Candle Hammer Pattern

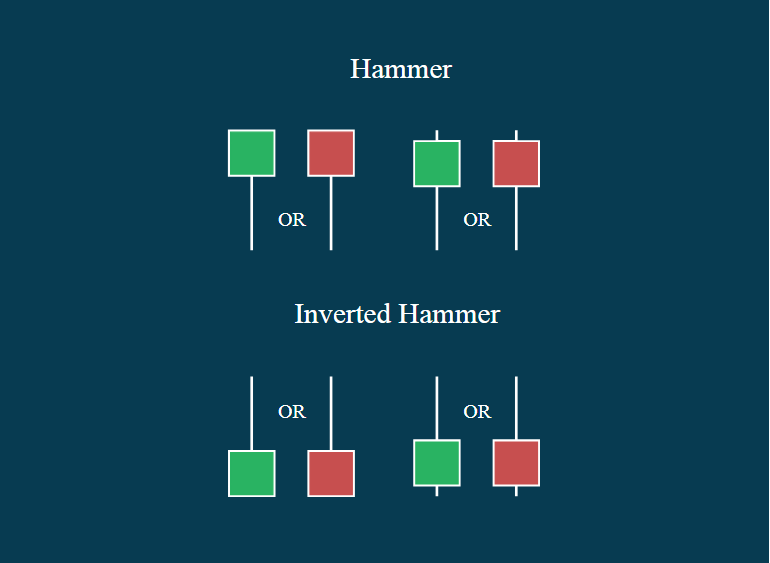

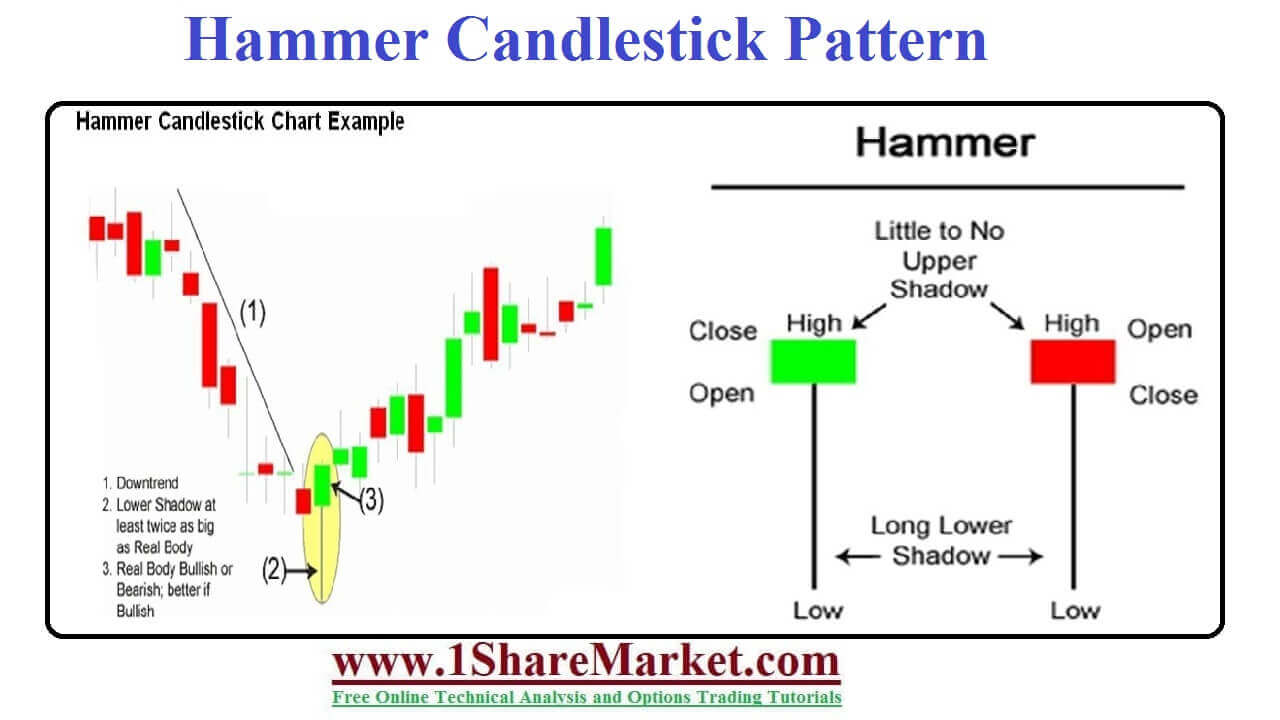

Candle Hammer Pattern - Web hammer candlestick patterns occur when the price of an asset falls to levels that are far below the opening price of the trading period before rallying back to recover some (or all) of those losses as the charting period completes. The hammer helps traders visualize where support and demand are located. Our guide includes expert trading tips and examples. The following characteristics can identify it: Web the hammer candlestick pattern is a bullish reversal pattern used by traders to signal a potential change in a downward price trend. The opening price, close, and top are approximately at the same price, while there is a long wick that extends lower, twice as big as the short body. Web a hammer candlestick pattern occurs when a security trades significantly lower than its opening but then rallies to close near its opening price. Hammer candlestick has a unique shape. Knowing how to read candlestick charts can help you to identify or. A small body at the upper end of the trading range. After the appearance of the hammer, the prices start moving up. A hammer shows that although there were selling pressures during the day, ultimately a strong buying pressure drove the price back up. The following characteristics can identify it: Hammer candlestick has a unique shape. You read a candlestick by looking at its color, body and wicks. These candles are typically green or white on stock charts. After the appearance of the hammer, the prices start moving up. Web the hanging man candlestick pattern is characterized by a short wick (or no wick) on top of small body (the candlestick), with a long shadow underneath. This shows a hammering out of a base and reversal setup. A. Lower shadow more than twice the length of the body. Web the hanging man candlestick pattern is characterized by a short wick (or no wick) on top of small body (the candlestick), with a long shadow underneath. The opening price, close, and top are approximately at the same price, while there is a long wick that extends lower, twice as. A minor difference between the opening and closing prices forms a small candle body. Web the hammer candlestick pattern is a bullish reversal pattern that indicates a potential price reversal to the upside. Lower shadow more than twice the length of the body. While the stock has lost 5.8% over the past week, it could witness a trend reversal as. A minor difference between the opening and closing prices forms a small candle body. The long lower shadow is a strong indication that buying pressure has significantly rejected and countered selling pressure, suggesting the strong likelihood of a bullish reversal. Our guide includes expert trading tips and examples. Web candlestick patterns are used in all forms of trading, including forex.. They consist of small to medium size lower shadows, a real body, and little to no upper wick. The opening price, close, and top are approximately at the same price, while there is a long wick that extends lower, twice as big as the short body. This is one of the popular price patterns in candlestick charting. Web candlestick patterns. Occurrence after bearish price movement. Web what is a hammer chart and how to trade it? The hammer helps traders visualize where support and demand are located. Web in this blog post, we are going to explore the hammer candlestick pattern, a bullish reversal candlestick. Enjoy an evening of paint & sip at one of our 116 studios across the. Web the hammer candlestick pattern is a bullish reversal pattern used by traders to signal a potential change in a downward price trend. Web learn how to use the hammer candlestick pattern to spot a bullish reversal in the markets. You will improve your candlestick analysis skills and be able to apply them in trading. While the stock has lost. Lower shadow more than twice the length of the body. We curate a warm and inviting experience as you learn about polish pottery and unique polish artisan products. Web the hammer candlestick is a bullish reversal pattern that signals a potential price bottom and ensuing upward move. After the appearance of the hammer, the prices start moving up. Our big. This shows a hammering out of a base and reversal setup. Occurrence after bearish price movement. Our guide includes expert trading tips and examples. A small real body, long lower shadow (twice the length of the body), minimal or no upper. Web the hammer pattern consists of one candlestick with a small body, a long lower shadow, and a small. Our guide includes expert trading tips and examples. Web hammer candlestick patterns occur when the price of an asset falls to levels that are far below the opening price of the trading period before rallying back to recover some (or all) of those losses as the charting period completes. Examples of use as a trading indicator. Web what is a hammer chart and how to trade it? Web the hammer pattern consists of one candlestick with a small body, a long lower shadow, and a small or nonexistent upper shadow. The opening price, close, and top are approximately at the same price, while there is a long wick that extends lower, twice as big as the short body. Web candlestick patterns are used in all forms of trading, including forex. You will improve your candlestick analysis skills and be able to apply them in trading. Learn what it is, how to identify it, and how to use it for intraday trading. A small real body, long lower shadow (twice the length of the body), minimal or no upper. Lower shadow more than twice the length of the body. They consist of small to medium size lower shadows, a real body, and little to no upper wick. Web the hammer candlestick pattern is a bullish reversal pattern used by traders to signal a potential change in a downward price trend. Web in financial technical analysis, a candlestick pattern is a movement in prices shown graphically on a candlestick chart that some believe can help to identify repeating patterns of a particular market movement. This is one of the popular price patterns in candlestick charting. After the appearance of the hammer, the prices start moving up.

Hammer Candlestick Pattern Trading Guide

How to Read the Inverted Hammer Candlestick Pattern? Bybit Learn

Hammer Candlestick Pattern Trading Guide

Hammer Candlestick What Is It and How to Use It in Trend Reversal

Mastering the Hammer Candlestick Pattern A StepbyStep Guide to

Mastering the Hammer Candlestick Pattern A StepbyStep Guide to

How to Trade the Hammer Candlestick Pattern Pro Trading School

Candlestick Patterns The Definitive Guide (2021)

Hammer candlestick pattern Defination with Advantages and limitation

Hammer Candlestick Pattern Forex Trading

Web The Hammer Candlestick Formation Is Viewed As A Bullish Reversal Candlestick Pattern That Mainly Occurs At The Bottom Of Downtrends.

Web The Hammer Candlestick Is A Bullish Reversal Pattern That Signals A Potential Price Bottom And Ensuing Upward Move.

The Information Below Will Help You Identify This Pattern On The Charts And Predict Further Price Dynamics.

Web The Hanging Man Candlestick Pattern Is Characterized By A Short Wick (Or No Wick) On Top Of Small Body (The Candlestick), With A Long Shadow Underneath.

Related Post: