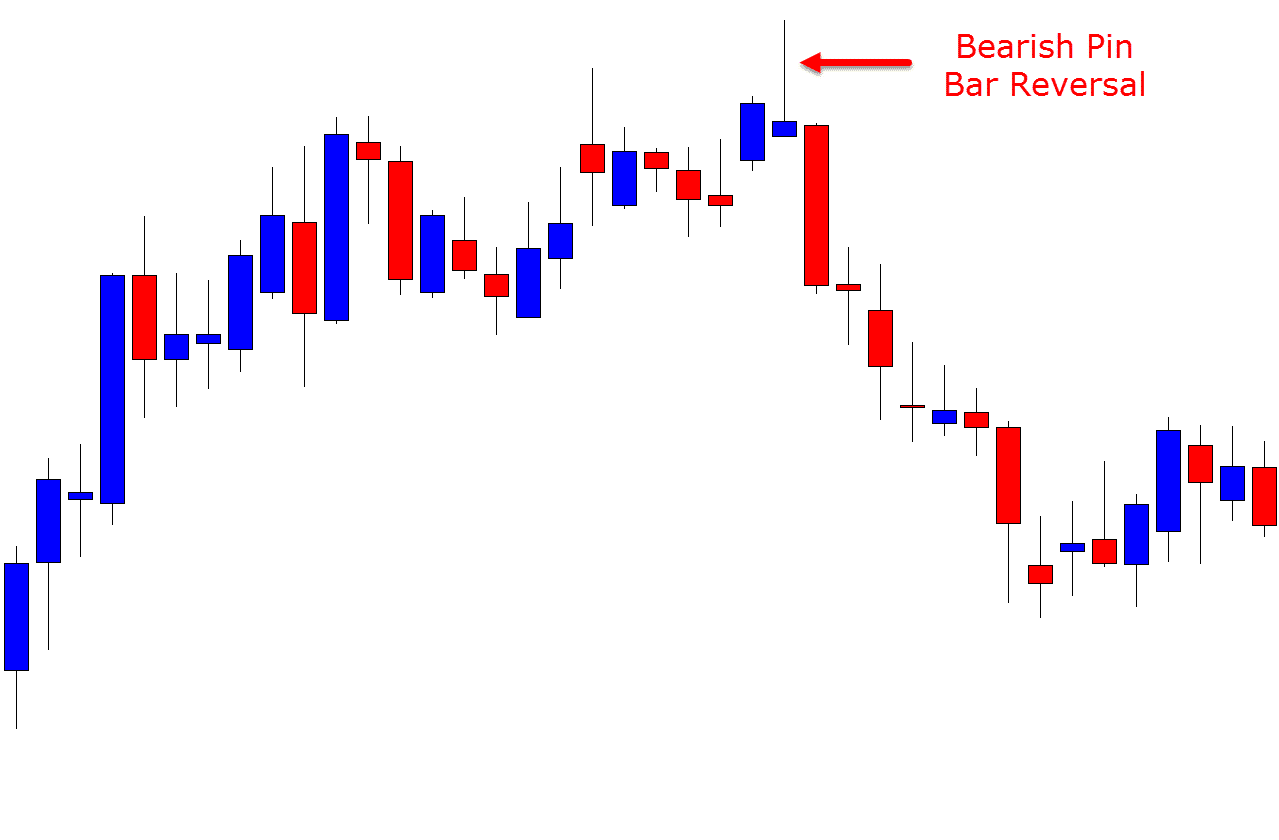

Candlestick Bearish Reversal Patterns - Web candlestick formations can provide valuable insights into price movement, including uptrends, downtrends, continuation patterns, reversal patterns, and more. They are typically red or black on stock charts. What does a candlestick reversal pattern look like? This pattern is particularly relevant for traders and analysts who rely on candlestick charting to make informed decisions about market movements. Web the bearish deliberation candlestick pattern is a technical analysis formation that signals a potential bearish reversal in an uptrending market. Although unusual, it might occur when all the prices are equal. A gravestone doji is a bearish reversal candlestick pattern that is formed when the open, low, and closing prices are all near each other with a long upper shadow. Web 8 min read. Web the shooting star candlestick pattern consists of a single candlestick with a small body at the bottom and a long upper shadow. For a bearish dragonfly doji candlestick pattern, the following. Web bearish japanese candlestick reversal patterns are displayed below from strongest to weakest. Web bearish candlestick patterns are either a single or combination of candlesticks that usually point to lower price movements in a stock. Whether you trade stocks, forex, or crypto, understanding bullish and bearish reversal candlestick patterns can help you adeptly navigate price action. Bearish candlestick patterns come. Web in this guide, we'll explore the most powerful candlestick reversal patterns that signal potential trend reversions. One can use these kinds of patterns to identify a potential reversal in assets’ prices. Web it is widely recognised as a bullish reversal candlestick chart pattern that emerges at the bottom of downtrends. There are also bullish candlesticks. A gravestone doji is. 4.2 candlestick bearish reversal patterns. Appearing at the end of the uptrend, this bearish candlestick pattern indicates weakness in the ongoing price movement and shows that the bulls have pushed the prices up but they are not able to push further. How to find high probability trend continuation setups. Bearish abandoned baby (3 candlesticks), engulfing bearish (2 candlesticks), harami bearish. The shift can be either bullish or bearish. Web the shooting star candlestick pattern consists of a single candlestick with a small body at the bottom and a long upper shadow. The long upper shadow must be at least twice the length of the candle’s body. Web besides, some traders use several bearish candlestick patterns to detect the seller’s domination. Web the bearish deliberation candlestick pattern is a technical analysis formation that signals a potential bearish reversal in an uptrending market. You can find candlestick reversal patterns on daily, weekly, monthly, or intraday charts. Bearish candles show that the price of a stock is going down. Web 8 min read. How to find high probability bearish reversal setups. Web it is widely recognised as a bullish reversal candlestick chart pattern that emerges at the bottom of downtrends. They typically tell us an exhaustion story — where bulls are giving up and bears are taking over. It is a bearish reversal indicator, meaning that its appearance usually prompts a shift in the trend from bullish to bearish. Web in. Web some of the key bearish reversal patterns include: 4.2 candlestick bearish reversal patterns. Web in this guide, we'll explore the most powerful candlestick reversal patterns that signal potential trend reversions. Various candlestick reversal patterns exist, but not all of them are equally strong or reliable. As a rule, a candlestick shows four prices of an asset: How to understand any candlestick pattern without memorizing a single one. Bearish candles show that the price of a stock is going down. Although unusual, it might occur when all the prices are equal. This is when momentum begins to shift. Whether you trade stocks, forex, or crypto, understanding bullish and bearish reversal candlestick patterns can help you adeptly navigate. 📚 a gravestone doji is a bearish pattern that suggests a reversal followed by a downtrend in the price action. One can use these kinds of patterns to identify a potential reversal in assets’ prices. For a bearish dragonfly doji candlestick pattern, the following. Bearish candlestick patterns come in. Here we have listed all the bearish chart patterns that can. Web the following charts are example of some important candlestick reversal patterns, as described by steve nison on candlecharts.com and in his book, “japanese candlestick charting. Many of these are reversal patterns. Web candlestick patterns show the price movement of an asset within a certain timeframe. Web find out how bullish and bearish reversal candlestick patterns show that the market. How to find high probability trend continuation setups. Candlestick pattern strength is described as either strong, reliable, or weak. Web candlestick formations can provide valuable insights into price movement, including uptrends, downtrends, continuation patterns, reversal patterns, and more. This is when momentum begins to shift. This pattern is particularly relevant for traders and analysts who rely on candlestick charting to make informed decisions about market movements. It can signal an end of the bearish trend, a bottom or a support level. Get a definition, signals of an uptrend, and downtrend on real charts. The opening price, the closing price, the high price and the low price. Web find out how bullish and bearish reversal candlestick patterns show that the market is reversing. Web some of the key bearish reversal patterns include: Bearish abandoned baby (3 candlesticks), engulfing bearish (2 candlesticks), harami bearish (2 candlesticks), dark cloud cover (2 candlesticks), evening star (3 candlesticks), and shooting star (1. As a result, the prolonged lower shadow is the most important feature of this candlestick pattern. They typically tell us an exhaustion story — where bulls are giving up and bears are taking over. Web 8 min read. Therefore, traders should be on the lookout for signs of a potential reversal, such as bullish candlestick patterns, a break above key resistance levels, or a shift in trading volume indicating increased buying activity. Various candlestick reversal patterns exist, but not all of them are equally strong or reliable.

All candlestick patterns for Trading Bearish reversal patterns for

Bearish Candlestick Patterns Blogs By CA Rachana Ranade

Bearish Reversal Candlestick Patterns Technical Analysis

Bearish Candlestick Reversal Patterns Stock trading learning, Stock

Trader Tips Common candlestick reversal patterns Profit Myntra

bearishreversalcandlestickpatternsforexsignals Candlestick

What are Bearish Candlestick Patterns

The Bearish Harami candlestick pattern show a strong reversal

Bearish Reversal Candlestick Patterns The Forex Geek

Bearish Reversal Candlesticks Patterns for BINANCEBTCUSDT by EXCAVO

Web In Financial Technical Analysis, A Candlestick Pattern Is A Movement In Prices Shown Graphically On A Candlestick Chart That Some Believe Can Help To Identify Repeating Patterns Of A Particular Market Movement.

Web A Reversal Candlestick Pattern Is A Bullish Or Bearish Reversal Pattern Formed By One Or More Candles.

Whether You Trade Stocks, Forex, Or Crypto, Understanding Bullish And Bearish Reversal Candlestick Patterns Can Help You Adeptly Navigate Price Action.

How To Understand Any Candlestick Pattern Without Memorizing A Single One.

Related Post: